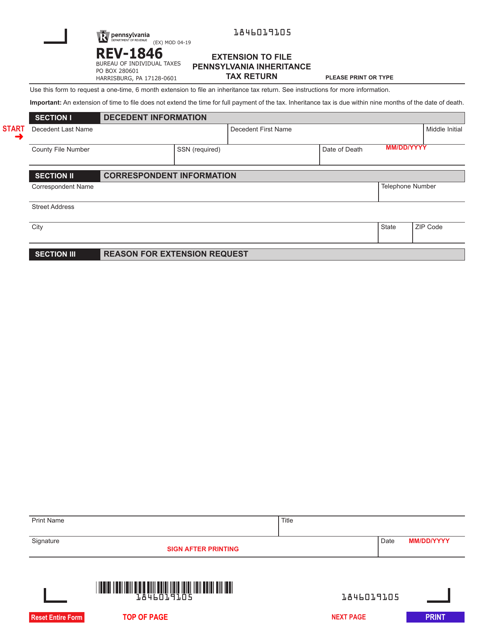

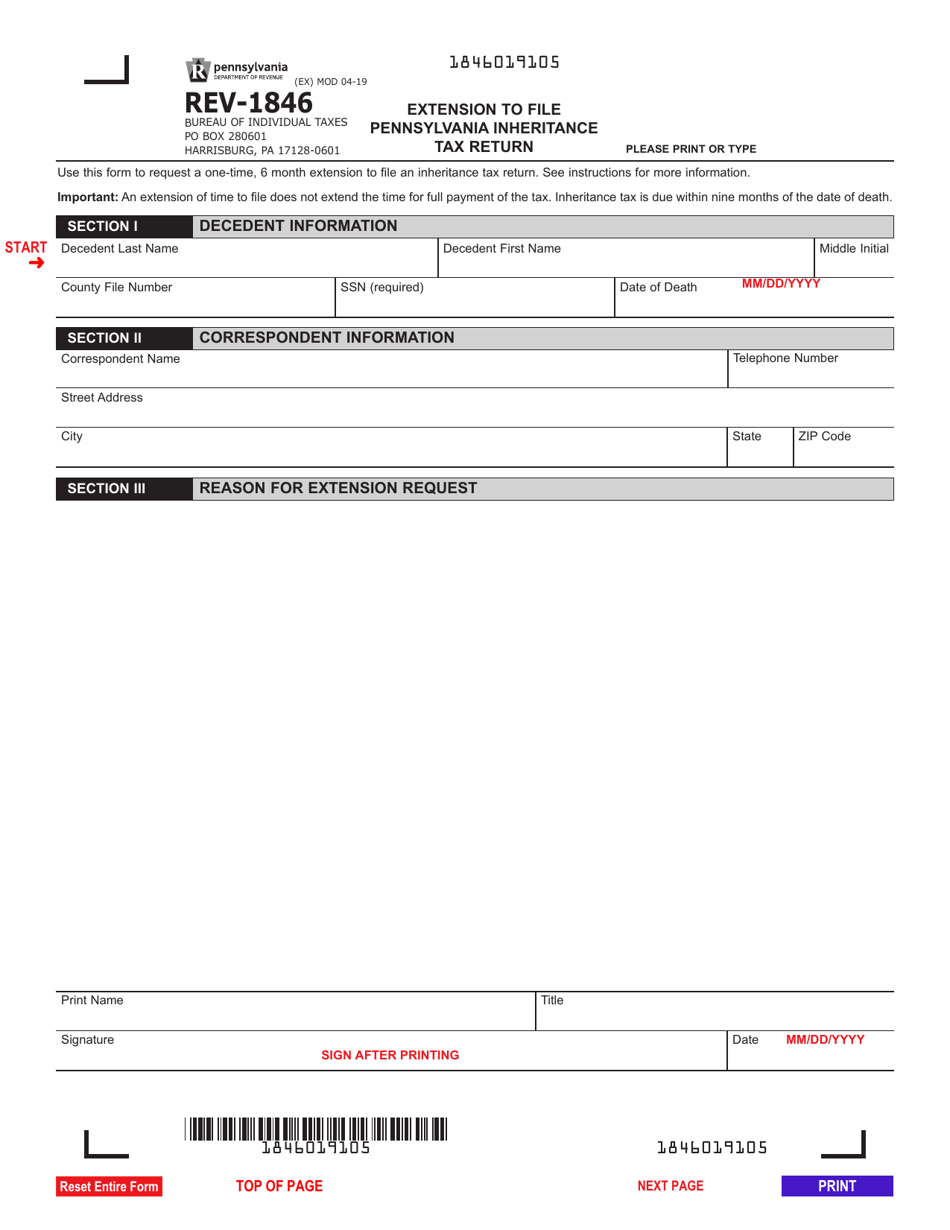

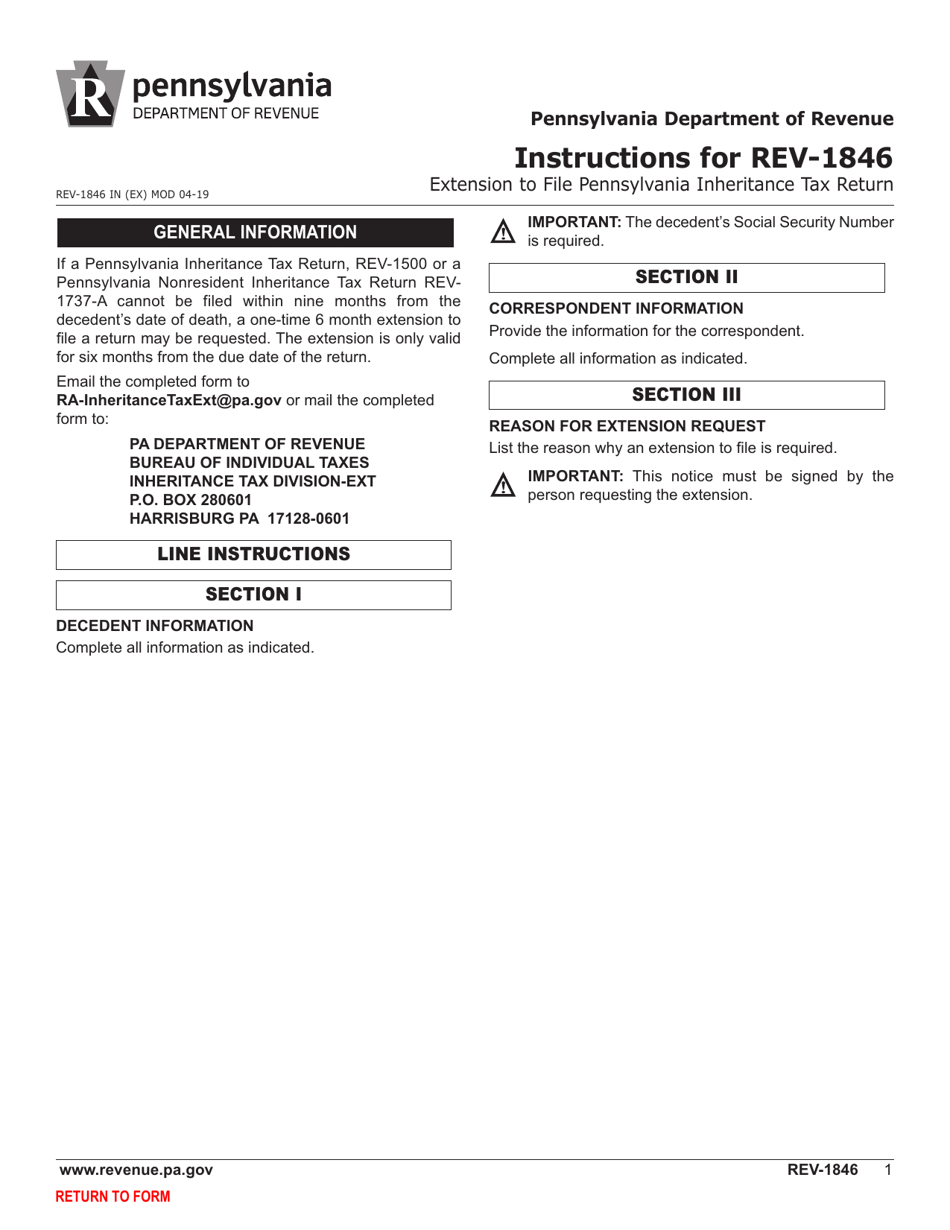

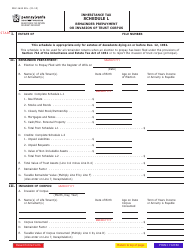

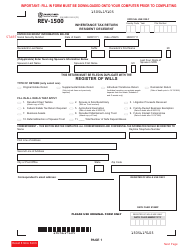

Form REV-1846 Extension to File Pennsylvania Inheritance Tax Return - Pennsylvania

What Is Form REV-1846?

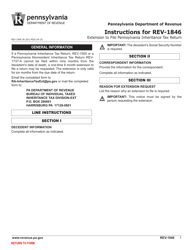

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1846?

A: Form REV-1846 is the Extension to File Pennsylvania Inheritance Tax Return.

Q: What is the purpose of Form REV-1846?

A: The purpose of Form REV-1846 is to request an extension to file the Pennsylvania Inheritance Tax Return.

Q: Can I file an extension using Form REV-1846?

A: Yes, you can file an extension using Form REV-1846.

Q: When should I file Form REV-1846?

A: You should file Form REV-1846 at least 30 days before the due date of the Pennsylvania Inheritance Tax Return.

Q: Is there a fee for filing Form REV-1846?

A: No, there is no fee for filing Form REV-1846.

Q: How long does the extension granted by Form REV-1846 last?

A: The extension granted by Form REV-1846 lasts for an additional six months.

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1846 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.