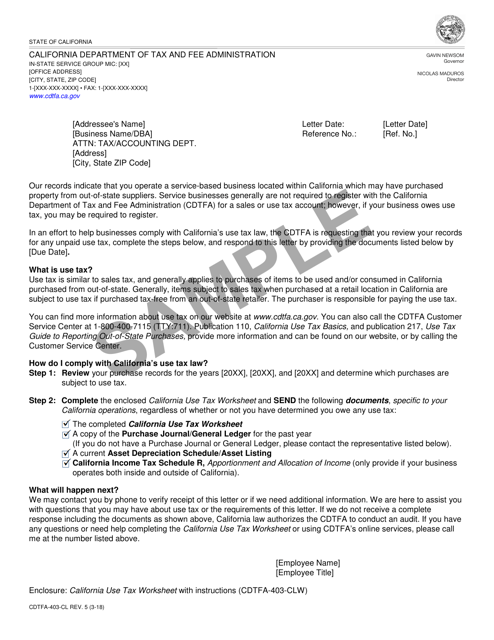

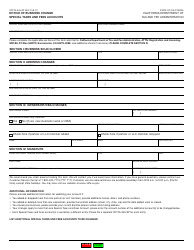

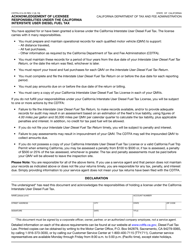

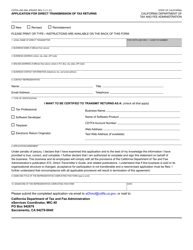

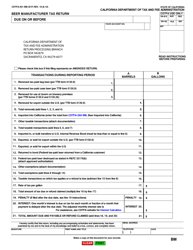

Sample Form CDTFA-403-CL Tax-Gap in-State Service Contact Letter - California

What Is Form CDTFA-403-CL?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

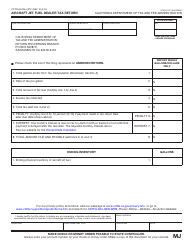

Q: What is Form CDTFA-403-CL?

A: Form CDTFA-403-CL is a Tax-Gap in-State Service Contact Letter in California.

