This version of the form is not currently in use and is provided for reference only. Download this version of

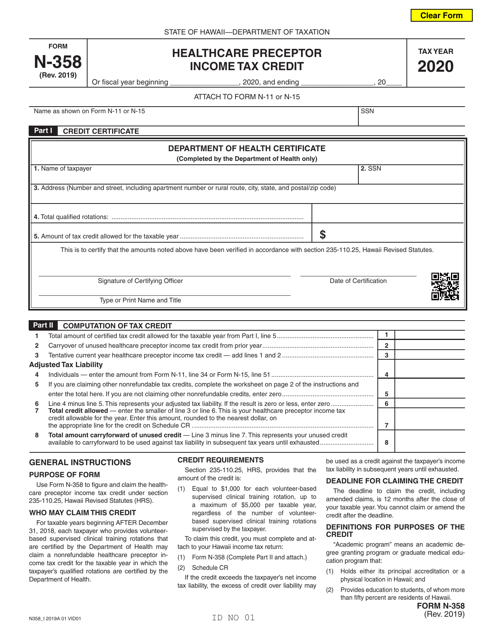

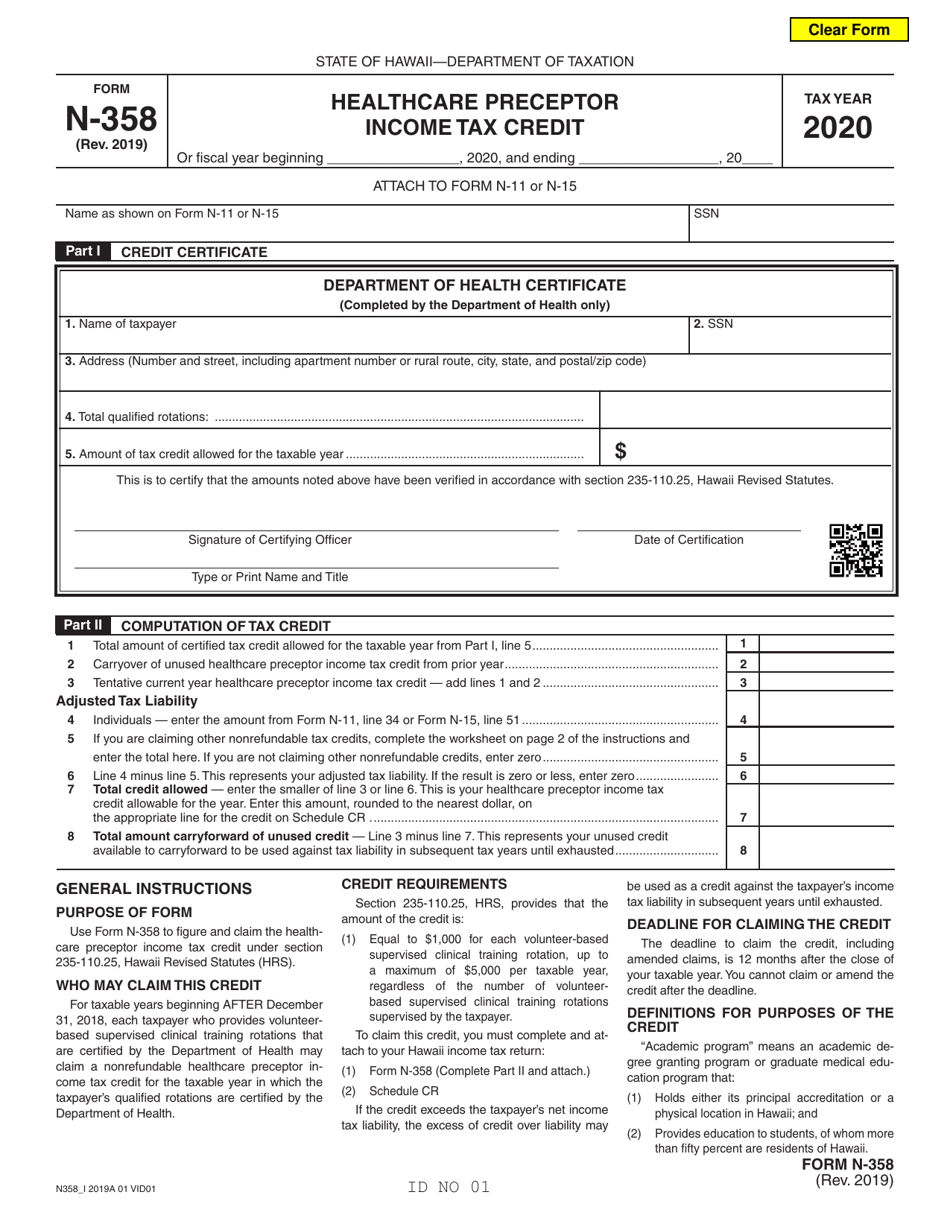

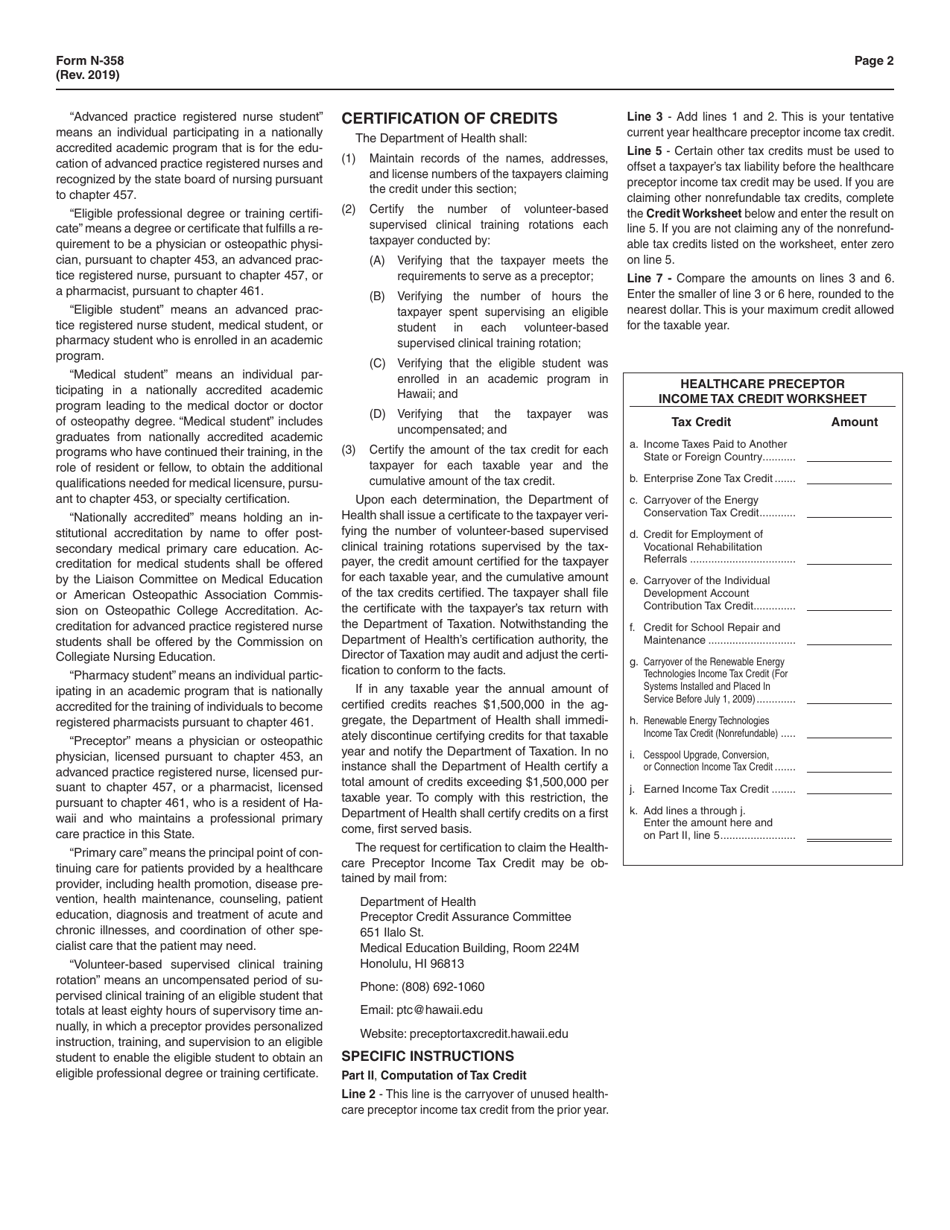

Form N-358

for the current year.

Form N-358 Healthcare Preceptor Income Tax Credit - Hawaii

What Is Form N-358?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-358?

A: Form N-358 is the Healthcare Preceptor Income Tax Credit form in Hawaii.

Q: What is the Healthcare Preceptor Income Tax Credit?

A: The Healthcare Preceptor Income Tax Credit is a tax credit available in Hawaii for healthcare professionals who serve as preceptors for certain health-related educational programs.

Q: Who can claim the Healthcare Preceptor Income Tax Credit?

A: Healthcare professionals who serve as preceptors for certain health-related educational programs in Hawaii can claim the tax credit.

Q: What is the purpose of the Healthcare Preceptor Income Tax Credit?

A: The purpose of the tax credit is to incentivize healthcare professionals to serve as preceptors, helping to train the next generation of healthcare providers.

Q: How much is the Healthcare Preceptor Income Tax Credit?

A: The amount of the tax credit is $2,500 per taxable year.

Q: What are the eligibility requirements for the Healthcare Preceptor Income Tax Credit?

A: To be eligible for the tax credit, healthcare professionals must meet certain criteria, including being licensed or certified in Hawaii, serving as a preceptor for at least three months, and having a written agreement with an eligible educational program.

Q: How do I claim the Healthcare Preceptor Income Tax Credit?

A: To claim the tax credit, healthcare professionals must complete Form N-358 and attach it to their Hawaii state tax return.

Q: Are there any limitations or restrictions on the Healthcare Preceptor Income Tax Credit?

A: Yes, there are limitations and restrictions on the tax credit, such as a cap on the total amount of credits available each year and a requirement to maintain records and documentation supporting the claim.

Q: Is the Healthcare Preceptor Income Tax Credit available in other states?

A: No, the Healthcare Preceptor Income Tax Credit is specific to Hawaii and is not available in other states.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-358 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.