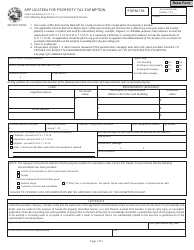

This version of the form is not currently in use and is provided for reference only. Download this version of

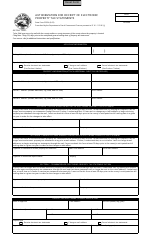

State Form 43708

for the current year.

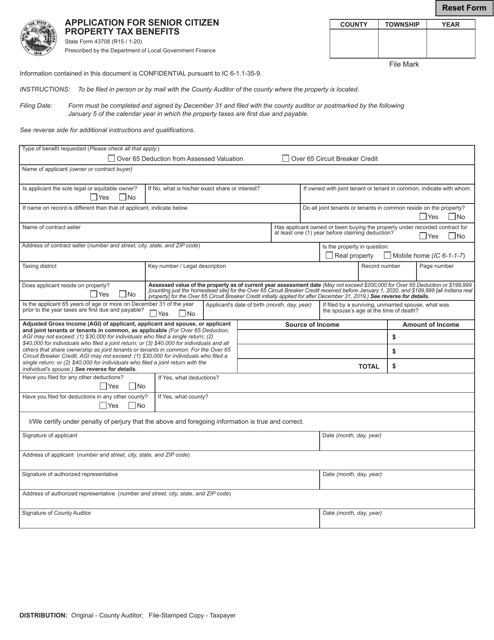

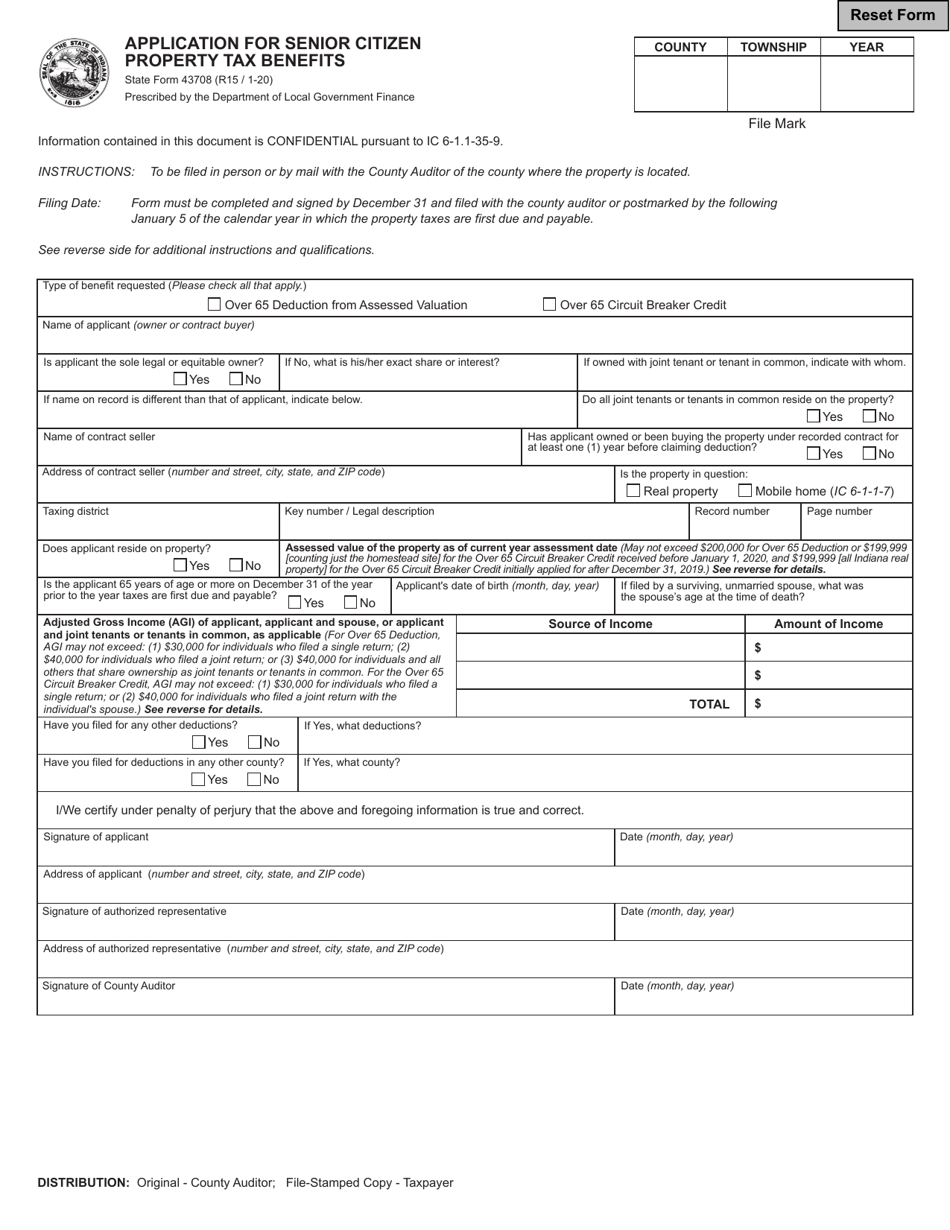

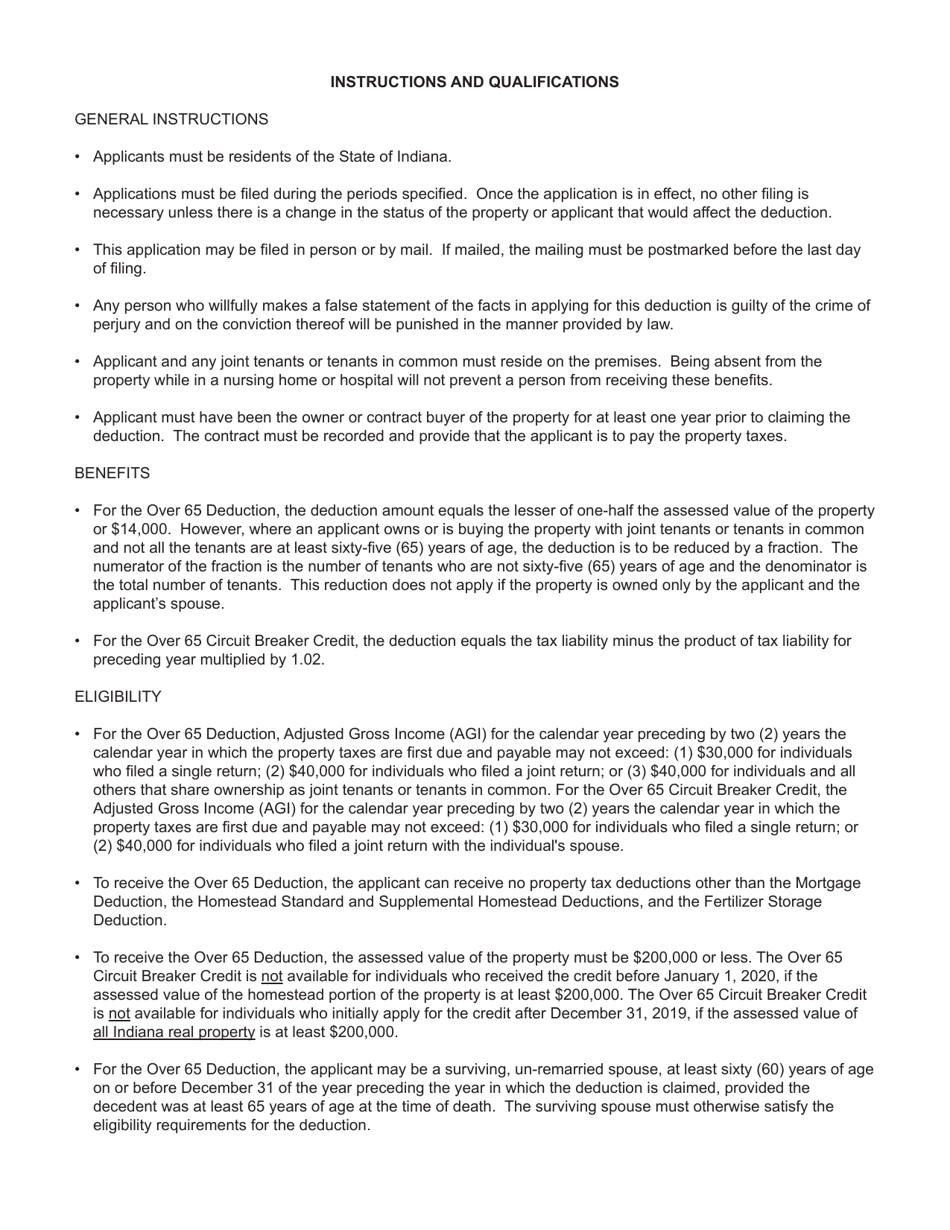

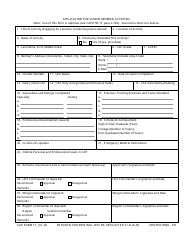

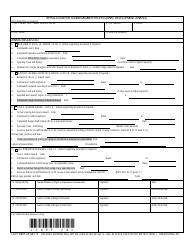

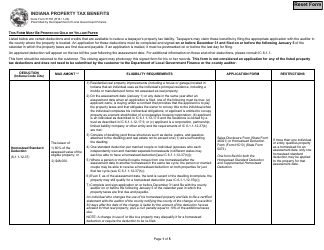

State Form 43708 Application for Senior Citizen Property Tax Benefits - Indiana

What Is State Form 43708?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

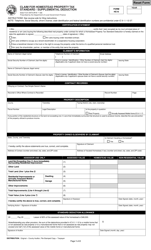

Q: What is State Form 43708?

A: State Form 43708 is the application for Senior Citizen Property Tax Benefits in Indiana.

Q: Who can use State Form 43708?

A: Senior citizens in Indiana who meet certain eligibility requirements can use State Form 43708.

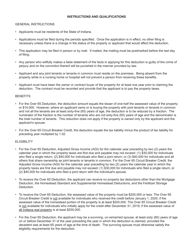

Q: What are the eligibility requirements for Senior Citizen Property Tax Benefits?

A: The eligibility requirements for Senior Citizen Property Tax Benefits in Indiana include being at least 65 years old and meeting income and residency requirements.

Q: When is the deadline to submit State Form 43708?

A: The deadline to submit State Form 43708 varies by county. It is recommended to contact your local county assessor's office for the specific deadline.

Q: What happens after I submit State Form 43708?

A: After you submit State Form 43708, your application will be reviewed by the county assessor's office. If you qualify, you will start receiving the Senior Citizen Property Tax Benefits.

Q: Are the Senior Citizen Property Tax Benefits the same in all counties?

A: No, the Senior Citizen Property Tax Benefits may vary slightly by county in Indiana. It is recommended to contact your local county assessor's office for more information.

Q: Can I apply for Senior Citizen Property Tax Benefits if I am not yet 65 years old?

A: No, the eligibility requirement for Senior Citizen Property Tax Benefits in Indiana is being at least 65 years old.

Q: What documents do I need to submit with State Form 43708?

A: The required documents may vary by county, but generally you will need to provide proof of age, income, and residency. It is recommended to contact your local county assessor's office for the specific document requirements.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 43708 by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.