This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-966 (State Form 50150)

for the current year.

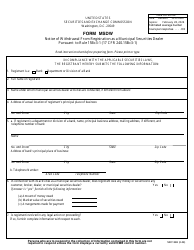

Form IT-966 (State Form 50150) Notice of Corporate Dissolution Liquidation or Withdrawal - Indiana

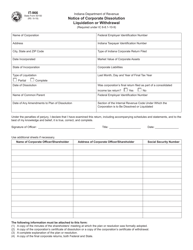

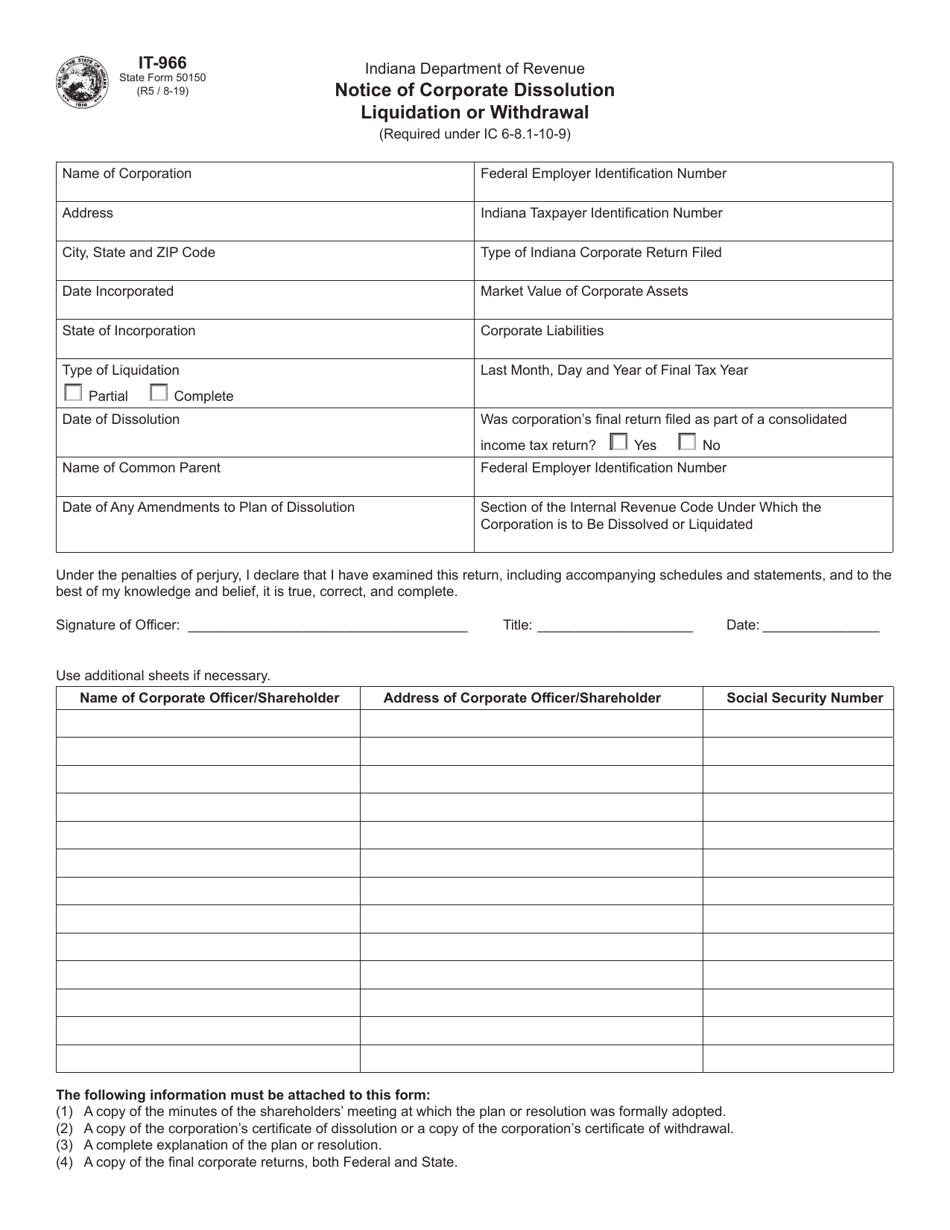

What Is Form IT-966 (State Form 50150)?

