This version of the form is not currently in use and is provided for reference only. Download this version of

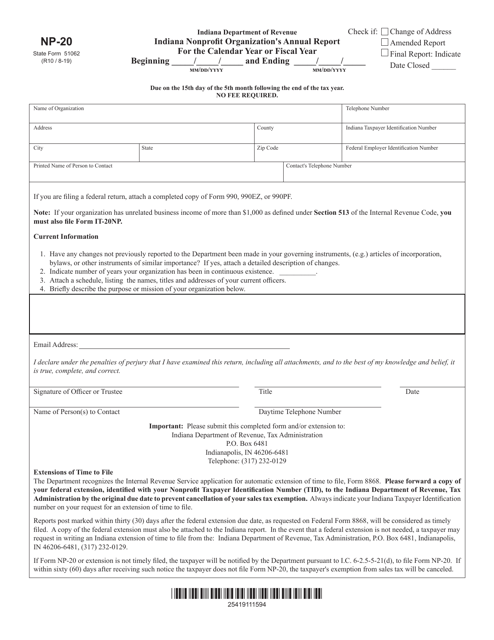

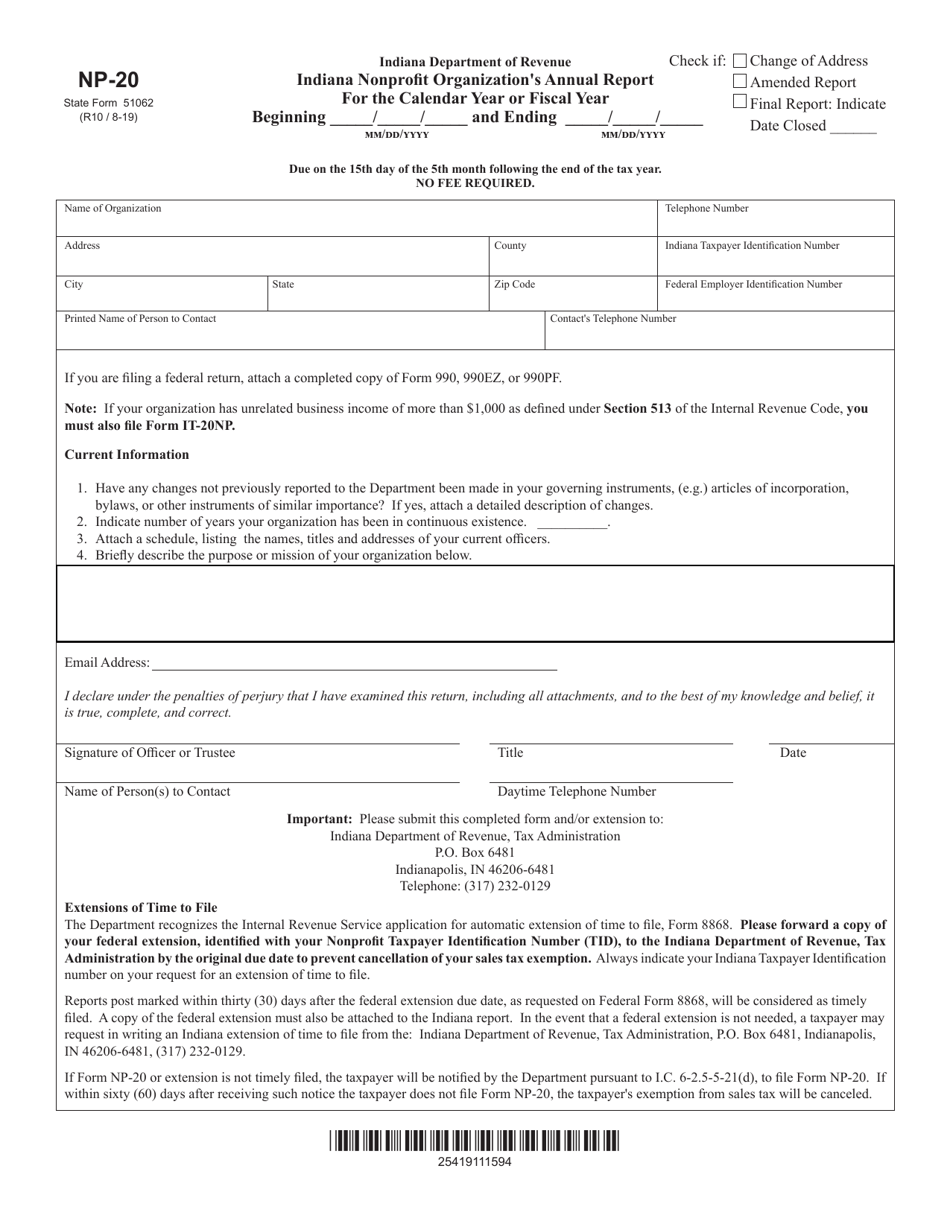

Form NP-20 (State Form 51062)

for the current year.

Form NP-20 (State Form 51062) Indiana Nonprofit Organization's Annual Report - Indiana

What Is Form NP-20 (State Form 51062)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NP-20?

A: Form NP-20 is the Indiana Nonprofit Organization's Annual Report.

Q: What is the purpose of Form NP-20?

A: The purpose of Form NP-20 is to report the annual activities and financial information of a nonprofit organization in Indiana.

Q: Who needs to file Form NP-20?

A: All nonprofit organizations registered in Indiana need to file Form NP-20.

Q: What information is required on Form NP-20?

A: Form NP-20 requires information about the organization's activities, financial transactions, and any changes to its officers and directors.

Q: When is the deadline to file Form NP-20?

A: Form NP-20 must be filed by the 15th day of the 5th month following the close of the organization's fiscal year.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NP-20 (State Form 51062) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.