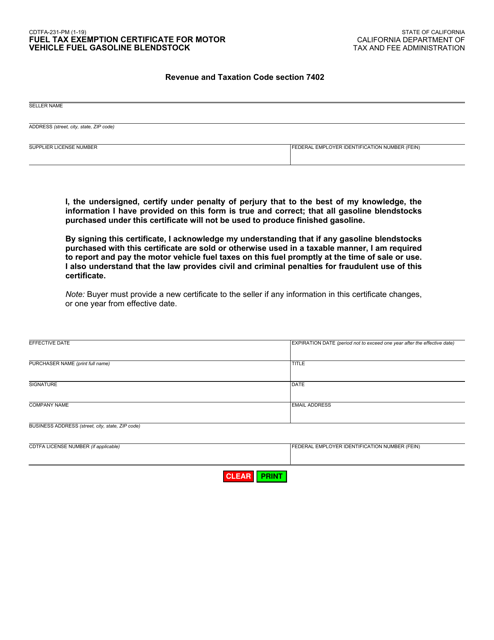

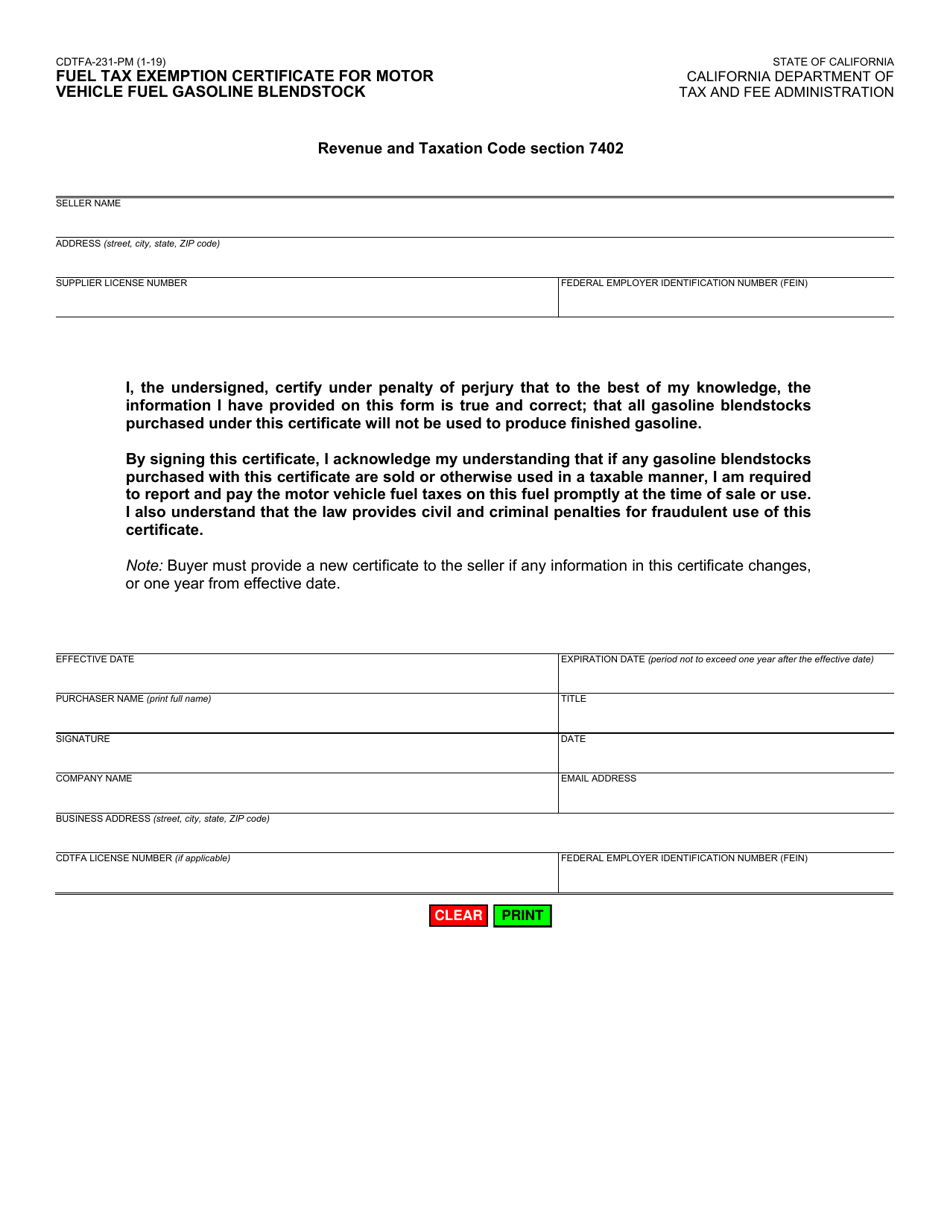

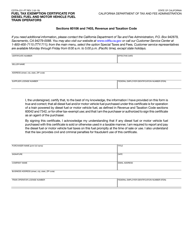

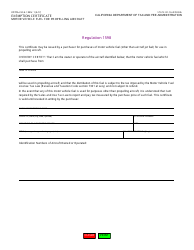

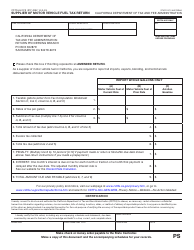

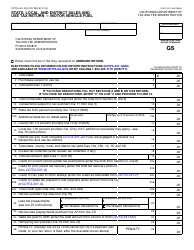

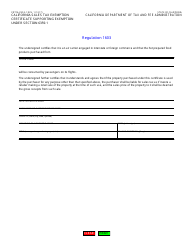

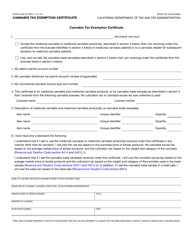

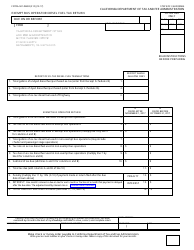

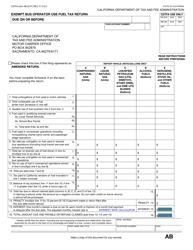

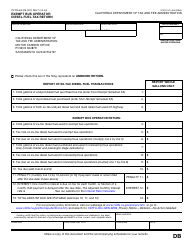

Form CDTFA-231-PM Fuel Tax Exemption Certificate for Motor Vehicle Fuel Gasoline Blendstock - California

What Is Form CDTFA-231-PM?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-231-PM?

A: Form CDTFA-231-PM is the Fuel Tax Exemption Certificate for Motor Vehicle Fuel Gasoline Blendstock in California.

Q: What is the purpose of this form?

A: This form is used to claim an exemption from fuel taxes on motor vehicle fuel gasoline blendstock in California.

Q: Who needs to fill out this form?

A: Any individual or business that qualifies for a fuel tax exemption for motor vehicle fuel gasoline blendstock in California needs to fill out this form.

Q: What information is required on this form?

A: The form requires information such as the claimant's name, address, and identification number, as well as details about the motor vehicle fuel gasoline blendstock being claimed for exemption.

Q: Are there any filing fees associated with this form?

A: No, there are no filing fees associated with this form.

Q: What should I do if I need assistance with this form?

A: If you need assistance with this form, you can contact the California Department of Tax and Fee Administration (CDTFA) directly.

Q: Is this form specific to California?

A: Yes, this form is specific to California and is used to claim a fuel tax exemption for motor vehicle fuel gasoline blendstock in the state.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-231-PM by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.