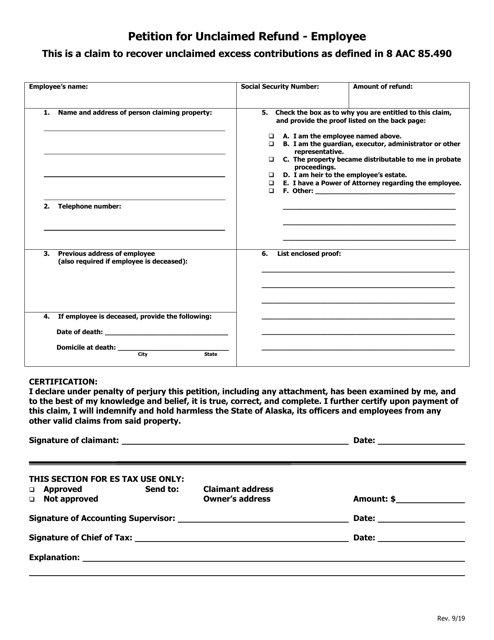

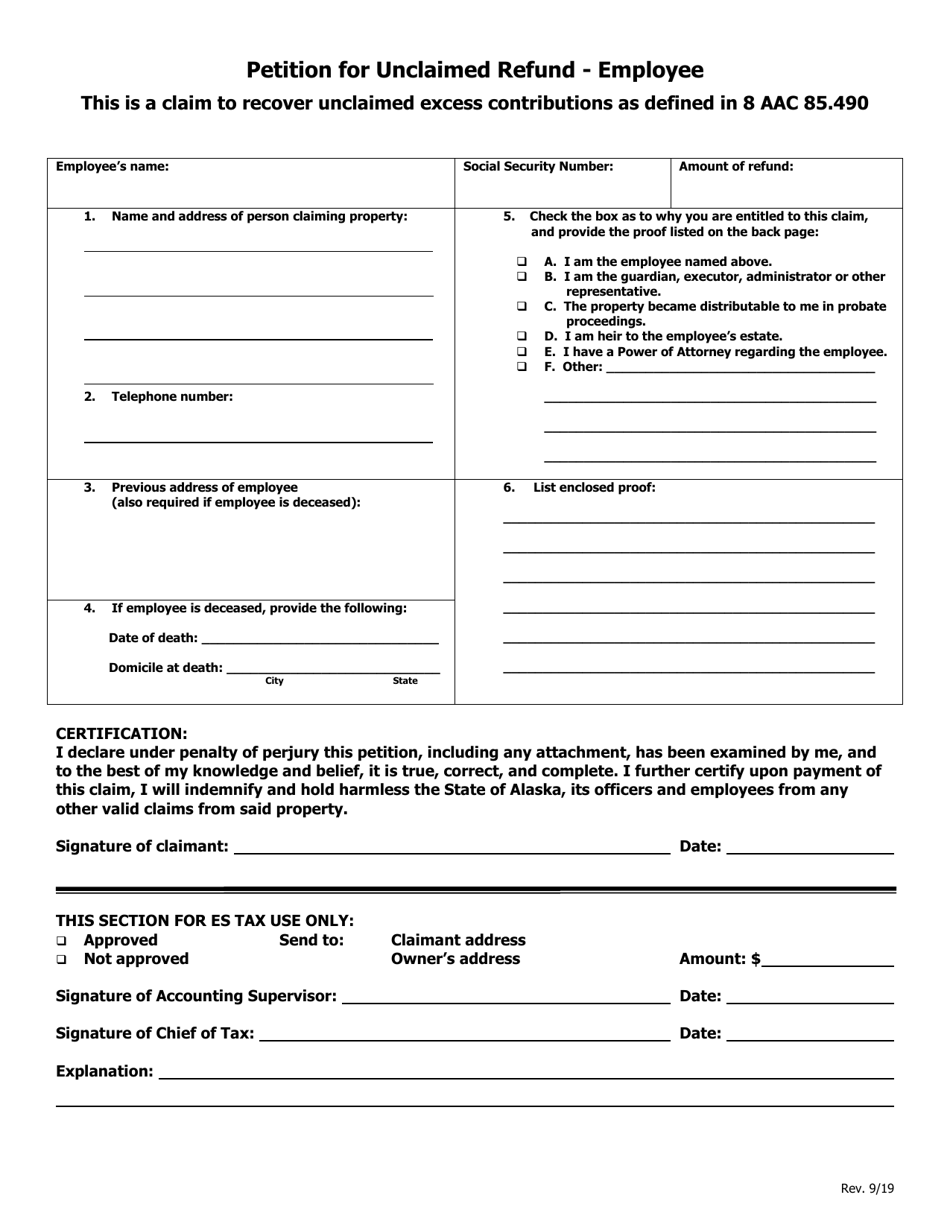

Petition for Unclaimed Refund - Employee - Alaska

Petition for Unclaimed Refund - Employee is a legal document that was released by the Alaska Department of Labor and Workforce Development - a government authority operating within Alaska.

FAQ

Q: What is a petition for unclaimed refund?

A: A petition for unclaimed refund is a request to recover money that has not been claimed by the intended recipient.

Q: Who can file a petition for unclaimed refund as an employee in Alaska?

A: An employee in Alaska who paid taxes and did not receive a refund can file a petition for unclaimed refund.

Q: Why would an employee file a petition for unclaimed refund in Alaska?

A: An employee would file a petition for unclaimed refund in Alaska if they believe they are owed a refund for overpaid taxes.

Q: What is the purpose of filing a petition for unclaimed refund?

A: The purpose of filing a petition for unclaimed refund is to request the return of money that is rightfully theirs.

Q: How can an employee in Alaska file a petition for unclaimed refund?

