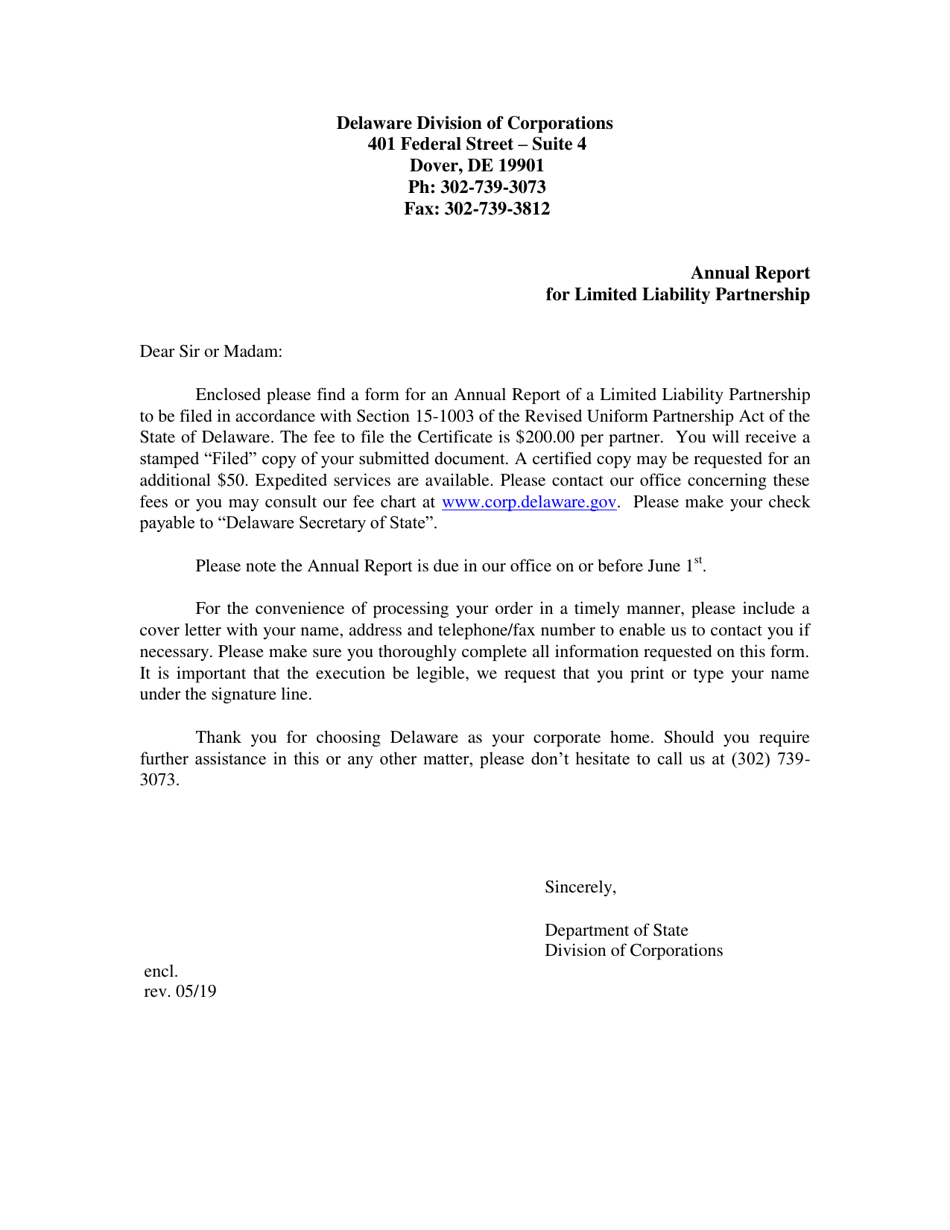

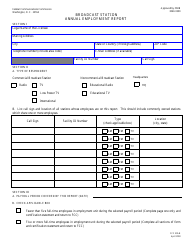

Annual Report for Limited Liability Partnership - Delaware

Annual Report for Limited Liability Partnership is a legal document that was released by the Delaware Department of State - a government authority operating within Delaware.

FAQ

Q: What is a limited liability partnership (LLP)?

A: A limited liability partnership is a type of business structure that combines the benefits of a partnership and a corporation. It provides the partners with limited liability protection.

Q: What are the advantages of forming an LLP in Delaware?

A: Some advantages of forming an LLP in Delaware include: limited liability protection for partners, flexible management structure, tax benefits, and credibility in the business world.

