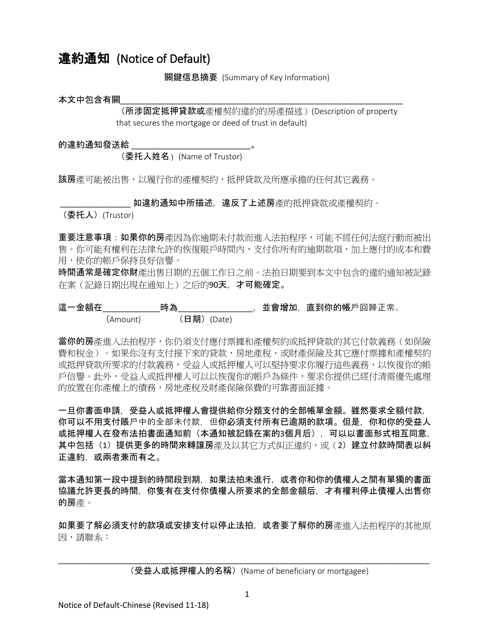

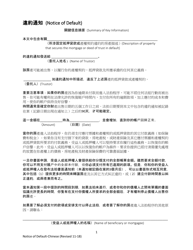

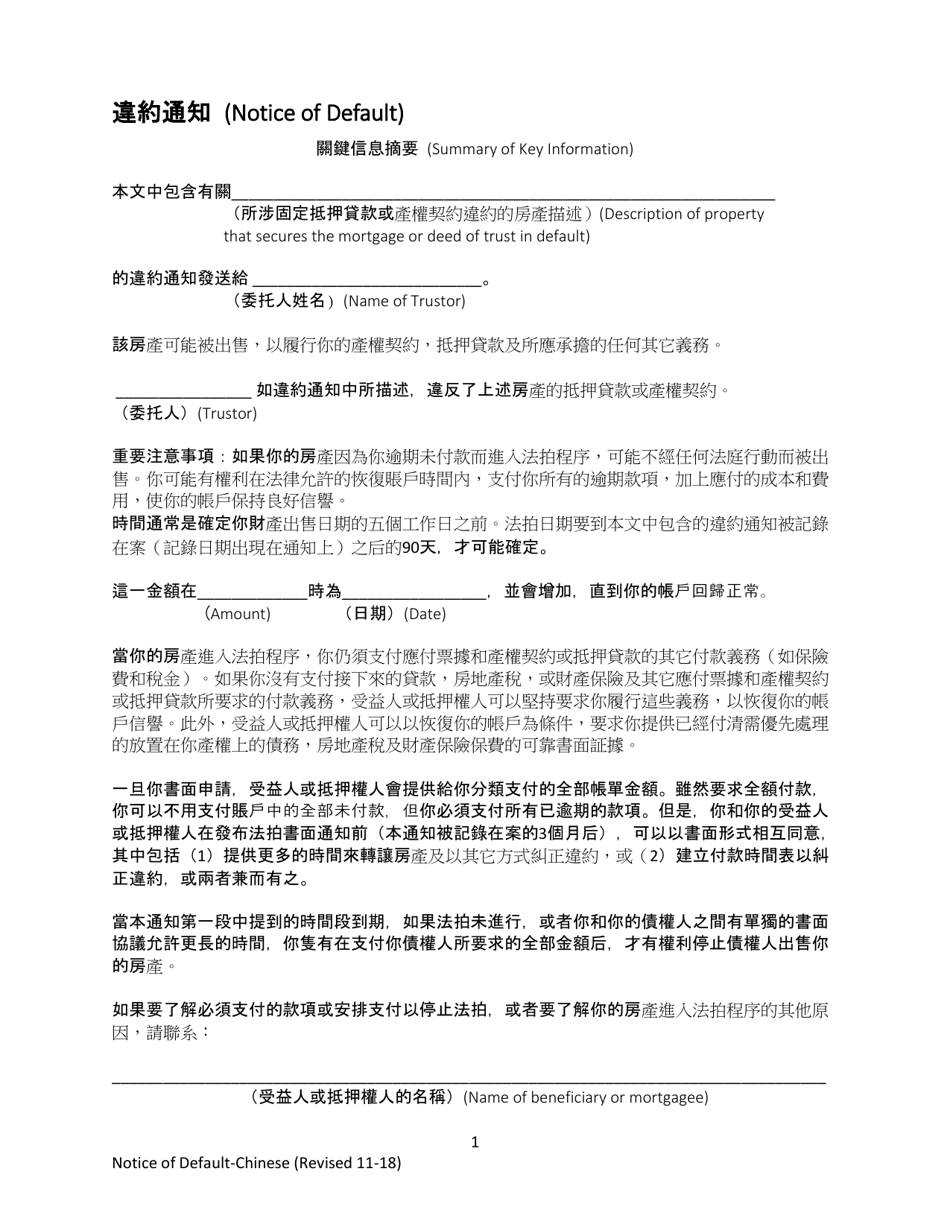

Notice of Default - California (Chinese)

This is a legal document that was released by the California Department of Financial Protection and Innovation - a government authority operating within California.

The document is provided in Chinese.

FAQ

Q: What is a Notice of Default?

A: A Notice of Default is a formal notice sent to a borrower by a lender stating that the borrower has defaulted on their mortgage or loan agreement.

Q: What does a Notice of Default mean?

A: A Notice of Default means that the borrower has failed to make payments or comply with the terms of their mortgage or loan agreement, and the lender has initiated the foreclosure process.

Q: What are the consequences of receiving a Notice of Default?

A: Receiving a Notice of Default means that foreclosure proceedings have begun, and the lender has the right to take legal action to recover the property.

Q: How long does it take for a Notice of Default to lead to foreclosure?

A: The timing can vary, but generally it takes a few months from the receipt of a Notice of Default to the completion of foreclosure.

Q: What steps should I take if I receive a Notice of Default?

A: If you receive a Notice of Default, you should contact your lender immediately to discuss possible options such as loan modification or repayment plan.

Q: Can I stop foreclosure after receiving a Notice of Default?

A: Yes, you may be able to stop foreclosure even after receiving a Notice of Default by working with your lender to find a solution, such as applying for a loan modification or entering into a repayment plan.

Form Details:

- Released on November 1, 2018;

- The latest edition currently provided by the California Department of Financial Protection and Innovation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the California Department of Financial Protection and Innovation.