This version of the form is not currently in use and is provided for reference only. Download this version of

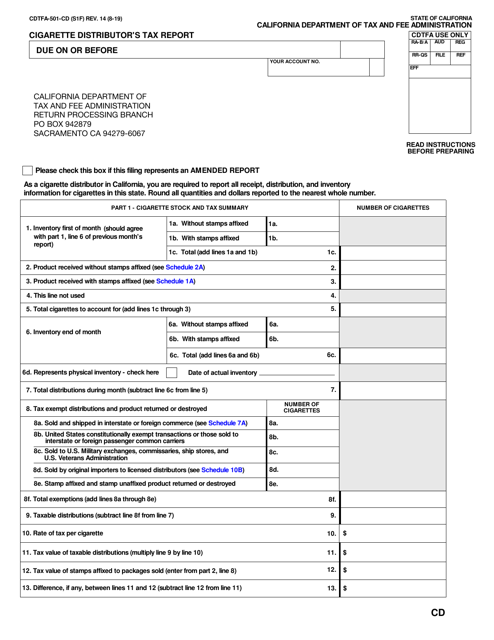

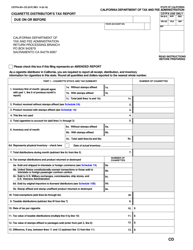

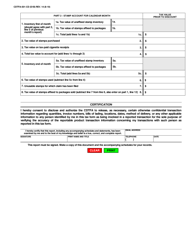

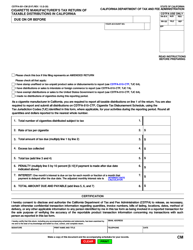

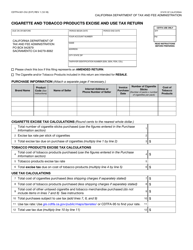

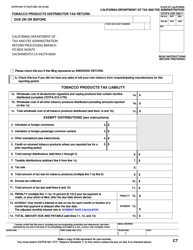

Form CDTFA-501-CD

for the current year.

