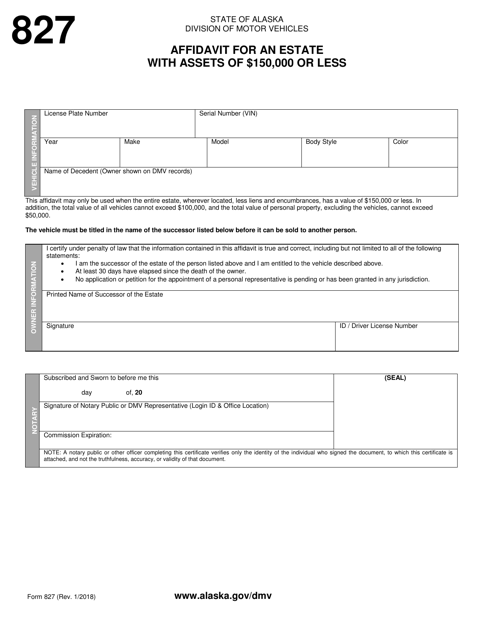

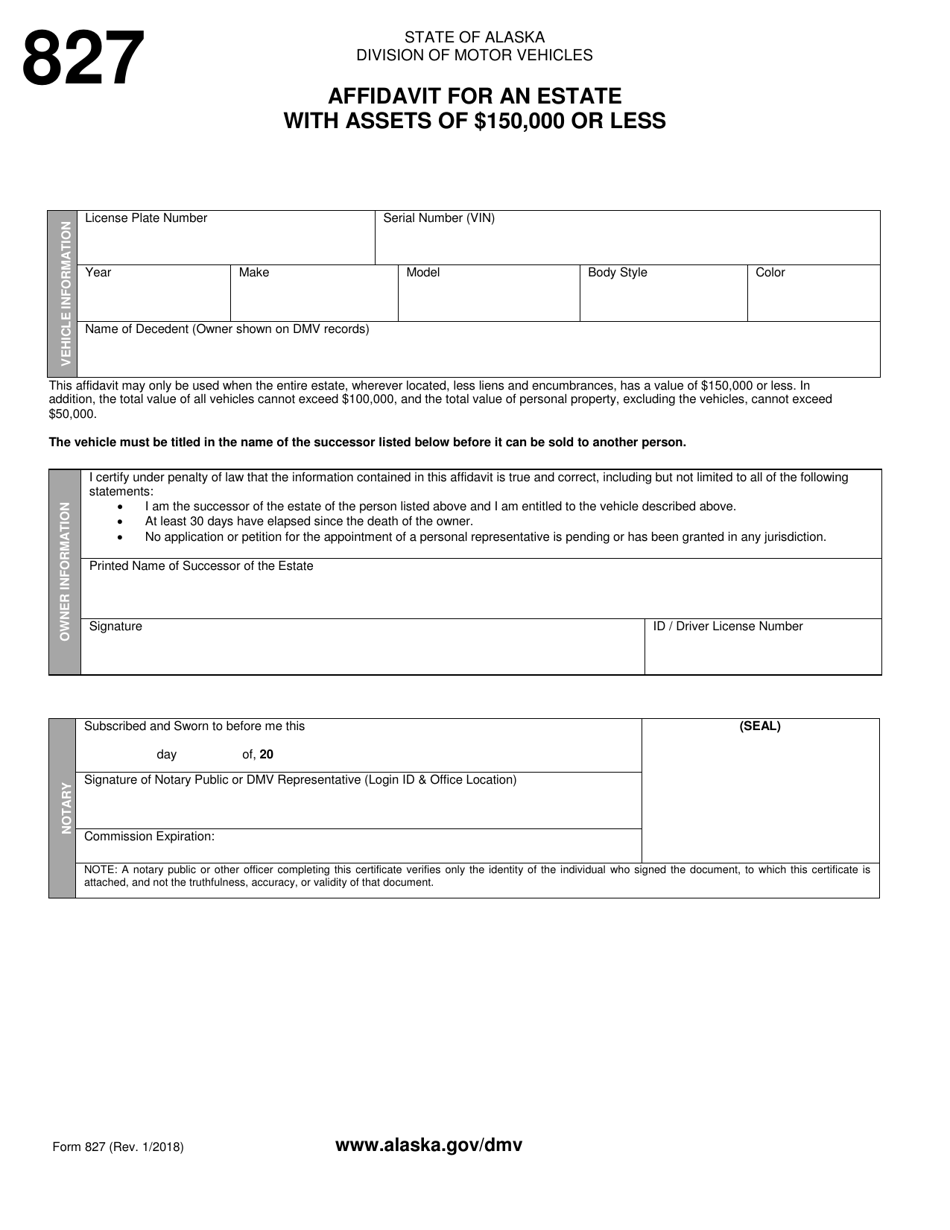

Form 827 Affidavit for an Estate With Assets of $150,000 or Less - Alaska

What Is Form 827?

This is a legal form that was released by the Alaska Department of Administration - a government authority operating within Alaska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 827?

A: Form 827 is an affidavit for an estate with assets of $150,000 or less.

Q: Who needs to file Form 827?

A: Individuals who are administering an estate in Alaska with assets of $150,000 or less need to file Form 827.

Q: What is the purpose of Form 827?

A: The purpose of Form 827 is to provide a simplified process for the transfer of assets in small estates.

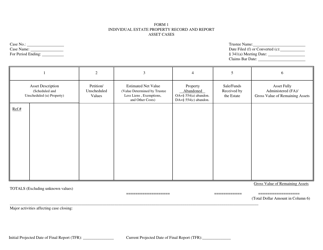

Q: What does Form 827 require?

A: Form 827 requires information about the deceased person, the estate's assets, and the person administering the estate.

Q: Do I need to attach any documents to Form 827?

A: You may need to attach a copy of the deceased person's death certificate and other supporting documents.

Q: Is there a filing fee for Form 827?

A: The filing fee for Form 827 may vary depending on the court. Contact the probate court in Alaska for more information.

Q: What happens after I file Form 827?

A: After filing Form 827, the court will review the affidavit and may issue an order allowing the transfer of assets to the proper beneficiaries.

Q: Are there any time limits for filing Form 827?

A: There may be specific time limits for filing Form 827. Contact the probate court in Alaska for more information.

Q: Can I use Form 827 for estates with assets over $150,000?

A: No, Form 827 is specifically for estates with assets of $150,000 or less.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Alaska Department of Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 827 by clicking the link below or browse more documents and templates provided by the Alaska Department of Administration.