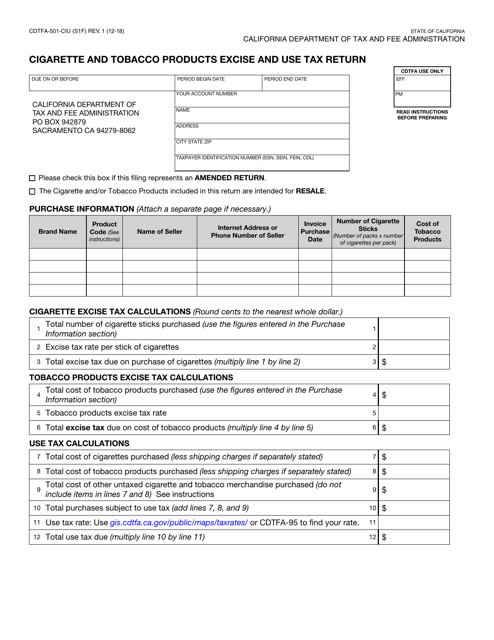

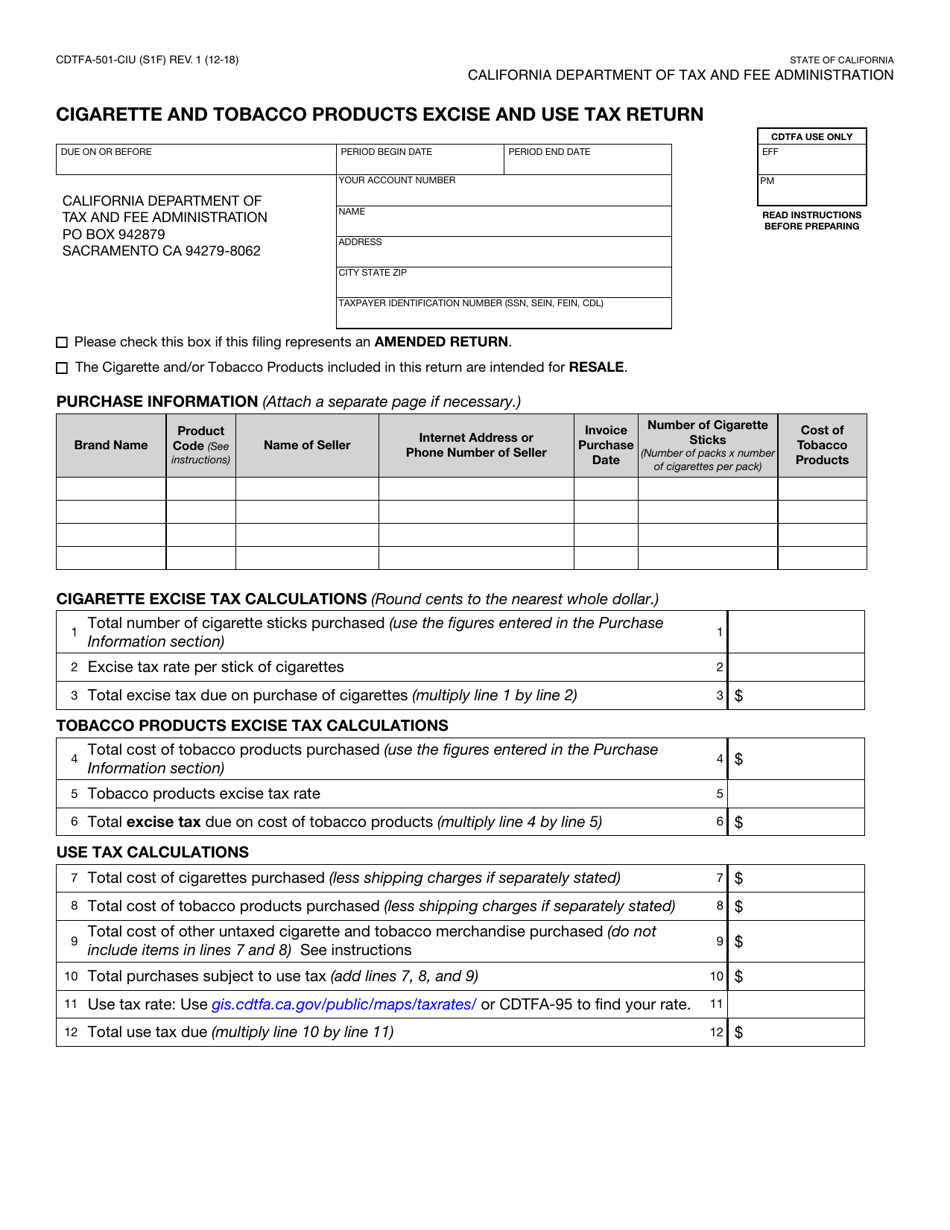

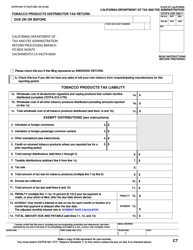

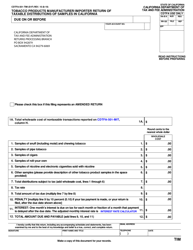

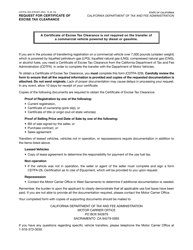

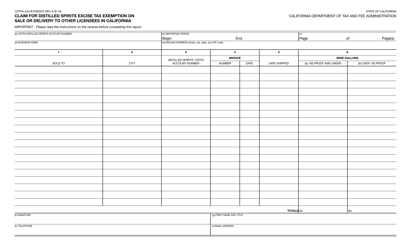

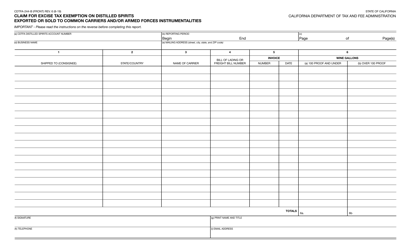

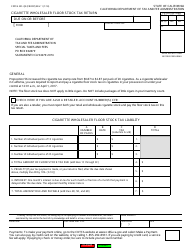

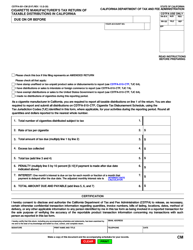

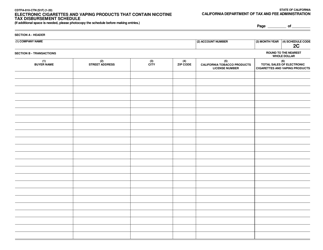

Form CDTFA-501-CIU Cigarette and Tobacco Products Excise and Use Tax Return - California

What Is Form CDTFA-501-CIU?