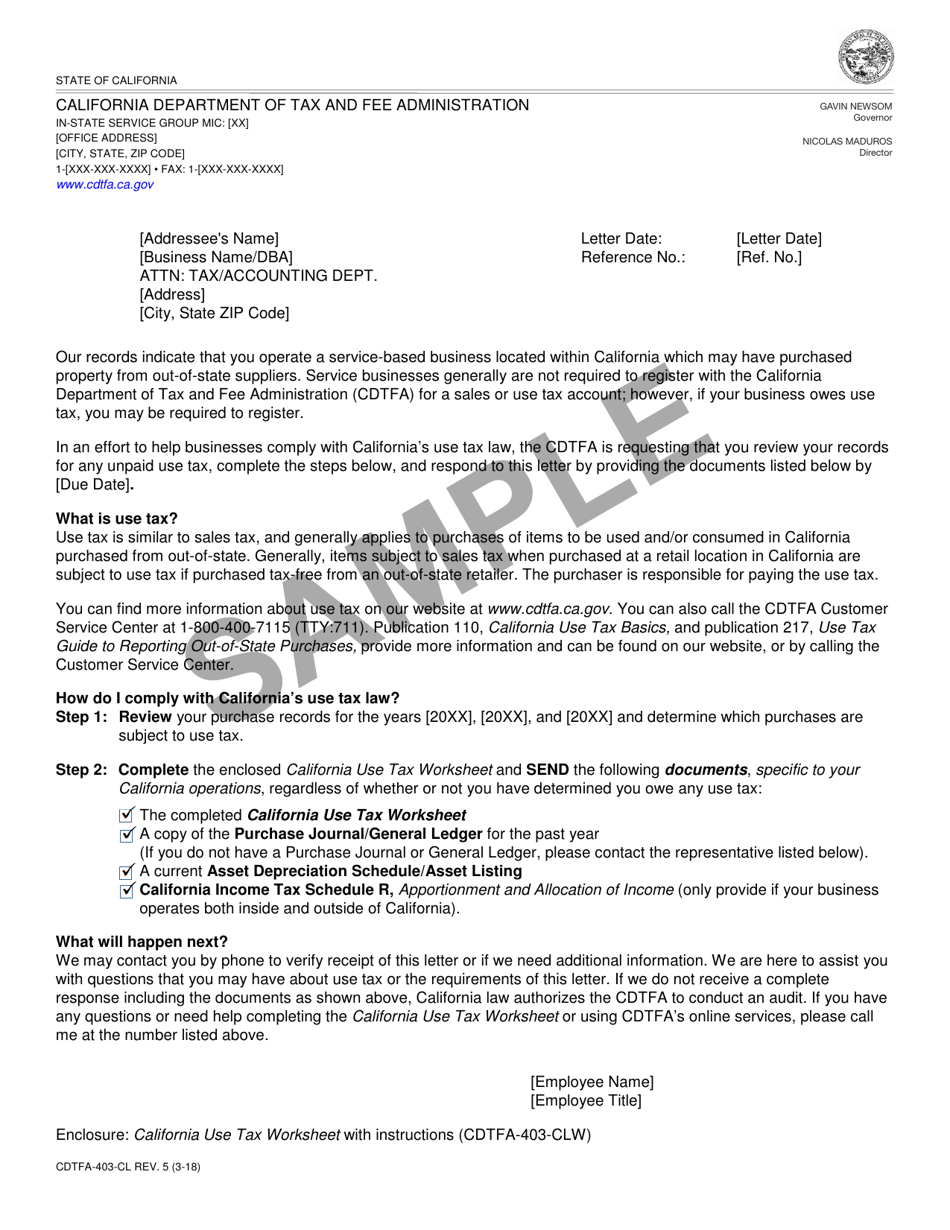

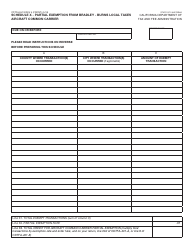

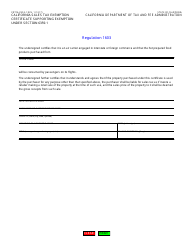

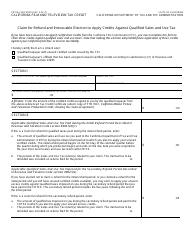

Q: What is the purpose of Form CDTFA-403-CL?

A: The purpose of Form CDTFA-403-CL is to address tax compliance issues in the state of California.

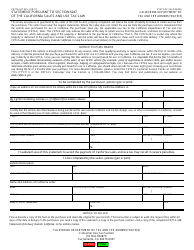

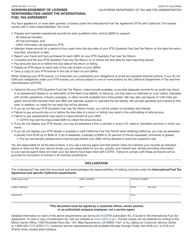

Q: Who is required to use Form CDTFA-403-CL?

A: Taxpayers in California who have potential tax compliance issues may be required to use Form CDTFA-403-CL.

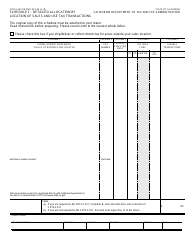

Q: What does the Tax-Gap in-State Service Contact Letter refer to?

A: The Tax-Gap in-State Service Contact Letter refers to a letter sent by the California Department of Tax and Fee Administration (CDTFA) to address potential tax gaps or compliance issues.

Q: Is Form CDTFA-403-CL specific to any particular industry or type of taxpayer?

A: No, Form CDTFA-403-CL can be applicable to taxpayers across different industries and types in California.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

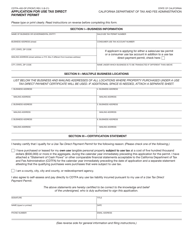

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CDTFA-403-CL by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.