Q: How do I form an LLP in Delaware?

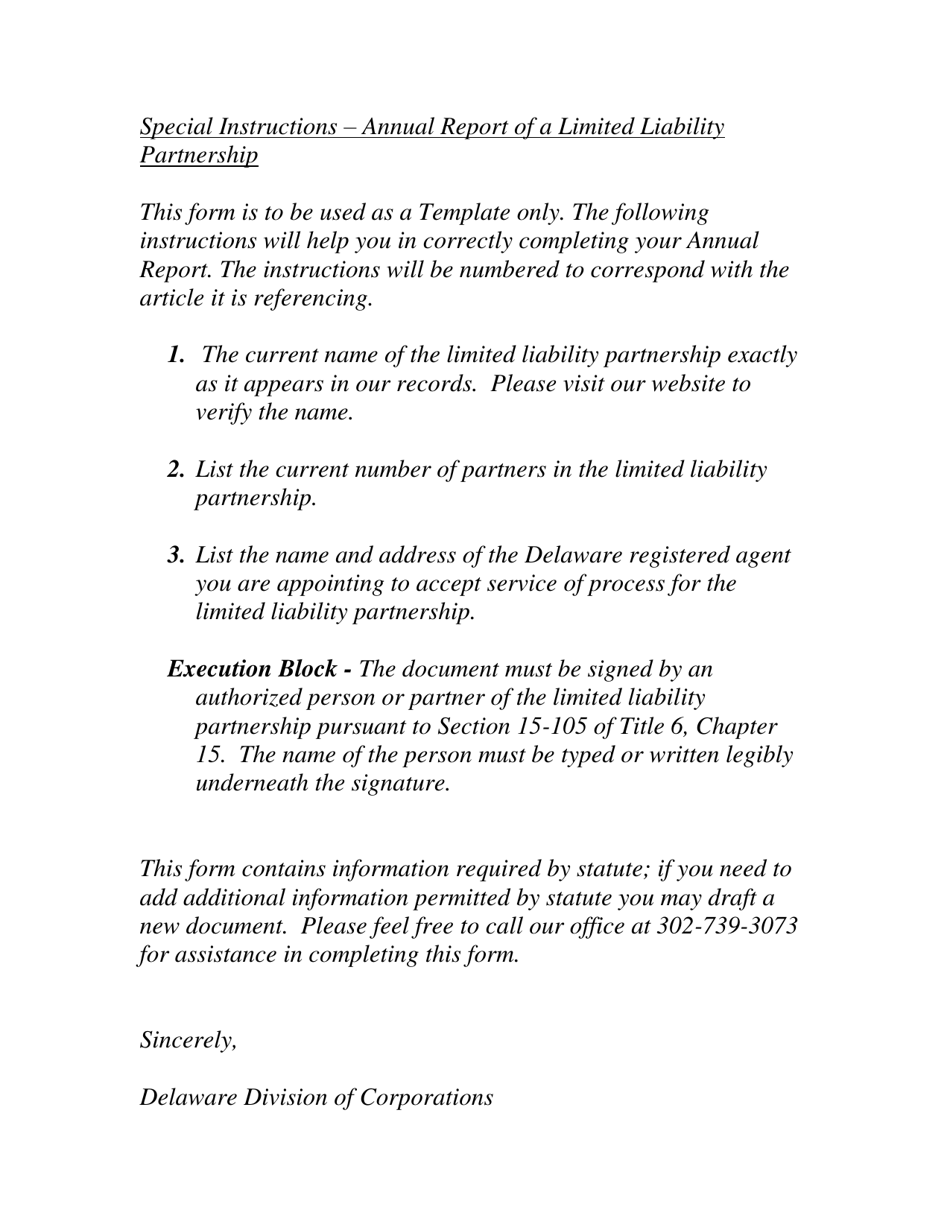

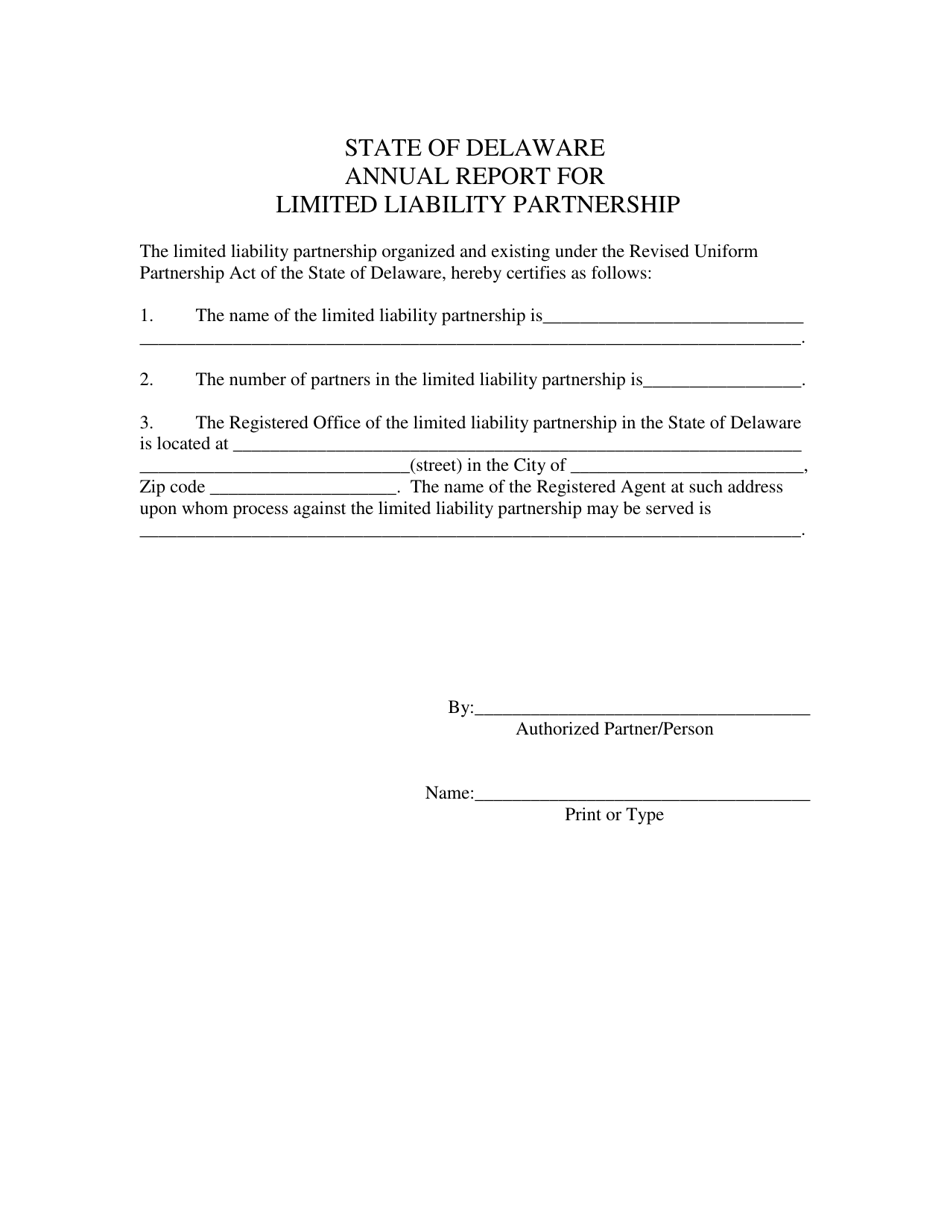

A: To form an LLP in Delaware, you need to file a Certificate of Limited Liability Partnership with the Delaware Secretary of State. The certificate must include certain information about the LLP, such as its name, address, and registered agent.

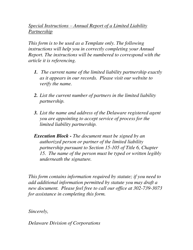

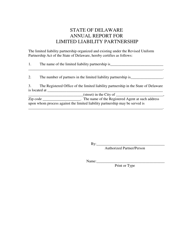

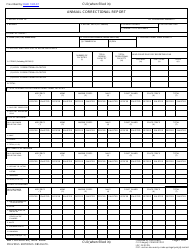

Q: What are the ongoing requirements for an LLP in Delaware?

A: Ongoing requirements for an LLP in Delaware include filing an Annual Report and paying the annual franchise tax. The Annual Report includes updated information about the LLP, such as the names and addresses of partners.

Q: What is the annual franchise tax for an LLP in Delaware?

A: The annual franchise tax for an LLP in Delaware varies based on the LLP's total gross assets in Delaware. The minimum tax is $300, and the maximum tax is $200,000.

Q: Can an LLP be formed with just one partner?

A: No, a limited liability partnership in Delaware must have at least two partners.

Form Details:

- Released on May 1, 2019;

- The latest edition currently provided by the Delaware Department of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Delaware Department of State.