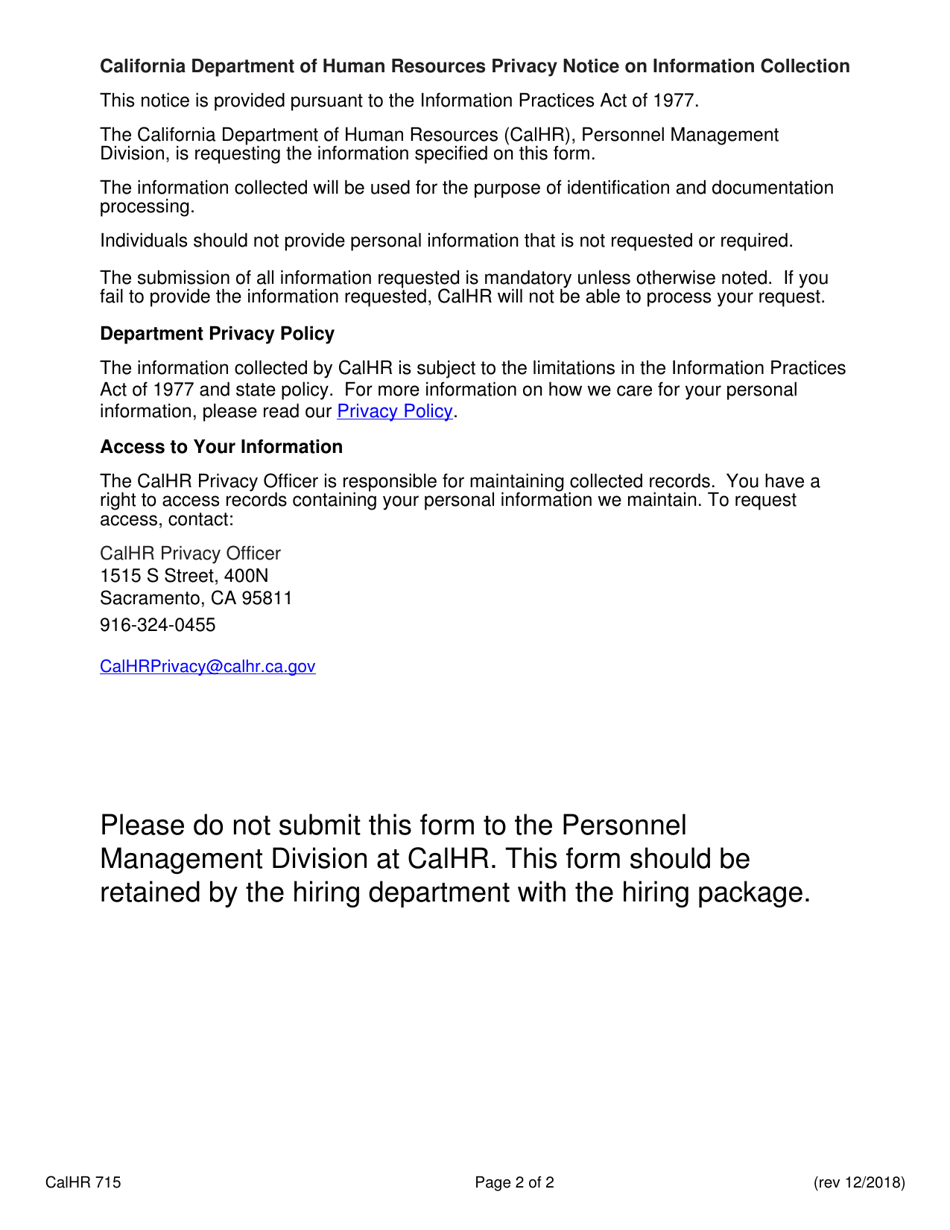

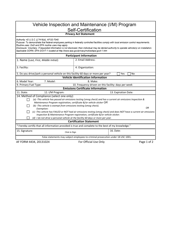

This version of the form is not currently in use and is provided for reference only. Download this version of

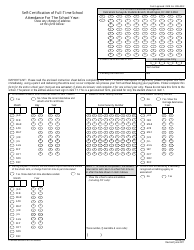

Form CALHR715

for the current year.

