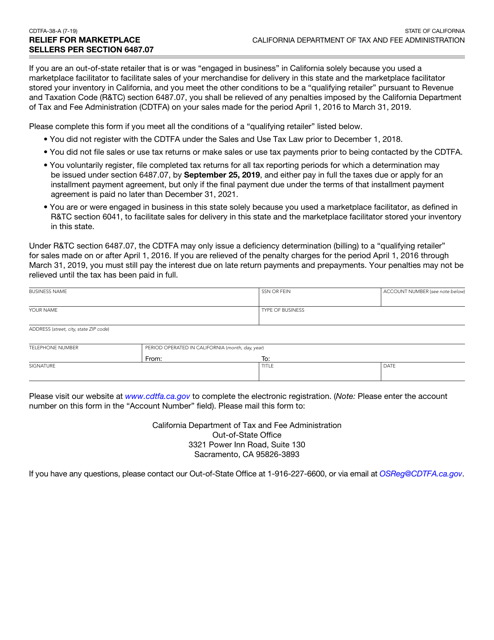

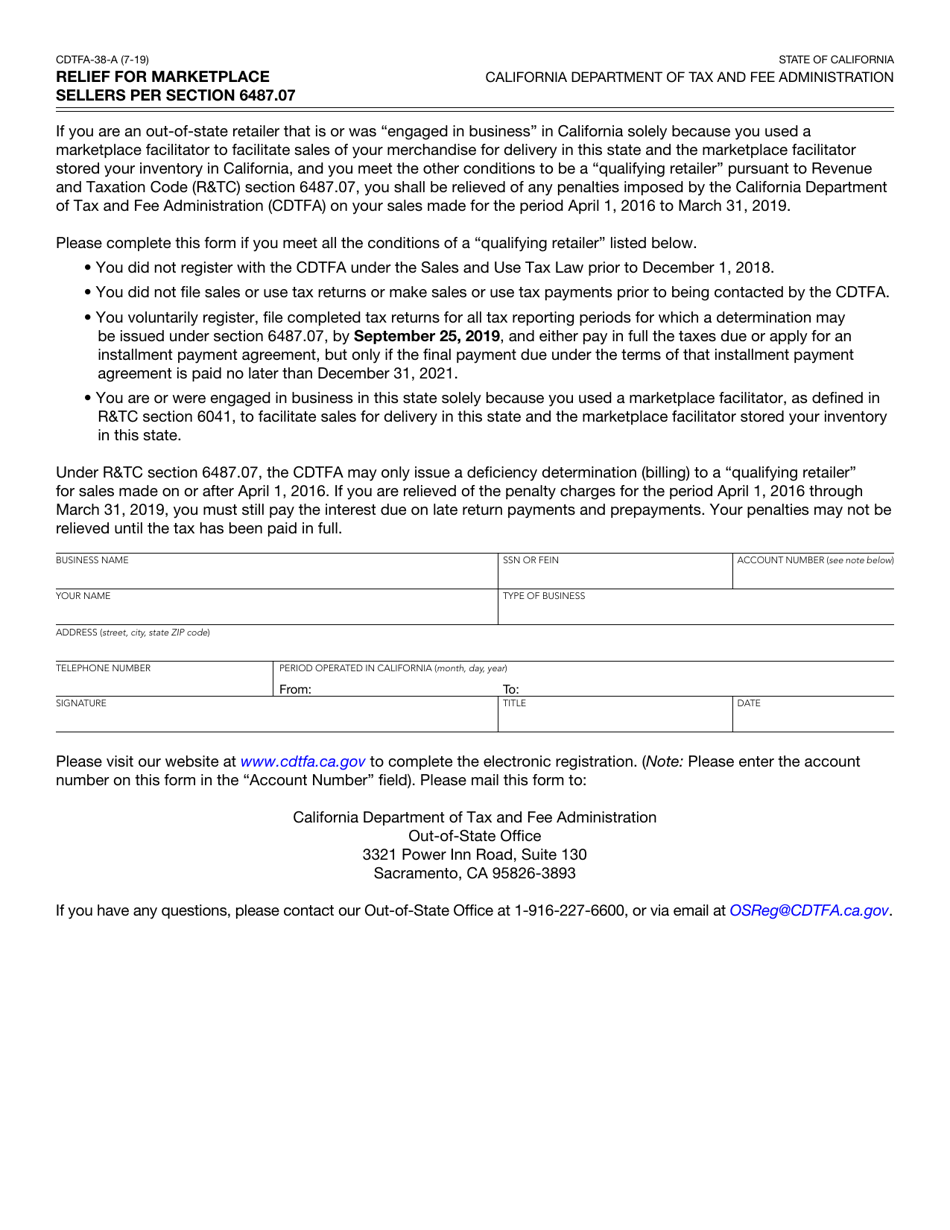

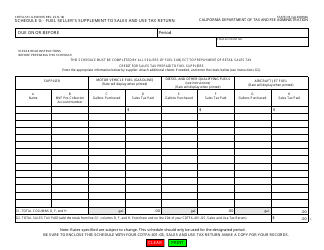

Form CDTFA-38-A Relief for Marketplace Sellers Per Section 6487.07 - California

What Is Form CDTFA-38-A?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-38-A?

A: Form CDTFA-38-A is a form used to claim relief for marketplace sellers in California.

Q: What is the purpose of Form CDTFA-38-A?

A: The purpose of Form CDTFA-38-A is to claim relief for marketplace sellers under Section 6487.07 of the California Revenue and Taxation Code.

Q: Who can use Form CDTFA-38-A?

A: Form CDTFA-38-A can be used by marketplace sellers who meet the requirements outlined in Section 6487.07 of the California Revenue and Taxation Code.

Q: What is the relief provided by Form CDTFA-38-A?

A: Form CDTFA-38-A provides relief for marketplace sellers from certain California tax obligations.

Q: What are the requirements to claim relief using Form CDTFA-38-A?

A: The requirements to claim relief using Form CDTFA-38-A include meeting the definition of a marketplace seller and complying with certain reporting and remittance requirements.

Q: Are there any filing fees for Form CDTFA-38-A?

A: No, there are no filing fees for Form CDTFA-38-A.

Q: Is Form CDTFA-38-A specific to California?

A: Yes, Form CDTFA-38-A is specific to marketplace sellers in California.

Q: Are there any penalties for not filing Form CDTFA-38-A?

A: Failure to file Form CDTFA-38-A may result in the marketplace seller being held liable for certain California tax obligations.

Q: Can I claim relief using Form CDTFA-38-A if I am not a marketplace seller?

A: No, only marketplace sellers who meet the requirements can claim relief using Form CDTFA-38-A.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-38-A by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.