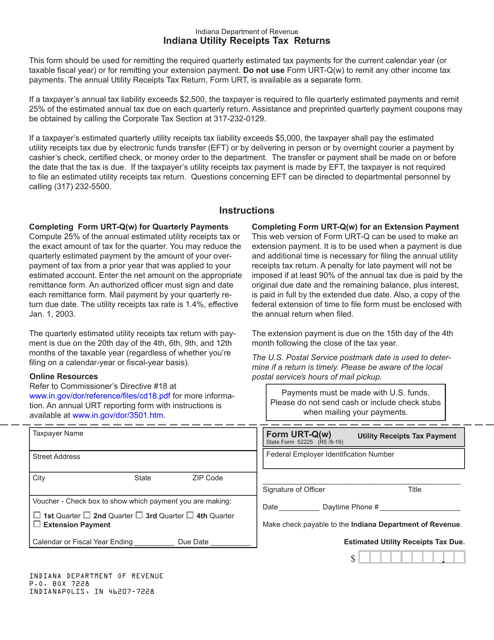

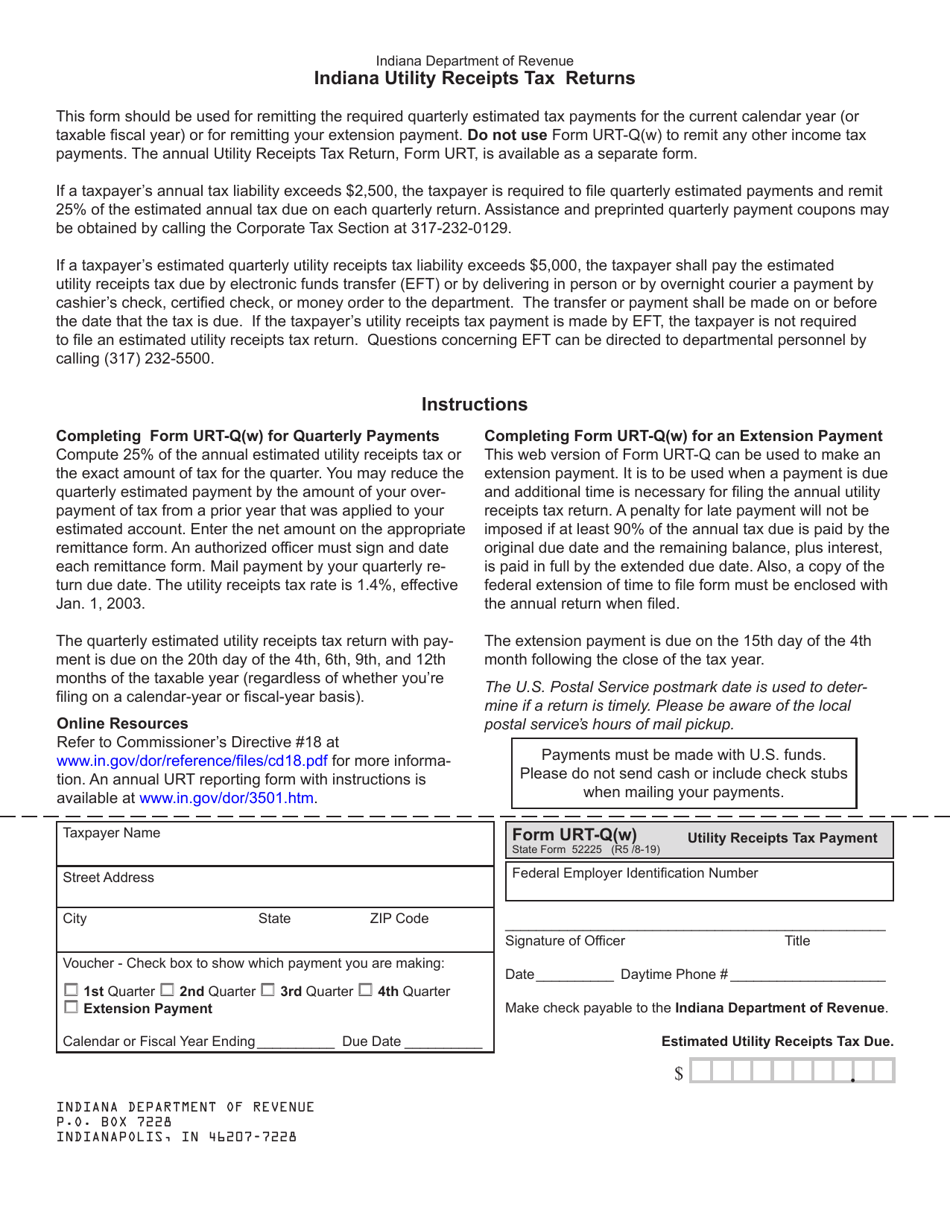

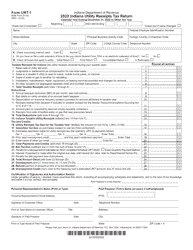

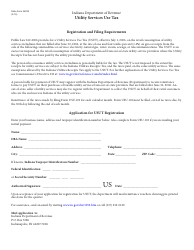

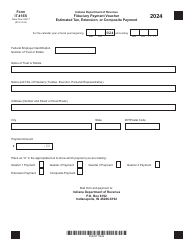

Form URT-Q(W) (State Form 52225) Utility Receipts Tax Payment - Indiana

What Is Form URT-Q(W) (State Form 52225)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form URT-Q(W)?

A: Form URT-Q(W) is a tax return form for making Utility Receipts Tax payments in Indiana.

Q: What is the purpose of form URT-Q(W)?

A: The purpose of form URT-Q(W) is to make Utility Receipts Tax payments to the state of Indiana.

Q: Who needs to file form URT-Q(W)?

A: Individuals or businesses that owe Utility Receipts Tax to the state of Indiana need to file form URT-Q(W).

Q: When is form URT-Q(W) due?

A: The due date for form URT-Q(W) varies and is specified by the Indiana Department of Revenue.

Q: How do I fill out form URT-Q(W)?

A: To fill out form URT-Q(W), you will need to provide information about your utility receipts and calculate the amount of tax owed.

Q: What should I do if I have questions about form URT-Q(W)?

A: If you have any questions about form URT-Q(W), you can contact the Indiana Department of Revenue for assistance.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form URT-Q(W) (State Form 52225) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.