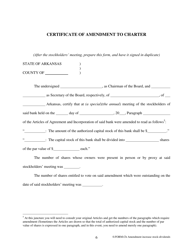

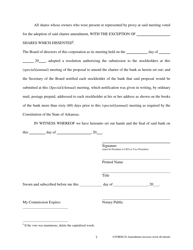

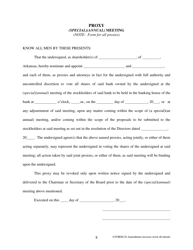

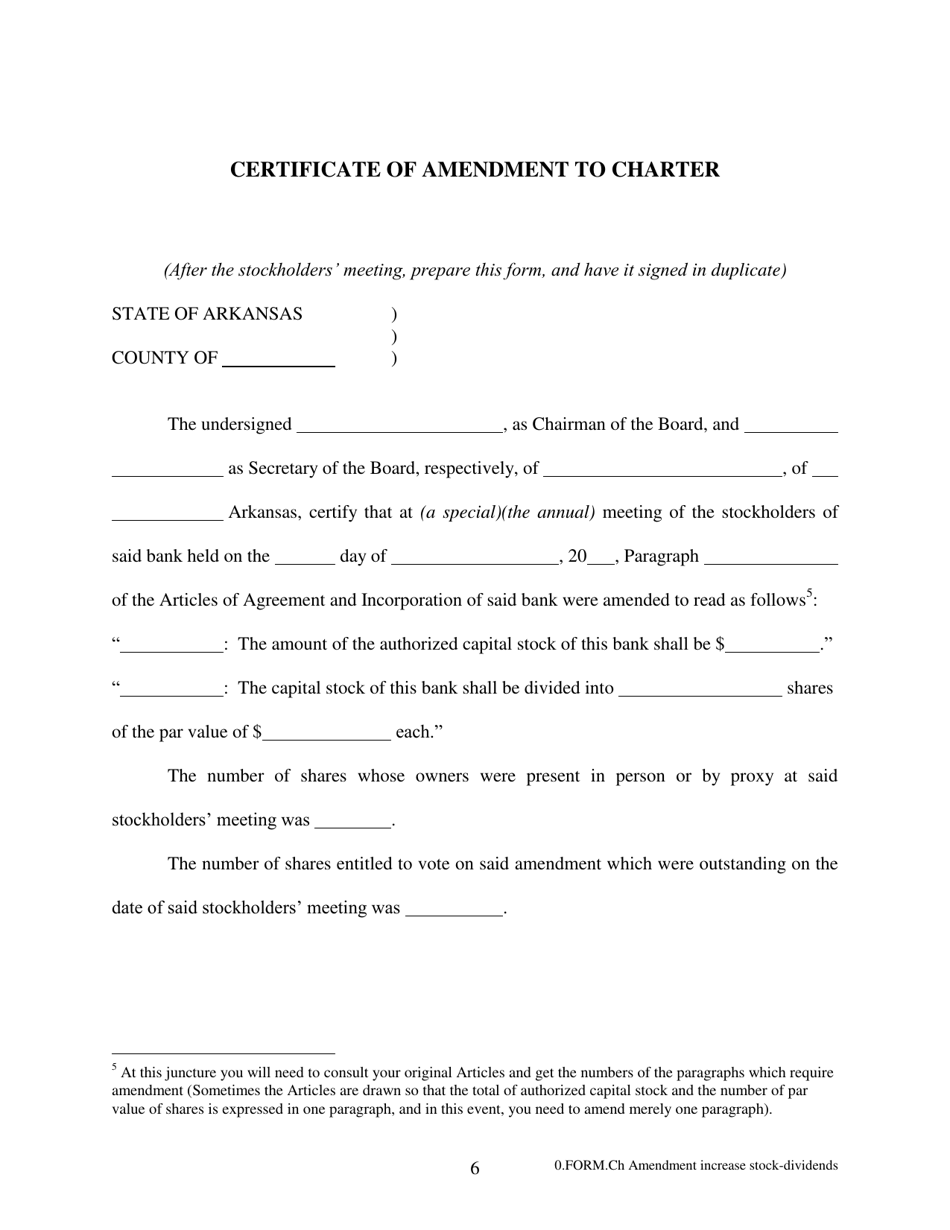

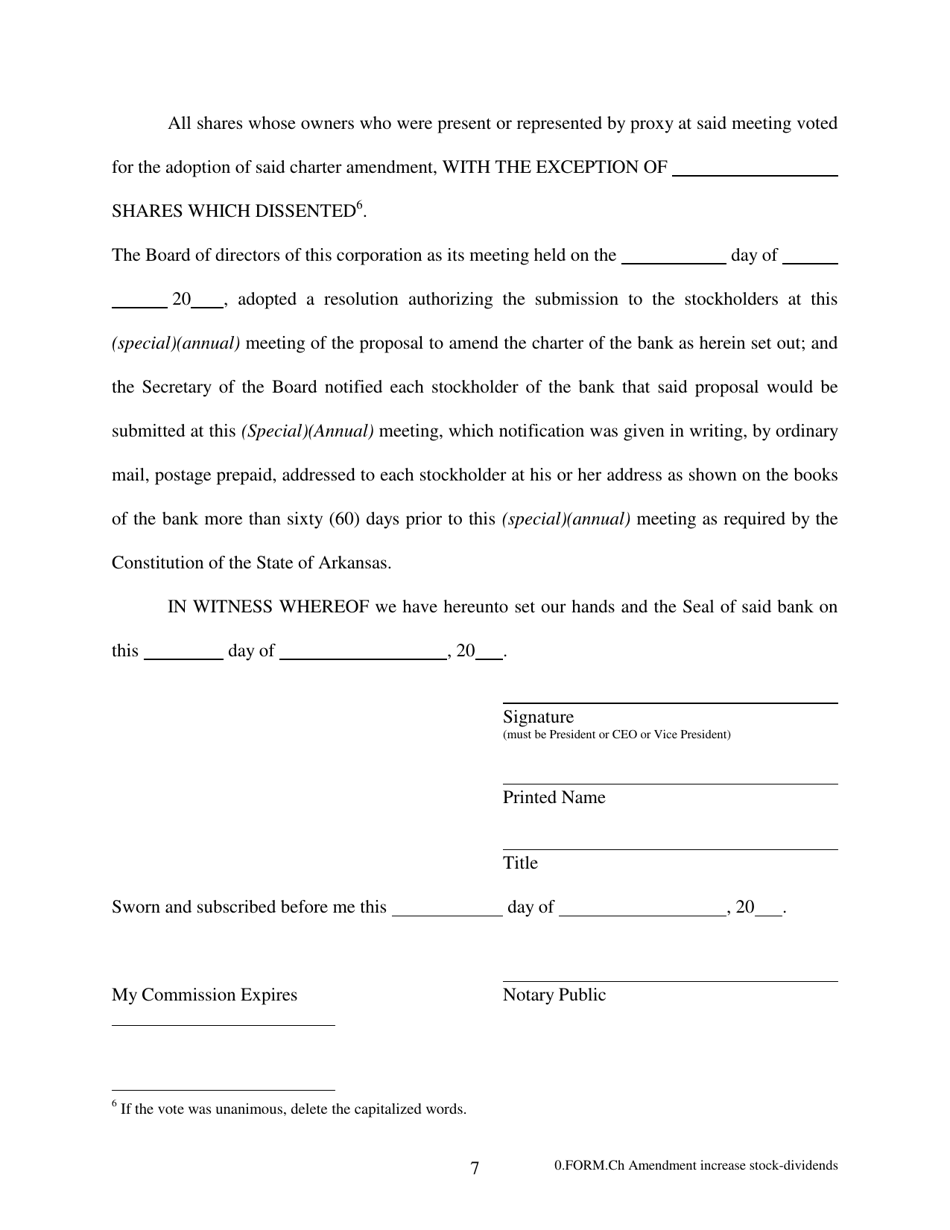

Increase / Decrease Stock - Stock Dividends - Arkansas

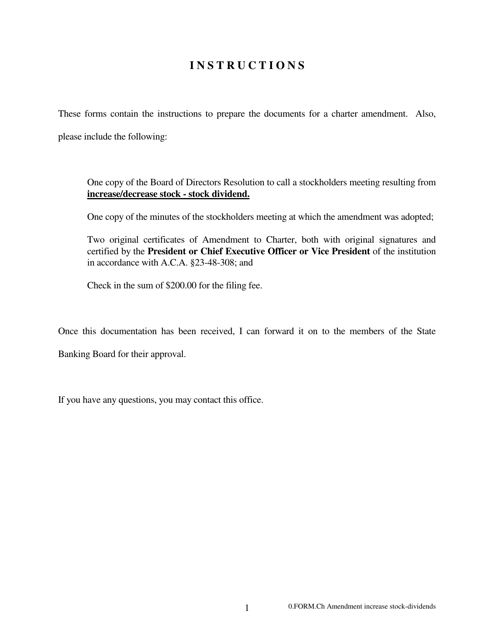

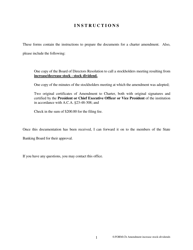

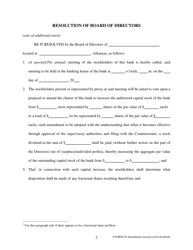

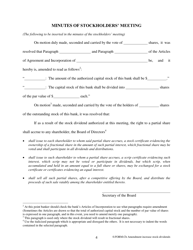

Increase/Decrease Stock - Stock Dividends is a legal document that was released by the Arkansas State Bank Department - a government authority operating within Arkansas.

