This version of the form is not currently in use and is provided for reference only. Download this version of

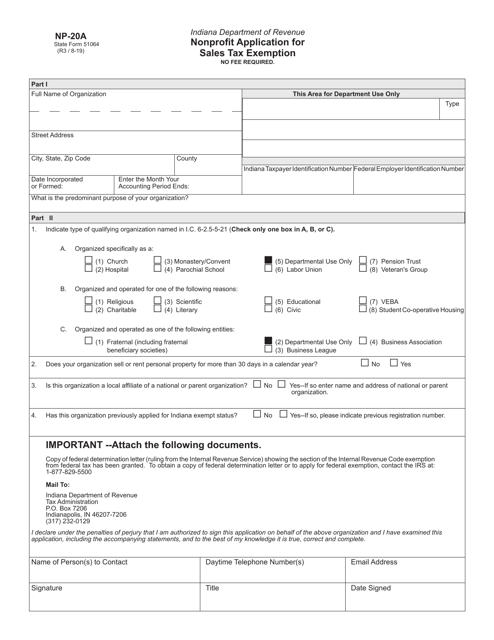

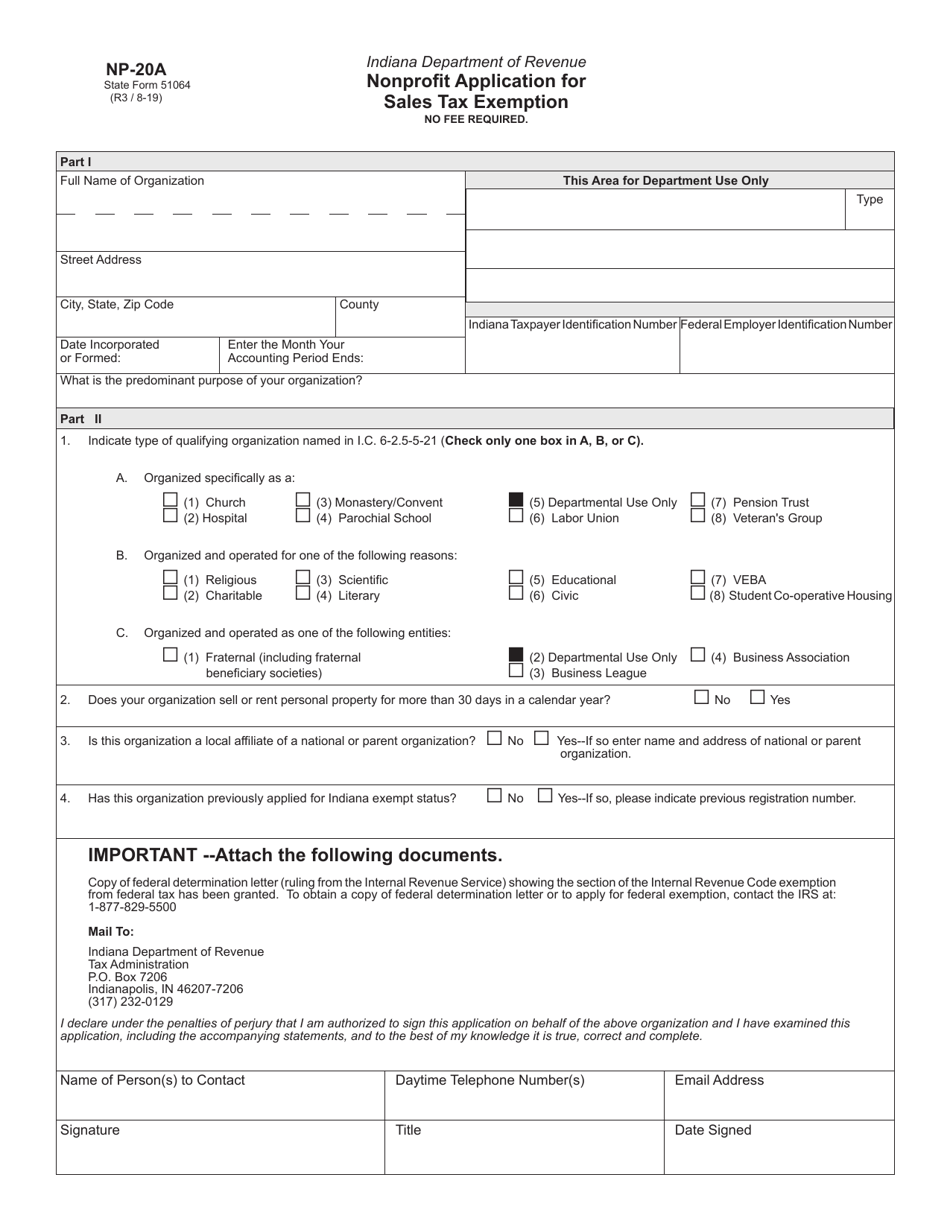

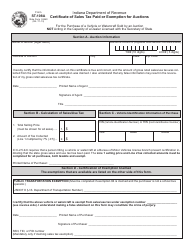

Form NP-20A (State Form 51064)

for the current year.

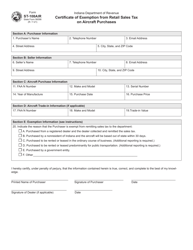

Form NP-20A (State Form 51064) Nonprofit Application for Sales Tax Exemption - Indiana

What Is Form NP-20A (State Form 51064)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

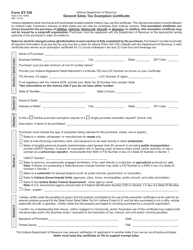

Q: What is Form NP-20A?

A: Form NP-20A is the Nonprofit Application for Sales Tax Exemption.

Q: What is the purpose of Form NP-20A?

A: The purpose of Form NP-20A is to apply for sales tax exemption for nonprofit organizations in Indiana.

Q: Who needs to fill out this form?

A: Nonprofit organizations in Indiana that want to apply for sales tax exemption.

Q: Is there a fee for filing this form?

A: No, there is no fee for filing Form NP-20A.

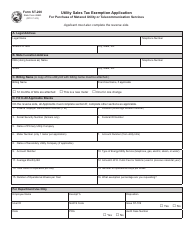

Q: What documents do I need to include with my application?

A: You will need to include your federal determination letter, proof of Indiana tax-exempt status, and other supporting documents as requested in the instructions.

Q: What is the processing time for this application?

A: The processing time for the application varies, but it may take several weeks to months.

Q: How will I know if my application is approved?

A: You will receive a written notice from the Indiana Department of Revenue regarding the status of your application.

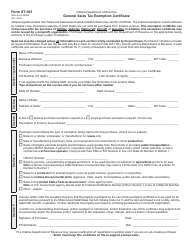

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NP-20A (State Form 51064) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.