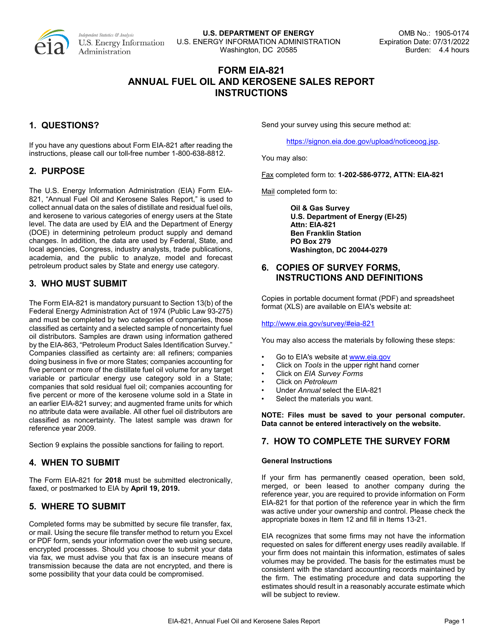

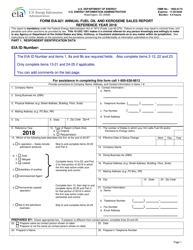

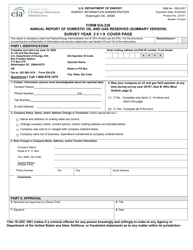

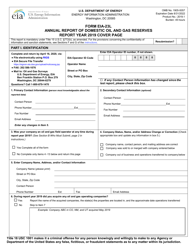

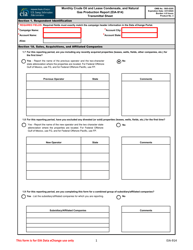

Instructions for Form EIA-821 Annual Fuel Oil and Kerosene Sales Report

This document contains official instructions for Form EIA-821 , Annual Fuel Oil and Kerosene Sales Report - a form released and collected by the U.S. Energy Information Administration.

FAQ

Q: What is Form EIA-821?

A: Form EIA-821 is a report for annual fuel oil and kerosene sales.

Q: Who needs to file Form EIA-821?

A: Fuel oil and kerosene suppliers and distributors need to file Form EIA-821.

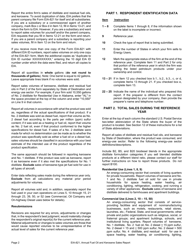

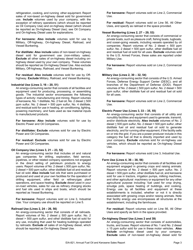

Q: What information is required in Form EIA-821?

A: Form EIA-821 requires information on fuel oil and kerosene sales, including quantities and prices.

Q: When is Form EIA-821 due?

A: Form EIA-821 is due by the last day of February following the reporting year.

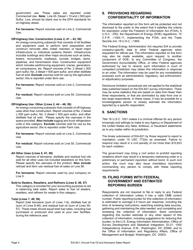

Q: Is there a penalty for not filing Form EIA-821?

A: Yes, there is a penalty for not filing Form EIA-821 or submitting false information.

Q: Can I request an extension for filing Form EIA-821?

A: Yes, you can request an extension for filing Form EIA-821, but it must be done before the due date.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the U.S. Energy Information Administration.