This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

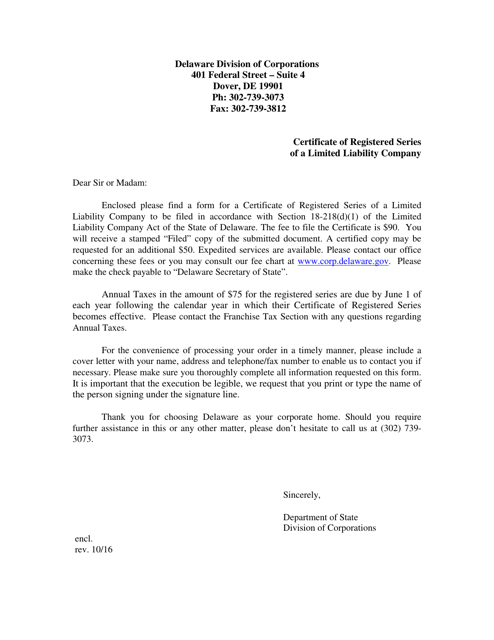

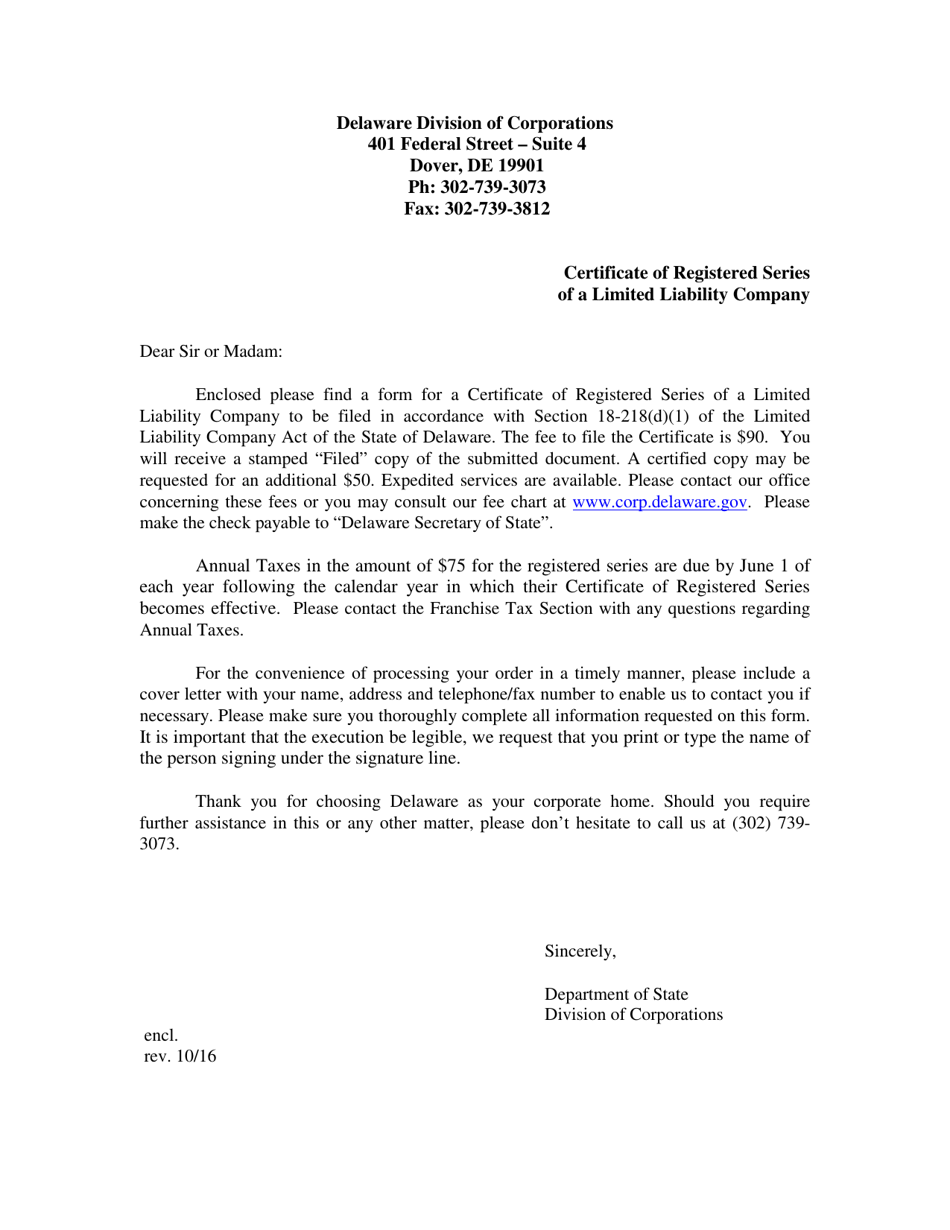

Certificate of Registered Series of Limited Liability Company - Delaware

Certificate of Registered Series of Limited Liability Company is a legal document that was released by the Delaware Department of State - Division of Corporations - a government authority operating within Delaware.

