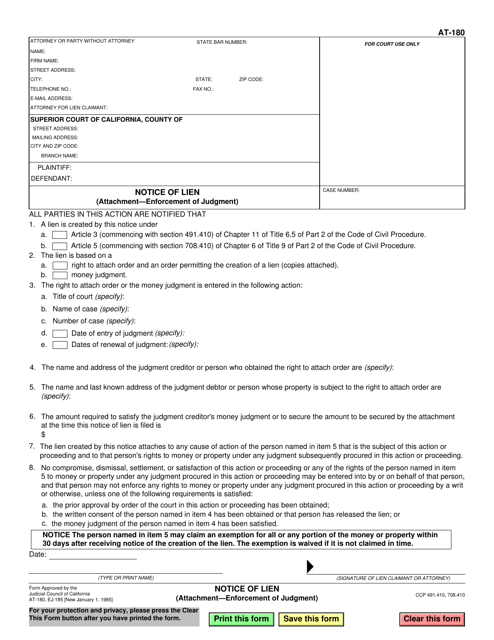

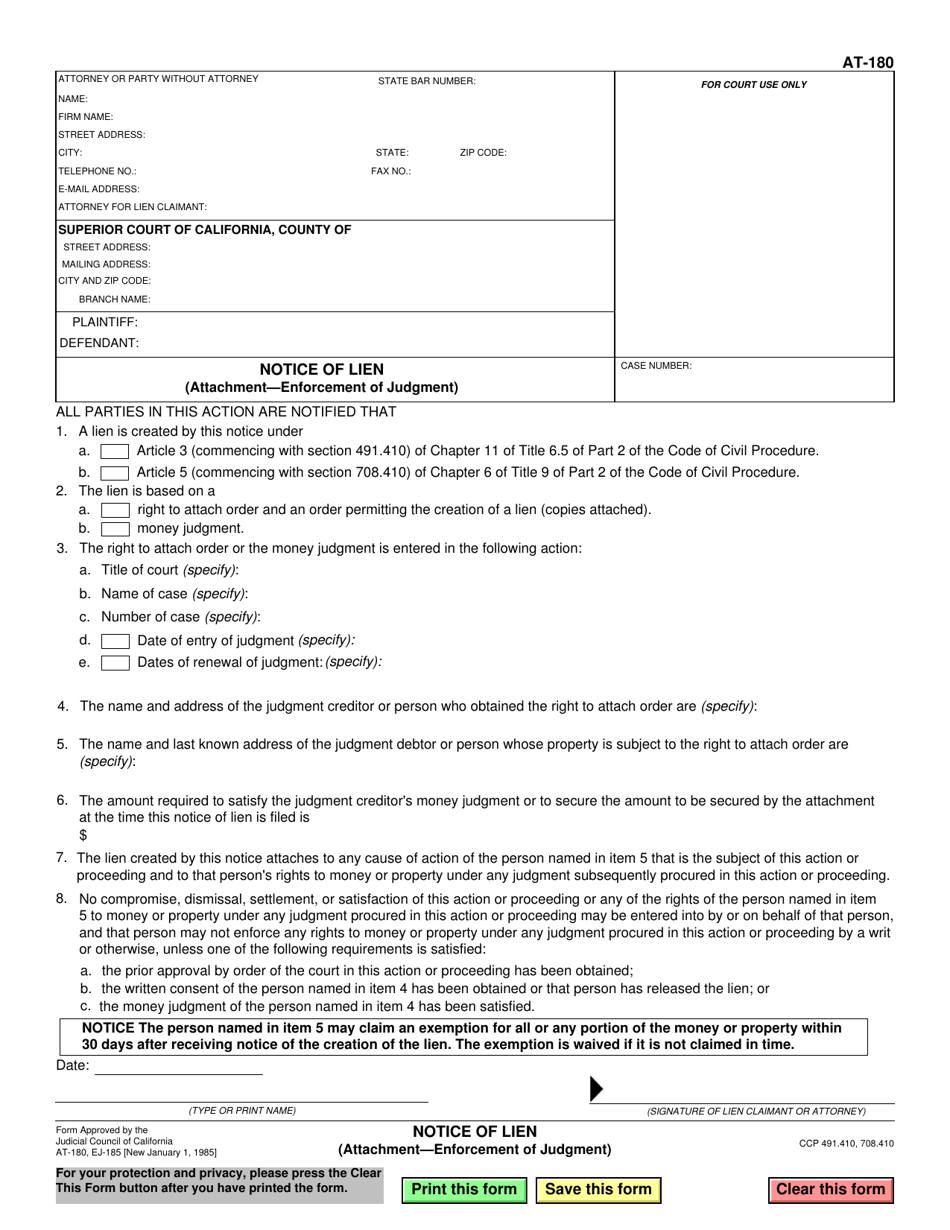

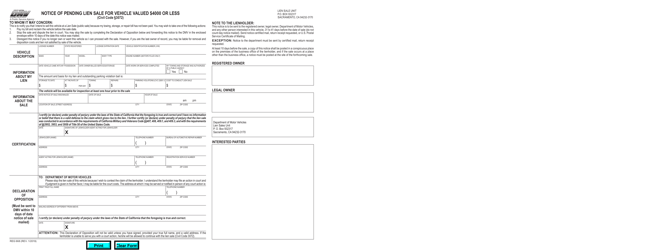

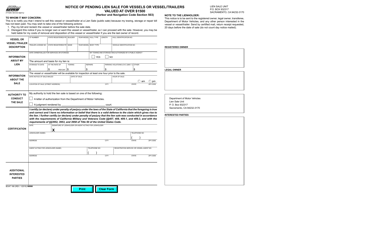

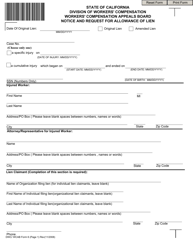

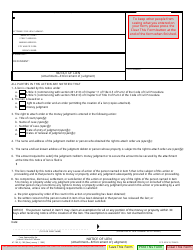

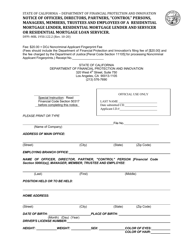

Form AT-180 Notice of Lien (Attachment - Enforcement of Judgment) - California

What Is Form AT-180?

This is a legal form that was released by the California Superior Court - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AT-180?

A: Form AT-180 is a Notice of Lien for the Enforcement of Judgment in California.

Q: What is the purpose of Form AT-180?

A: The purpose of Form AT-180 is to notify the public that a judgment lien has been placed on a specific property.

Q: What is a judgment lien?

A: A judgment lien is a legal claim against a property that is owned by a debtor to secure payment of a judgment.

Q: Who can file Form AT-180?

A: Form AT-180 can be filed by a judgment creditor who has obtained a judgment against a debtor.

Q: What information is required on Form AT-180?

A: Form AT-180 requires information about the judgment creditor, the debtor, and the property subject to the lien.

Q: How is Form AT-180 filed?

A: Form AT-180 is filed with the California Secretary of State or the county recorder's office, depending on the type of property being liened.

Q: Is there a fee for filing Form AT-180?

A: Yes, there is a fee for filing Form AT-180. The fee amount varies depending on the county in which the form is filed.

Q: How long does a judgment lien last?

A: In California, a judgment lien generally lasts for 10 years, and can be renewed for additional periods of 10 years.

Q: What happens if a judgment lien is not paid?

A: If a judgment lien is not paid, the judgment creditor may take further legal action to enforce the judgment, such as seizing and selling the property.

Q: Can a judgment lien be removed?

A: Yes, a judgment lien can be removed if the judgment is satisfied or if the debtor successfully challenges the validity of the lien.

Form Details:

- Released on January 1, 1985;

- The latest edition provided by the California Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AT-180 by clicking the link below or browse more documents and templates provided by the California Superior Court.