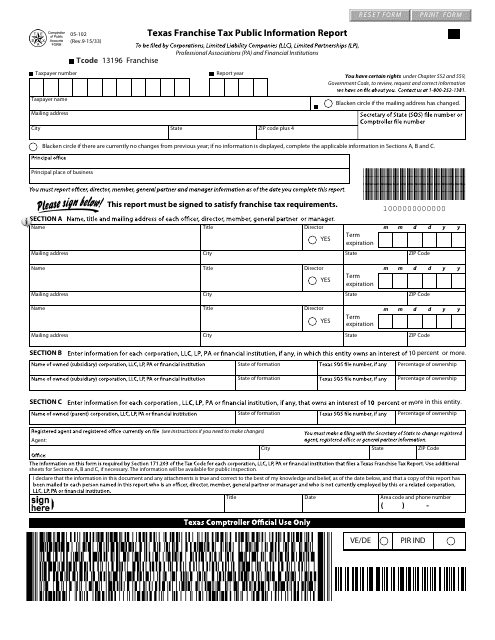

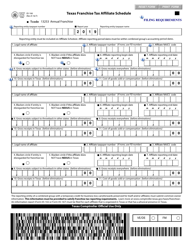

Form 05-102 Texas Franchise Tax Public Information Report - Texas

What Is Form 05-102?

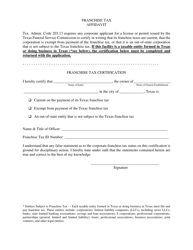

Form 05-102, Texas Franchise Tax Public Information Report , is a tax form filed by corporations, limited partnerships, and different business entities that are registered in Texas.

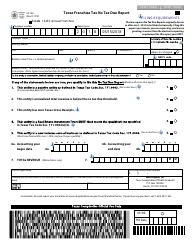

Franchise tax is a tax that enterprises pay when they want to establish their business in certain states. Franchise tax is not based on the income of the entity so it is not connected with federal and state income taxes that must be filed annually. Basically, a franchise tax charges entities or corporations for the privilege of running a business in the state.

Texas franchise tax (or "privilege tax," as it is also called) is imposed on every taxable company or business which is set in Texas.

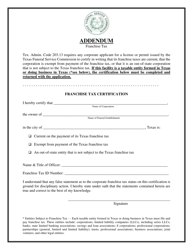

This form is provided by the Texas Comptroller of Public Accounts - the state's chief tax collector and accountant that operates only within Texas. This form must be filed the day a franchise tax report is made and it accompanies the particular franchise tax report (there are many kinds of reports and it depends on the company) and any other tax forms required.

The latest fillable 05-102 Form was issued on September 1, 2015 and is available for download through the link below.

Texas Franchise Tax Public Information Report Instructions

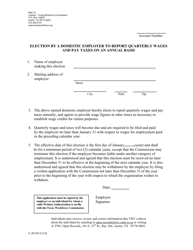

The 05-102 Form is filed by a director, competent officer, or authorized person. All of the Texas franchise tax public information reports are to send to one addressee: Texas Comptroller of Public Accounts, PO Box 149348, Austin, TX 78714-9348 .

