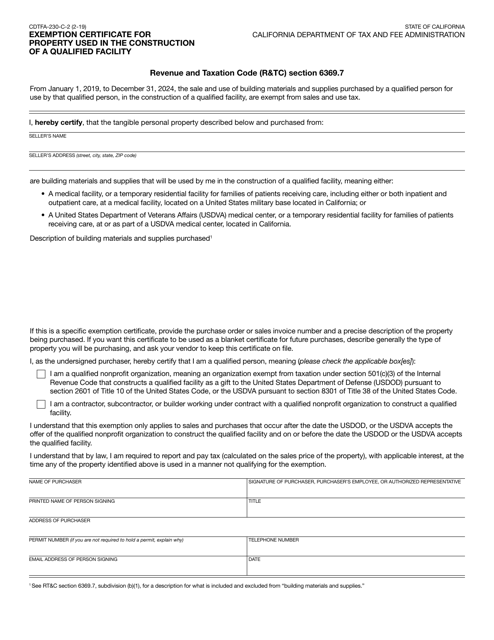

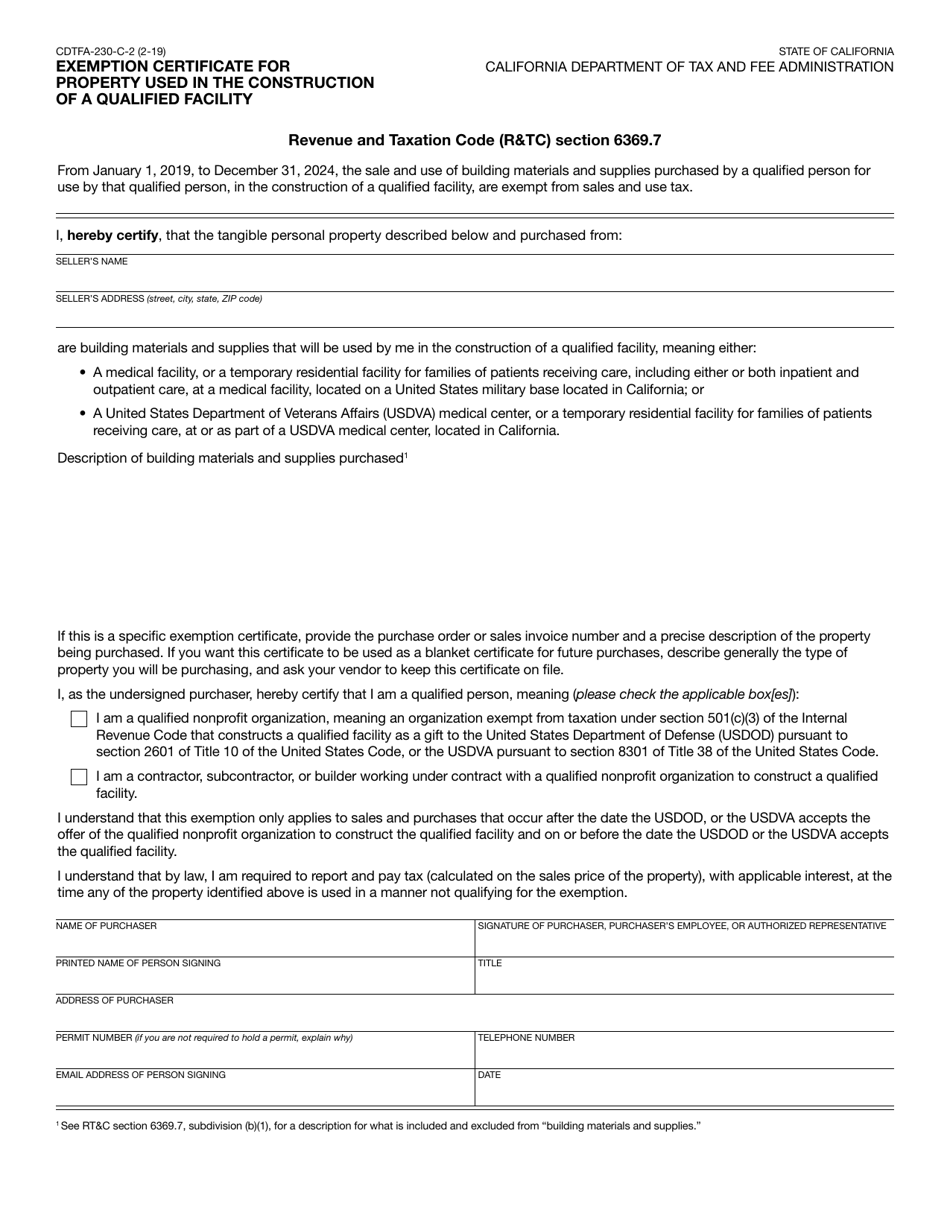

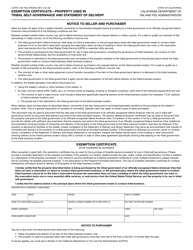

Form CDTFA-230-C-2 Exemption Certificate for Property Used in the Construction of a Qualified Facility - California

What Is Form CDTFA-230-C-2?

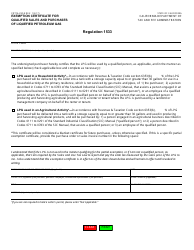

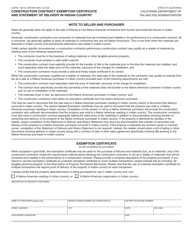

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-230-C-2?

A: Form CDTFA-230-C-2 is an Exemption Certificate for Property Used in the Construction of a Qualified Facility in California.

Q: Who uses Form CDTFA-230-C-2?

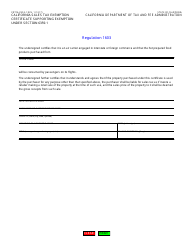

A: This form is used by individuals and businesses who are seeking an exemption for property used in the construction of a qualified facility in California.

Q: What is a qualified facility?

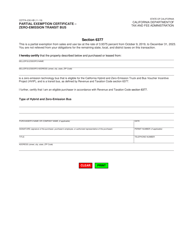

A: A qualified facility is a building or structure that is owned and used by a person or business primarily for the generation or production of renewable energy.

Q: What is the purpose of this exemption certificate?

A: The purpose of this exemption certificate is to provide proof that the property being purchased will be used in the construction of a qualified facility, and therefore is exempt from certain taxes.

Q: What taxes are exempt with this certificate?

A: With this certificate, the property being purchased is exempt from sales and use taxes in California.

Q: What information is required on the form?

A: The form requires information such as the purchaser's name and address, the seller's name and address, a description of the property, and a signed statement asserting that the property will be used in the construction of a qualified facility.

Q: Is there a fee to file this form?

A: No, there is no fee to file Form CDTFA-230-C-2.

Q: Is this exemption certificate permanent?

A: No, this exemption certificate is only valid for a single purchase and will need to be obtained for each qualifying purchase.

Q: Are there any other requirements to qualify for this exemption?

A: Yes, there are additional requirements that must be met in order to qualify for this exemption. These requirements are outlined in the instructions accompanying the form.

Form Details:

- Released on February 1, 2019;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-230-C-2 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.