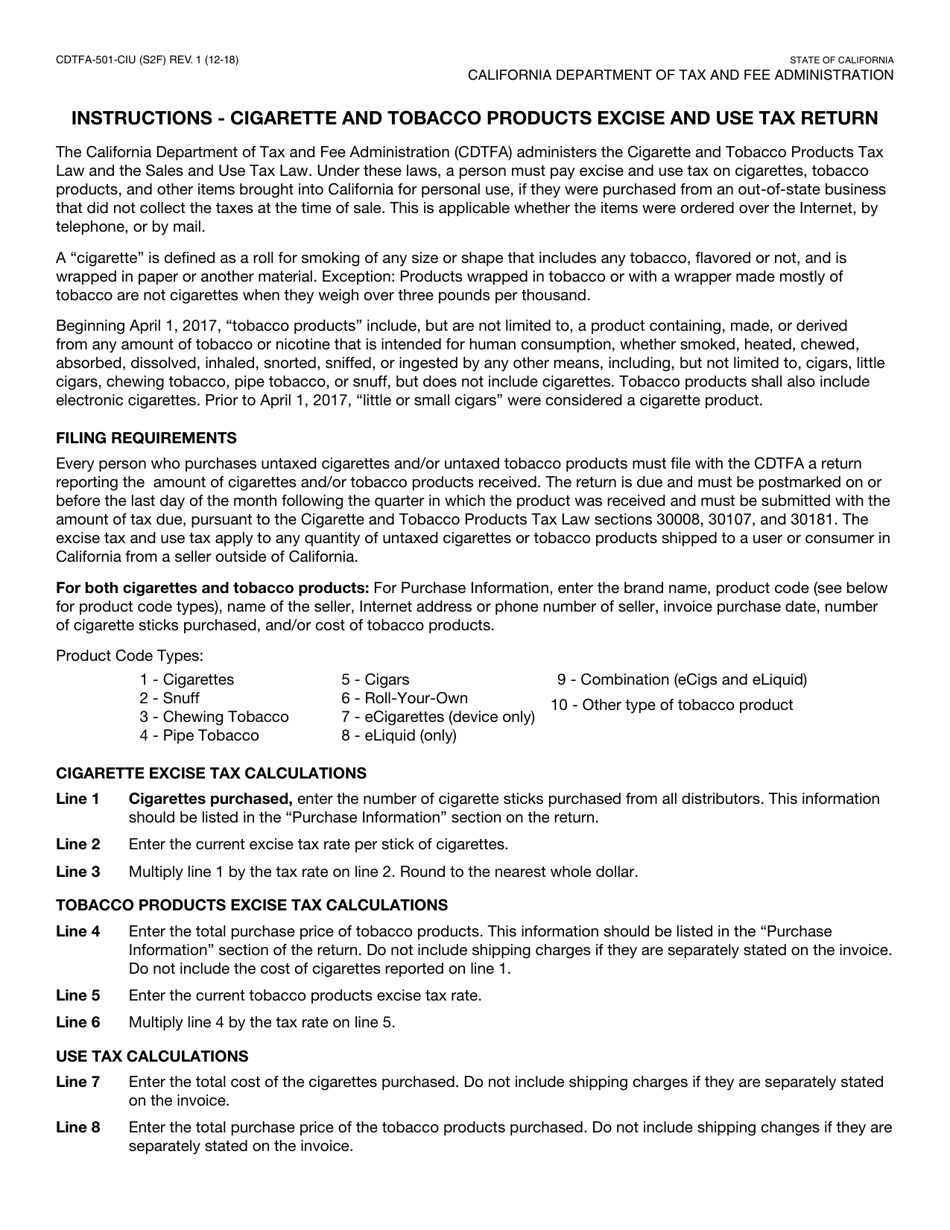

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form CDTFA-501-CIU?

A: The Form CDTFA-501-CIU is the Cigarette and Tobacco Products Excise and Use Tax Return in California.

Q: What is the purpose of Form CDTFA-501-CIU?

