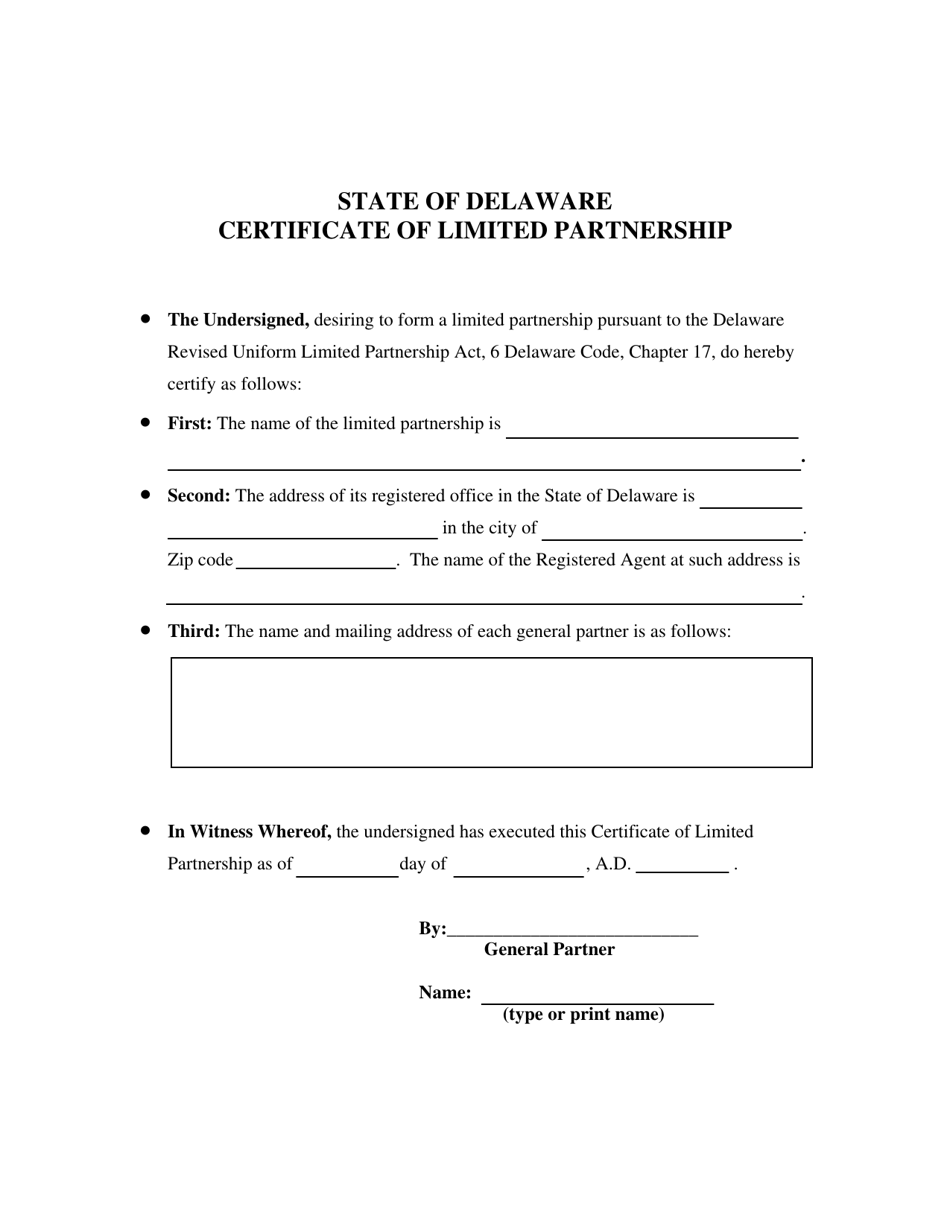

Certificate of Limited Partnership - Delaware

Certificate of Limited Partnership is a legal document that was released by the Delaware Department of State - a government authority operating within Delaware.

FAQ

Q: What is a Certificate of Limited Partnership?

A: A Certificate of Limited Partnership is a legal document that establishes a limited partnership in the state of Delaware.

Q: What is a limited partnership?

A: A limited partnership is a type of partnership where there are one or more general partners who manage the business and are personally liable for its debts, and one or more limited partners who contribute capital but have limited liability.

Q: Why would I need a Certificate of Limited Partnership?

A: You would need a Certificate of Limited Partnership if you want to establish a limited partnership in Delaware and operate your business under this legal structure.

Q: How do I obtain a Certificate of Limited Partnership in Delaware?

A: To obtain a Certificate of Limited Partnership in Delaware, you must file a completed Certificate of Limited Partnership form with the Delaware Secretary of State and pay the required filing fee.

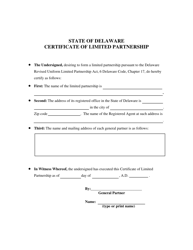

Q: What information do I need to include in the Certificate of Limited Partnership?

A: The Certificate of Limited Partnership must include the name and address of the partnership, the name and address of each general partner, and the amount of capital each limited partner is contributing.

Q: Is there a filing fee for the Certificate of Limited Partnership?

A: Yes, there is a filing fee for the Certificate of Limited Partnership. The fee varies depending on the size of the partnership.

Q: What is the difference between a general partner and a limited partner?

A: A general partner is actively involved in managing the business and has unlimited personal liability for its debts. A limited partner is not involved in management and has limited liability.

Q: Can a limited partner become a general partner?

A: Yes, a limited partner can become a general partner if they are given the authority to do so under the partnership agreement.

Q: Can a limited partnership be dissolved?

A: Yes, a limited partnership can be dissolved through a process outlined in the partnership agreement or by obtaining a court order.

Q: Are there any ongoing requirements for a limited partnership in Delaware?

A: Yes, a limited partnership in Delaware must file an annual report and pay an annual franchise tax to the Delaware Secretary of State.

Form Details:

- Released on June 1, 2004;

- The latest edition currently provided by the Delaware Department of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Delaware Department of State.