FAQ

Q: What is a stock dividend?

A: A stock dividend is a distribution of additional shares of stock to existing shareholders.

Q: How does a stock dividend affect the value of a stock?

A: A stock dividend does not affect the value of a stock, but it increases the number of shares owned by each shareholder.

Q: Why do companies issue stock dividends?

A: Companies may issue stock dividends to reward shareholders, to conserve cash, or to decrease the price per share.

Q: Does Arkansas tax stock dividends?

A: Yes, Arkansas taxes stock dividends as regular income.

Q: What is the tax rate on stock dividends in Arkansas?

A: The tax rate on stock dividends in Arkansas varies based on the individual's income tax bracket.

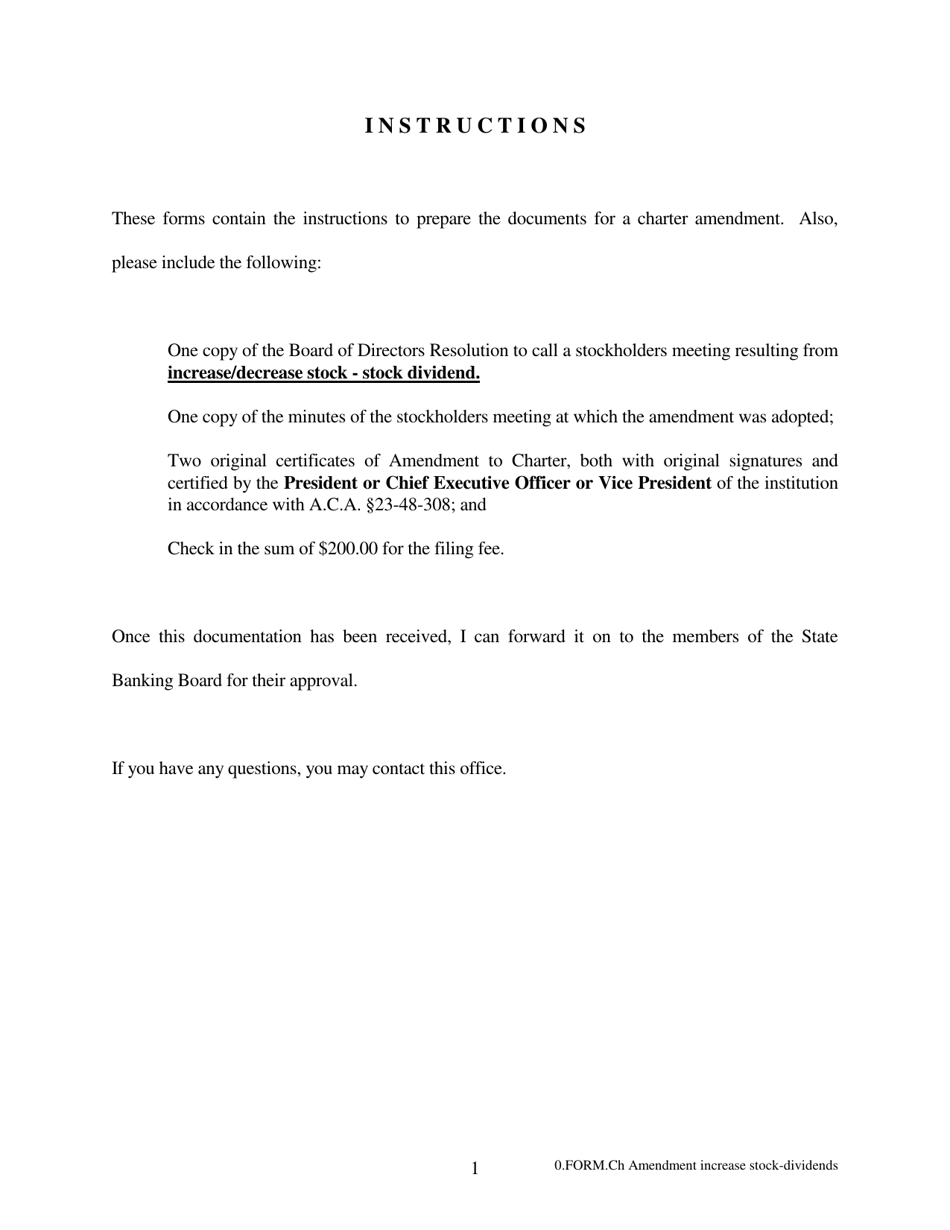

Form Details:

- The latest edition currently provided by the Arkansas State Bank Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

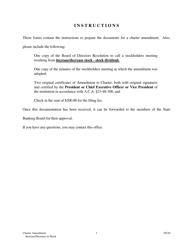

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Arkansas State Bank Department.