This version of the form is not currently in use and is provided for reference only. Download this version of

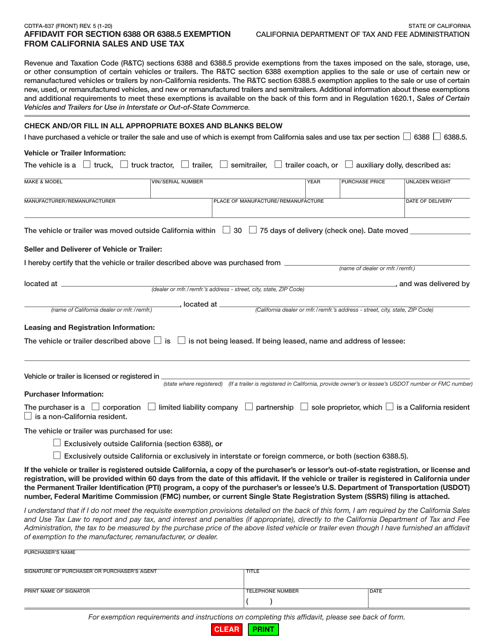

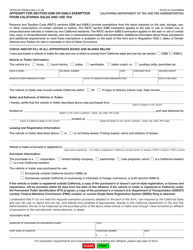

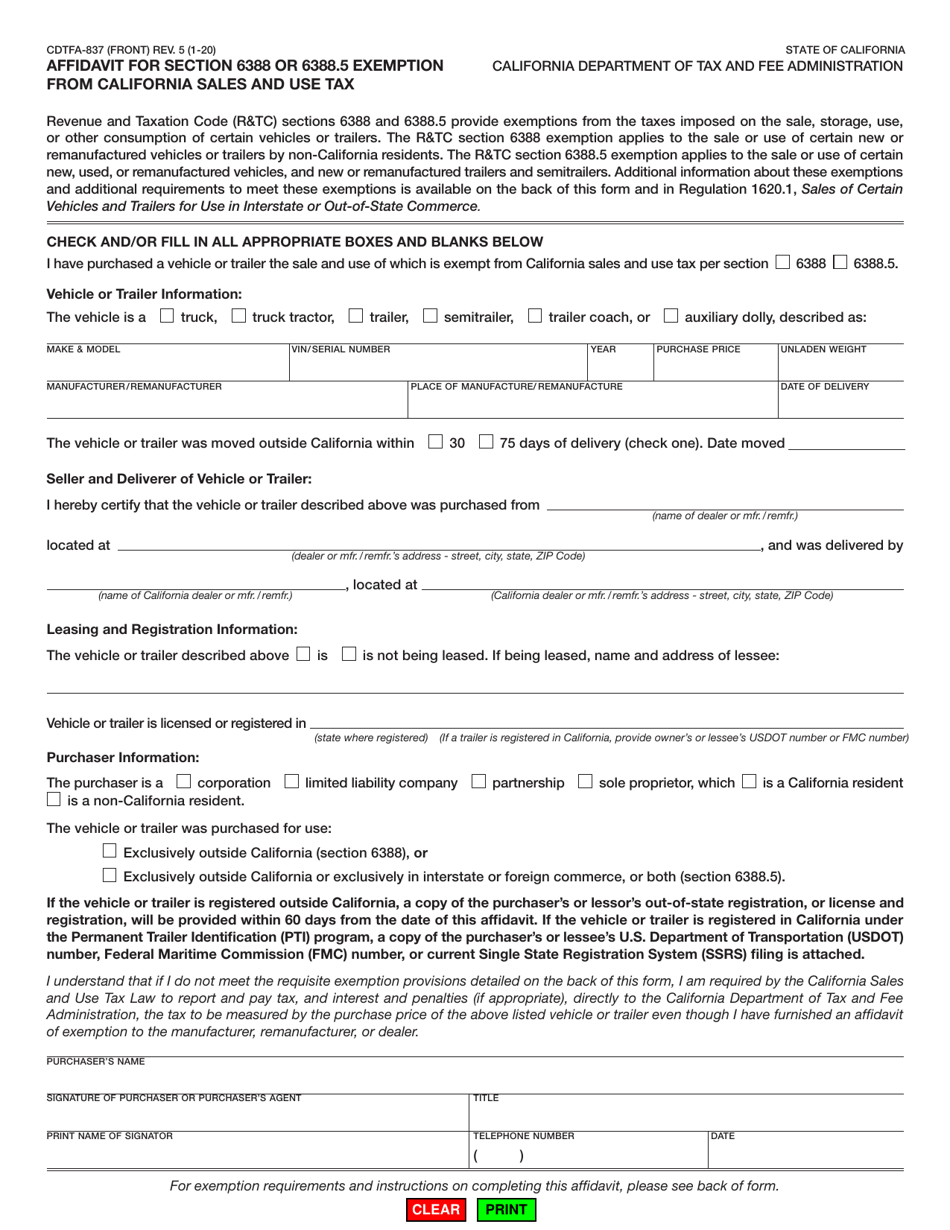

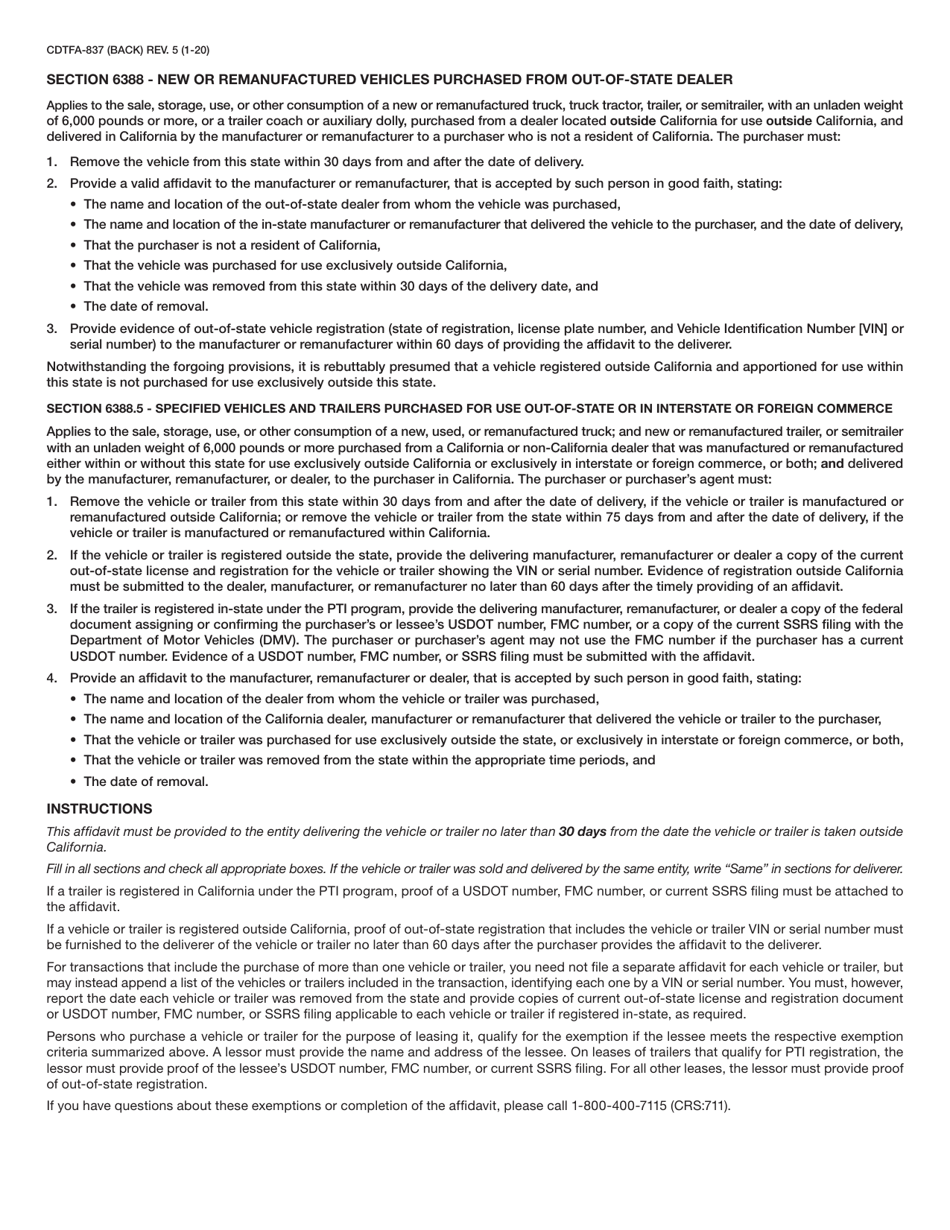

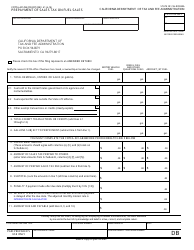

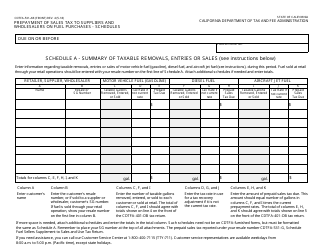

Form CDTFA-837

for the current year.

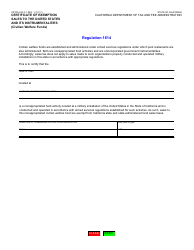

Form CDTFA-837 Affidavit for Section 6388 or 6388.5 Exemption From the California Sales and Use Tax - California

What Is Form CDTFA-837?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-837?

