This version of the form is not currently in use and is provided for reference only. Download this version of

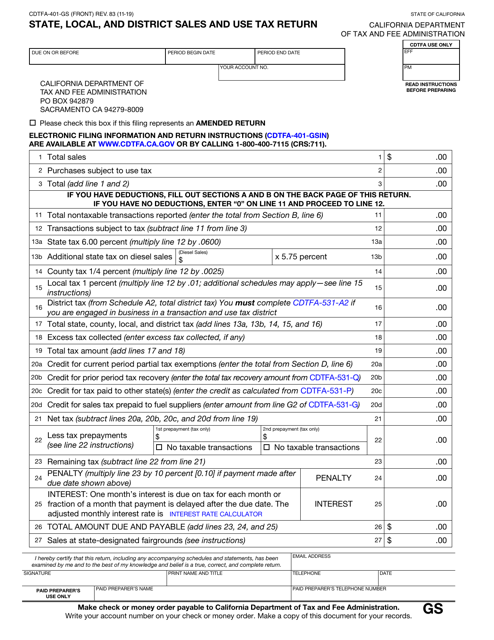

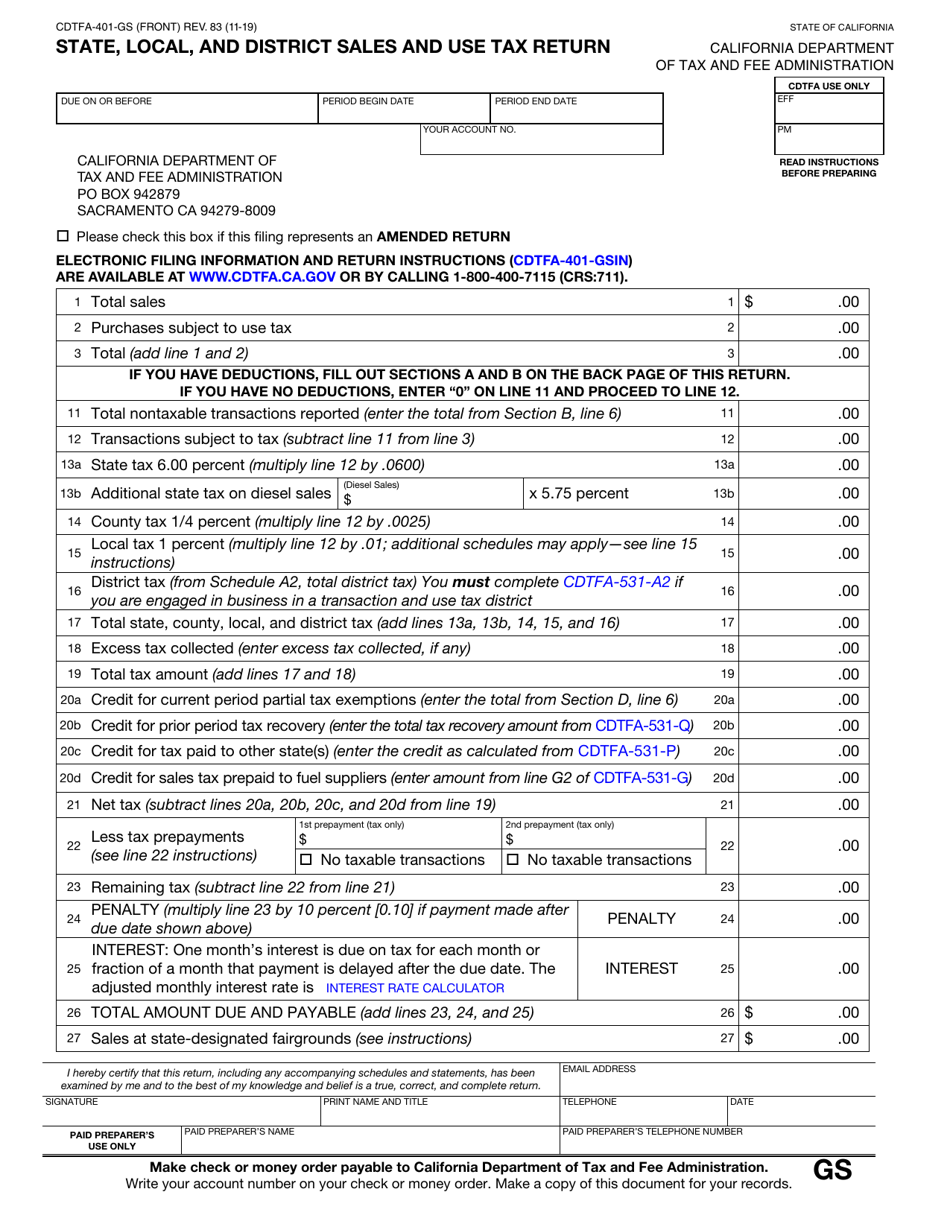

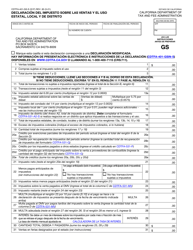

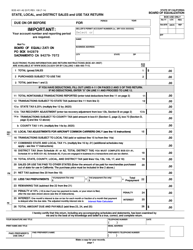

Form CDTFA-401-GS

for the current year.

Form CDTFA-401-GS State, Local, and District Sales and Use Tax Return - California

What Is Form CDTFA-401-GS?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

Q: What is CDTFA-401-GS?

A: CDTFA-401-GS is the form used in California to file the State, Local, and District Sales and Use Tax Return.

Q: Who needs to file CDTFA-401-GS?

A: Businesses operating in California that are engaged in selling or leasing tangible personal property, vehicles, or certain digital products are required to file CDTFA-401-GS.

Q: What is the purpose of CDTFA-401-GS?

A: The purpose of CDTFA-401-GS is to report and remit the state, local, and district sales and use tax collected by businesses in California.

Q: How often should CDTFA-401-GS be filed?

A: CDTFA-401-GS should be filed on a regular basis, generally on a quarterly basis. However, some businesses may be required to file monthly or annual returns.

Q: Are there any penalties for not filing CDTFA-401-GS?

A: Yes, there are penalties for not filing CDTFA-401-GS or for filing late. These penalties can include monetary fines and interest charges.

Q: Is CDTFA-401-GS used for both sales tax and use tax?

A: Yes, CDTFA-401-GS is used to report both sales tax and use tax.

Q: What is the due date for filing CDTFA-401-GS?

A: The due date for filing CDTFA-401-GS varies depending on the reporting period. It is generally due by the end of the month following the end of the reporting period.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-401-GS by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.