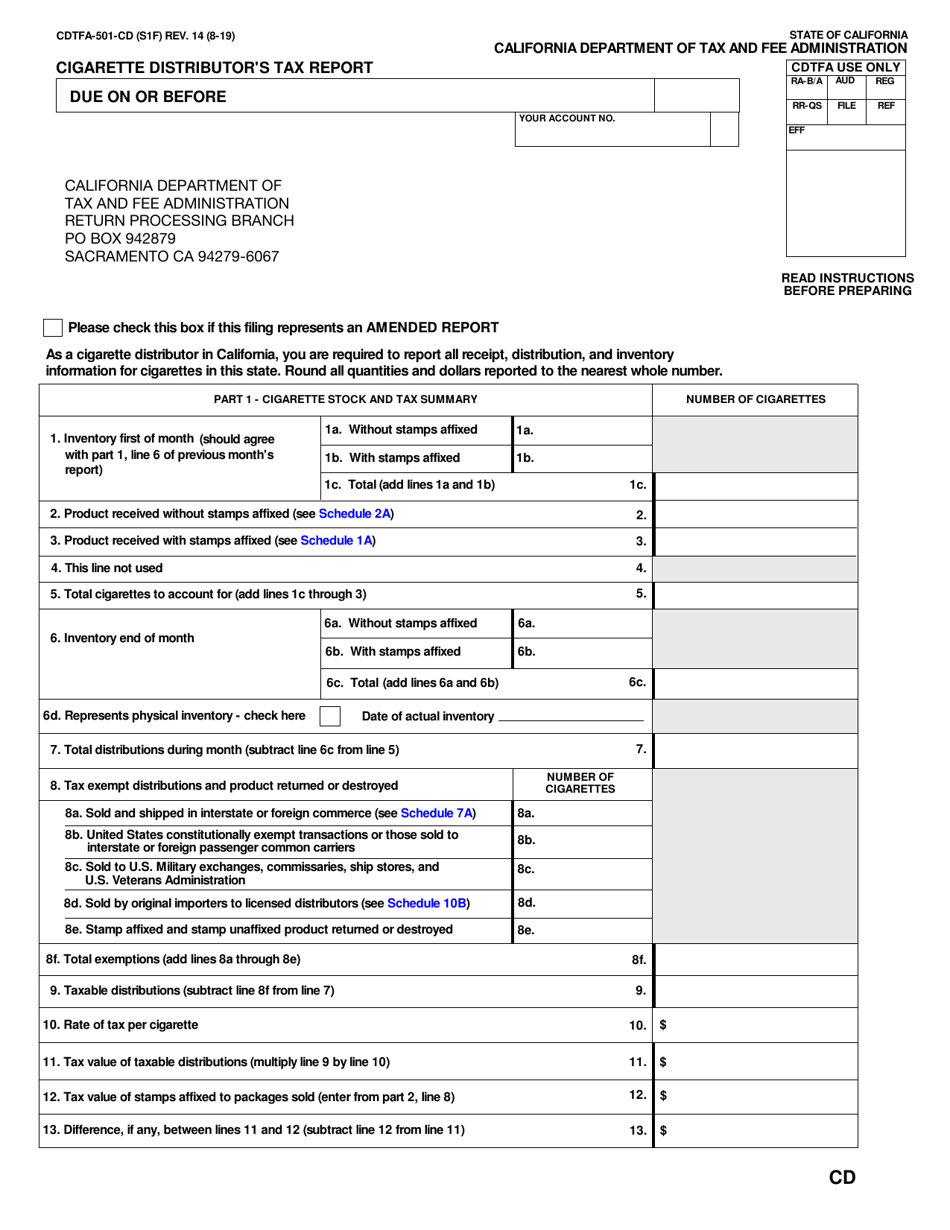

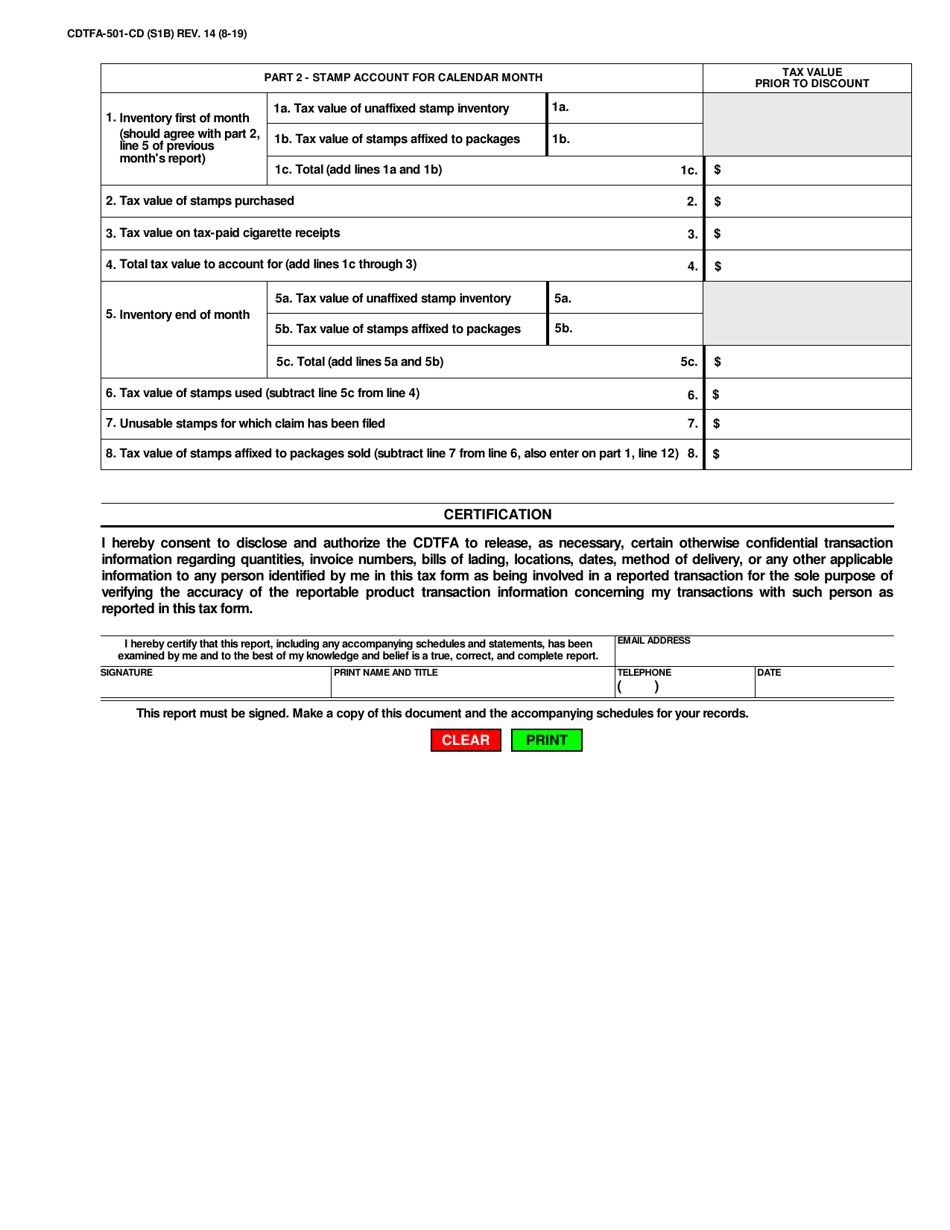

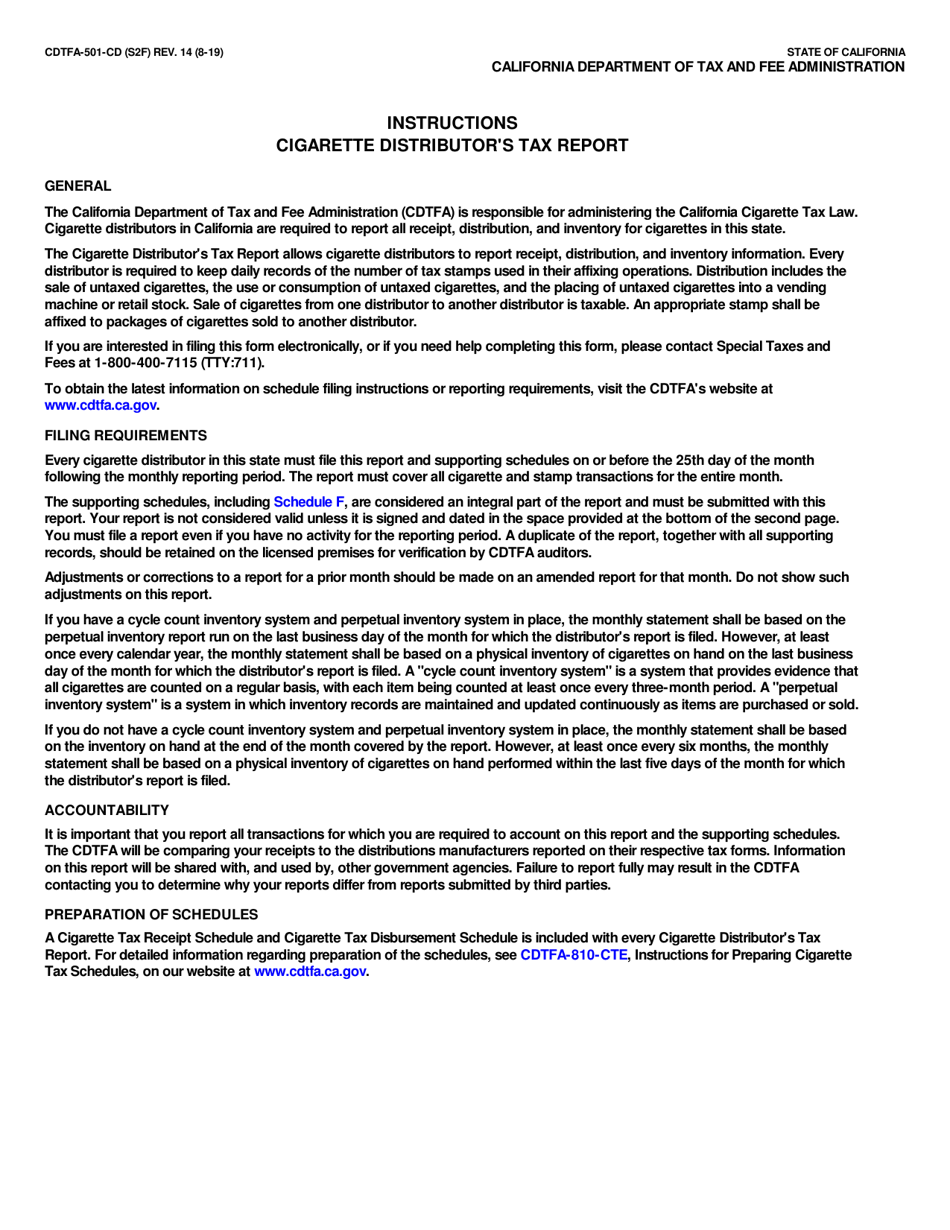

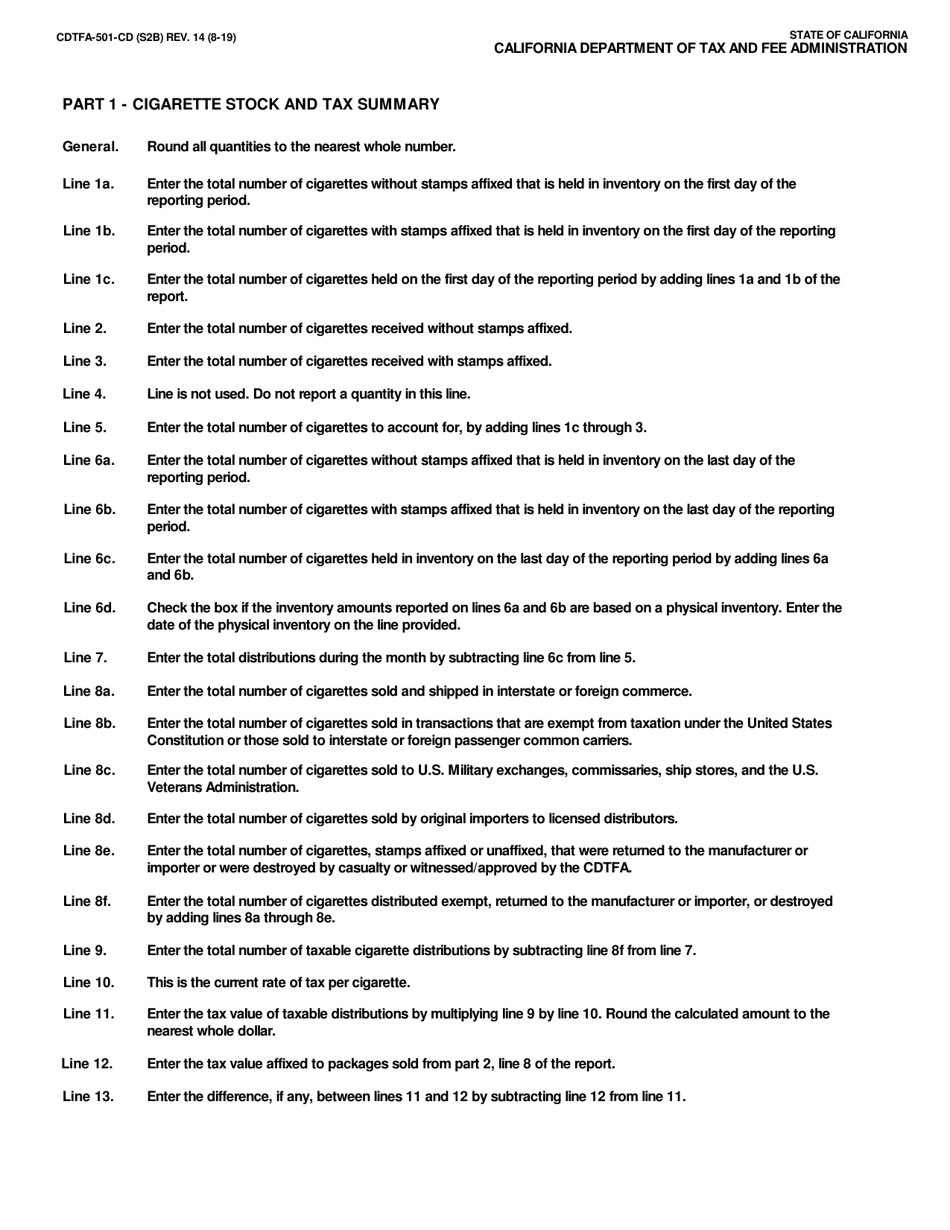

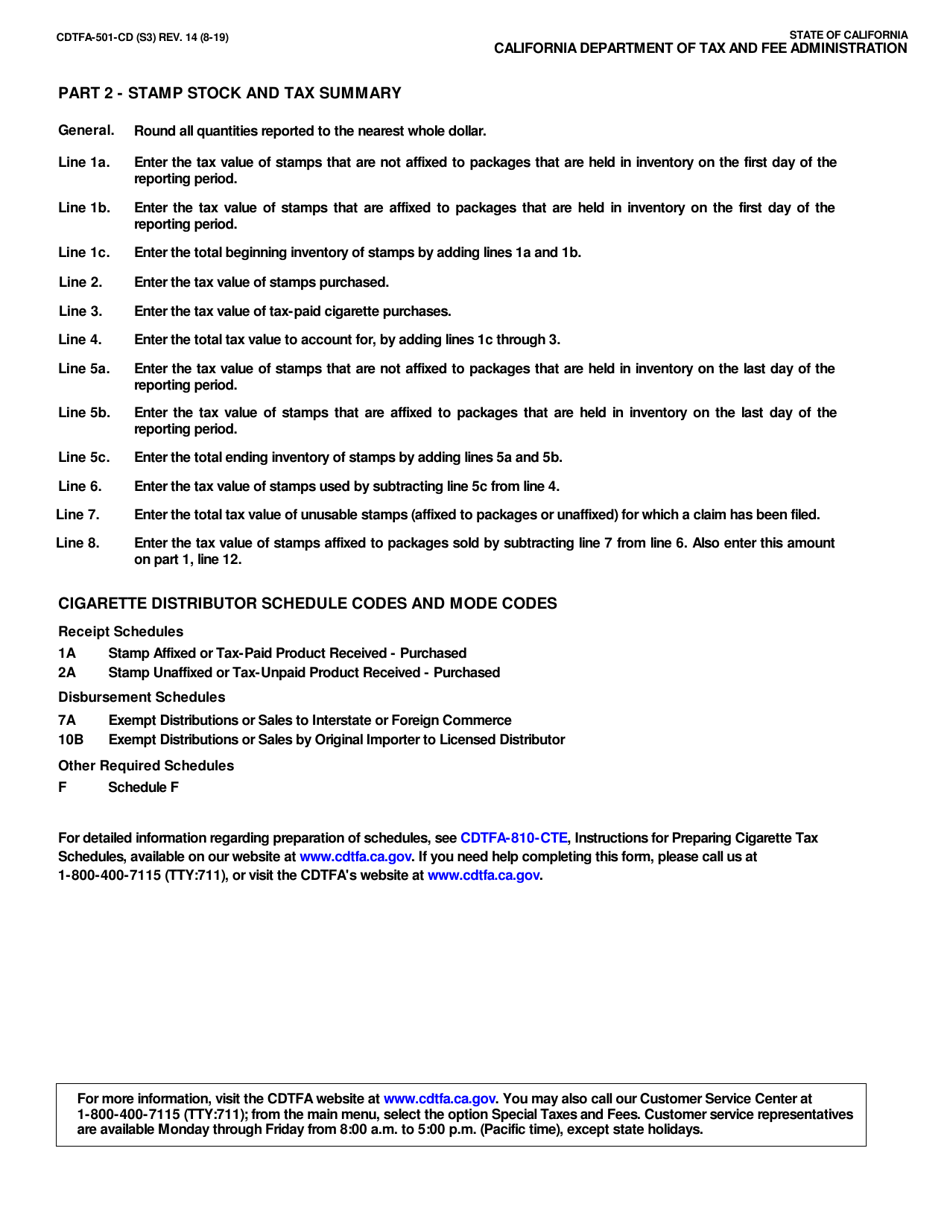

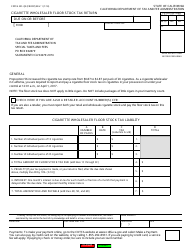

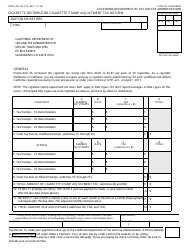

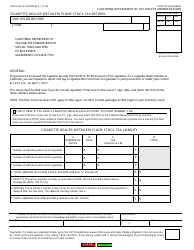

Form CDTFA-501-CD Cigarette Distributor's Tax Report - California

What Is Form CDTFA-501-CD?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

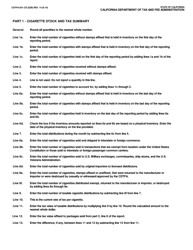

Q: What is Form CDTFA-501-CD?

A: Form CDTFA-501-CD is the Cigarette Distributor's Tax Report for California.

Q: Who needs to file Form CDTFA-501-CD?

A: Cigarette distributors in California need to file Form CDTFA-501-CD.

Q: What is the purpose of Form CDTFA-501-CD?

A: Form CDTFA-501-CD is used to report and pay the cigarette tax owed by distributors in California.

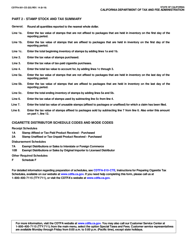

Q: When is Form CDTFA-501-CD due?

A: Form CDTFA-501-CD is due on a monthly basis, and the due date is generally on or before the 25th day of the month following the reporting period.

Q: Are there any penalties for not filing Form CDTFA-501-CD?

A: Yes, there are penalties for not filing Form CDTFA-501-CD, including late filing penalties and interest charges on the tax owed.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-501-CD by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.