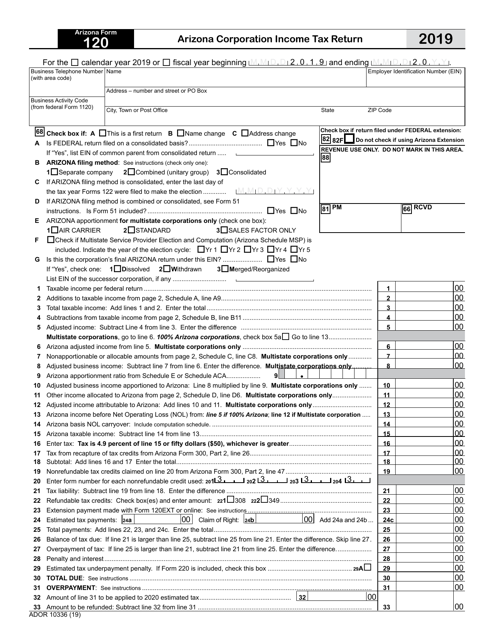

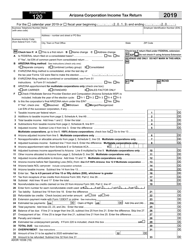

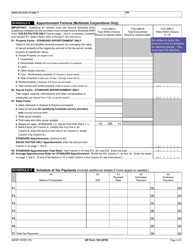

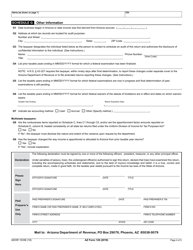

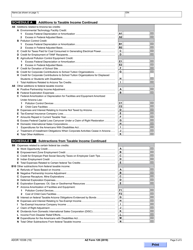

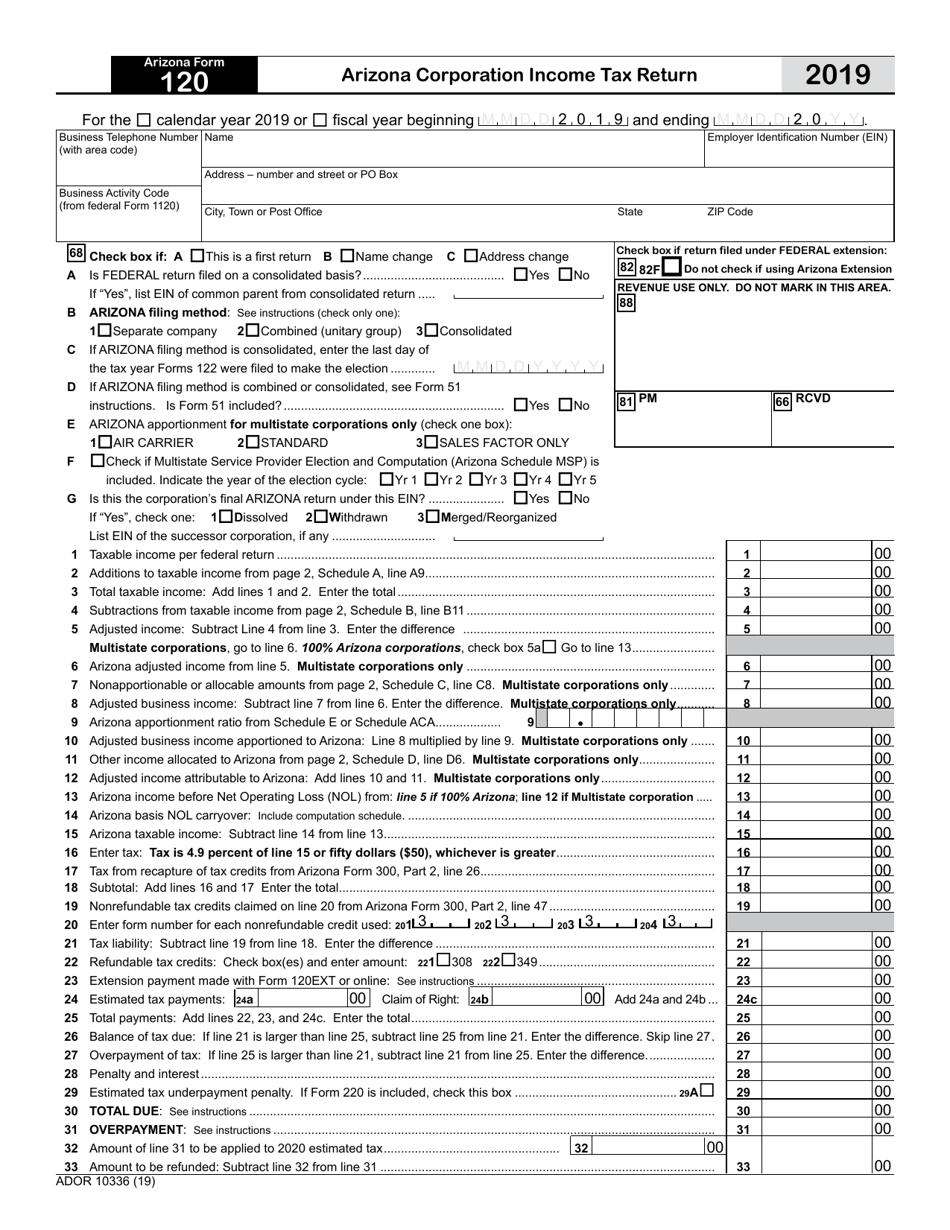

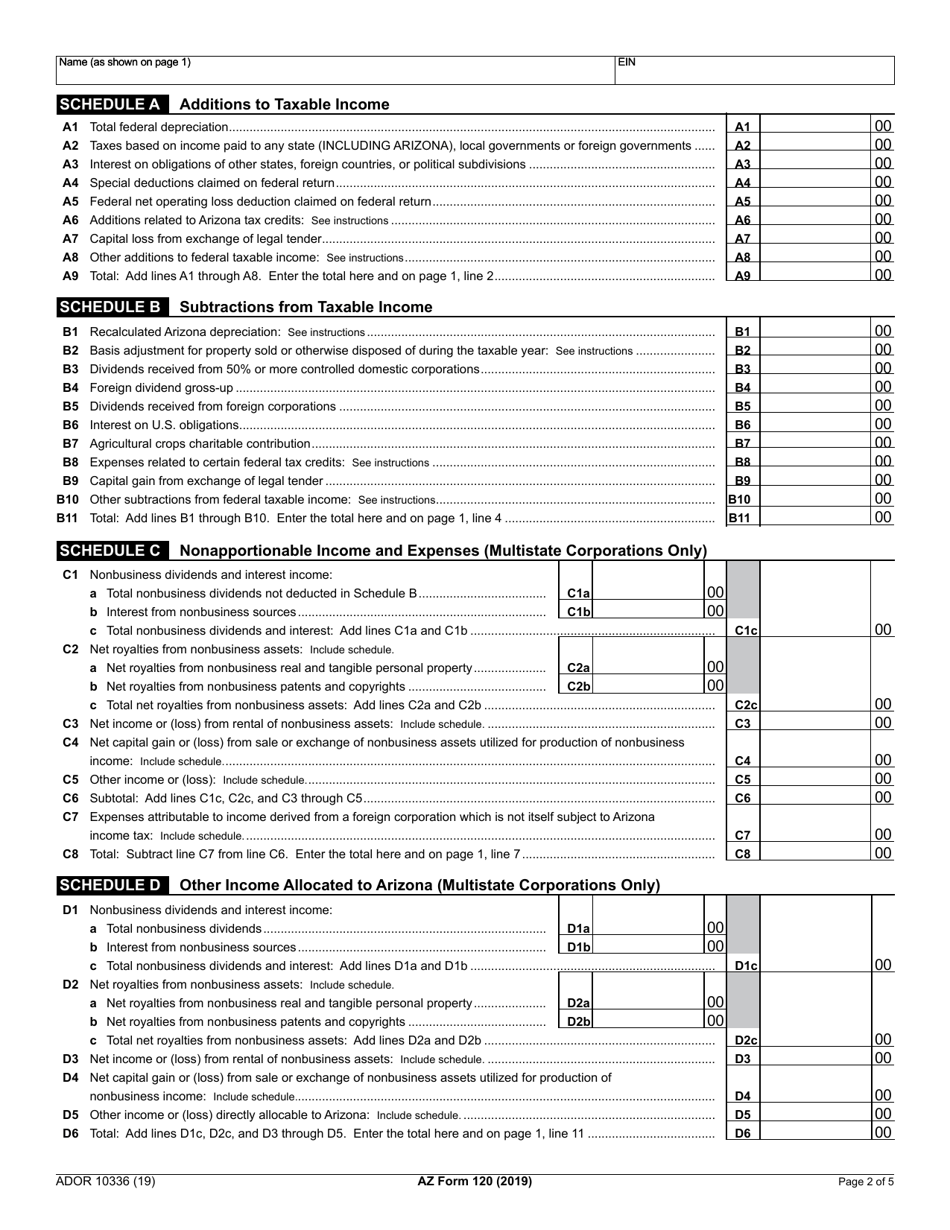

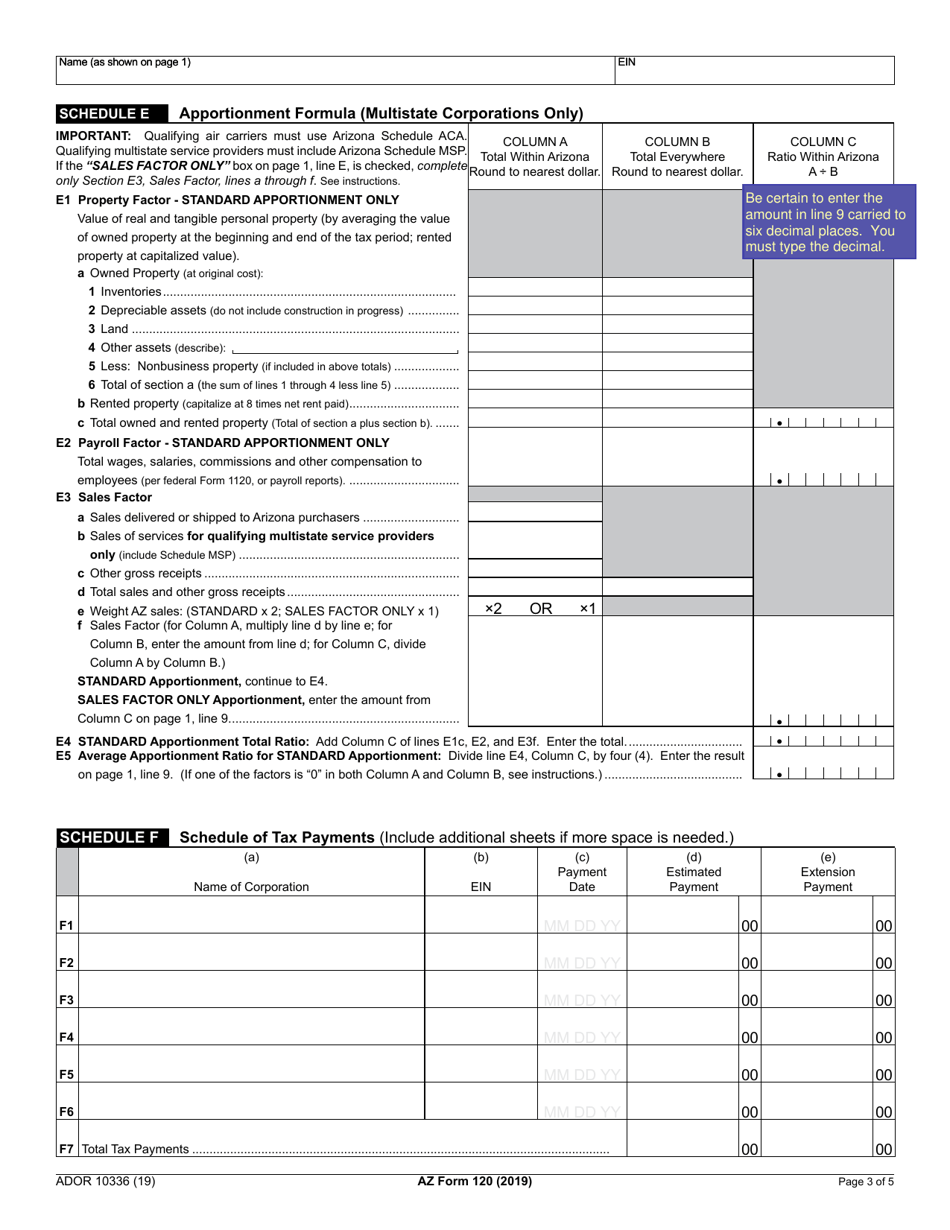

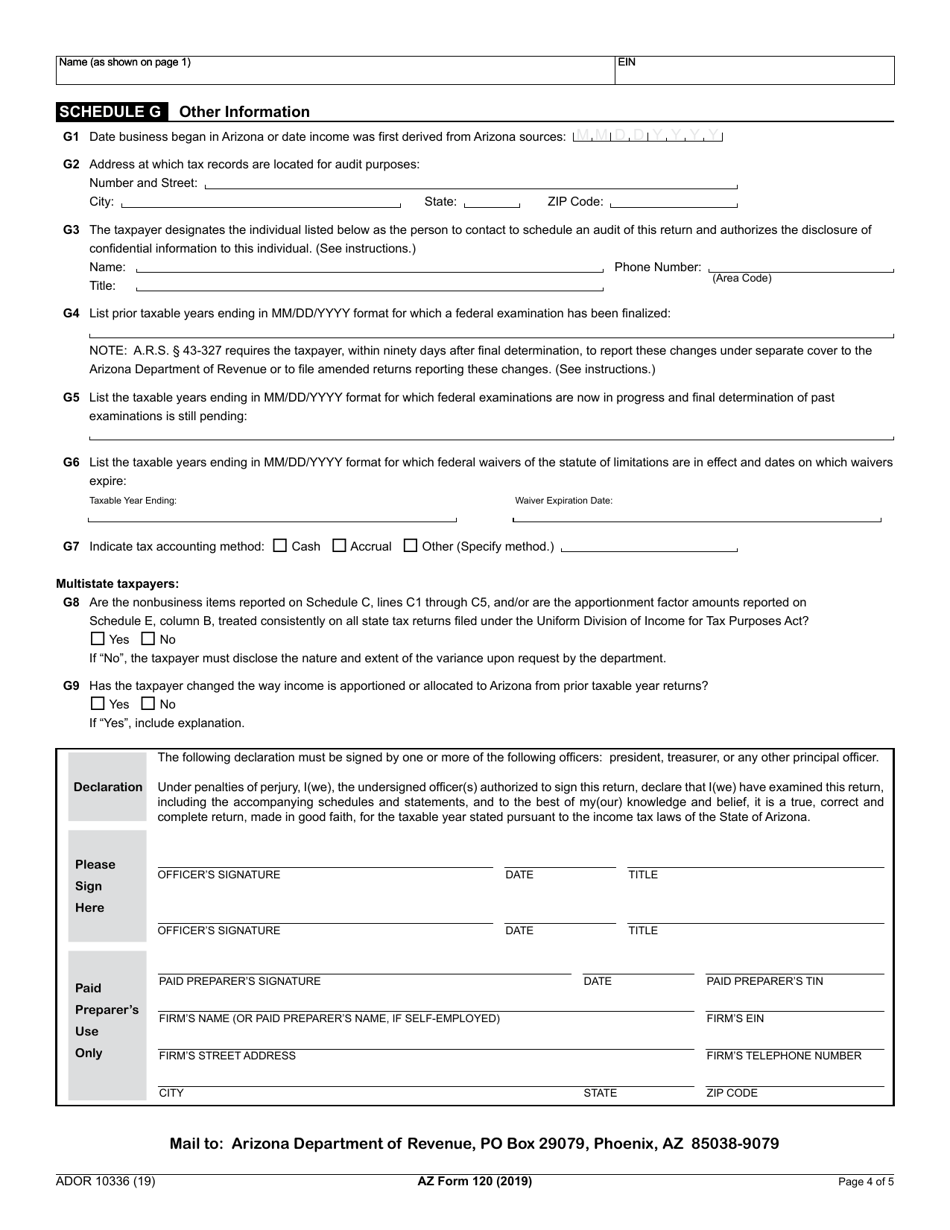

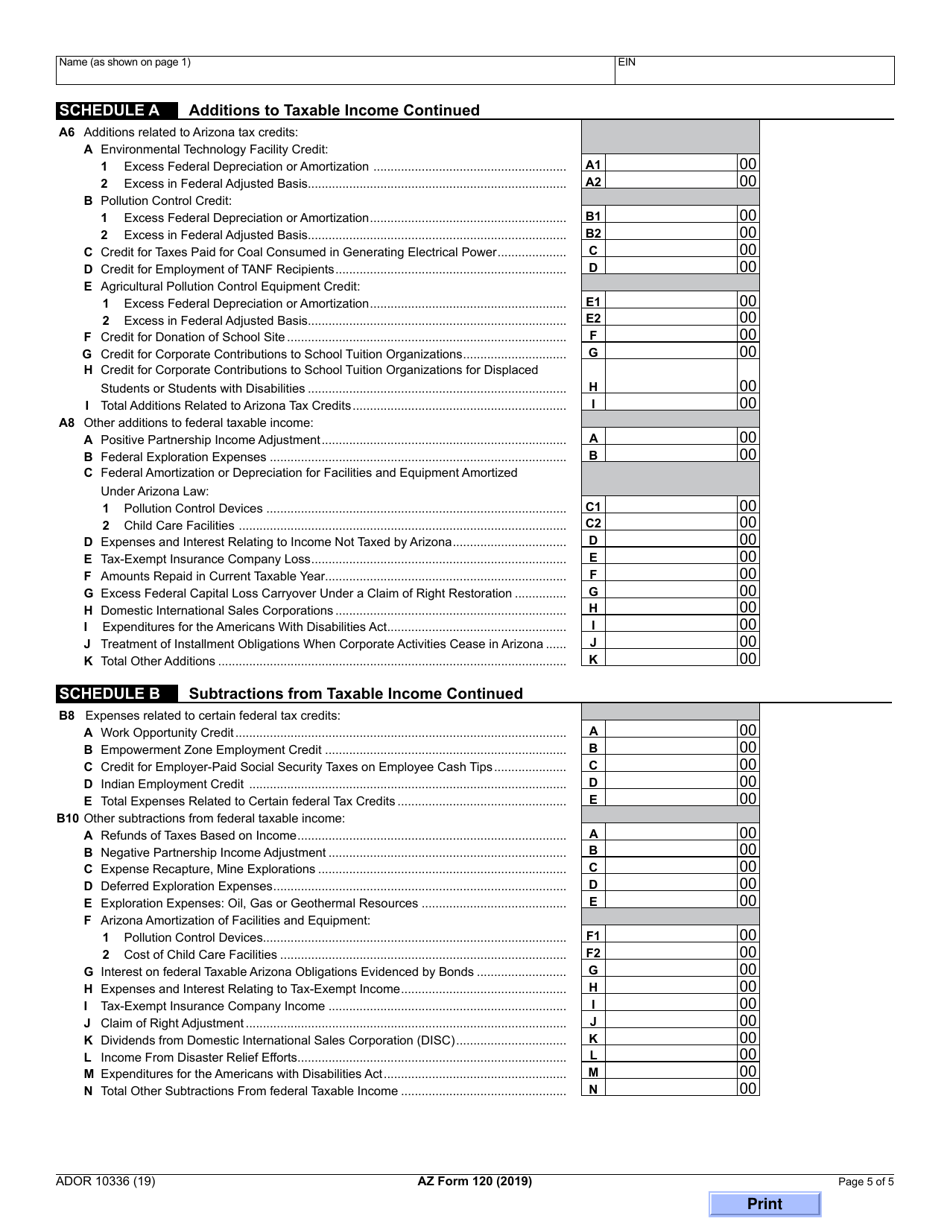

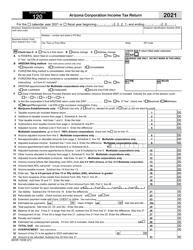

