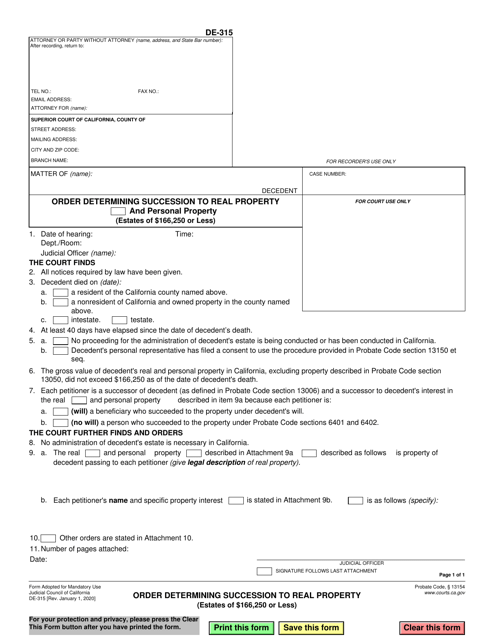

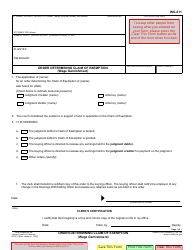

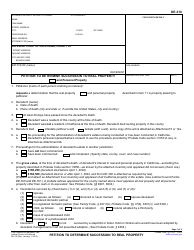

This version of the form is not currently in use and is provided for reference only. Download this version of

Form DE-315

for the current year.

