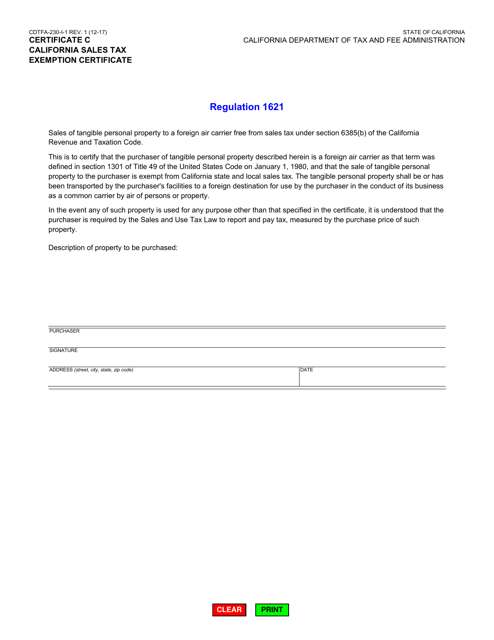

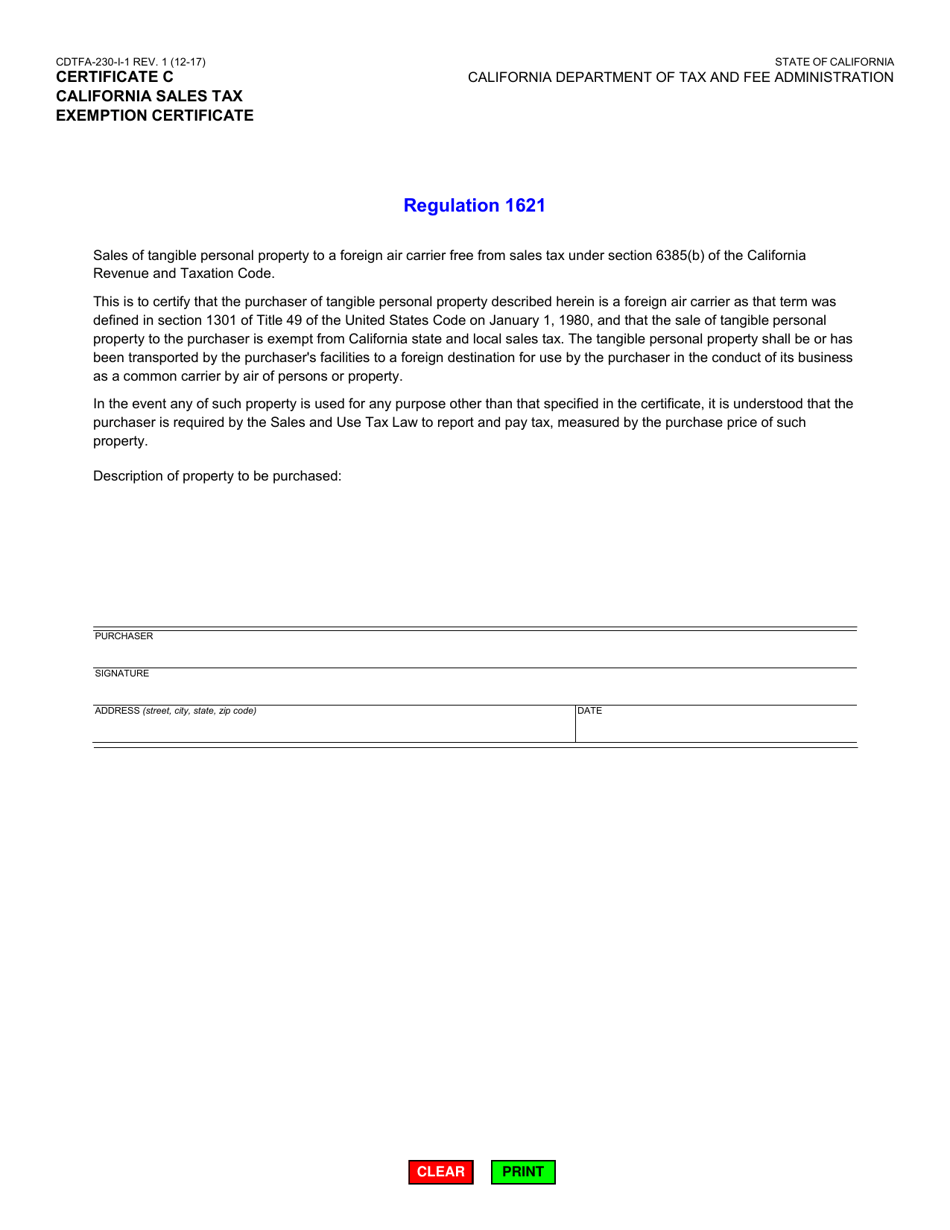

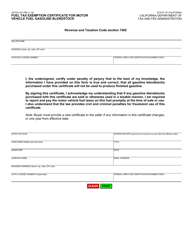

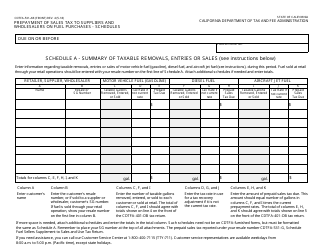

Form CDTFA-230-I-1 Certificate C California Sales Tax Exemption Certificate - California

What Is Form CDTFA-230-I-1 Certificate C?

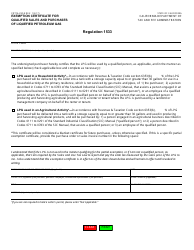

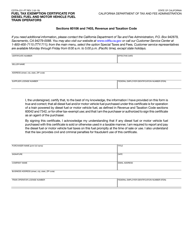

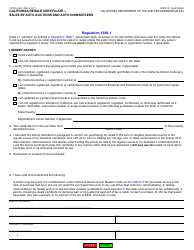

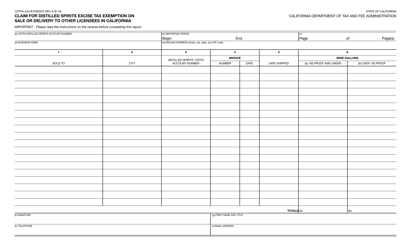

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California.The document is a supplement to Form CDTFA-230-I-1, Certificate C - California Sales Tax Exemption Certificate (Foreign Air Carrier). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-230-I-1?

A: Form CDTFA-230-I-1 is the Certificate C California Sales Tax Exemption Certificate for California.

Q: What is the purpose of Form CDTFA-230-I-1?

A: The purpose of Form CDTFA-230-I-1 is to claim a sales tax exemption in California.

Q: Who needs to fill out Form CDTFA-230-I-1?

A: The entity or organization that wants to claim a sales tax exemption in California needs to fill out Form CDTFA-230-I-1.

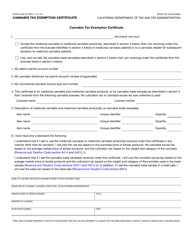

Q: What information is required on Form CDTFA-230-I-1?

A: Form CDTFA-230-I-1 requires the entity's name, address, and other identifying information, as well as the reason for claiming the sales tax exemption.

Q: How do I submit Form CDTFA-230-I-1?

A: Form CDTFA-230-I-1 can be submitted electronically or by mail to the California Department of Tax and Fee Administration (CDTFA).

Q: Are there any special requirements for claiming a sales tax exemption with Form CDTFA-230-I-1?

A: Yes, certain organizations or entities may need to provide additional documentation or meet specific criteria to claim a sales tax exemption using Form CDTFA-230-I-1. It is recommended to review the instructions and guidelines provided by the CDTFA.

Q: Can I use Form CDTFA-230-I-1 for other states?

A: No, Form CDTFA-230-I-1 is specific to claiming a sales tax exemption in California. Other states may have their own exemption certificates and forms.

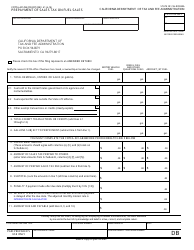

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-230-I-1 Certificate C by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.