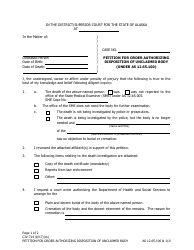

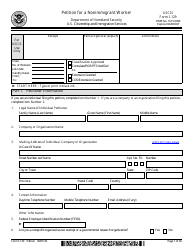

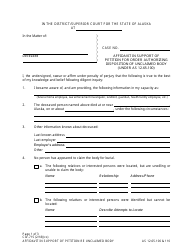

A: An employee in Alaska can file a petition for unclaimed refund by completing the necessary forms and submitting them to the appropriate government agency.

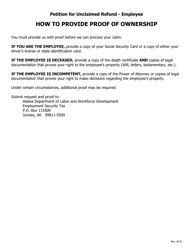

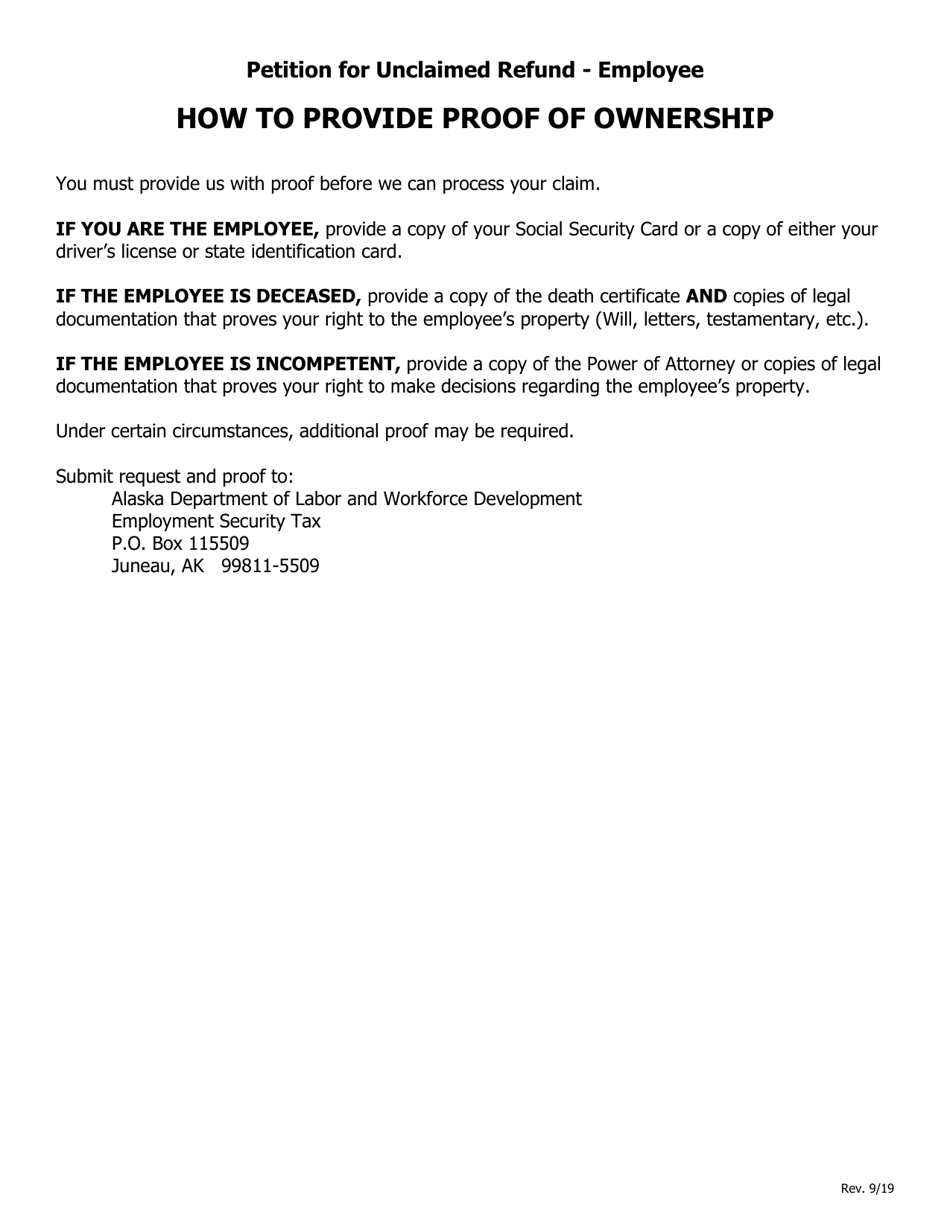

Q: What documents are needed to file a petition for unclaimed refund as an employee in Alaska?

A: The documents needed to file a petition for unclaimed refund as an employee in Alaska may include proof of payment, tax returns, and any other relevant supporting documents.

Q: Is there a deadline to file a petition for unclaimed refund in Alaska?

A: Yes, there is typically a deadline to file a petition for unclaimed refund in Alaska. It is important to check the specific requirements and deadlines set by the government agency.

Q: What happens after filing a petition for unclaimed refund in Alaska?

A: After filing a petition for unclaimed refund in Alaska, the government agency will review the claim and determine whether the refund should be issued.

Q: How long does it take to receive a refund after filing a petition for unclaimed refund in Alaska?

A: The processing time for a refund after filing a petition for unclaimed refund in Alaska can vary. It is best to contact the government agency for more information on the timeline.

Q: Can an employee in Alaska appeal the decision on their petition for unclaimed refund?

A: Yes, if an employee in Alaska disagrees with the decision on their petition for unclaimed refund, they may be able to appeal the decision by following the appropriate procedures.

Form Details:

- Released on September 1, 2019;

- The latest edition currently provided by the Alaska Department of Labor and Workforce Development;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Alaska Department of Labor and Workforce Development.