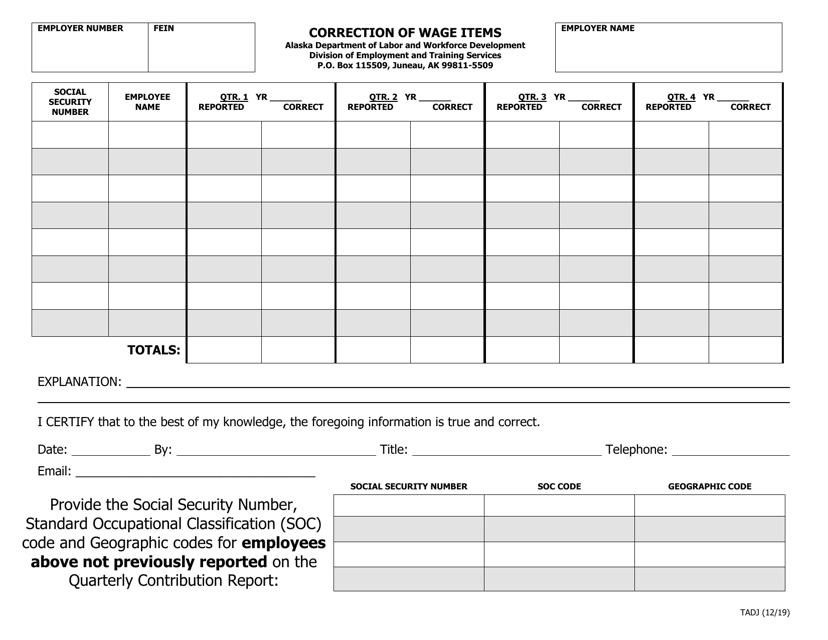

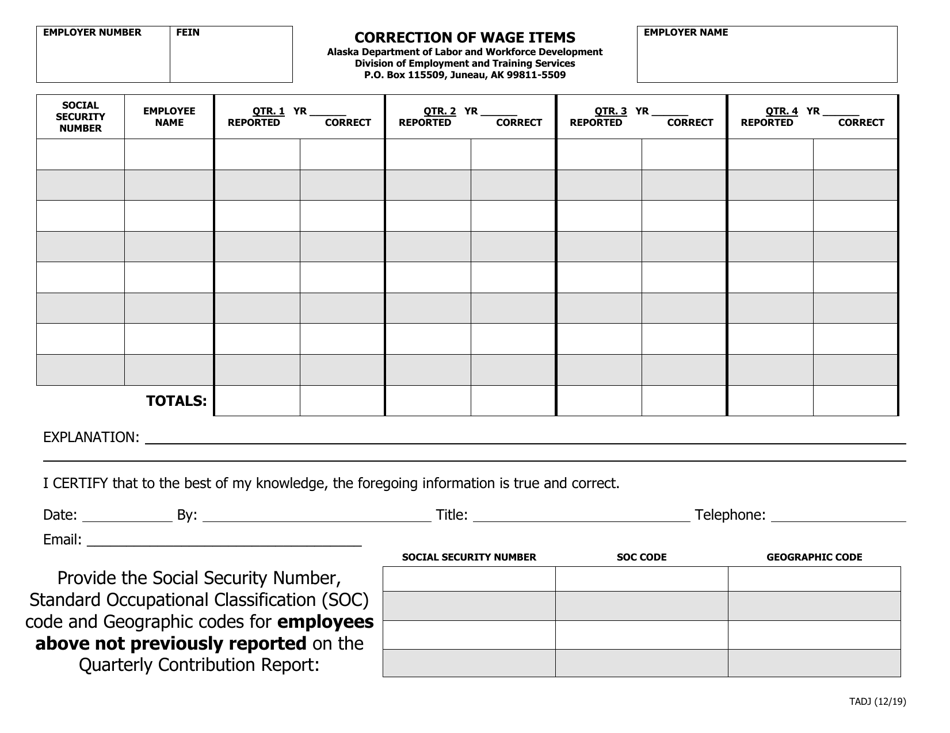

Form TADJ Correction of Wage Items - Alaska

What Is Form TADJ?

This is a legal form that was released by the Alaska Department of Labor and Workforce Development - a government authority operating within Alaska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TADJ?

A: Form TADJ is a form used to correct wage items in Alaska.

Q: What is the purpose of Form TADJ?

A: The purpose of Form TADJ is to correct any errors on a previously filed Alaska wage report.

Q: Who needs to file Form TADJ?

A: Anyone who needs to correct wage items on their Alaska wage report needs to file Form TADJ.

Q: What information is required on Form TADJ?

A: Form TADJ requires information such as the employer's name, employer identification number, and the corrected wage items.

Q: Are there any deadlines for filing Form TADJ?

A: Yes, Form TADJ must be filed within 30 days of discovering the error in the original wage report.

Q: Can Form TADJ be filed for multiple quarters?

A: Yes, Form TADJ can be used to correct wage items for multiple quarters.

Q: Is there a fee for filing Form TADJ?

A: No, there is no fee for filing Form TADJ.

Q: Can I make corrections to previously filed wage items without filing Form TADJ?

A: No, Form TADJ must be filed to make corrections to previously filed wage items.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Alaska Department of Labor and Workforce Development;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TADJ by clicking the link below or browse more documents and templates provided by the Alaska Department of Labor and Workforce Development.