This version of the form is not currently in use and is provided for reference only. Download this version of

Form CDTFA-501-IR

for the current year.

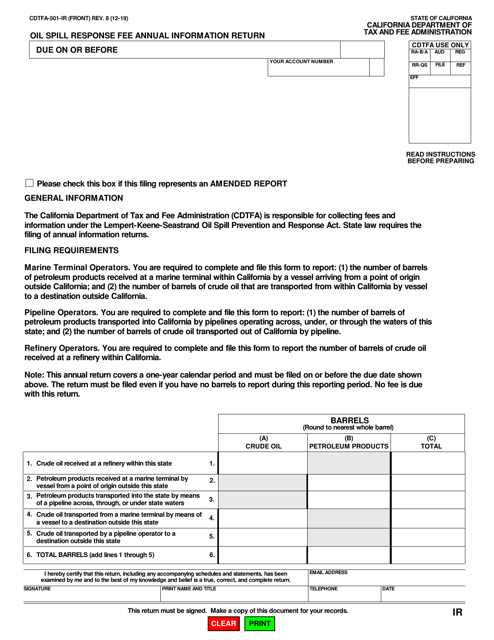

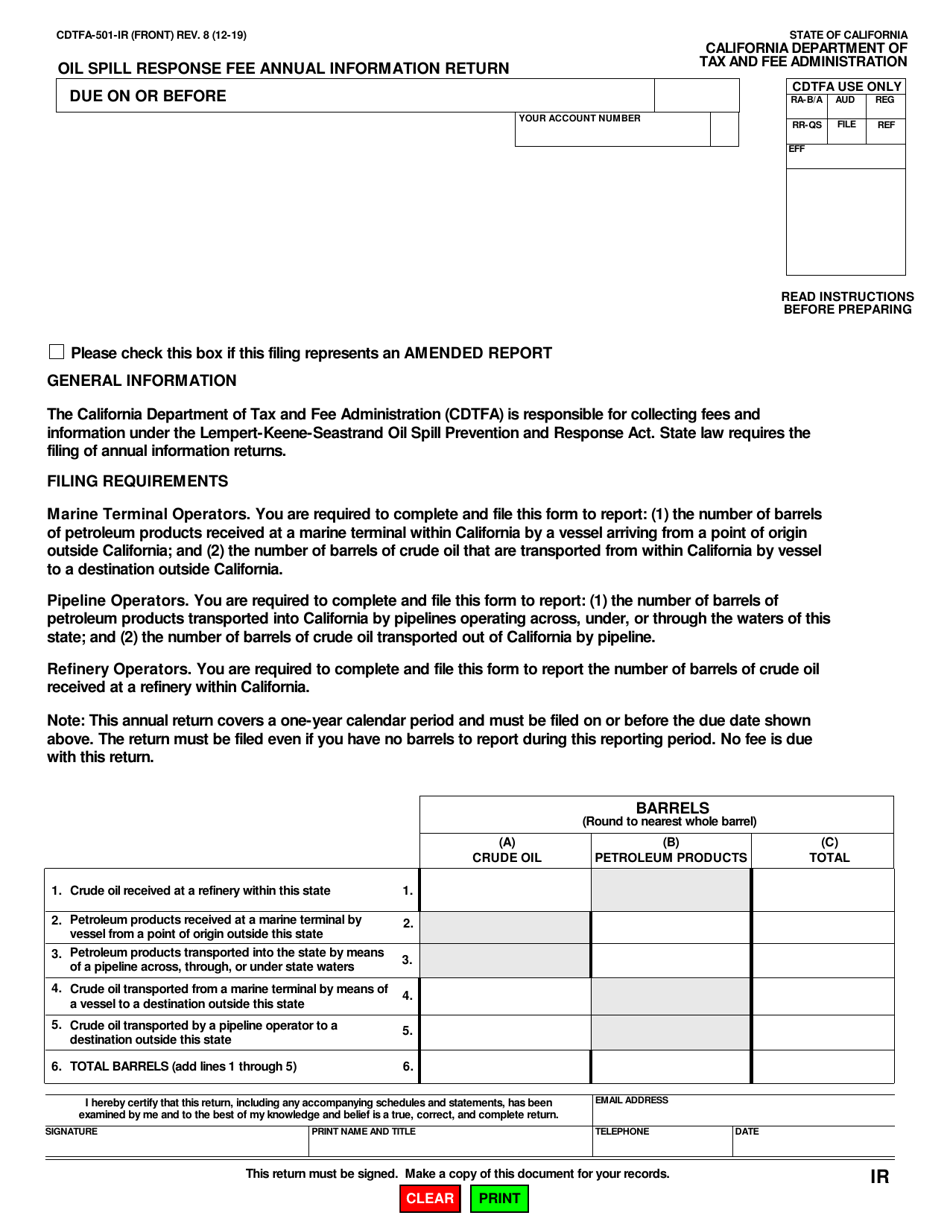

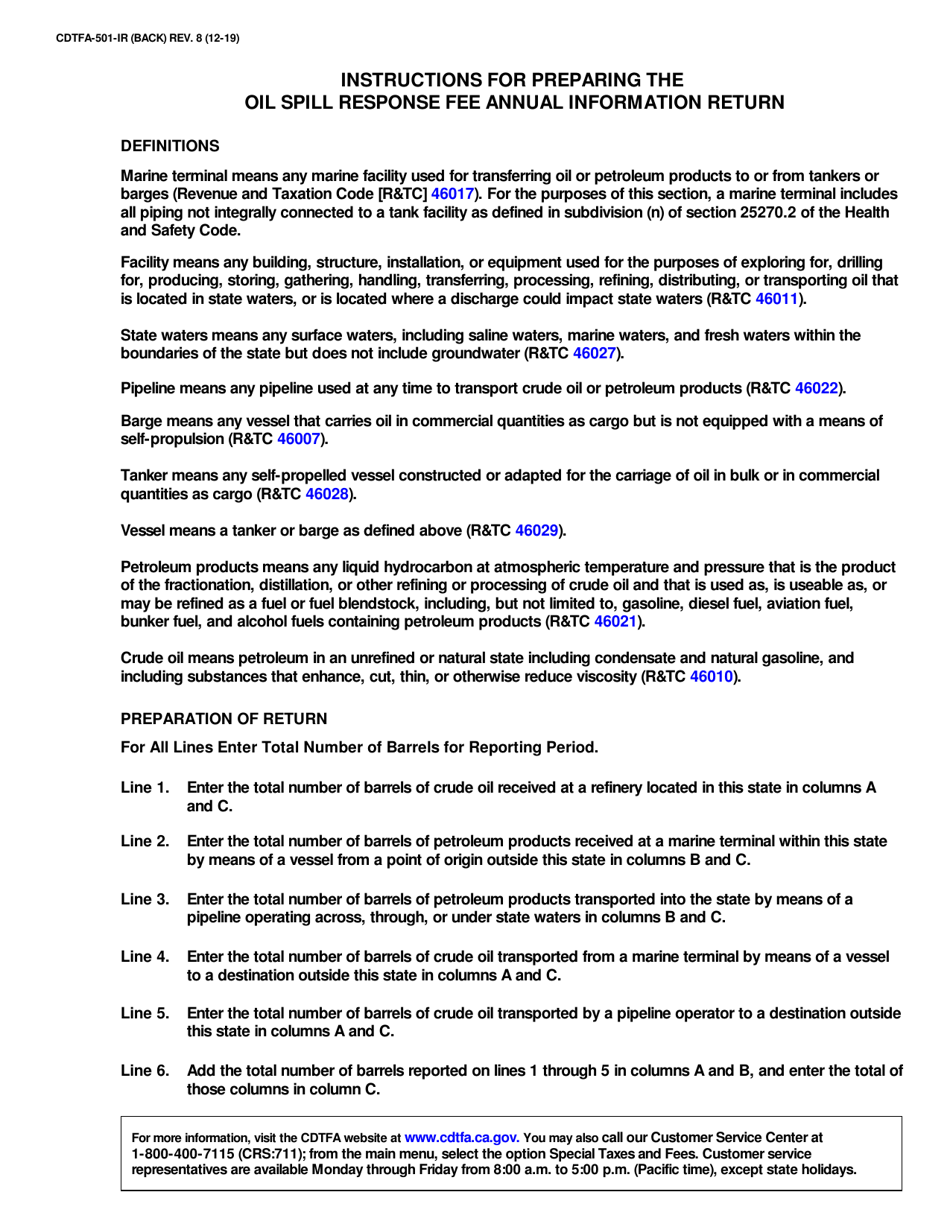

Form CDTFA-501-IR Oil Spill Response Fee Annual Information Return - California

What Is Form CDTFA-501-IR?

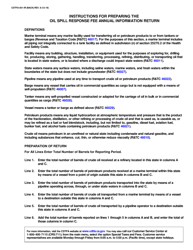

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-501-IR?

A: Form CDTFA-501-IR is the Oil Spill Response Fee Annual Information Return.

Q: What is the purpose of Form CDTFA-501-IR?

A: The purpose of Form CDTFA-501-IR is to report the necessary information for calculating the oil spill response fee in California.

Q: Who needs to file Form CDTFA-501-IR?

A: Businesses that are subject to the oil spill response fee in California must file Form CDTFA-501-IR.

Q: How often is Form CDTFA-501-IR filed?

A: Form CDTFA-501-IR is filed annually.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-501-IR by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.