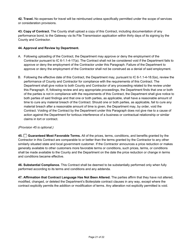

This version of the form is not currently in use and is provided for reference only. Download this version of

State Form 55930

for the current year.

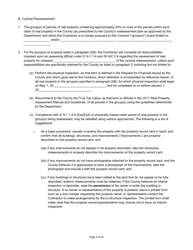

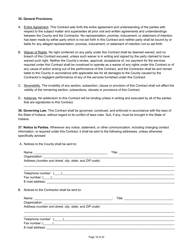

State Form 55930 Prescribed Contract for Annual Adjustments and Cyclical Reassessment - Indiana

What Is State Form 55930?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 55930?

A: State Form 55930 is a prescribed contract for annual adjustments and cyclical reassessment in Indiana.

Q: What is the purpose of State Form 55930?

A: The purpose of State Form 55930 is to provide a standardized contract for making annual adjustments and conducting cyclical reassessments.

Q: Who uses State Form 55930?

A: State Form 55930 is used by assessors and property owners in Indiana.

Q: What does the contract cover?

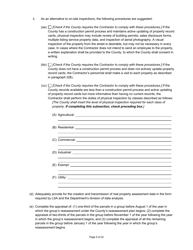

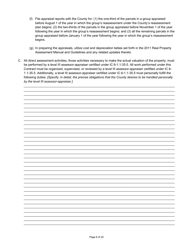

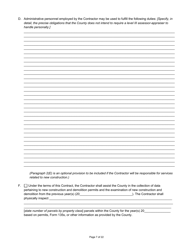

A: The contract covers the terms and conditions for conducting annual adjustments and cyclical reassessments of properties.

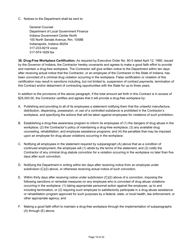

Q: Why are annual adjustments and cyclical reassessments necessary?

A: Annual adjustments and cyclical reassessments are necessary to ensure that property values are accurately assessed and reflect changes in the market.

Q: Is State Form 55930 mandatory?

A: Yes, State Form 55930 is a mandatory contract for annual adjustments and cyclical reassessments in Indiana.

Q: What is the penalty for not using State Form 55930?

A: Failure to use State Form 55930 may result in noncompliance with state regulations and potential penalties.

Q: Can the contract be modified?

A: The contract can be modified as long as the modifications comply with state laws and regulations.

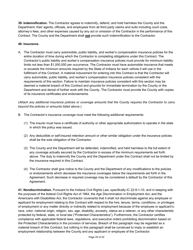

Q: Are there any fees associated with State Form 55930?

A: There may be fees associated with the filing or processing of State Form 55930. It is advisable to contact the local assessor's office for more information.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 55930 by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.