This version of the form is not currently in use and is provided for reference only. Download this version of

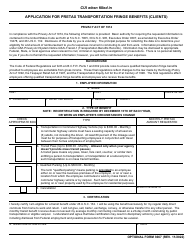

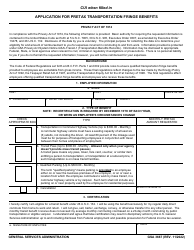

Optional Form 3667

for the current year.

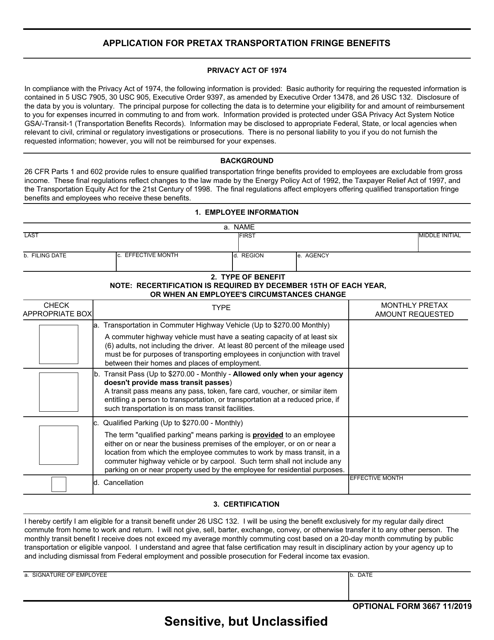

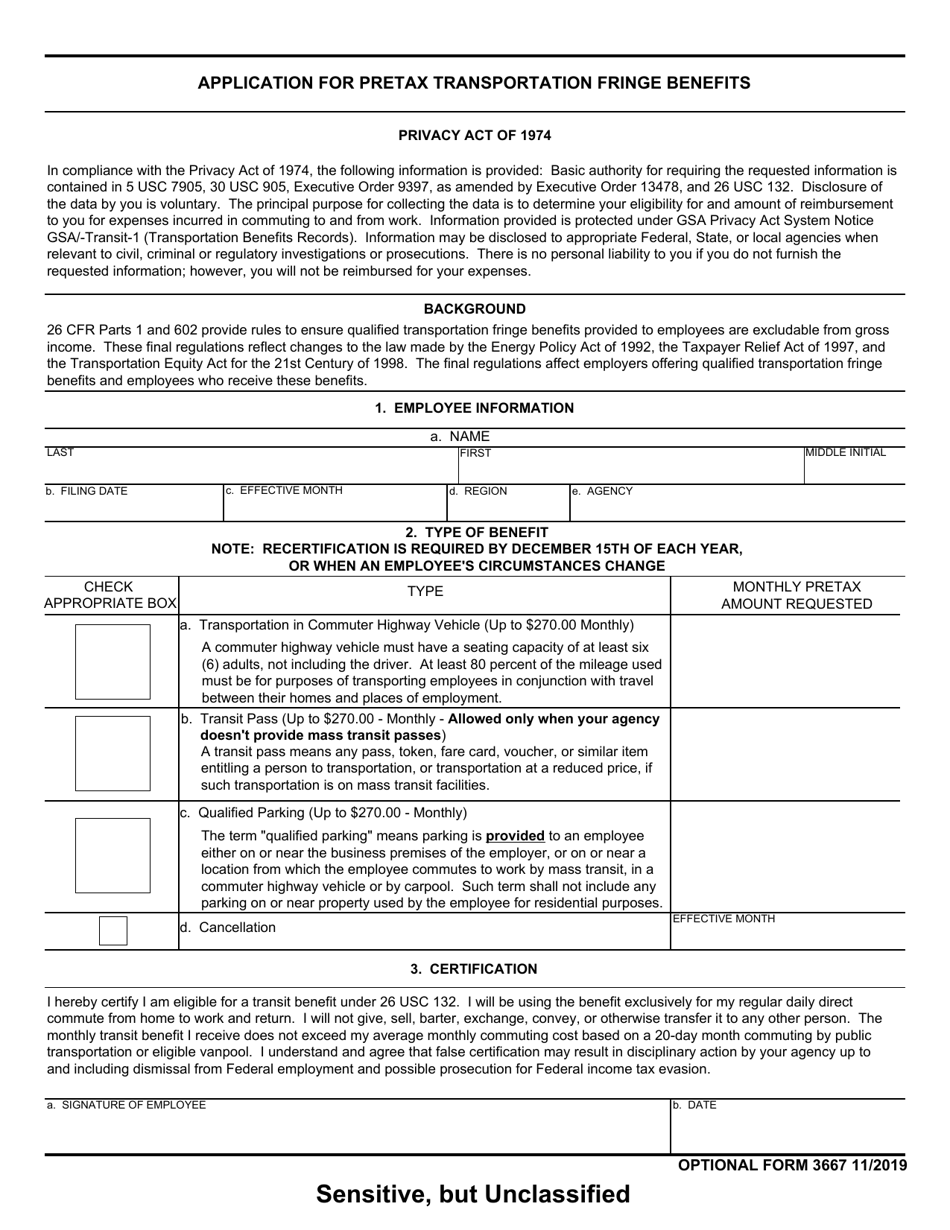

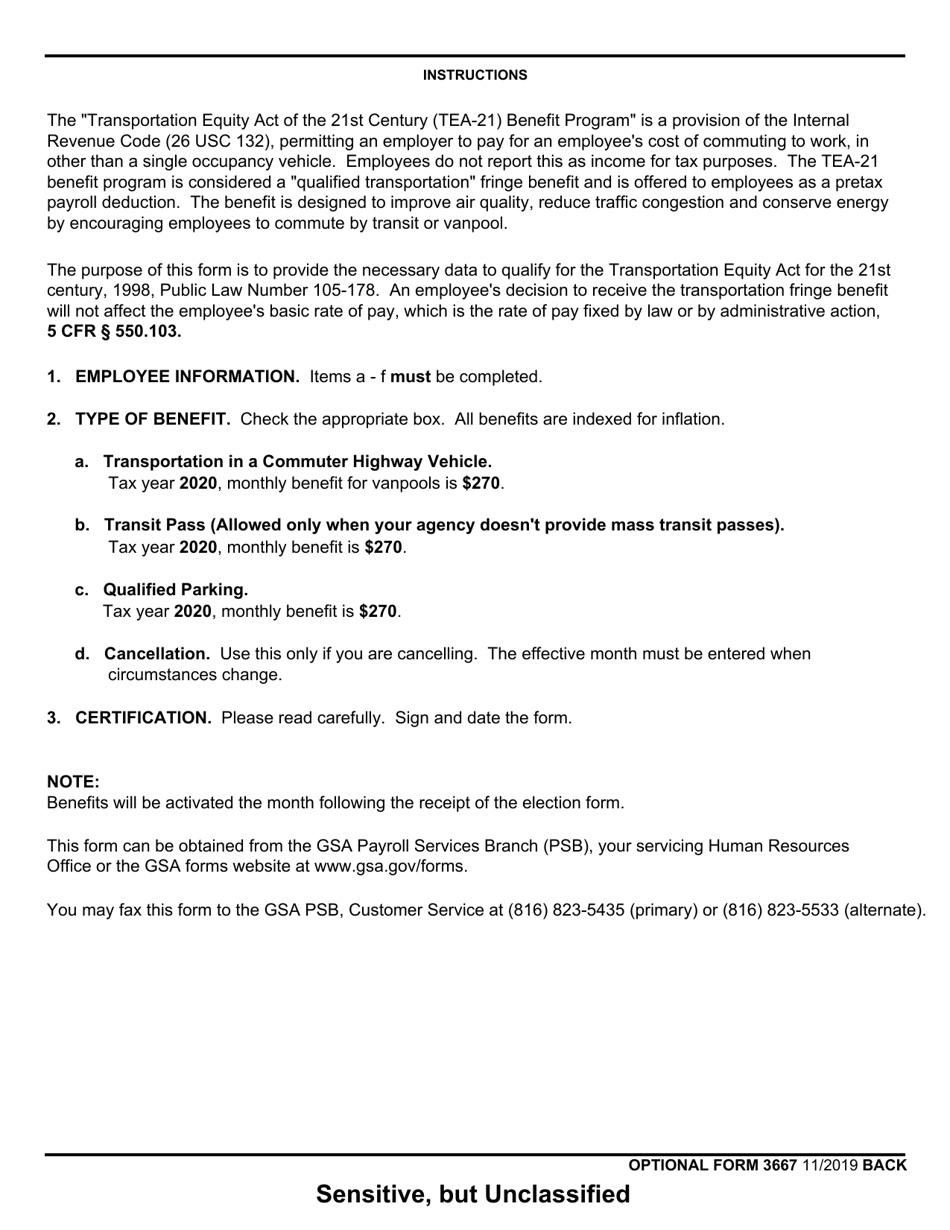

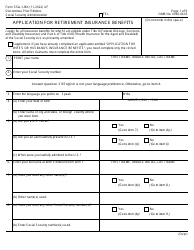

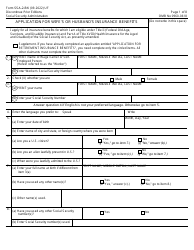

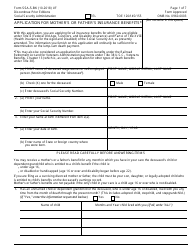

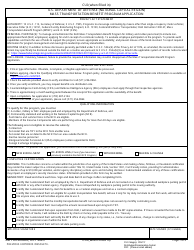

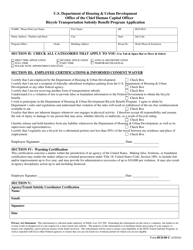

Optional Form 3667 Application for Pretax Transportation Fringe Benefits

What Is Optional Form 3667?

This is a legal form that was released by the U.S. General Services Administration on November 1, 2019 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Optional Form 3667?

A: Optional Form 3667 is an application for pretax transportation fringe benefits.

Q: What are pretax transportation fringe benefits?

A: Pretax transportation fringe benefits are a way for employees to pay for qualified commuting expenses, such as transit passes and parking, with pretax dollars.

Q: Who can use Optional Form 3667?

A: Employees who are interested in pretax transportation fringe benefits can use Optional Form 3667.

Q: What is the purpose of Optional Form 3667?

A: The purpose of Optional Form 3667 is to apply for pretax transportation fringe benefits.

Q: What information is required in Optional Form 3667?

A: Optional Form 3667 requires information such as the employee's name, Social Security number, employer's name, and the amount of pretax deductions requested for transportation fringe benefits.

Q: Can I change my pretax transportation fringe benefits after submitting Optional Form 3667?

A: Yes, you can make changes to your pretax transportation fringe benefits by submitting a new Optional Form 3667.

Form Details:

- Released on November 1, 2019;

- The latest available edition released by the U.S. General Services Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Optional Form 3667 by clicking the link below or browse more documents and templates provided by the U.S. General Services Administration.