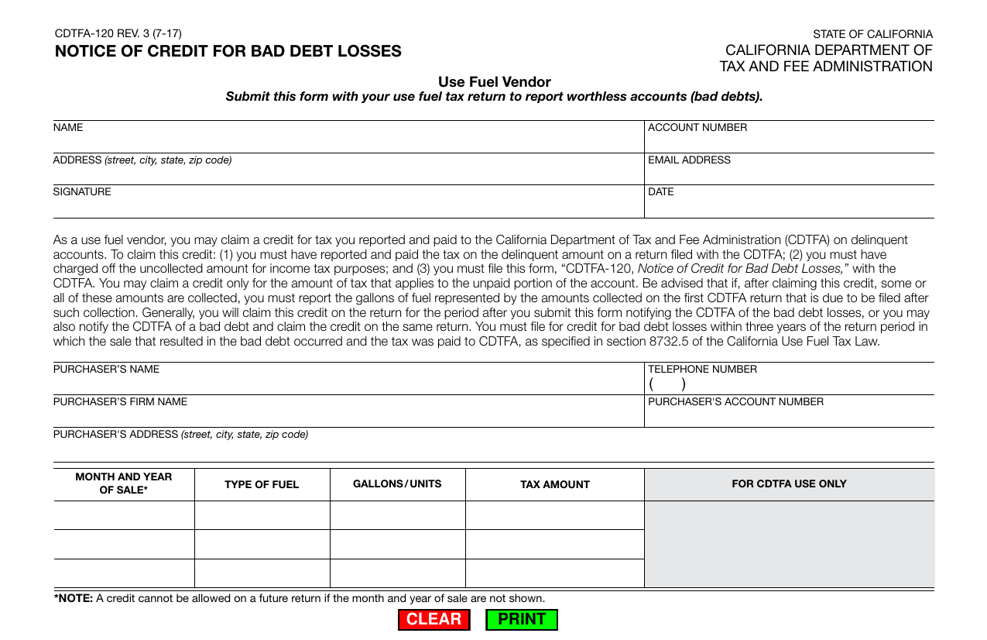

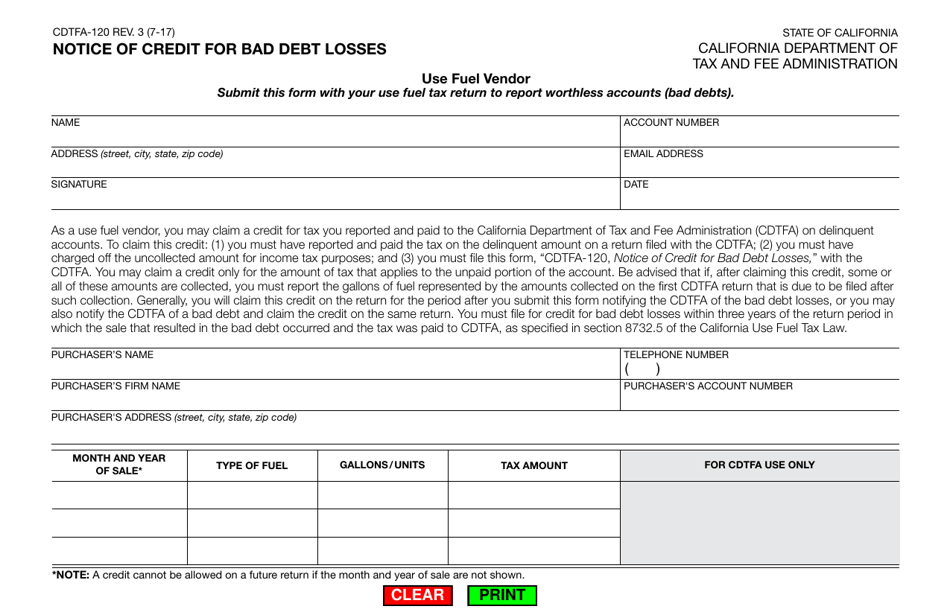

Form CDTFA-120 Notice of Credit for Bad Debt Losses - California

What Is Form CDTFA-120?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-120?

A: Form CDTFA-120 is the Notice of Credit for Bad Debt Losses used in California.

Q: What is the purpose of Form CDTFA-120?

A: The purpose of Form CDTFA-120 is to claim a credit for bad debt losses incurred in California.

Q: Who needs to file Form CDTFA-120?

A: Businesses in California that have incurred bad debt losses may need to file Form CDTFA-120.

Q: When should Form CDTFA-120 be filed?

A: Form CDTFA-120 should be filed within four years from the date the bad debt was charged off or taken as a deduction on a federal income tax return.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-120 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.