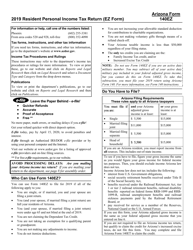

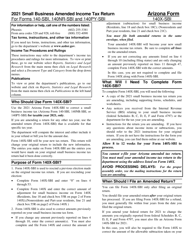

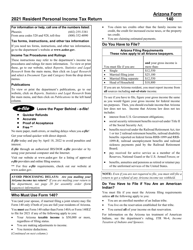

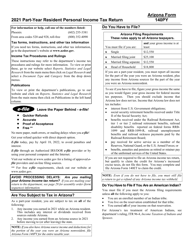

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Arizona Form 140PY, ADOR10149

for the current year.

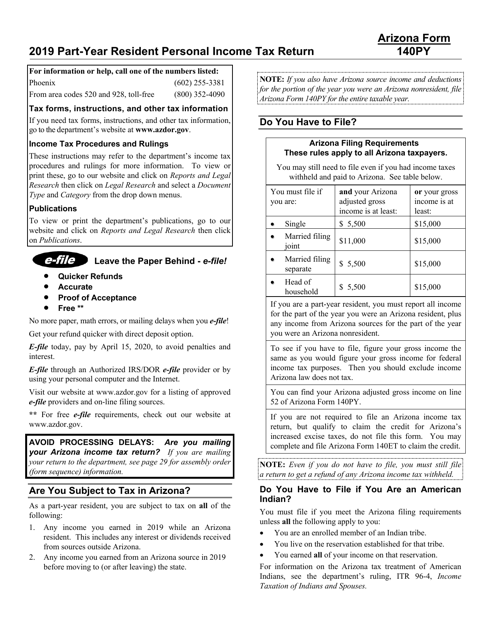

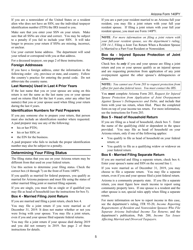

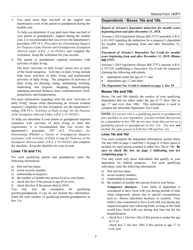

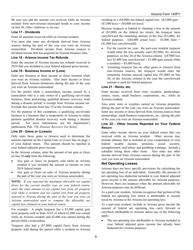

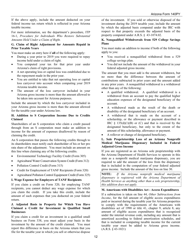

Instructions for Arizona Form 140PY, ADOR10149 Part-Year Resident Personal Income Tax Return - Arizona

This document contains official instructions for Arizona Form 140PY , and Form ADOR10149 . Both forms are released and collected by the Arizona Department of Revenue.

FAQ

Q: What is Arizona Form 140PY?

A: Arizona Form 140PY is the Part-Year Resident Personal Income Tax Return for Arizona.