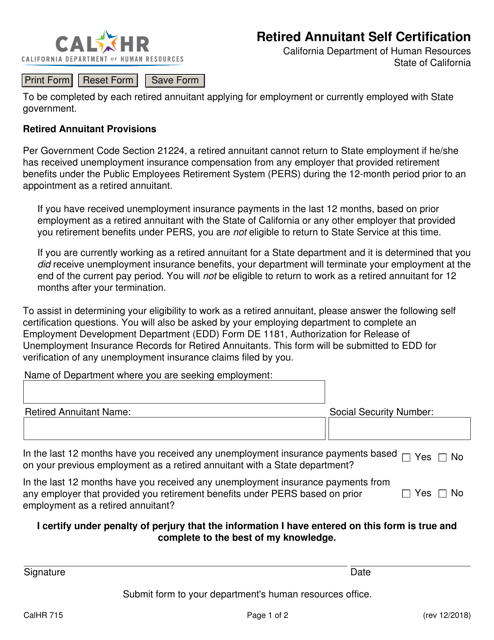

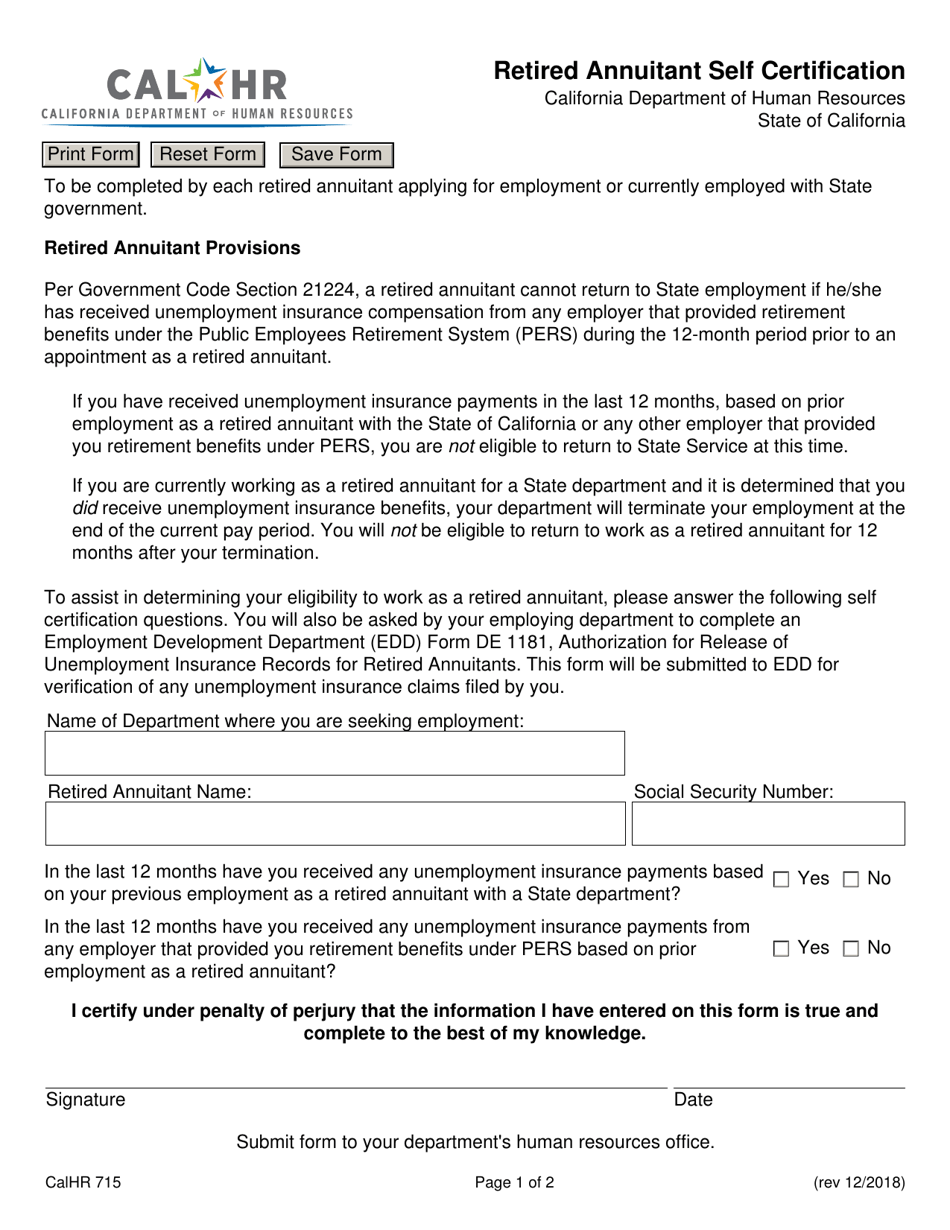

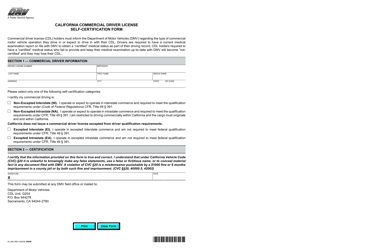

Form CALHR715 Retired Annuitant Self Certification - California

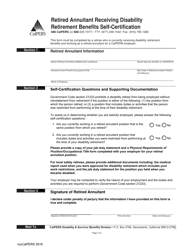

What Is Form CALHR715?

This is a legal form that was released by the California Department of Human Resources - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CALHR715 Retired Annuitant Self Certification?

A: CALHR715 Retired Annuitant Self Certification is a form used by retired employees in California to certify their eligibility for employment as a retired annuitant.

Q: Who needs to fill out CALHR715 Retired Annuitant Self Certification?

A: Retired employees who want to work as a retired annuitant in California need to fill out CALHR715 Retired Annuitant Self Certification.

Q: What is a retired annuitant?

A: A retired annuitant is a retired employee who is eligible for employment in a limited capacity, usually on a temporary or part-time basis.

Q: Why is CALHR715 Retired Annuitant Self Certification required?

A: CALHR715 Retired Annuitant Self Certification is required to verify that retired employees meet the eligibility criteria to work as retired annuitants in California.

Q: How do I fill out CALHR715 Retired Annuitant Self Certification?

A: To fill out CALHR715 Retired Annuitant Self Certification, provide your personal information, retirement information, and job-related information as required on the form.

Q: Are there any specific eligibility criteria for retired annuitants?

A: Yes, there are specific eligibility criteria for retired annuitants, such as being retired from the applicable retirement system, not exceeding specified hourly limits, and not working in a position that would disqualify retirement benefits.

Q: What happens after I submit CALHR715 Retired Annuitant Self Certification?

A: After submitting CALHR715 Retired Annuitant Self Certification, your eligibility as a retired annuitant will be verified, and you may be considered for employment opportunities as a retired annuitant in California.

Q: Can I work full-time as a retired annuitant?

A: No, retired annuitants are generally limited to working on a part-time or temporary basis and have specified hourly limits that should not be exceeded.

Q: Is CALHR715 Retired Annuitant Self Certification specific to California?

A: Yes, CALHR715 Retired Annuitant Self Certification is specific to California and is used to verify eligibility for retired annuitant employment in the state.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the California Department of Human Resources;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CALHR715 by clicking the link below or browse more documents and templates provided by the California Department of Human Resources.