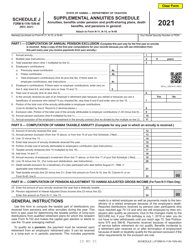

This version of the form is not currently in use and is provided for reference only. Download this version of

Form N-11 (N-15; N-40) Schedule J

for the current year.

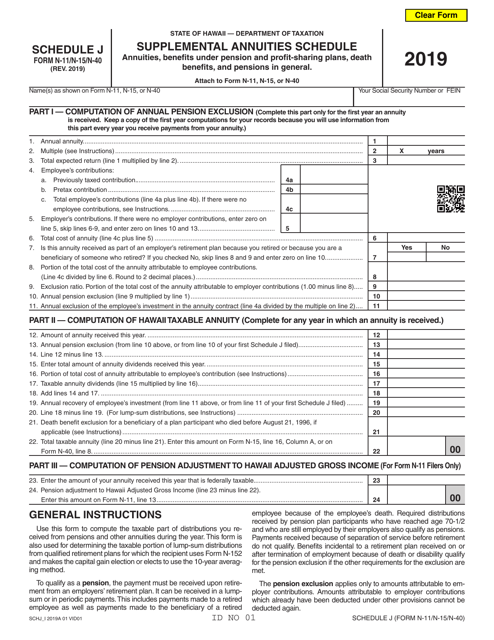

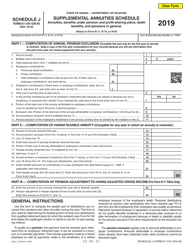

Form N-11 (N-15; N-40) Schedule J Supplemental Annuities Schedule - Hawaii

What Is Form N-11 (N-15; N-40) Schedule J?

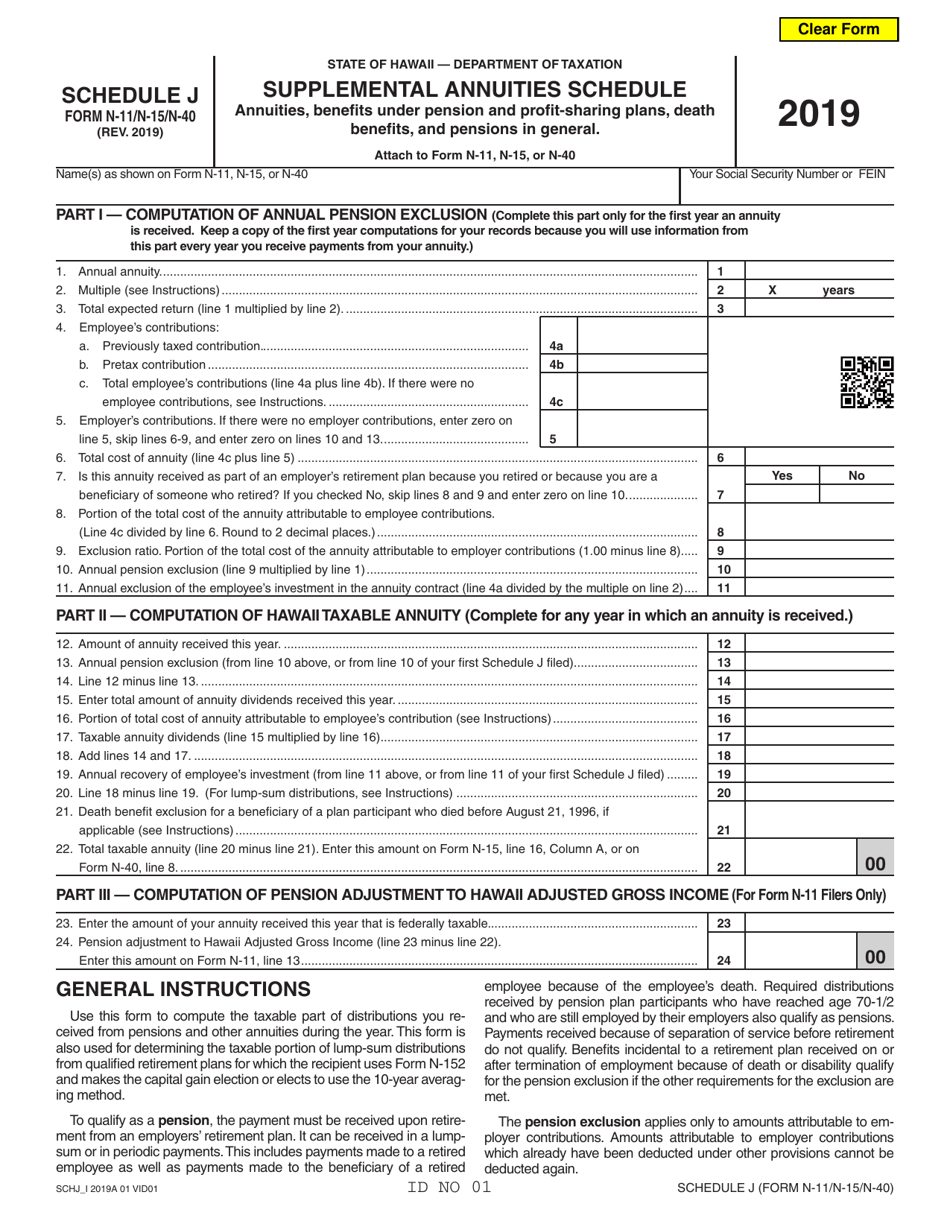

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii.The document is a supplement to Form N-15, and Form N-40. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form N-11?

A: Form N-11 is a tax form for individual taxpayers in Hawaii.

Q: What is Form N-15?

A: Form N-15 is a tax form for nonresident and part-year resident taxpayers in Hawaii.

Q: What is Form N-40?

A: Form N-40 is a tax form for individual taxpayers in Hawaii who are full-year residents.

Q: What is Schedule J Supplemental Annuities Schedule?

A: Schedule J Supplemental Annuities Schedule is a form used to report income from supplemental annuities in Hawaii.

Q: Who needs to fill out the Schedule J Supplemental Annuities Schedule?

A: Individual taxpayers in Hawaii who have income from supplemental annuities need to fill out Schedule J.

Q: Is the Schedule J Supplemental Annuities Schedule specific to Hawaii?

A: Yes, Schedule J is specific to Hawaii and is part of the Hawaii state tax forms.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-11 (N-15; N-40) Schedule J by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.