This version of the form is not currently in use and is provided for reference only. Download this version of

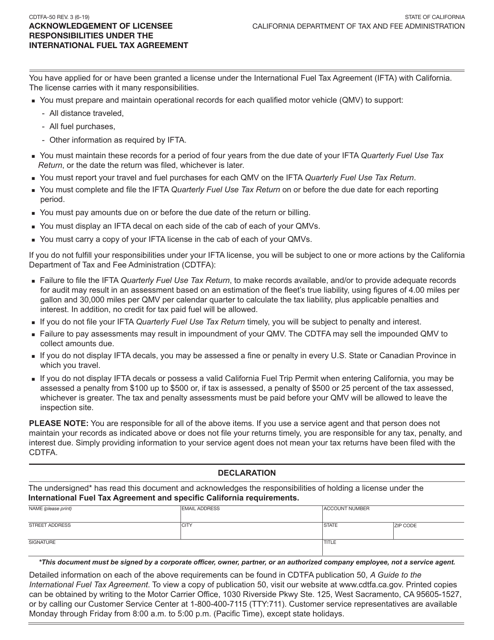

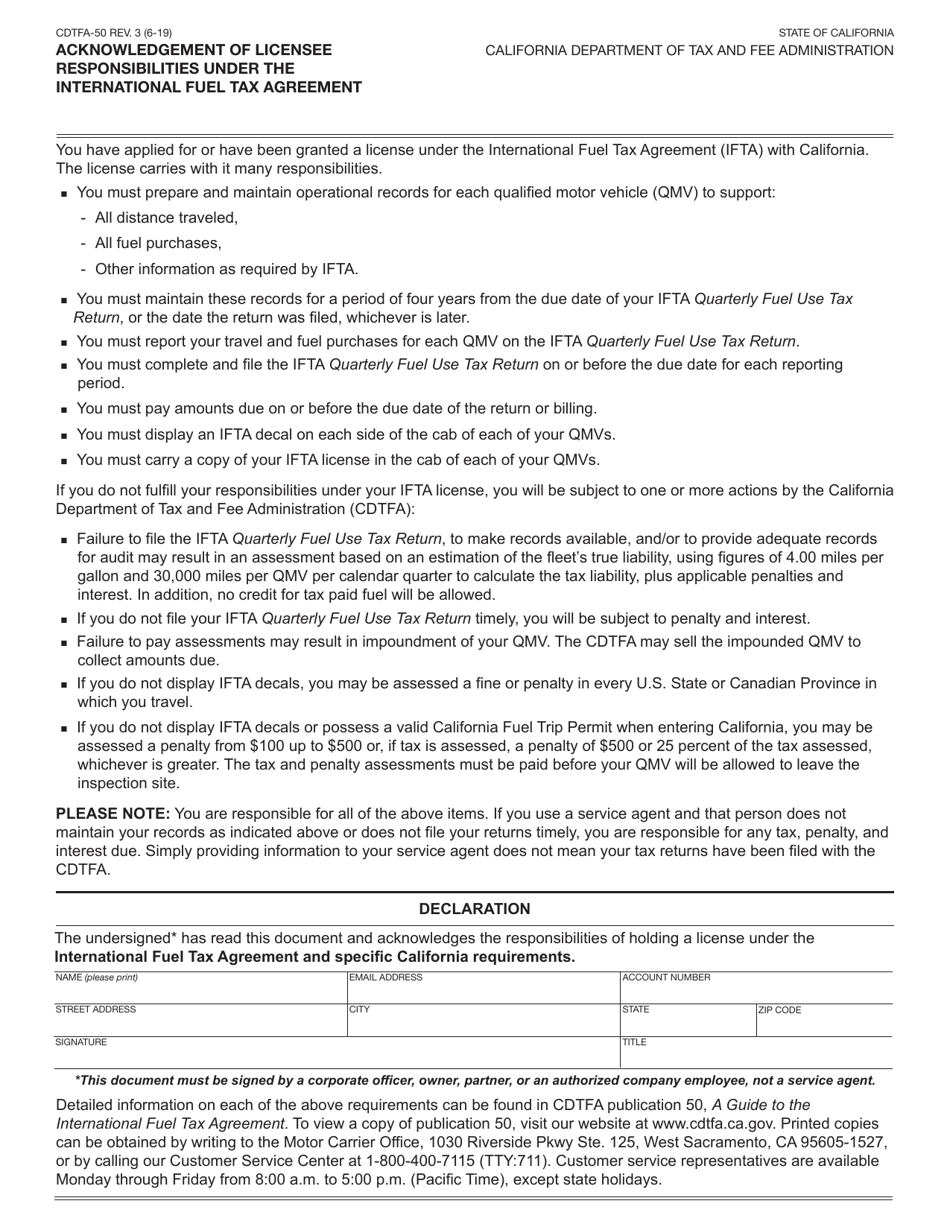

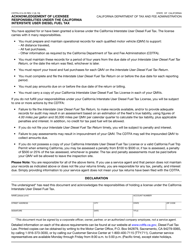

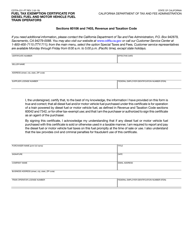

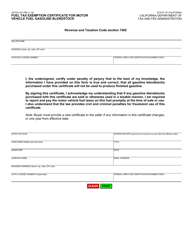

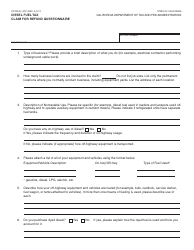

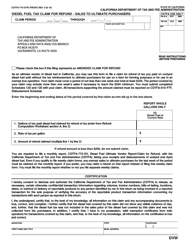

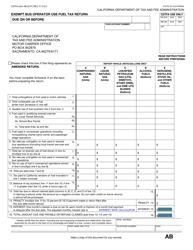

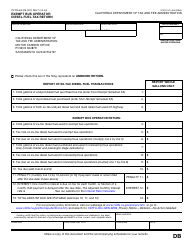

Form CDTFA-50

for the current year.

Form CDTFA-50 Acknowledgement of Licensee Responsibilities Under the International Fuel Tax Agreement - California

What Is Form CDTFA-50?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

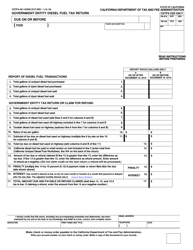

Q: What is Form CDTFA-50?

A: Form CDTFA-50 is the Acknowledgement of Licensee Responsibilities Under the International Fuel Tax Agreement (IFTA) in California.

Q: What is the International Fuel Tax Agreement (IFTA)?

A: The International Fuel Tax Agreement (IFTA) is an agreement between the United States and Canadian provinces that governs the reporting and payment of fuel taxes by interstate motor carriers.

Q: Who needs to file Form CDTFA-50?

A: Motor carriers in California who are registered under the International Fuel Tax Agreement (IFTA) must file Form CDTFA-50.

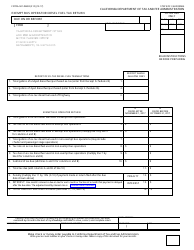

Q: What are the responsibilities of licensees under IFTA?

A: Licensees under IFTA are responsible for accurately reporting and paying fuel taxes based on the miles traveled in each participating jurisdiction.

Q: When is Form CDTFA-50 due?

A: Form CDTFA-50 is due on the last day of the month following the end of the calendar quarter.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-50 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.