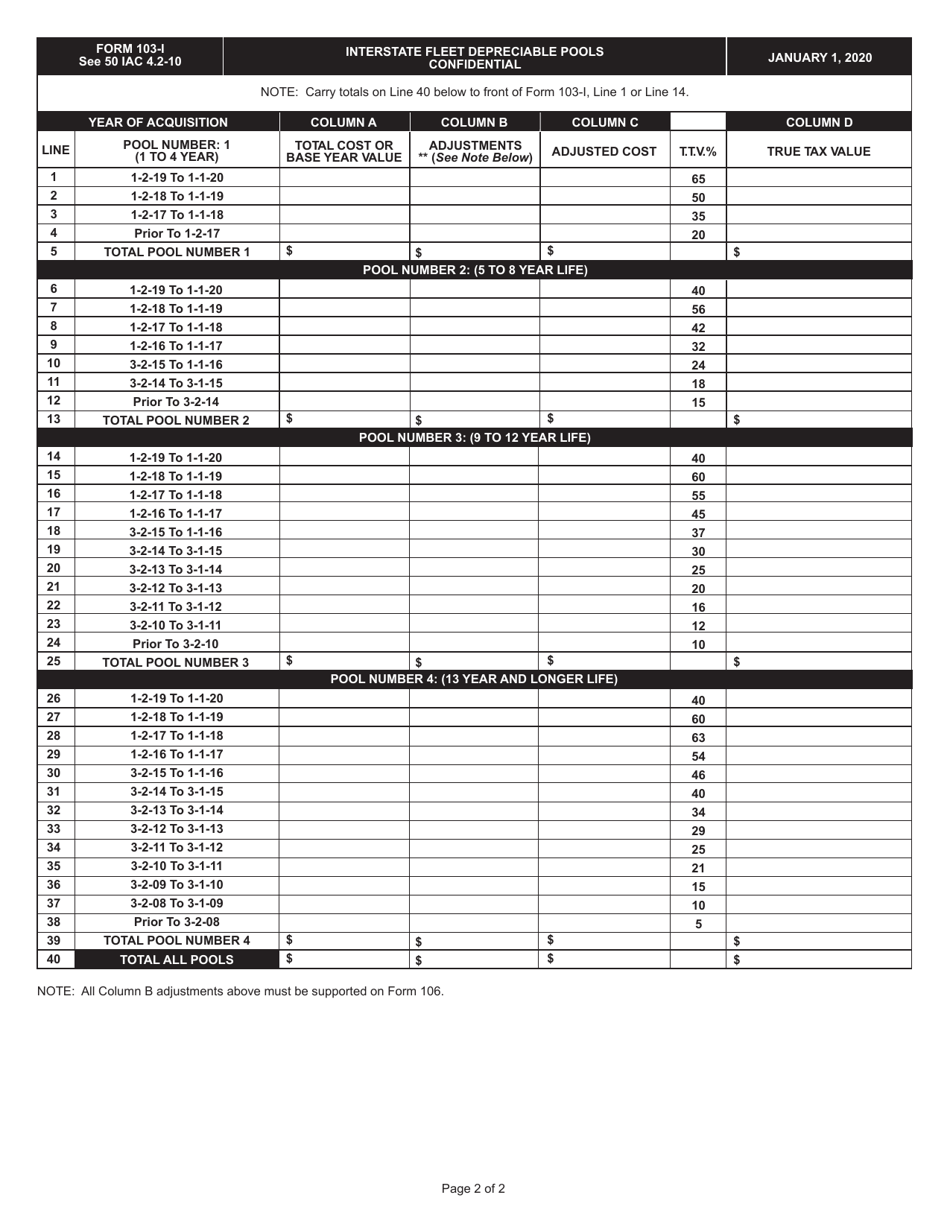

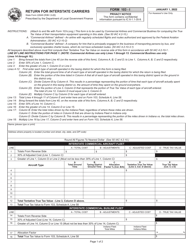

This version of the form is not currently in use and is provided for reference only. Download this version of

State Form 22649 (103-I)

for the current year.