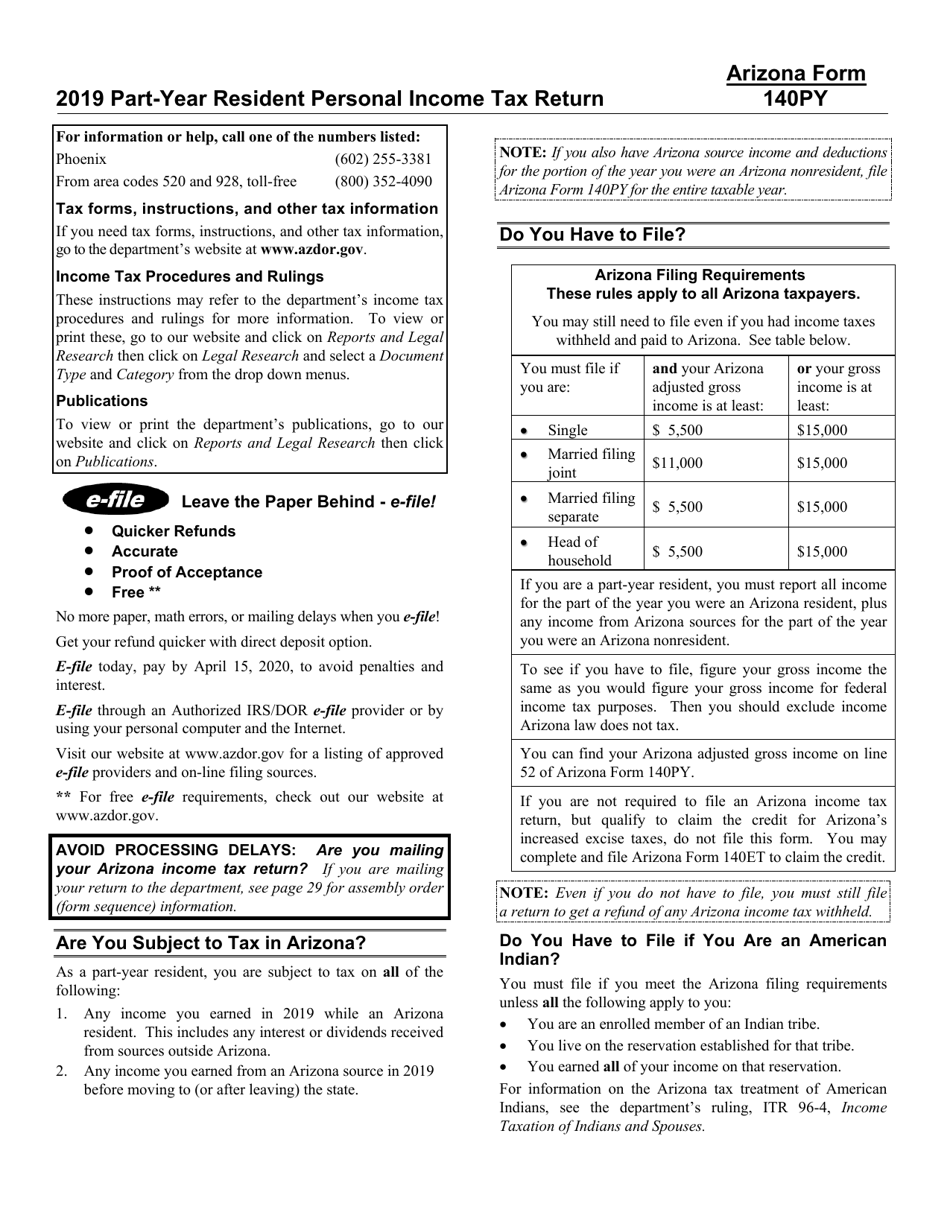

Q: Who is required to file Arizona Form 140PY?

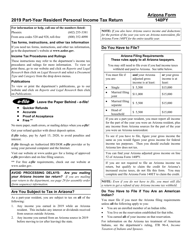

A: Part-year residents of Arizona who earned income in the state during the tax year are required to file Arizona Form 140PY.

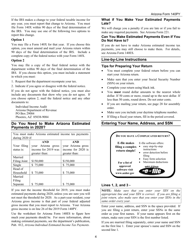

Q: What information is needed to complete Arizona Form 140PY?

A: To complete Arizona Form 140PY, you will need information about your income earned in Arizona, including wages, self-employment income, and rental income, as well as any deductions or credits you may be eligible for.

Q: When is the deadline for filing Arizona Form 140PY?

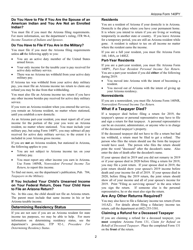

A: If you are a calendar year taxpayer, the deadline for filing Arizona Form 140PY is the same as the federal tax deadline, which is typically April 15th. However, if the 15th falls on a weekend or holiday, the deadline is extended to the next business day.

