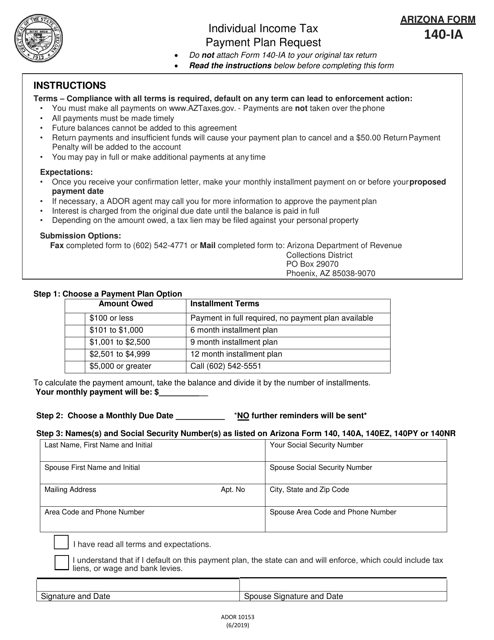

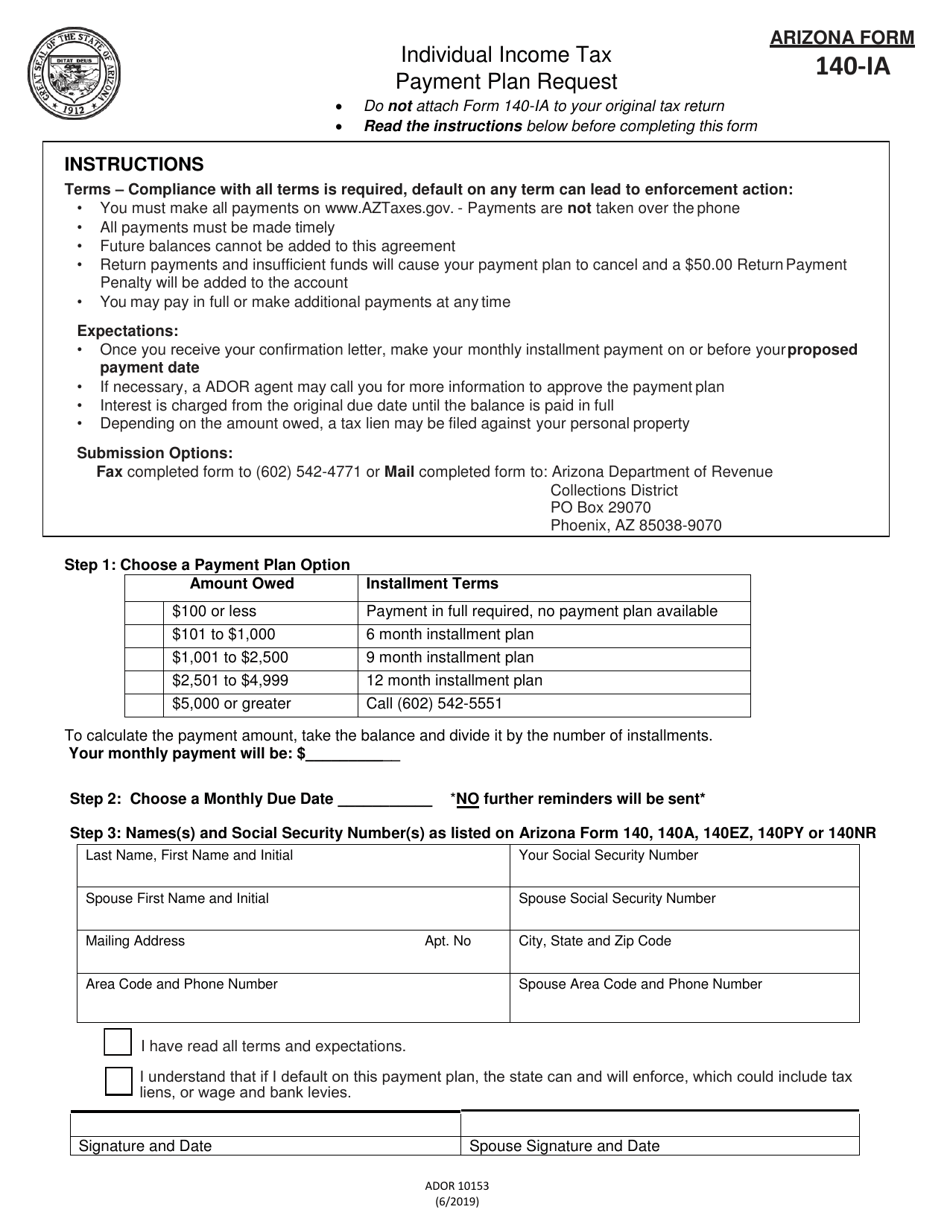

Arizona Form 140-IA (ADOR10153) Individual Income Tax Payment Plan Request - Arizona

What Is Arizona Form 140-IA (ADOR10153)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Arizona Form 140-IA?

A: Arizona Form 140-IA is an Individual IncomeTax Payment Plan Request form.

Q: What is the purpose of Arizona Form 140-IA?

A: The purpose of Arizona Form 140-IA is to request a payment plan for individual income tax owed in Arizona.

Q: Who needs to fill out Arizona Form 140-IA?

A: Anyone who wants to request a payment plan for their individual income tax owed in Arizona needs to fill out Arizona Form 140-IA.

Q: What information do I need to provide on Arizona Form 140-IA?

A: You will need to provide your personal information, tax year, payment plan details, and a detailed explanation of your financial situation.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 140-IA (ADOR10153) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.