FAQ

Q: What is a Certificate of Registered Series of Limited Liability Company?

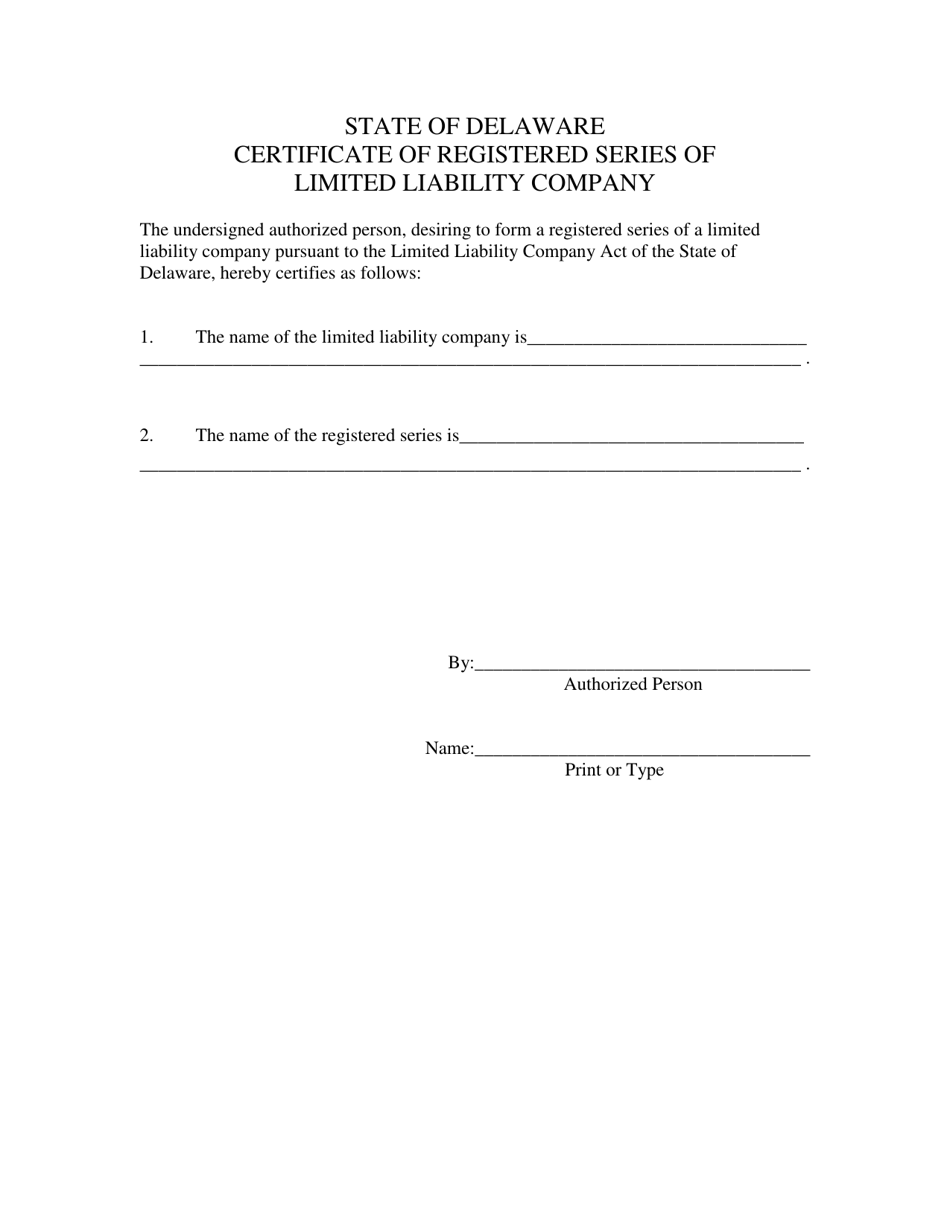

A: A Certificate of Registered Series of Limited Liability Company is a legal document that establishes the registration of a series within a limited liability company (LLC).

Q: What is a series within a limited liability company?

A: A series within a limited liability company is a designated portion or division of the LLC that has its own separate rights, powers, and obligations.

Q: Why would a limited liability company create a series?

A: A limited liability company may create a series to segregate assets, rights, and obligations for different purposes or business activities within the company.

Q: How is a series registered within a limited liability company?

A: A series is registered within a limited liability company by filing a Certificate of Registered Series of Limited Liability Company with the appropriate state agency.