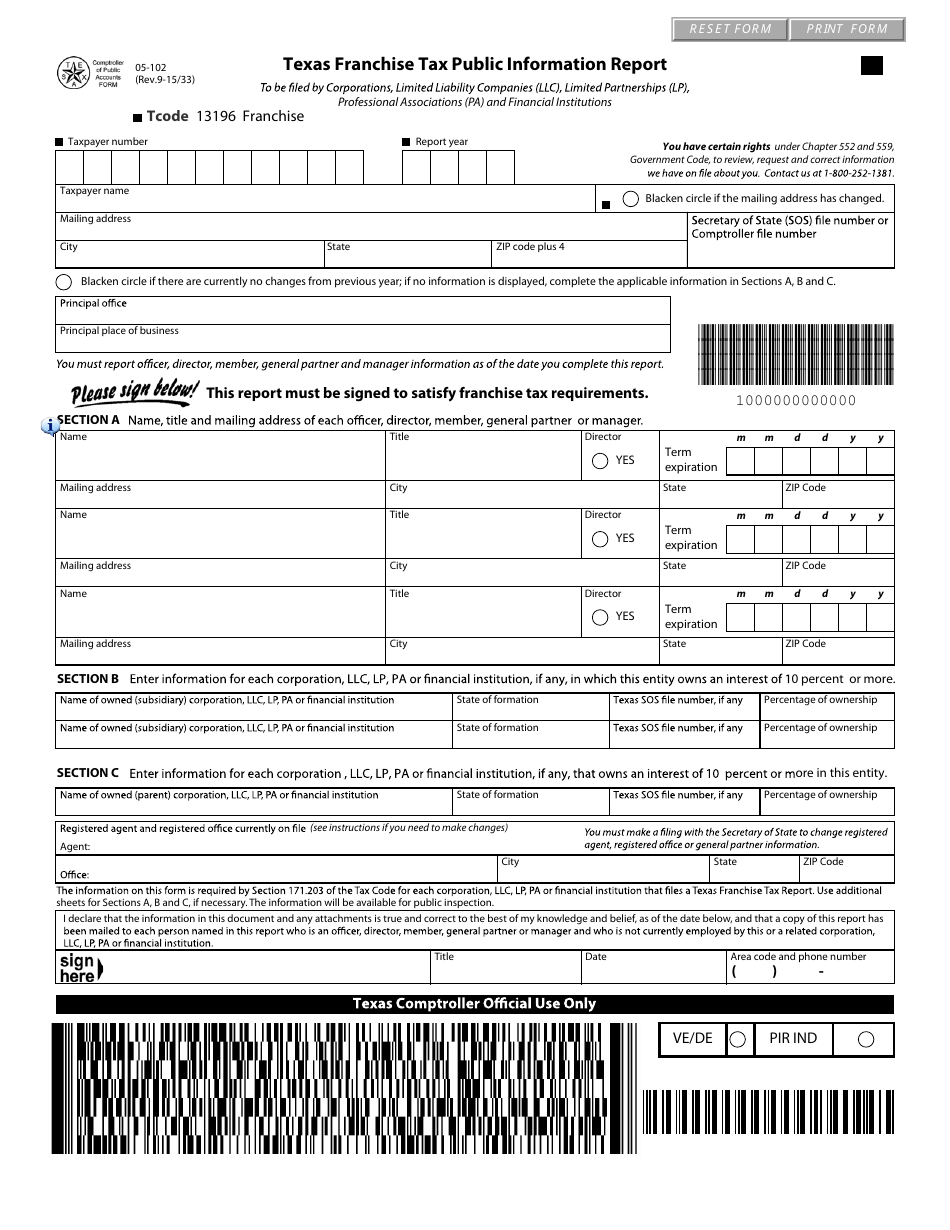

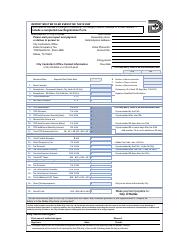

There are 4 sections in the 05-102 Form. The first section must contain relevant information about the taxpayer. The second section (section A) must contain information about members of all the members and partners. The third section (Section B) and it must contain names of all the companies in which the taxpayer's entity holds 10% or more. The last section or Section C must contain information about companies that hold 10% or more in the taxpayer's entity. Streamlining the information above and following these Form 05-102 instructions the following information must be provided in the report:

- Taxpayer number.

- Reporting year.

- Taxpayer name, mailing address.

- Principal office of the business entity.

- Principal place of business.

- Name, title, and mailing address of each officer, director, member, general partner, or manager (with the expiration date).

- Name of the owned (subsidiary) corporation or financial institution in which the business entity owns an interest of 10% or more (including the state of formation, Texas SOS file number).

- Name of each corporation, LLC, LP, etc. that owns an interest of 10 % or more in your business entity (including state of formation, Texas SOS file number, percentage of ownership).

- The filler has to sign, date the report, and type the appropriate phone number.