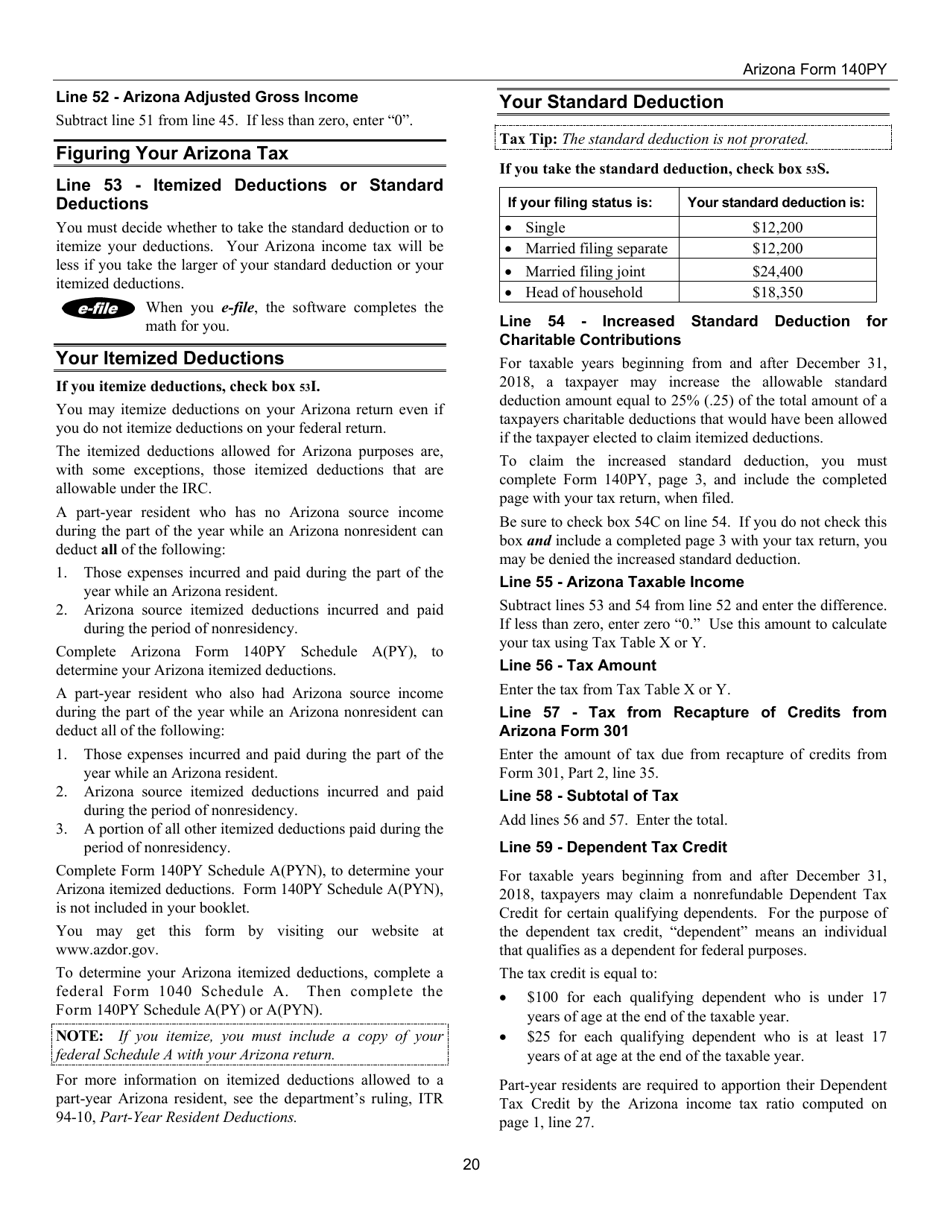

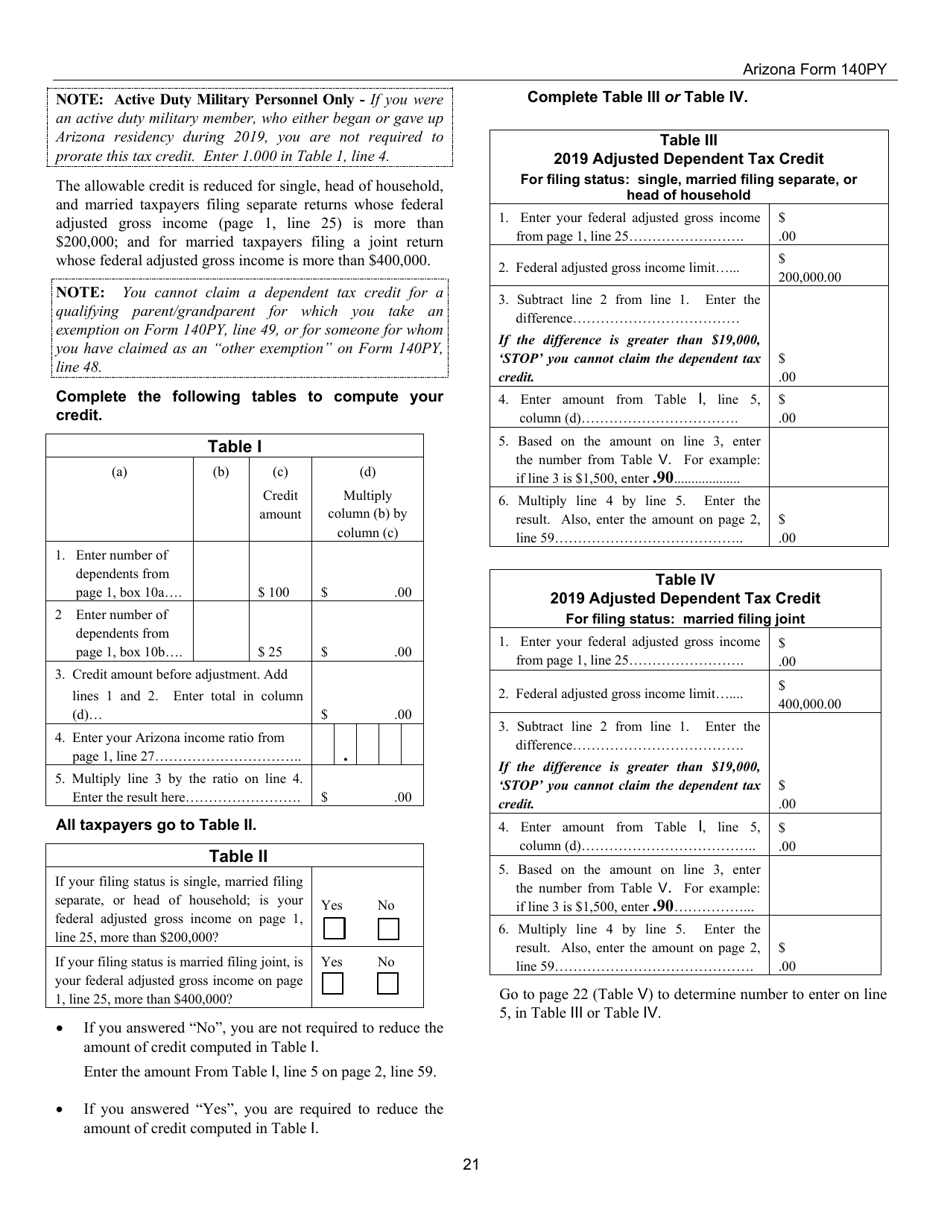

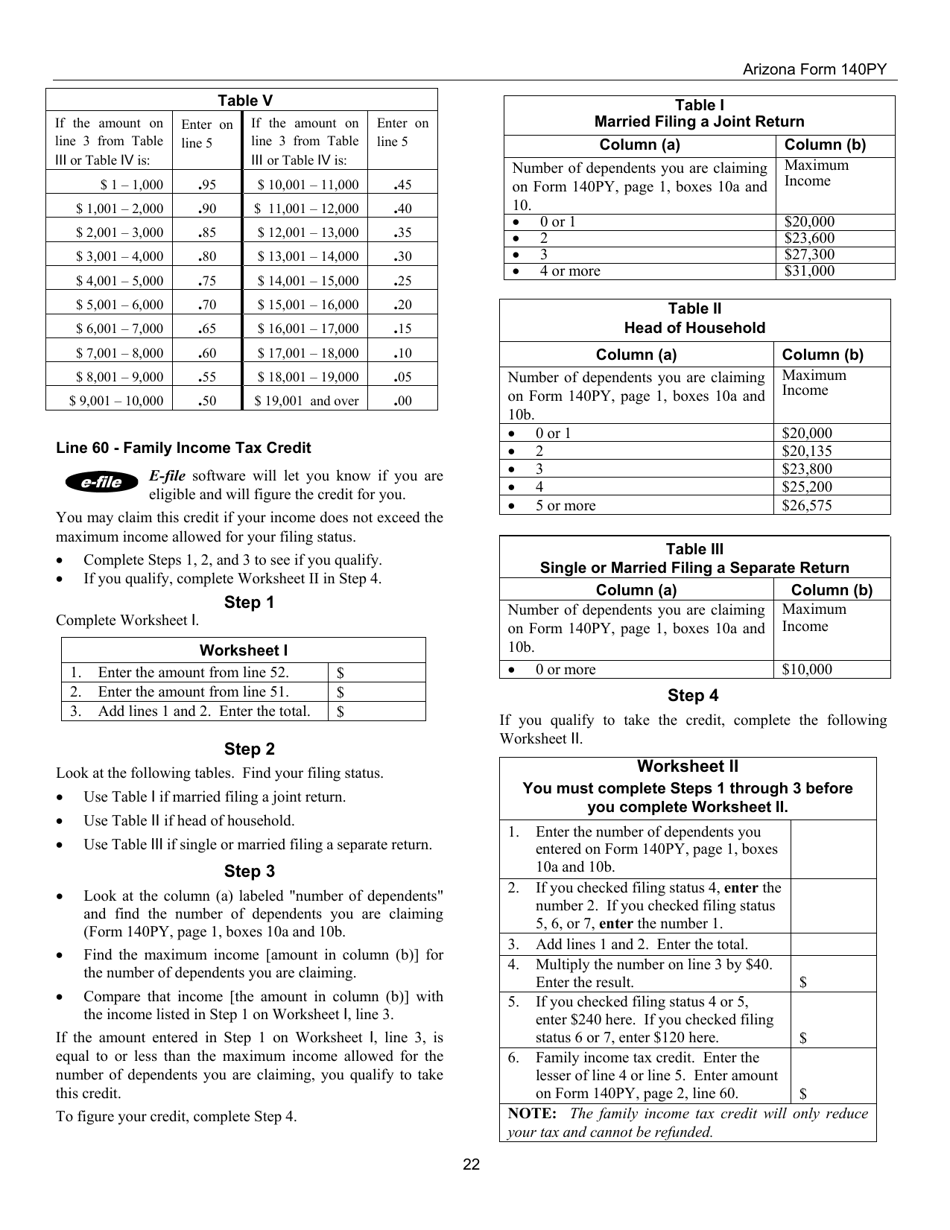

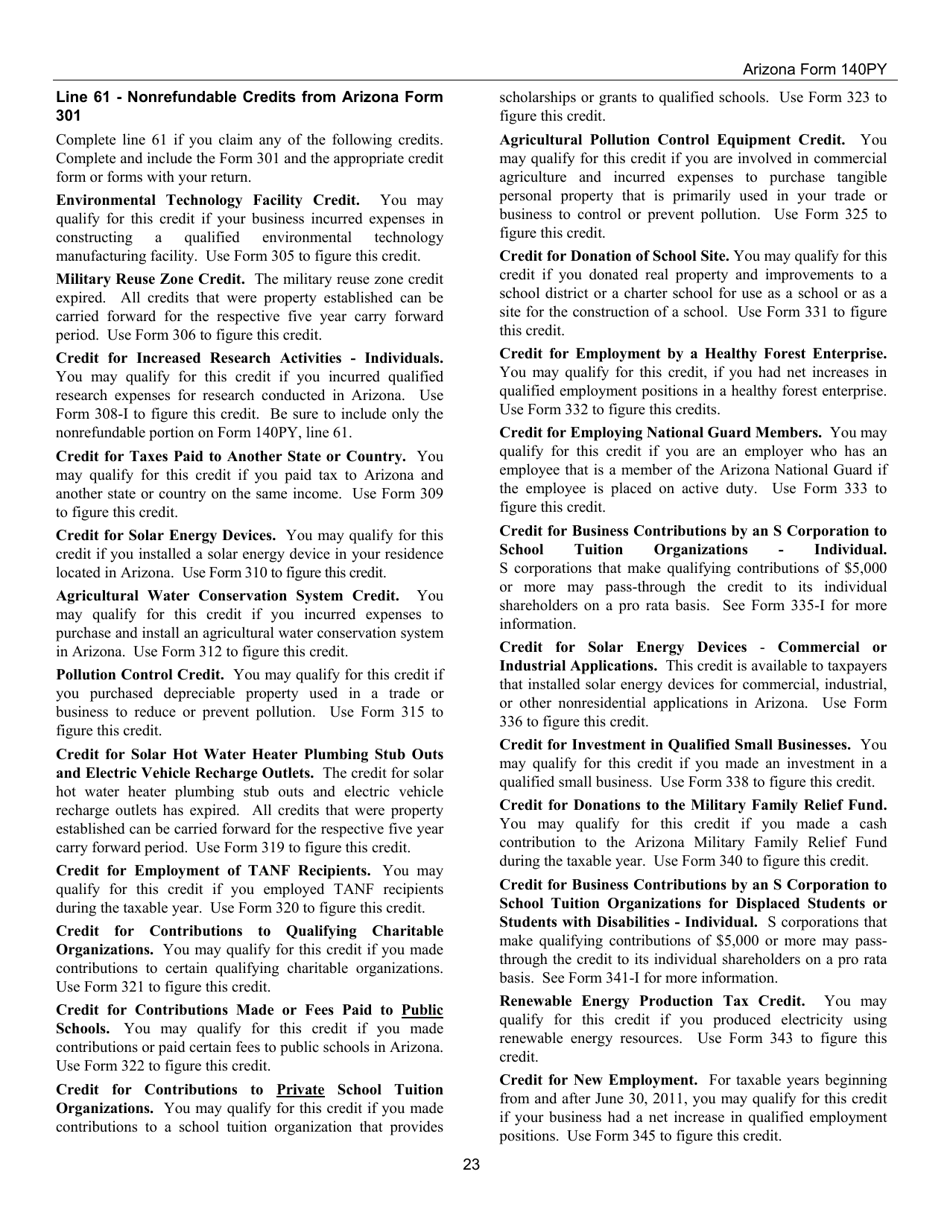

Q: Are there any credits or deductions available for part-year Arizona residents?

A: Yes, there are various credits and deductions available for part-year Arizona residents, including the Arizona Standard Deduction and the Credit for Taxes Paid to Another State or Country.

Q: What happens if I don't file Arizona Form 140PY?

A: If you are required to file Arizona Form 140PY and fail to do so, you may be subject to penalties and interest on any unpaid taxes.

Q: Can I file Arizona Form 140PY if I have moved out of Arizona?

A: Yes, if you were a part-year resident of Arizona and have since moved out of the state, you are still required to file Arizona Form 140PY for the portion of the year you were a resident.

Q: Can I use Arizona Form 140PY to claim a refund?

A: Yes, if you overpaid your income taxes as a part-year resident of Arizona, you can use Arizona Form 140PY to claim a refund.

Instruction Details:

- This 31-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.