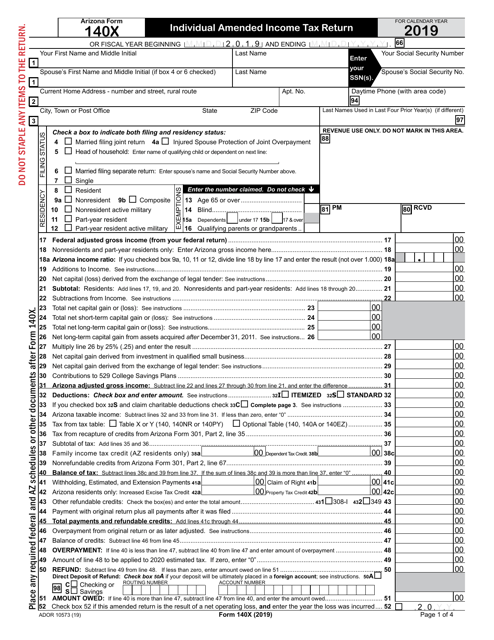

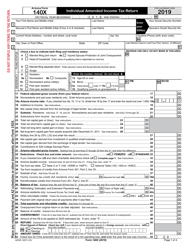

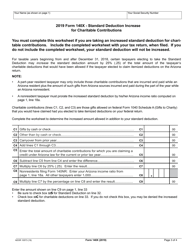

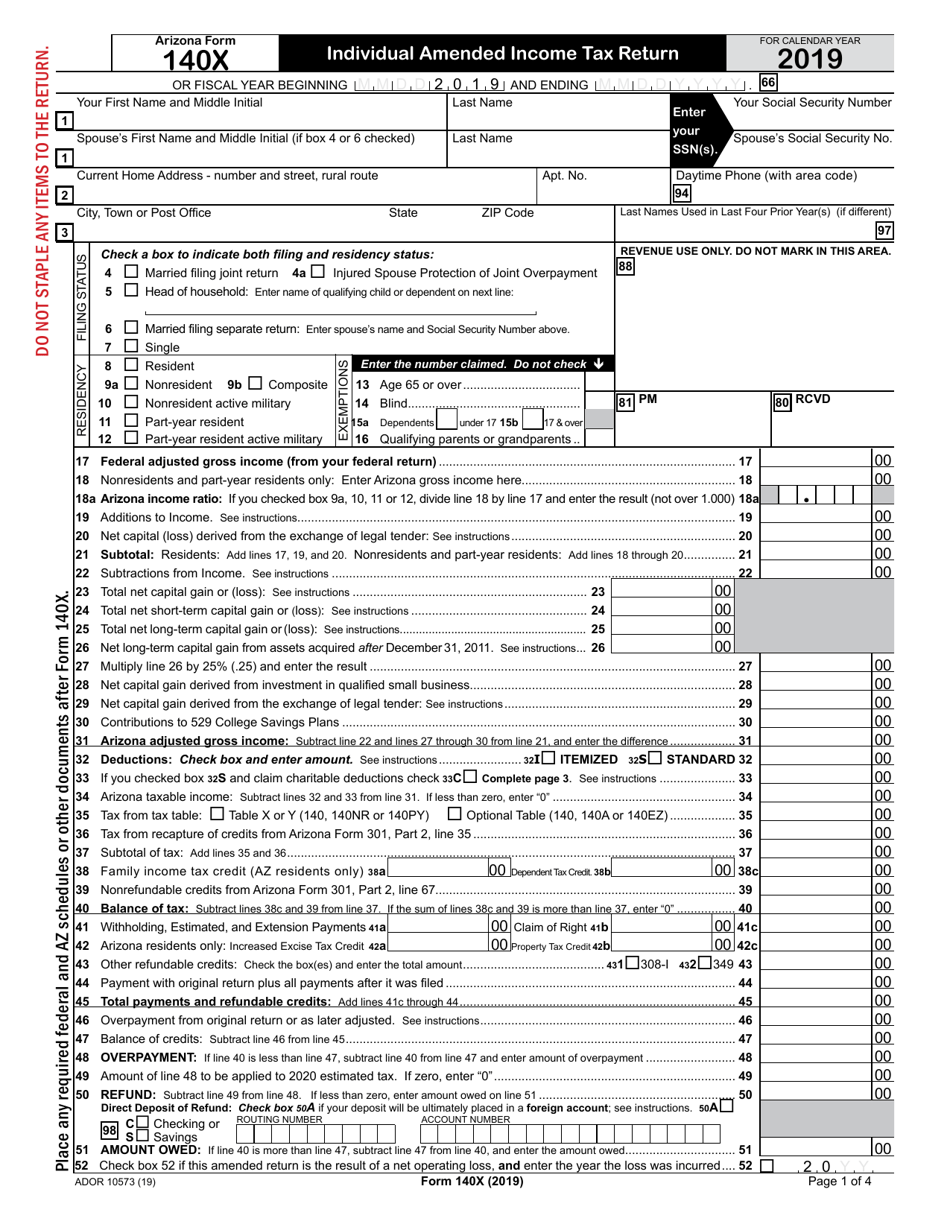

Arizona Form 140X (ADOR10573) Individual Amended Income Tax Return - Arizona

What Is Arizona Form 140X (ADOR10573)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 140X?