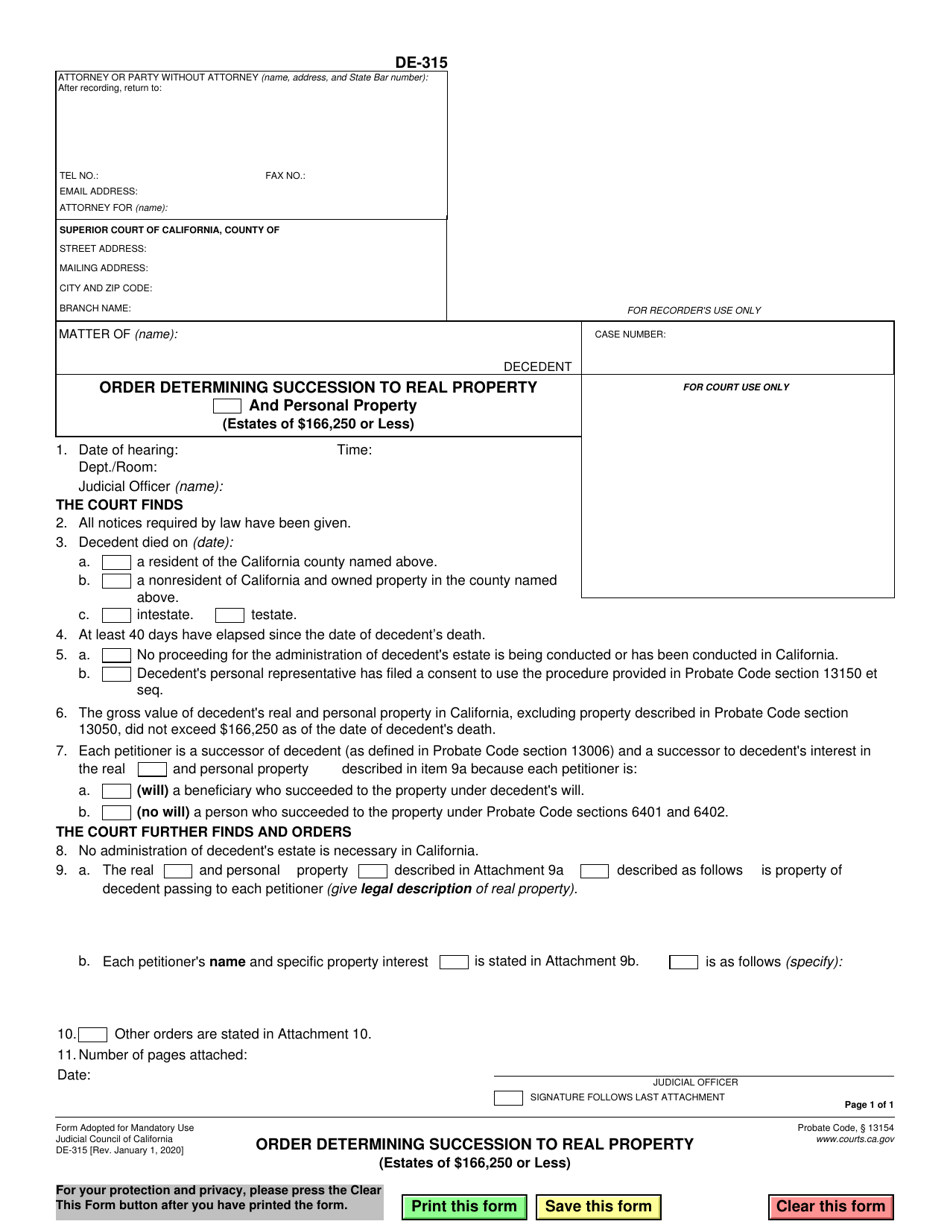

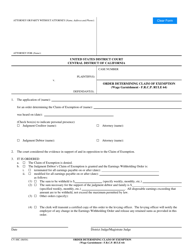

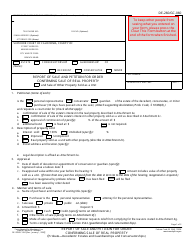

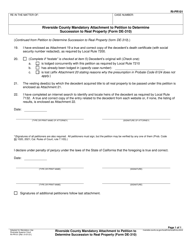

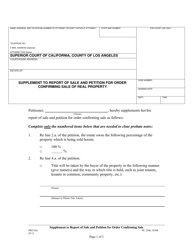

Form DE-315 Order Determining Succession to Real Property (Estates of $166,250 or Less) - California

What Is Form DE-315?

This is a legal form that was released by the California Superior Court - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

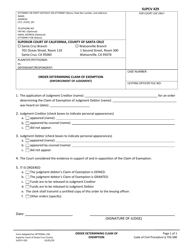

Q: What is Form DE-315?

A: Form DE-315 is an Order Determining Succession to Real Property (Estates of $166,250 or Less) in California.

Q: What is the purpose of Form DE-315?

A: The purpose of Form DE-315 is to determine the rightful successors to real property in estates of $166,250 or less.

Q: Who can use Form DE-315?

A: Form DE-315 is used by individuals in California who are dealing with a estate valued at $166,250 or less and need to determine the rightful recipients of real property.

Q: How much should the estate be valued at to use Form DE-315?

A: Form DE-315 is applicable for estates valued at $166,250 or less.

Q: Is Form DE-315 specific to a particular state?

A: Yes, Form DE-315 is specific to the state of California.

Q: What is required to fill out Form DE-315?

A: To fill out Form DE-315, you will need to provide information about the deceased person, the property, and the potential successors.

Q: Do I need to file Form DE-315 with the court?

A: Yes, you will need to file Form DE-315 with the court in order for the order determining succession to real property to be issued.

Q: Is there a fee for filing Form DE-315?

A: The filing fee for Form DE-315 may vary depending on the court. You will need to check with your local court for the exact fee.

Q: Are there any other forms or documents that need to be filed along with Form DE-315?

A: In some cases, you may need to file additional forms or documents along with Form DE-315. It is recommended to consult with an attorney to ensure all necessary documents are filed.

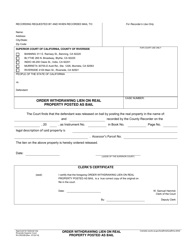

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the California Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DE-315 by clicking the link below or browse more documents and templates provided by the California Superior Court.