This version of the form is not currently in use and is provided for reference only. Download this version of

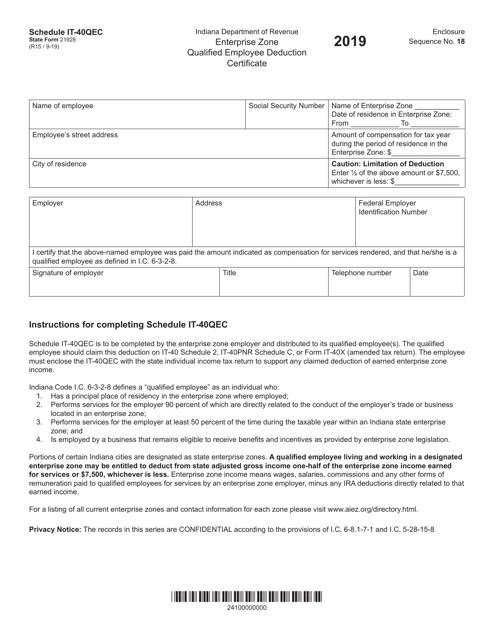

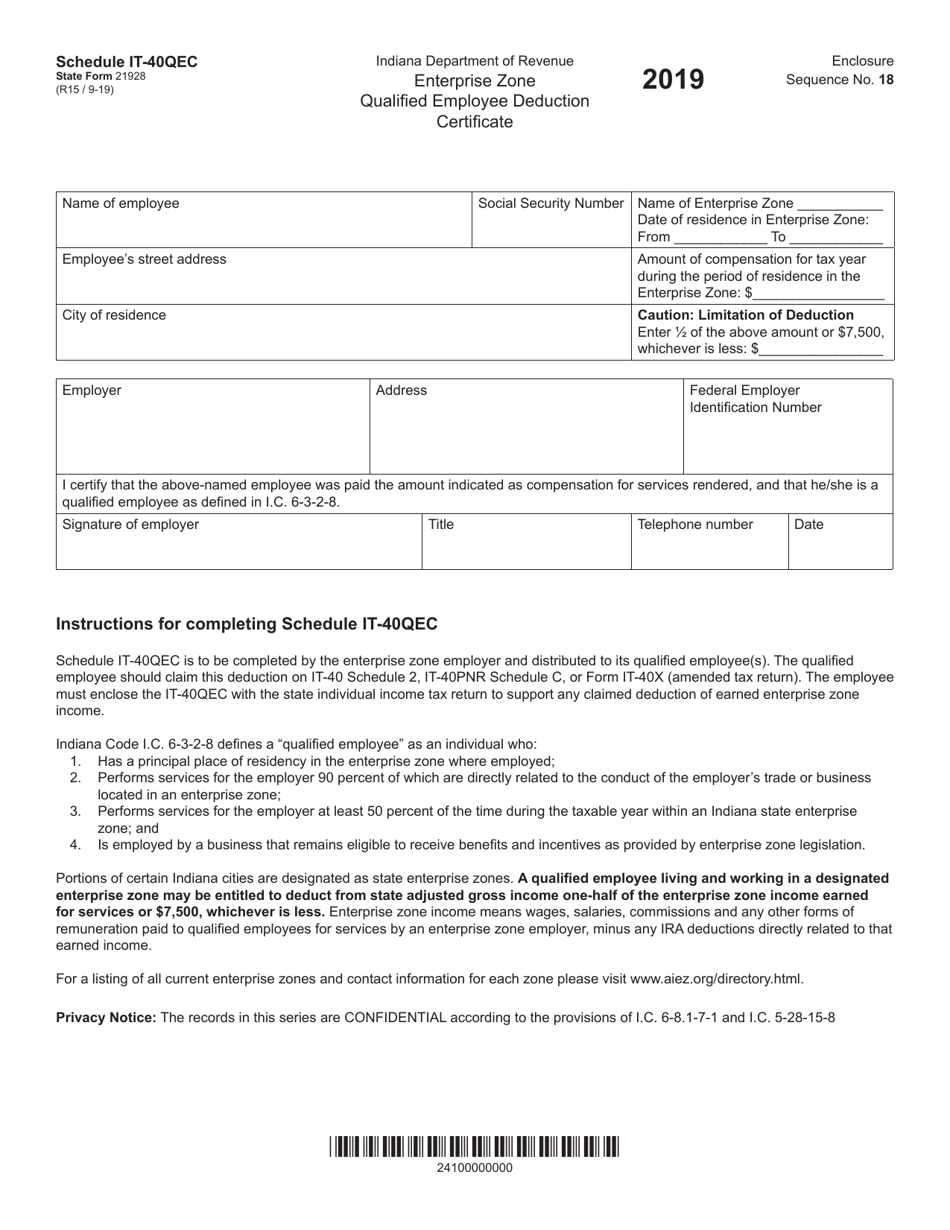

State Form 21928 Schedule IT-40QEC

for the current year.

State Form 21928 Schedule IT-40QEC Enterprise Zone Qualified Employee Deduction Certificate - Indiana

What Is State Form 21928 Schedule IT-40QEC?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 21928?

A: State Form 21928 is a certificate used in Indiana for claiming the Enterprise Zone Qualified Employee Deduction.

Q: What is Schedule IT-40QEC?

A: Schedule IT-40QEC is a tax form in Indiana that is used to report the Enterprise Zone Qualified Employee Deduction.

Q: What is the Enterprise Zone Qualified Employee Deduction?

A: The Enterprise Zone Qualified Employee Deduction is a tax deduction available in Indiana for employees who work in certain designated enterprise zones.

Q: What is the purpose of the deduction certificate?

A: The deduction certificate, such as State Form 21928, is used to certify that an employee qualifies for the Enterprise Zone Qualified Employee Deduction.

Q: Do I need to attach the deduction certificate to my tax return?

A: Yes, you will need to attach the deduction certificate, such as State Form 21928, to your tax return to claim the Enterprise Zone Qualified Employee Deduction.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 21928 Schedule IT-40QEC by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.