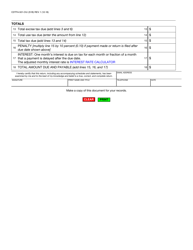

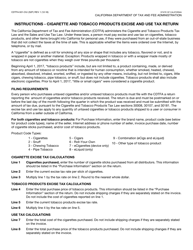

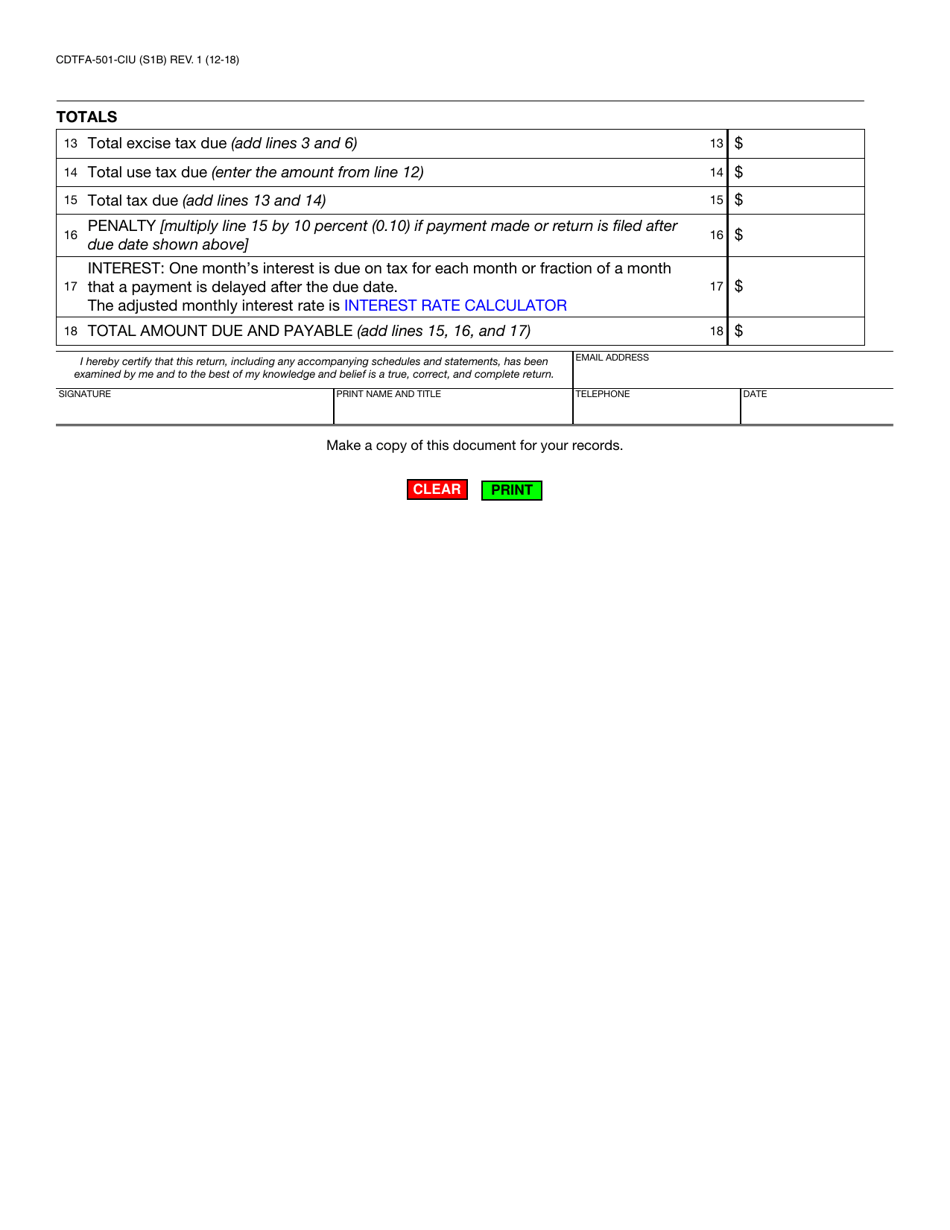

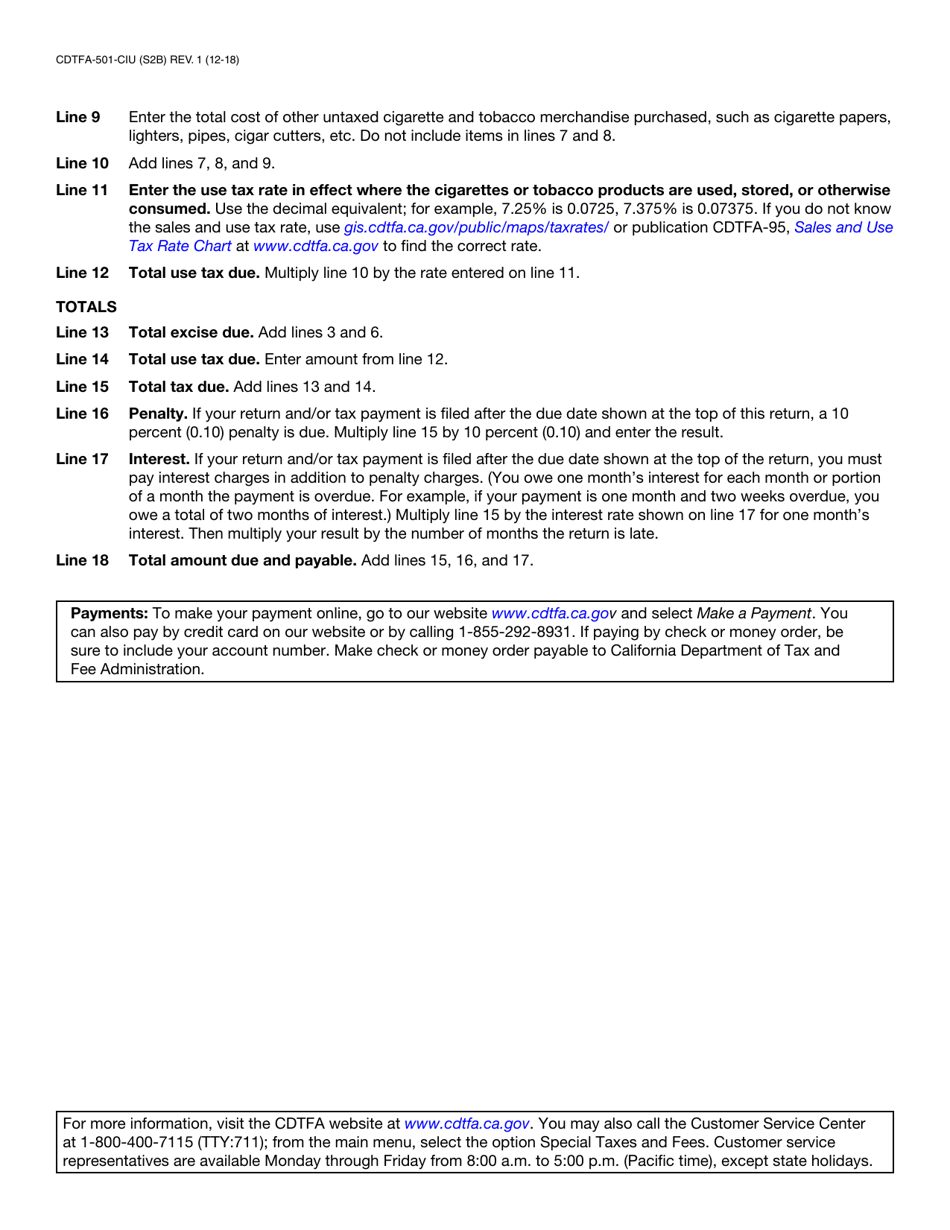

A: The purpose of Form CDTFA-501-CIU is to report and remit excise and use taxes on cigarette and tobacco products in California.

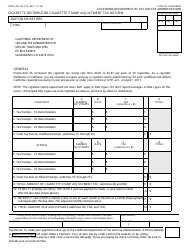

Q: Who needs to file Form CDTFA-501-CIU?

A: Any person or business that sells or distributes cigarettes or tobacco products in California needs to file Form CDTFA-501-CIU.

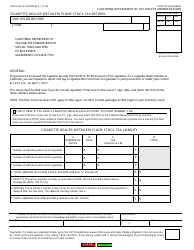

Q: What information is required on Form CDTFA-501-CIU?

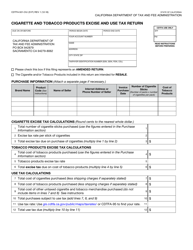

A: Form CDTFA-501-CIU requires information such as sales and purchases of cigarettes and tobacco products, tax due, and any credits or deductions.

Q: When is Form CDTFA-501-CIU due?

A: Form CDTFA-501-CIU is due on a monthly basis and must be filed by the 25th day of the month following the reporting period.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-501-CIU by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.