A: Form CDTFA-837 is the Affidavit for Section 6388 or 6388.5 Exemption From the California Sales and Use Tax.

Q: What is the purpose of Form CDTFA-837?

A: Form CDTFA-837 is used to claim exemption from the California Sales and Use Tax under Section 6388 or 6388.5.

Q: Who needs to fill out Form CDTFA-837?

A: Any individual or business claiming exemption from the California Sales and Use Tax under Section 6388 or 6388.5 needs to fill out Form CDTFA-837.

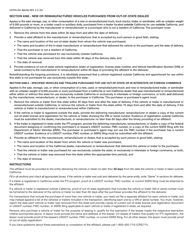

Q: What are Sections 6388 and 6388.5 of the California Sales and Use Tax Law?

A: Sections 6388 and 6388.5 of the California Sales and Use Tax Law provide exemptions for certain types of transactions.

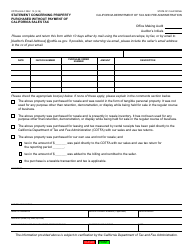

Q: Are there any supporting documents required to be submitted with Form CDTFA-837?

A: Yes, depending on the type of exemption being claimed, supporting documents such as certificates or evidence may be required to be submitted along with Form CDTFA-837.

Q: What should I do if I need help filling out Form CDTFA-837?

A: If you need assistance filling out Form CDTFA-837, you can contact the California Department of Tax and Fee Administration (CDTFA) directly for guidance.

Form Details:

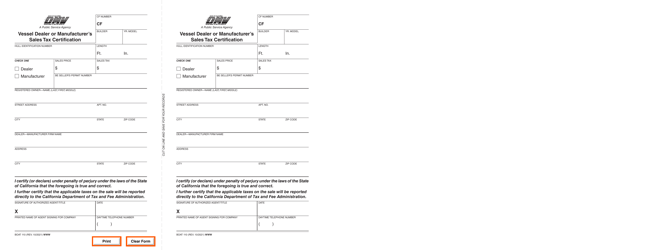

- Released on January 1, 2020;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-837 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.