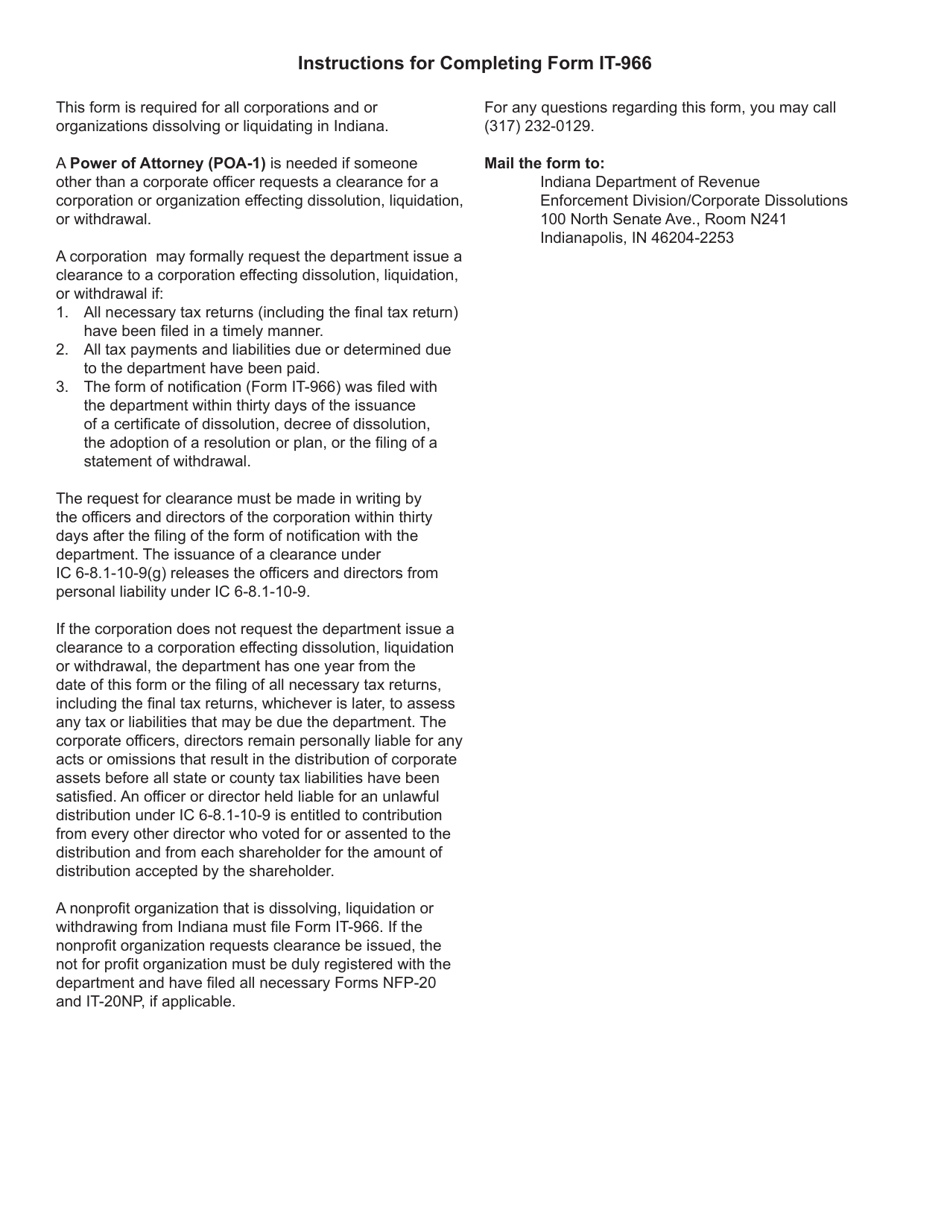

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-966?

A: Form IT-966 is a notice of corporate dissolution, liquidation, or withdrawal form in Indiana.

Q: What is the purpose of Form IT-966?

A: The purpose of Form IT-966 is to notify the state of Indiana about the dissolution, liquidation, or withdrawal of a corporation.

Q: Who needs to file Form IT-966?

A: Corporations that are dissolving, liquidating, or withdrawing from Indiana need to file Form IT-966.

Q: What information is required on Form IT-966?

A: Form IT-966 requires information such as the corporation's name, address, federal employer identification number, and details about the dissolution, liquidation, or withdrawal.

Q: When should Form IT-966 be filed?

A: Form IT-966 should be filed within 15 days after the date of dissolution, liquidation, or withdrawal.

Q: Are there any fees for filing Form IT-966?

A: No, there are no fees for filing Form IT-966.

Q: What are the consequences of not filing Form IT-966?

A: Failure to file Form IT-966 can result in penalties and additional legal obligations.

Q: Is Form IT-966 specific to Indiana?

A: Yes, Form IT-966 is specific to the state of Indiana and is not applicable to other states.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-966 (State Form 50150) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.