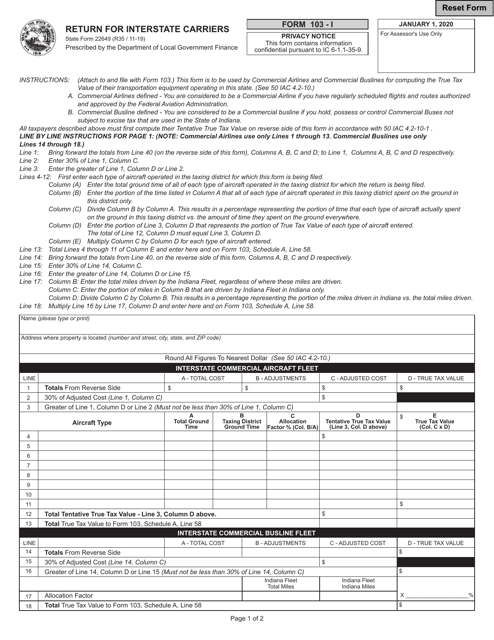

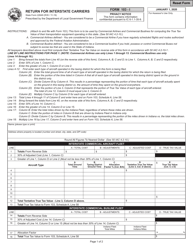

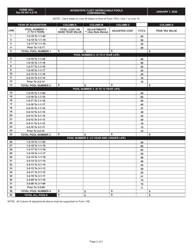

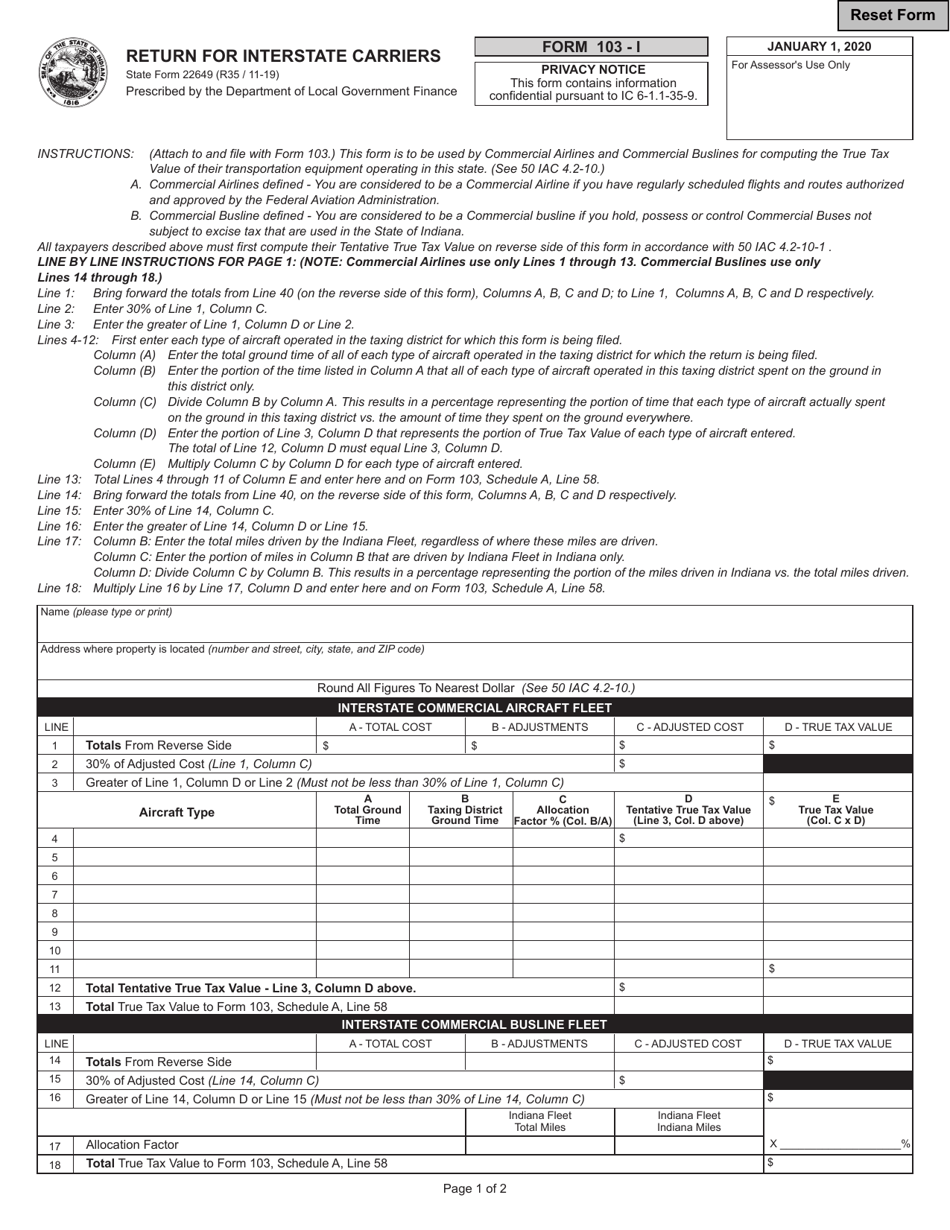

State Form 22649 (103-I) Return for Interstate Carriers - Indiana

What Is State Form 22649 (103-I)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 22649?

A: Form 22649 is a Return for Interstate Carriers form in Indiana.

Q: Who needs to file Form 22649?

A: Interstate carriers operating in Indiana need to file Form 22649.

Q: What is the purpose of filing Form 22649?

A: The purpose of filing Form 22649 is to report and pay taxes owed by interstate carriers in Indiana.

Q: When is Form 22649 due?

A: Form 22649 is due on a quarterly basis, with specific due dates depending on the tax period.

Q: What happens if I don't file Form 22649?

A: Failure to file Form 22649 or pay the taxes owed may result in penalties and interest charges.

Q: Are there any exemptions to filing Form 22649?

A: Exemptions may apply to certain carriers or transactions. Consult the instructions for Form 22649 for more information.

Q: What other documentation do I need to submit with Form 22649?

A: You may need to provide supporting documentation such as trip logs or other records as specified in the instructions for Form 22649.

Q: Who can I contact for help with Form 22649?

A: You can contact the Indiana Department of Revenue directly for assistance with Form 22649.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 22649 (103-I) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.