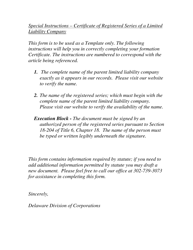

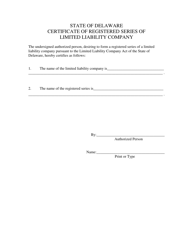

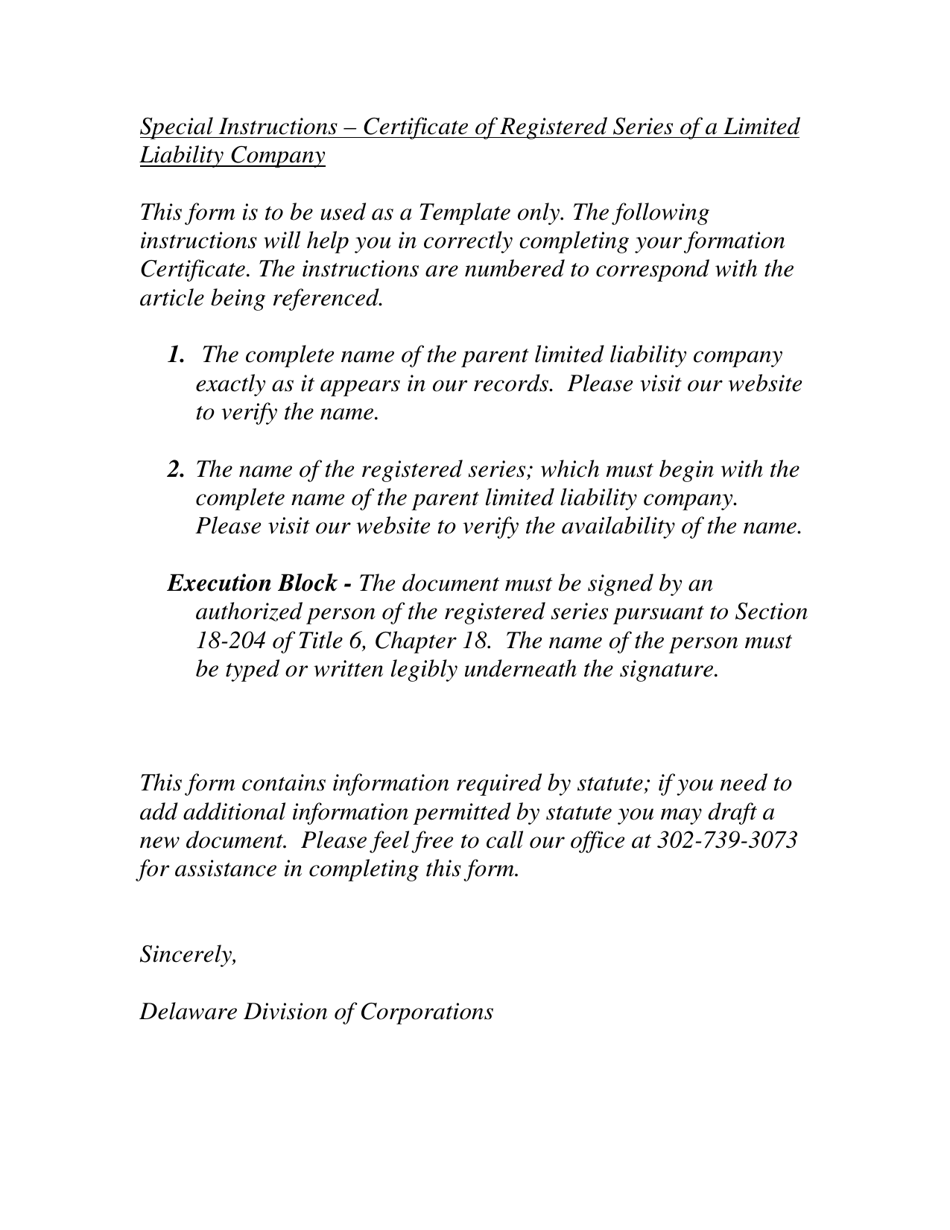

Q: What information is required in a Certificate of Registered Series of Limited Liability Company?

A: The information required in a Certificate of Registered Series of Limited Liability Company includes the name of the series, the address of its principal place of business, and the name and address of the LLC's registered agent.

Q: Is a Certificate of Registered Series of Limited Liability Company required in all states?

A: No, not all states recognize or allow the registration of series within limited liability companies. Delaware is one of the states that does allow it.

Q: What are the advantages of creating a series within a limited liability company?

A: The advantages of creating a series within a limited liability company include increased asset protection, greater flexibility in managing different business activities, and the ability to easily transfer or dispose of individual series.

Q: Can a series within a limited liability company have its own separate bank accounts and financial records?

A: Yes, a series within a limited liability company can have its own separate bank accounts and financial records, which helps to further distinguish its assets and liabilities from those of the LLC as a whole.

Q: Can a series within a limited liability company be formed after the initial creation of the LLC?

A: Yes, a series within a limited liability company can be formed after the initial creation of the LLC, as long as the state's laws and the LLC's operating agreement allow for it.

Q: Are there any specific tax implications for creating a series within a limited liability company?

A: Tax implications for creating a series within a limited liability company may vary depending on the specific circumstances and applicable state and federal tax laws. It is recommended to consult with a tax professional for guidance.

Form Details:

- Released on October 1, 2016;

- The latest edition currently provided by the Delaware Department of State - Division of Corporations;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Delaware Department of State - Division of Corporations.