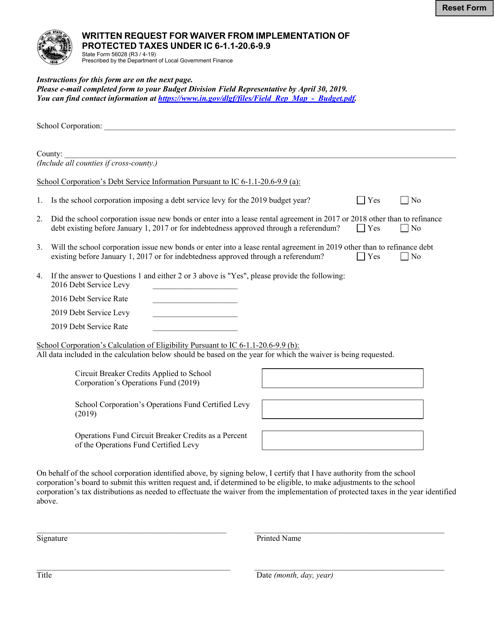

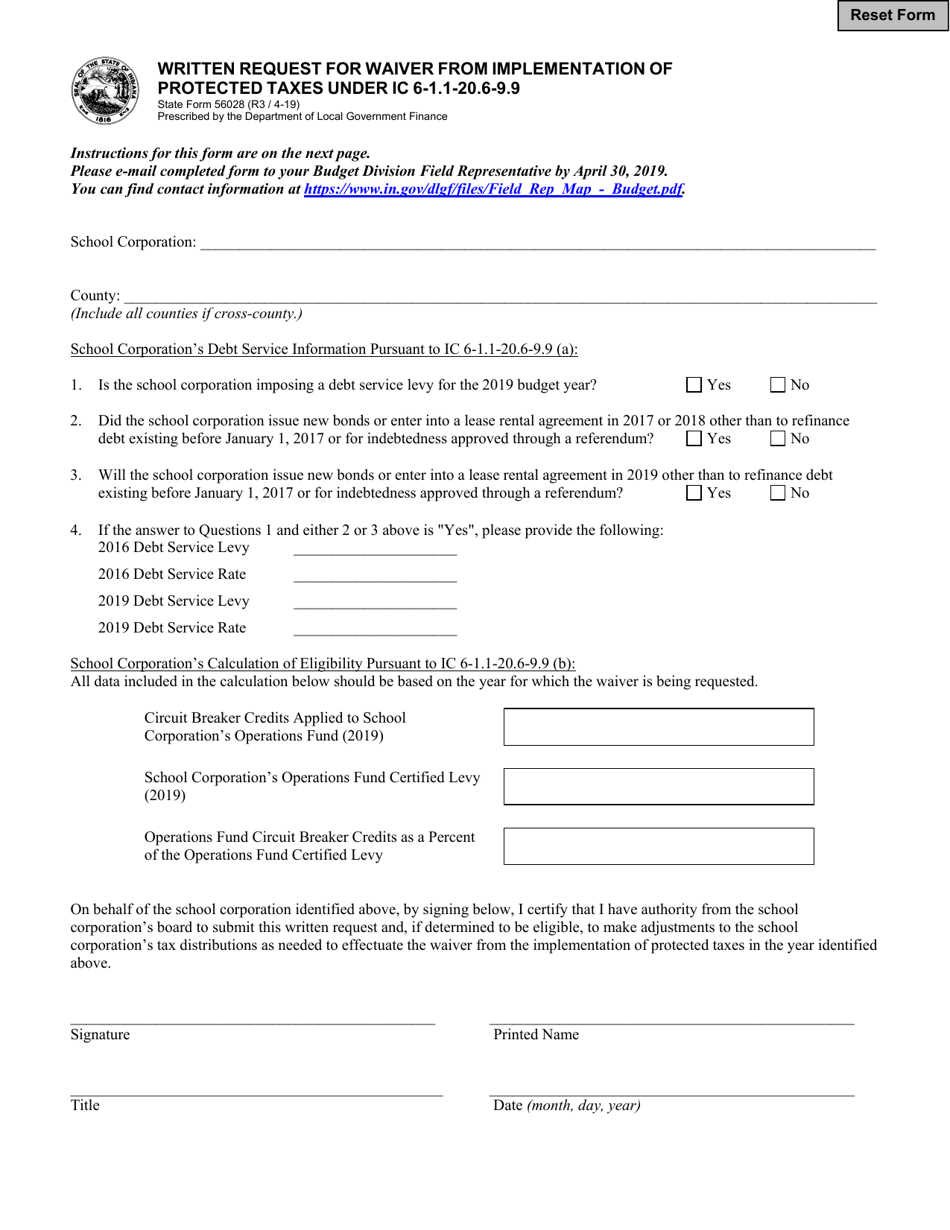

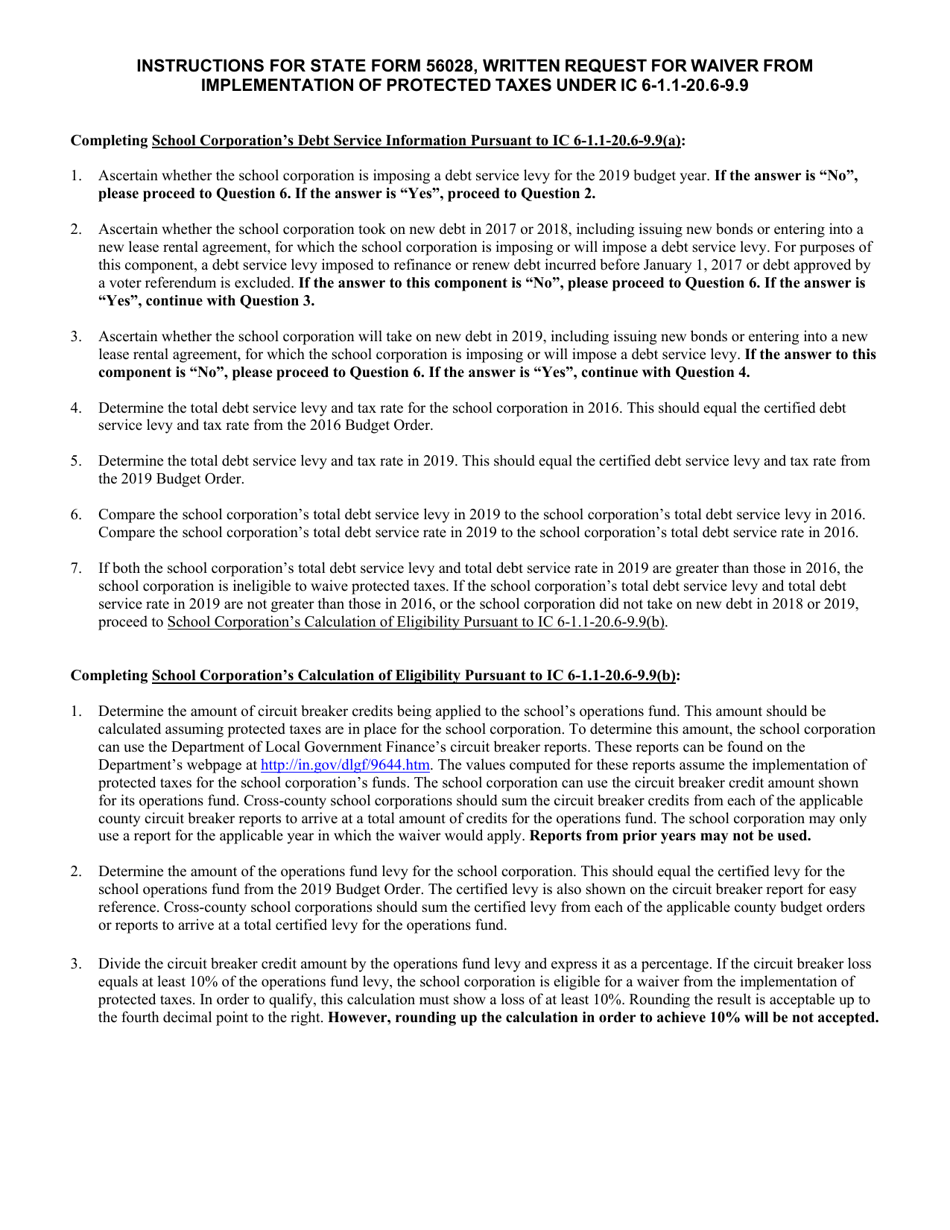

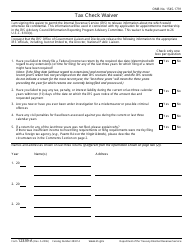

State Form 56028 Written Request for Waiver From Implementation of Protected Taxes Under Ic 6-1.1-20.6-9.9 - Indiana

What Is State Form 56028?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 56028?

A: State Form 56028 is the Written Request for Waiver From Implementation of Protected Taxes Under Ic 6-1.1-20.6-9.9 in Indiana.

Q: What is the purpose of State Form 56028?

A: The purpose of State Form 56028 is to request a waiver from implementing protected taxes in Indiana.

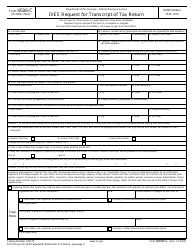

Q: What are protected taxes?

A: Protected taxes refer to certain taxes that are protected from new or increased rates or assessments.

Q: What is Ic 6-1.1-20.6-9.9?

A: Ic 6-1.1-20.6-9.9 is the specific section of the Indiana Code that relates to the implementation of protected taxes.

Q: Who can use State Form 56028?

A: Anyone who wants to request a waiver from implementing protected taxes in Indiana can use State Form 56028.

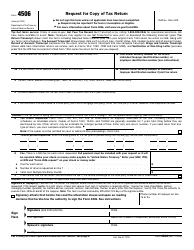

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 56028 by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.