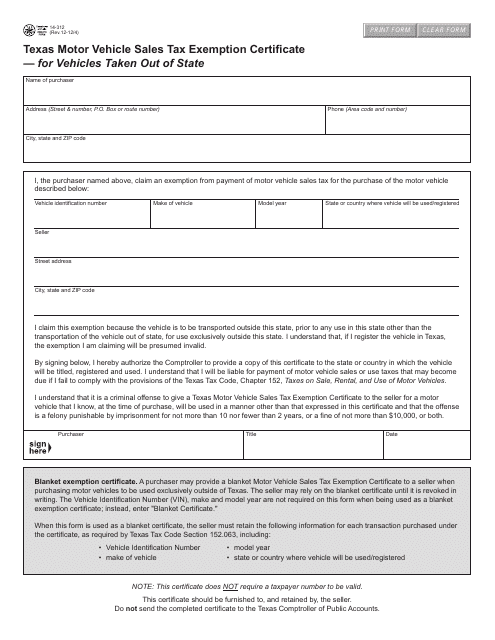

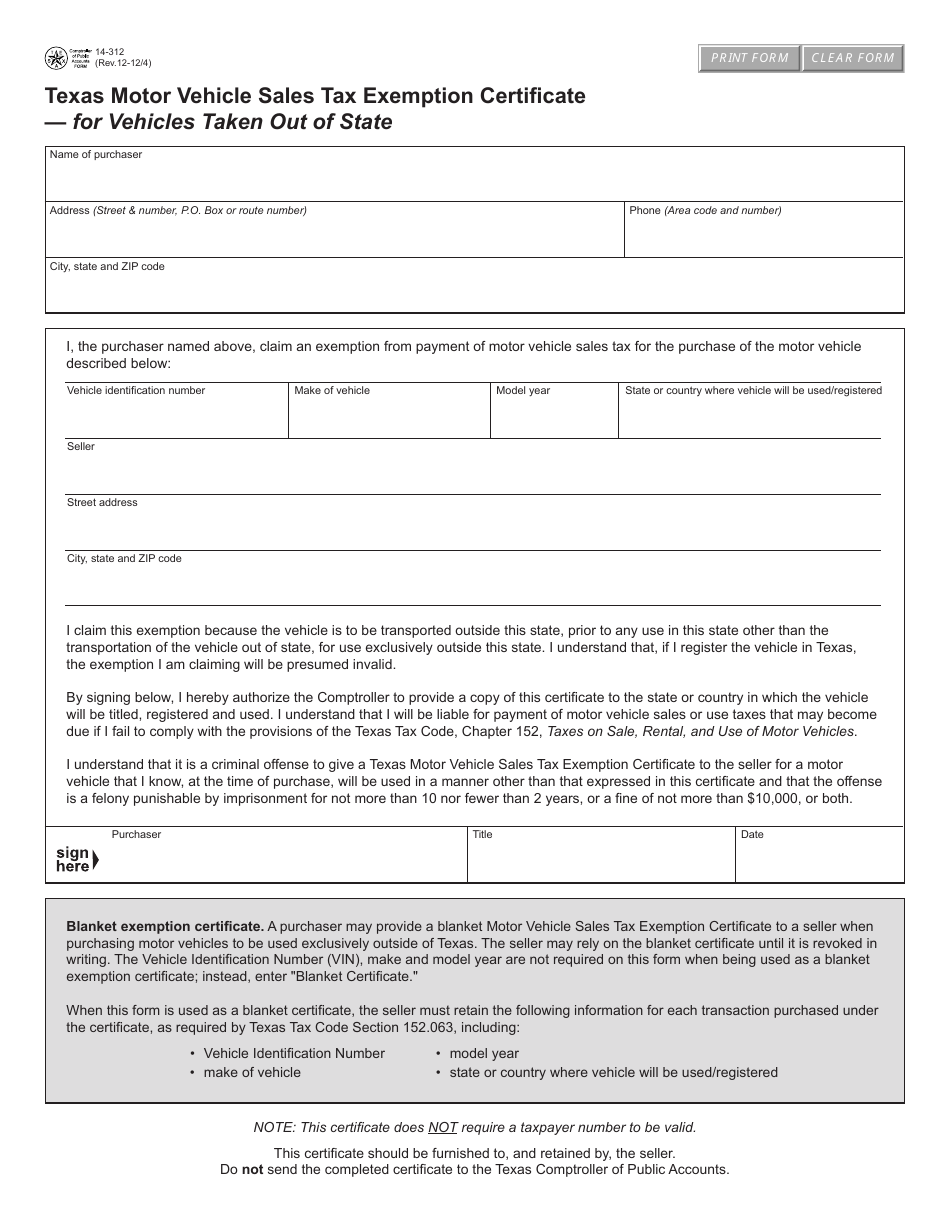

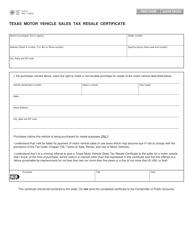

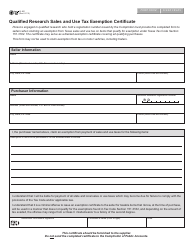

Form 14-312 Texas Motor Vehicle Sales Tax Exemption Certificate - for Vehicles Taken out of State - Texas

What Is Form 14-312?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 14-312?

A: Form 14-312 is the Texas Motor Vehicle Sales Tax Exemption Certificate, specifically for vehicles taken out of the state of Texas.

Q: What is the purpose of Form 14-312?

A: The purpose of Form 14-312 is to request an exemption from paying motor vehicle sales tax for vehicles that are taken out of the state of Texas.

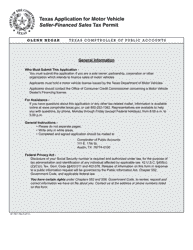

Q: Who can use Form 14-312?

A: Individuals who are taking a vehicle out of the state of Texas can use Form 14-312 to request a sales tax exemption.

Q: Do I need to fill out Form 14-312 if I am keeping the vehicle in Texas?

A: No, if you are keeping the vehicle in Texas, you do not need to fill out Form 14-312 for a sales tax exemption.

Q: What information do I need to provide on Form 14-312?

A: You will need to provide information such as your name, address, vehicle details, and the intended use and destination of the vehicle.

Q: Is there a deadline to submit Form 14-312?

A: Yes, Form 14-312 must be submitted within 30 days from the date the vehicle is taken out of the state of Texas.

Q: Can I get a refund of sales taxes already paid if I submit Form 14-312?

A: No, Form 14-312 is used to request an exemption from future motor vehicle sales tax, but it does not provide a refund for taxes already paid.

Q: Is Form 14-312 specific to Texas?

A: Yes, Form 14-312 is specific to the state of Texas and its motor vehicle sales tax exemption for vehicles taken out of the state.

Form Details:

- Released on December 1, 2012;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 14-312 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.