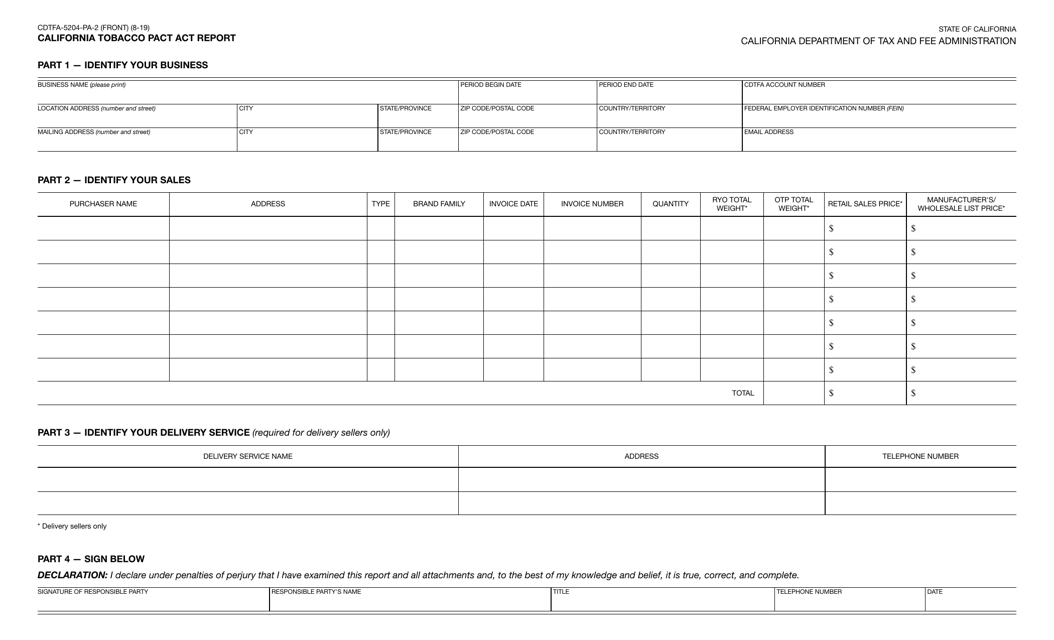

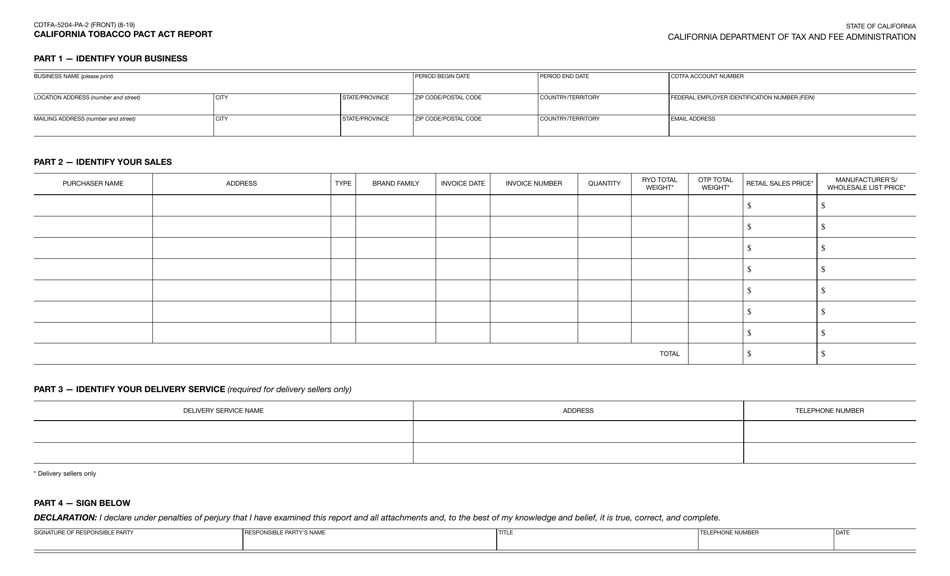

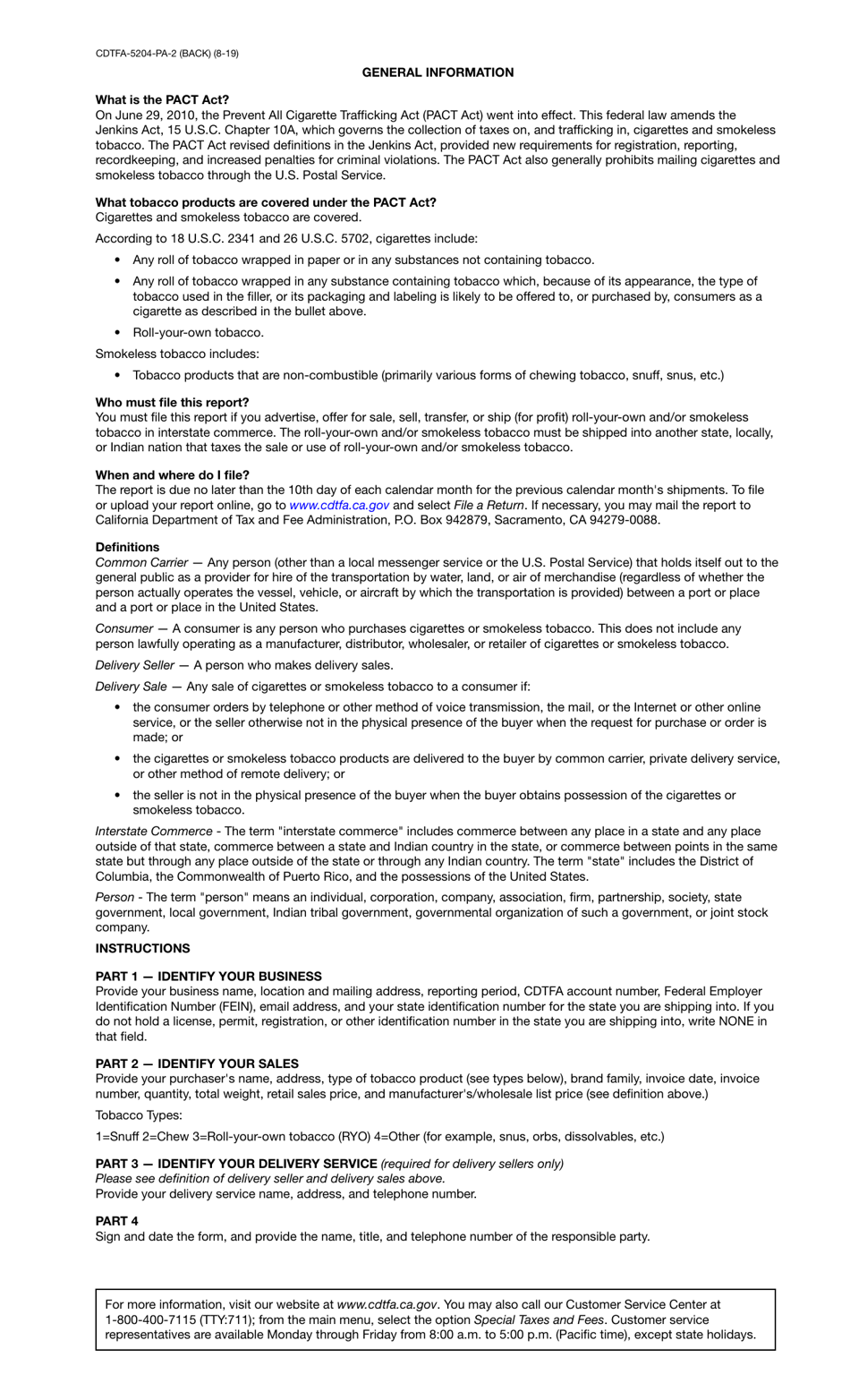

Form CDTFA-5204-PA-2 California Tobacco Pact Act Report - California

What Is Form CDTFA-5204-PA-2?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-5204-PA-2?

A: Form CDTFA-5204-PA-2 is the California Tobacco Pact Act Report.

Q: What is the California Tobacco Pact Act?

A: The California Tobacco Pact Act is a law that regulates the sale and distribution of tobacco products in California.

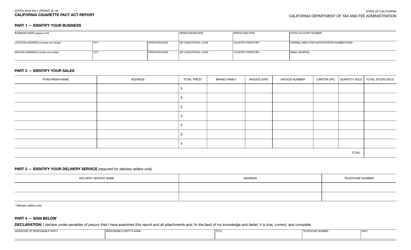

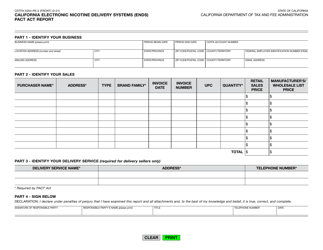

Q: Who needs to file Form CDTFA-5204-PA-2?

A: Any person or entity engaged in the sale or distribution of tobacco products in California needs to file Form CDTFA-5204-PA-2.

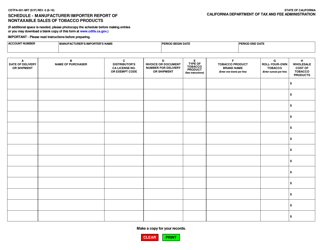

Q: What information is required on Form CDTFA-5204-PA-2?

A: Form CDTFA-5204-PA-2 requires information such as the name and address of the distributor, the number of cigarettes and weight of other tobacco products sold, and the amount of tax due.

Q: When is Form CDTFA-5204-PA-2 due?

A: Form CDTFA-5204-PA-2 is due on a quarterly basis, with the due dates being April 30, July 31, October 31, and January 31.

Q: What happens if I fail to file Form CDTFA-5204-PA-2?

A: Failure to file Form CDTFA-5204-PA-2 or paying the required tax can result in penalties and interest being assessed by the CDTFA.

Q: Are there any exemptions to filing Form CDTFA-5204-PA-2?

A: There are certain exemptions for small distributors, as well as distributors who only sell products exempt from the California Tobacco Pact Act.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-5204-PA-2 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.