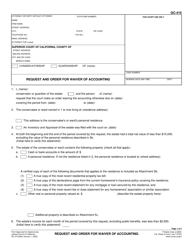

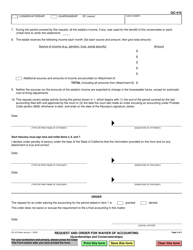

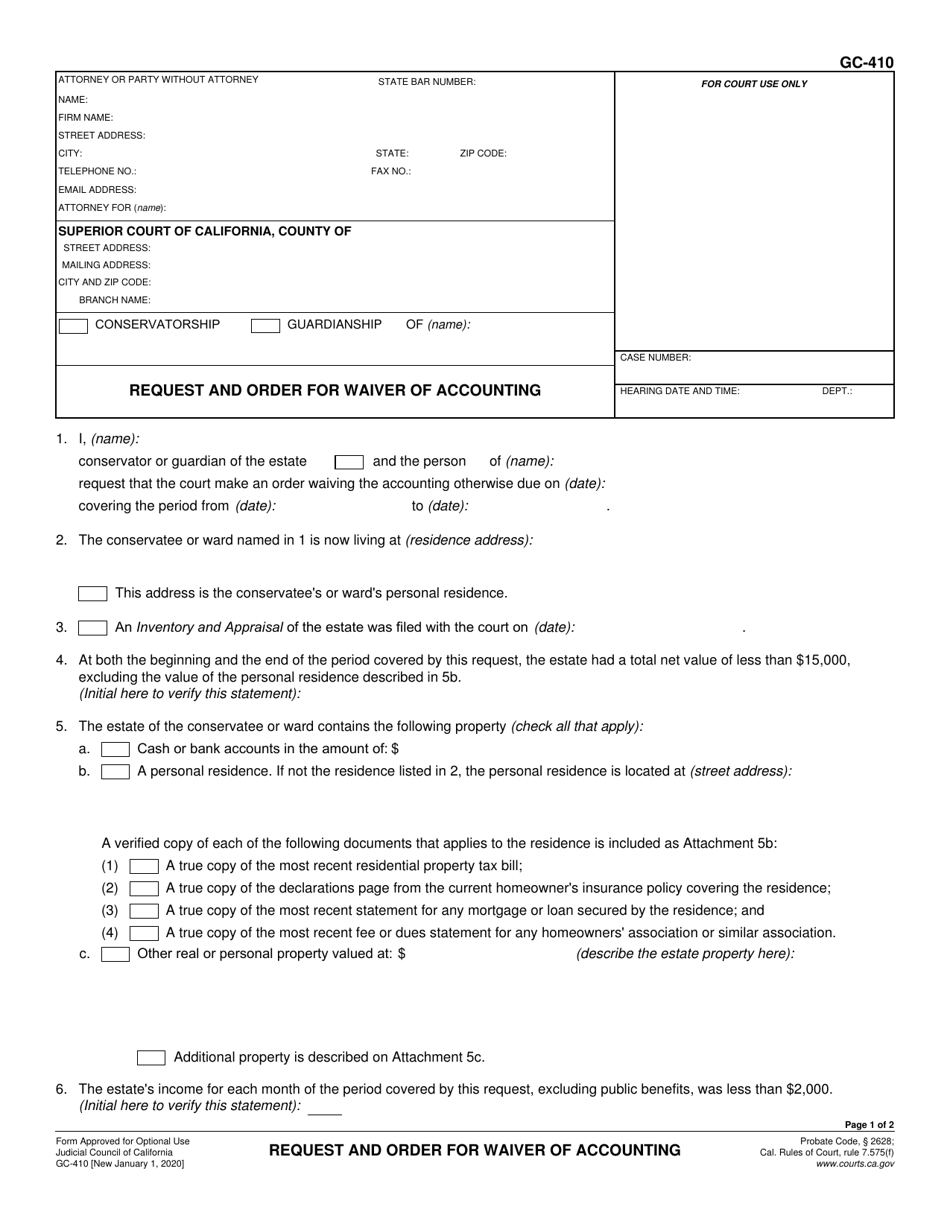

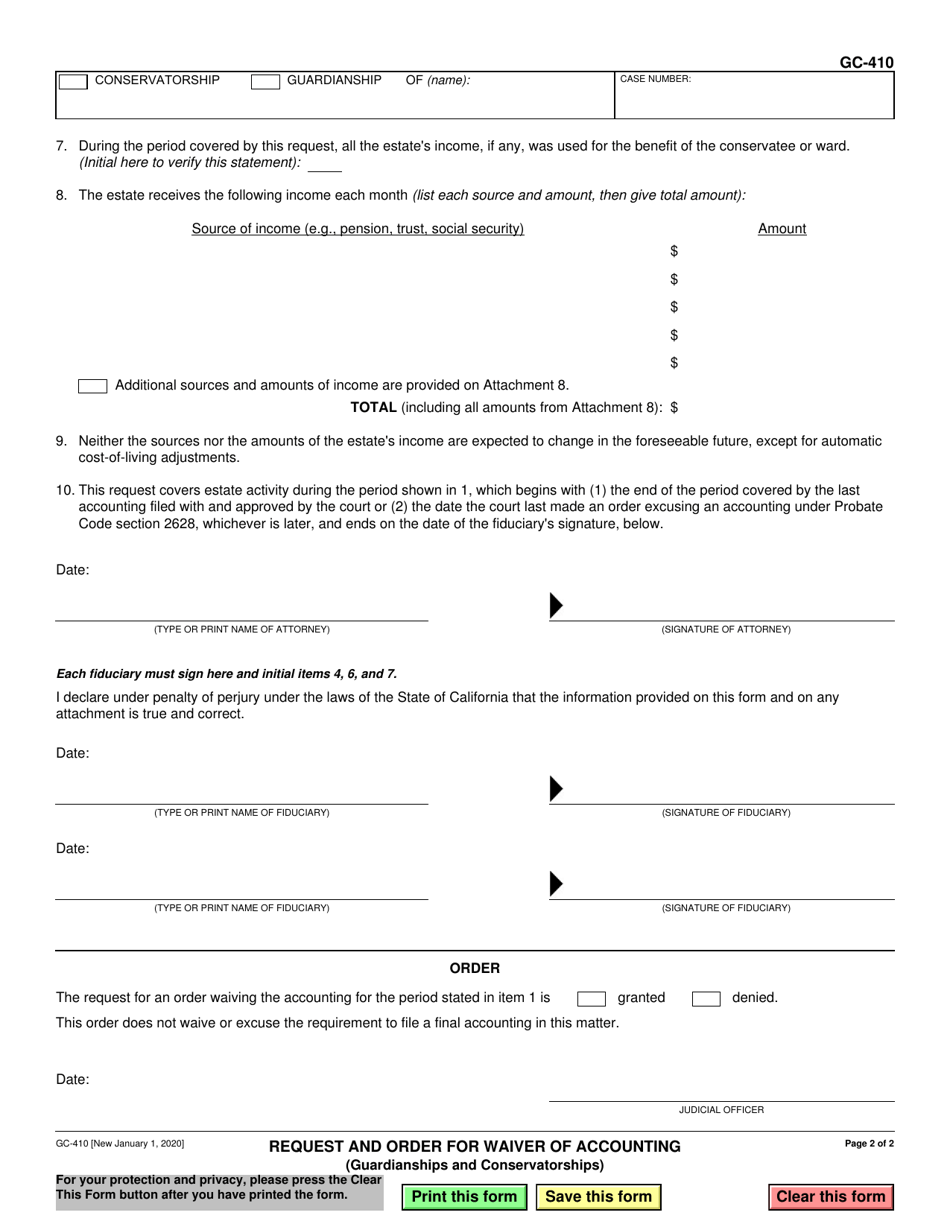

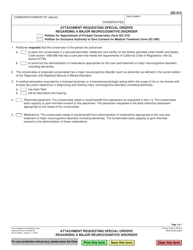

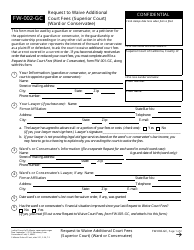

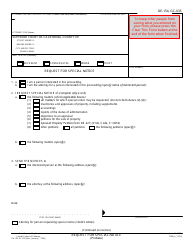

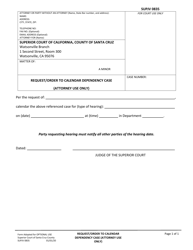

Form GC-410 Request and Order for Waiver of Accounting - California

What Is Form GC-410?

This is a legal form that was released by the California Superior Court - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

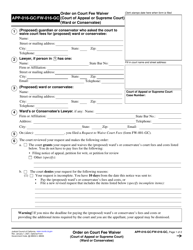

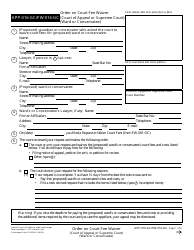

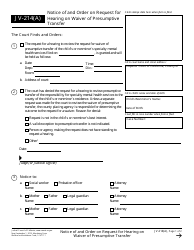

Q: What is the GC-410 form?

A: The GC-410 form is the Request and Order for Waiver of Accounting in California.

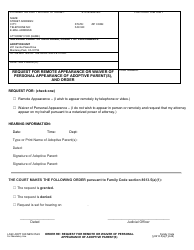

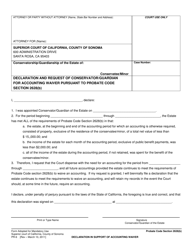

Q: What is the purpose of the GC-410 form?

A: The purpose of the GC-410 form is to request and order a waiver of accounting in the probate court.

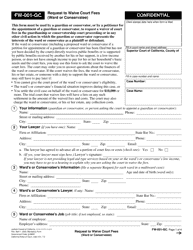

Q: Who needs to fill out the GC-410 form?

A: The executor or administrator of an estate in California needs to fill out the GC-410 form.

Q: When should the GC-410 form be filled out?

A: The GC-410 form should be filled out when the executor or administrator wants to request a waiver of accounting in the probate court.

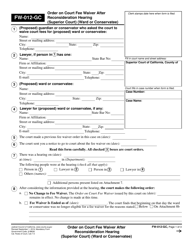

Q: What information is required on the GC-410 form?

A: The GC-410 form requires information such as the name of the estate, case number, and details about the request for waiver of accounting.

Q: Are there any fees to file the GC-410 form?

A: There may be filing fees associated with the GC-410 form. It is best to check with the specific probate court for the current fee schedule.

Q: How long does it take to process the GC-410 form?

A: The processing time for the GC-410 form depends on the probate court. It is recommended to contact the court for an estimated timeline.

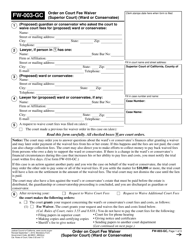

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the California Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GC-410 by clicking the link below or browse more documents and templates provided by the California Superior Court.