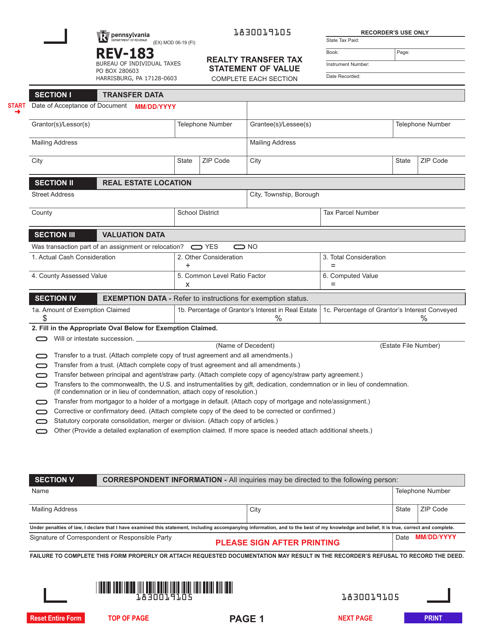

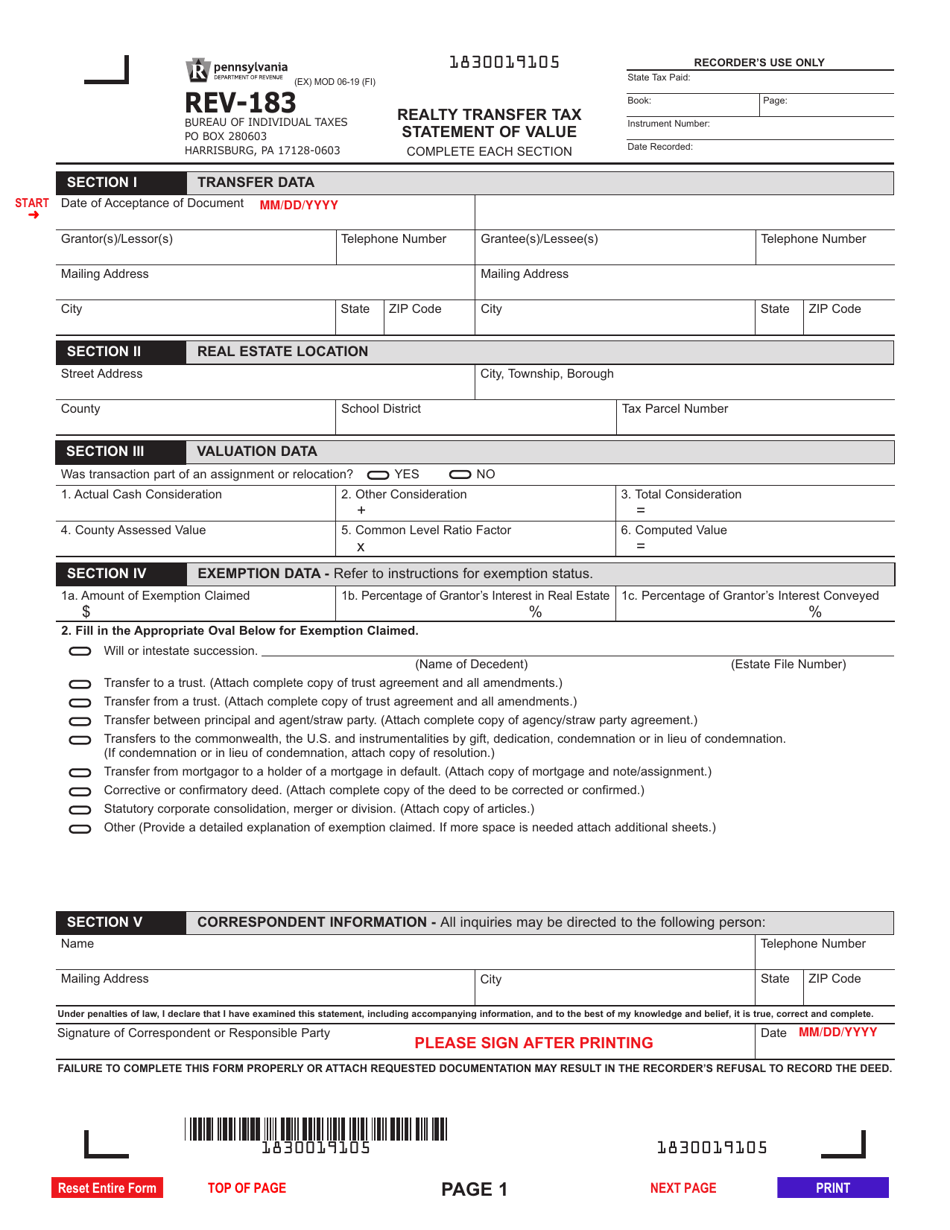

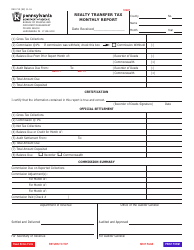

Form REV-183 Realty Transfer Tax Statement of Value - Pennsylvania

What Is Form REV-183?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-183?

A: Form REV-183 is the Realty Transfer Tax Statement of Value that is used in Pennsylvania.

Q: What is the purpose of Form REV-183?

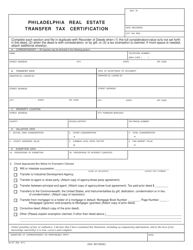

A: The purpose of Form REV-183 is to provide information about the value of real estate property being transferred in Pennsylvania.

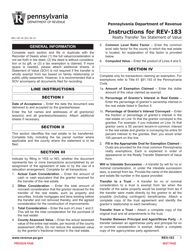

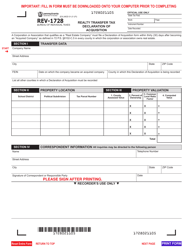

Q: Who needs to file Form REV-183?

A: Both the buyer and seller of the real estate property need to file Form REV-183 in Pennsylvania.

Q: When should Form REV-183 be filed?

A: Form REV-183 should be filed within 30 days of the transfer of real estate property in Pennsylvania.

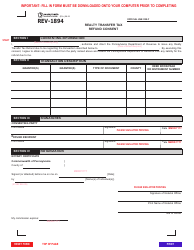

Q: Is there a fee for filing Form REV-183?

A: Yes, there is a fee for filing Form REV-183. The filing fee is based on the value of the property being transferred.

Q: What happens if Form REV-183 is not filed?

A: If Form REV-183 is not filed within the required timeframe, penalties and interest may be imposed by the Pennsylvania Department of Revenue.

Q: Are there any exemptions to filing Form REV-183?

A: Yes, there are certain exemptions to filing Form REV-183. These exemptions include transfers between spouses, transfers to government entities, and transfers between certain family members.

Q: What supporting documents are required to be submitted with Form REV-183?

A: Supporting documents that may be required to be submitted with Form REV-183 include a deed or other instrument of transfer, a settlement sheet, and any relevant agreements or disclosures related to the transfer of the property.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-183 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.