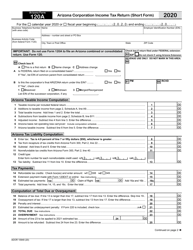

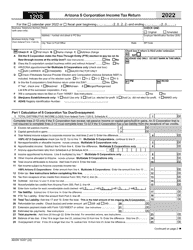

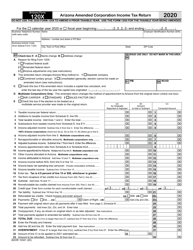

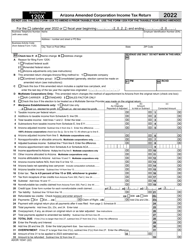

Arizona Form 120 (ADOR10336) Arizona Corporation Income Tax Return - Arizona

What Is Arizona Form 120 (ADOR10336)?

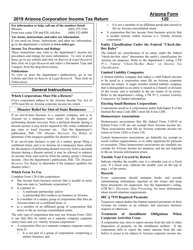

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 120?

A: Arizona Form 120 is the Arizona Corporation Income Tax Return.

Q: Who needs to file Arizona Form 120?

A: Corporations doing business in Arizona need to file Arizona Form 120.

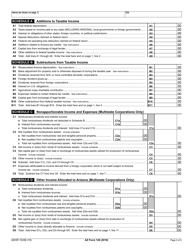

Q: What is the purpose of Arizona Form 120?

A: The purpose of Arizona Form 120 is to report the income, deductions, and tax liability of corporations in Arizona.

Q: Are there any filing fees associated with Arizona Form 120?

A: No, there are no filing fees associated with Arizona Form 120.

Q: What is the due date for filing Arizona Form 120?

A: Arizona Form 120 is due on the 15th day of the 4th month following the close of the tax year.

Q: Are there any penalties for late filing of Arizona Form 120?

A: Yes, there are penalties for late filing of Arizona Form 120. It is important to file the return on time to avoid penalties.

Q: What if I need an extension to file Arizona Form 120?

A: You can request an extension to file Arizona Form 120 by submitting Arizona Form 120EXT and paying any estimated tax due.

Q: What should I do if I have additional questions about Arizona Form 120?

A: If you have additional questions about Arizona Form 120, you can contact the Arizona Department of Revenue for assistance.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 120 (ADOR10336) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.