A: Arizona Form 140X is the Individual Amended Income Tax Return for Arizona.

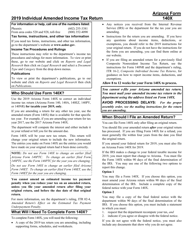

Q: Who needs to file Arizona Form 140X?

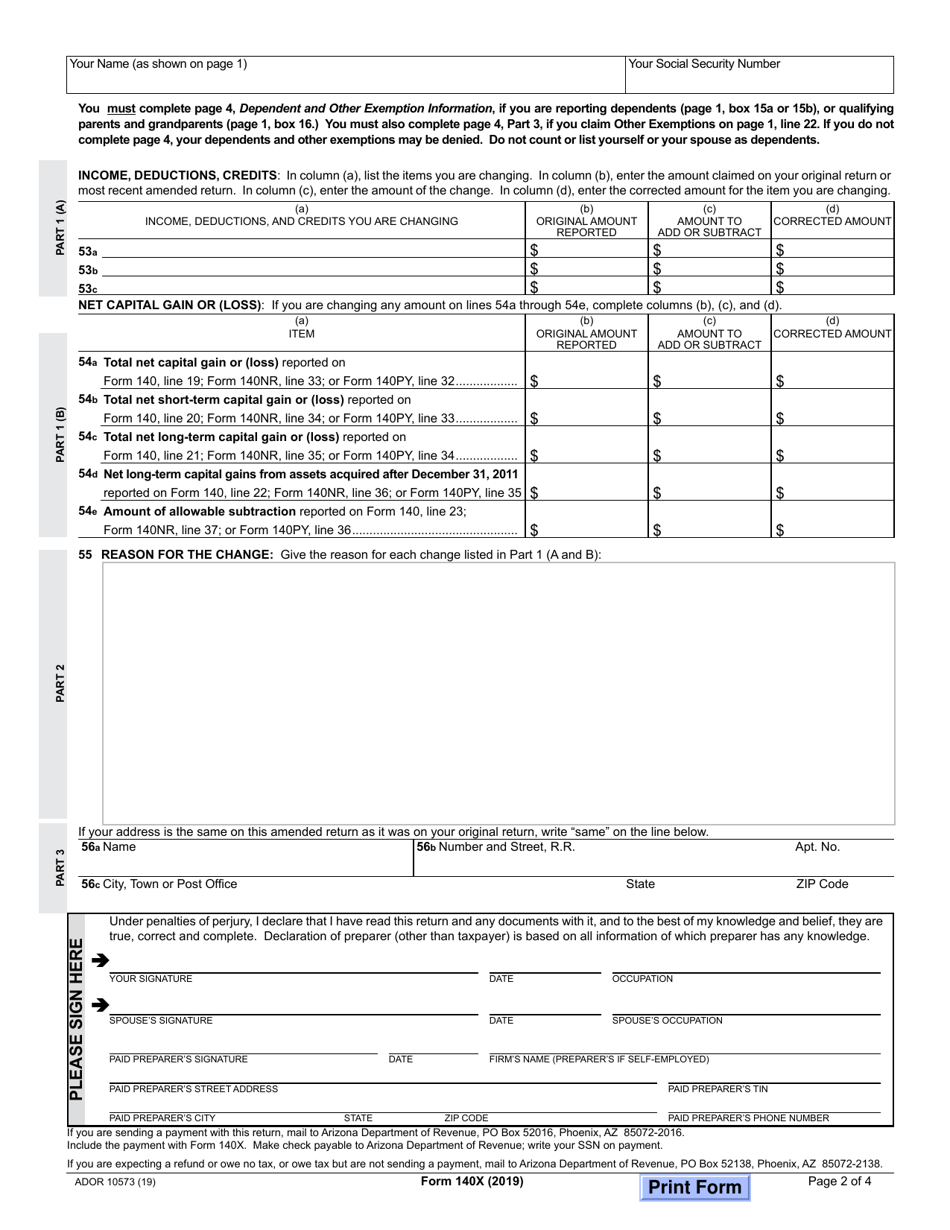

A: Any individual who needs to make changes to their previously filed Arizona income tax return should file Form 140X.

Q: When should I file Arizona Form 140X?

A: You should file Arizona Form 140X as soon as you discover an error or omission on your previous Arizona income tax return.

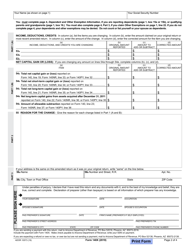

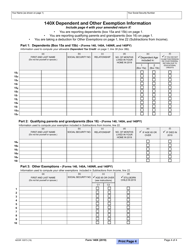

Q: What information do I need to complete Arizona Form 140X?

A: You will need your original Arizona income tax return, any necessary supporting documentation, and the corrected information.

Q: Are there any fees associated with filing Arizona Form 140X?

A: No, there are no fees required to file Arizona Form 140X.

Q: Can Arizona Form 140X be e-filed?

A: No, Arizona Form 140X must be filed by mail.

Q: What happens after I file Arizona Form 140X?

A: After you file Arizona Form 140X, the Arizona Department of Revenue will review your amended return and process any necessary adjustments to your tax liability.

Q: How long does it take to process Arizona Form 140X?

A: Processing times can vary, but it typically takes the Arizona Department of Revenue 8-12 weeks to process an amended return.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 140X (ADOR10573) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.