This version of the form is not currently in use and is provided for reference only. Download this version of

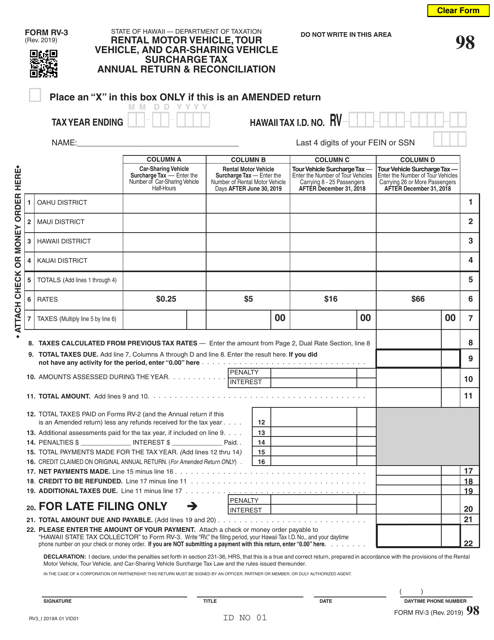

Form RV-3

for the current year.

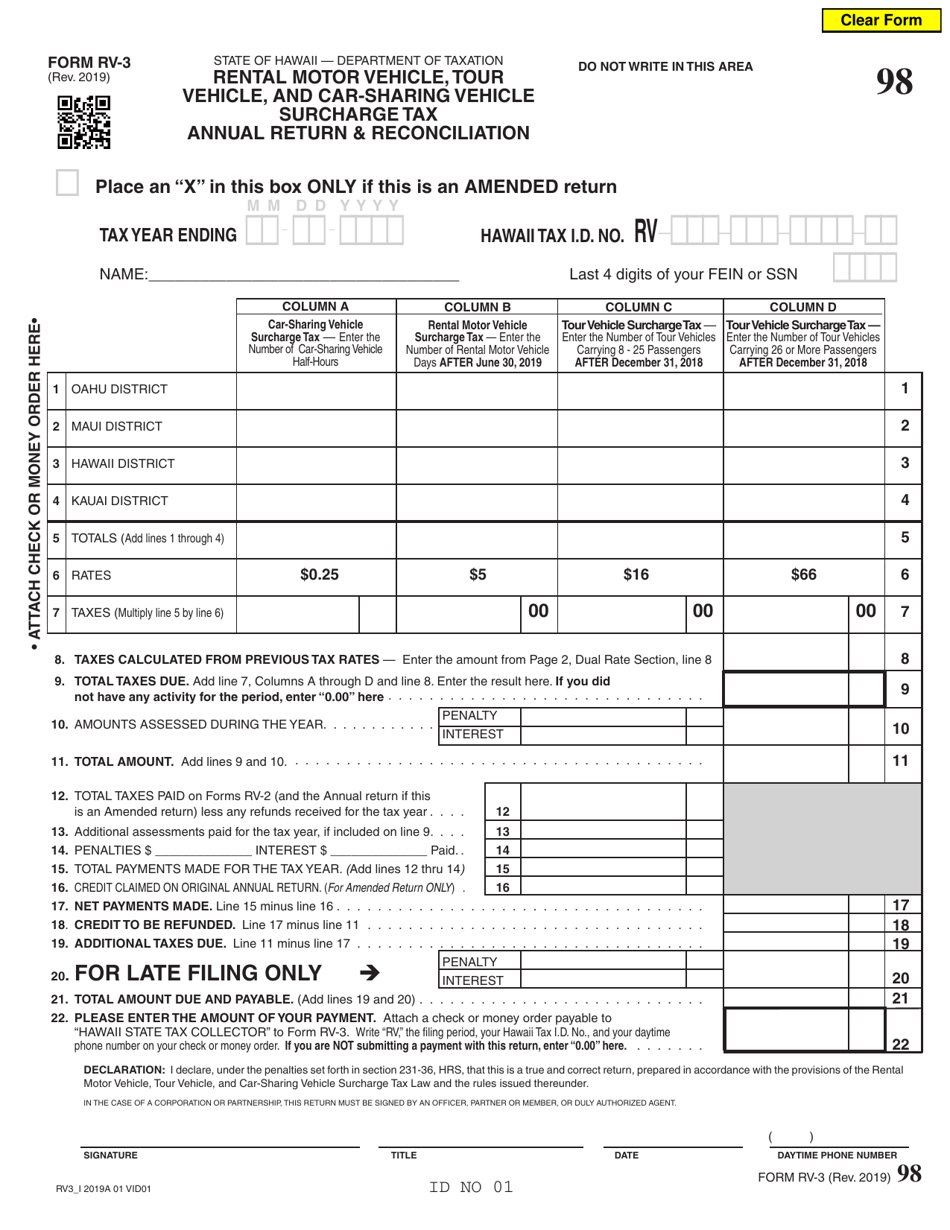

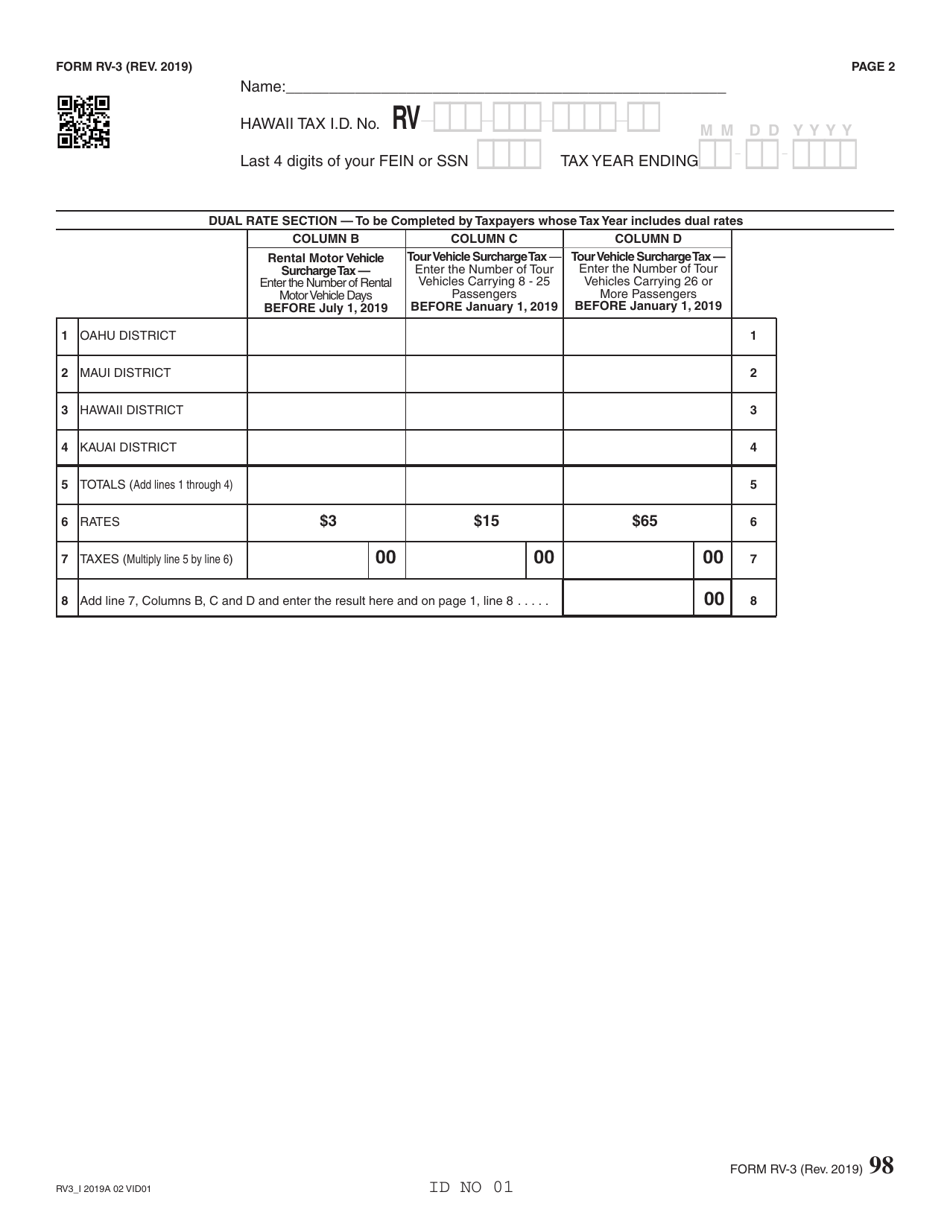

Form RV-3 Rental Motor Vehicle, Tour Vehicle, and Car-Sharing Vehicle Surcharge Tax Annual Return and Reconciliation - Hawaii

What Is Form RV-3?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RV-3?

A: Form RV-3 is a tax return form for rental motor vehicles, tour vehicles, and car-sharing vehicles in Hawaii.

Q: What does the Form RV-3 Annual Return and Reconciliation entail?

A: The Form RV-3 Annual Return and Reconciliation is used to report and reconcile the surcharge tax for rental motor vehicles, tour vehicles, and car-sharing vehicles in Hawaii.

Q: Who needs to file Form RV-3?

A: Owners or operators of rental motor vehicles, tour vehicles, and car-sharing vehicles in Hawaii need to file Form RV-3.

Q: When is Form RV-3 due?

A: Form RV-3 is due on or before the 20th day of the month following the reporting period.

Q: What is the purpose of the surcharge tax for rental motor vehicles, tour vehicles, and car-sharing vehicles?

A: The surcharge tax is used to support transportation-related projects and programs in Hawaii.

Q: What if I fail to file or pay the surcharge tax?

A: Failure to file or pay the surcharge tax may result in penalties and interest.

Q: Can I file Form RV-3 electronically?

A: Yes, Hawaii Department of Taxation allows electronic filing of Form RV-3.

Q: Are there any exemptions or deductions available for the surcharge tax?

A: Yes, there are certain exemptions and deductions available. Please refer to the instructions provided with Form RV-3 for more information.

Q: Who should I contact for more information about Form RV-3?

A: For more information about Form RV-3, you can contact the Hawaii Department of Taxation.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RV-3 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.