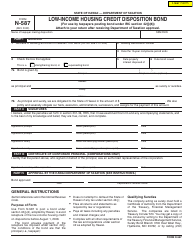

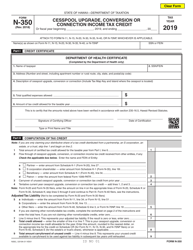

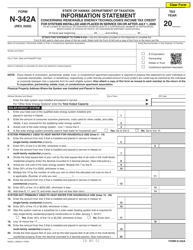

This version of the form is not currently in use and is provided for reference only. Download this version of

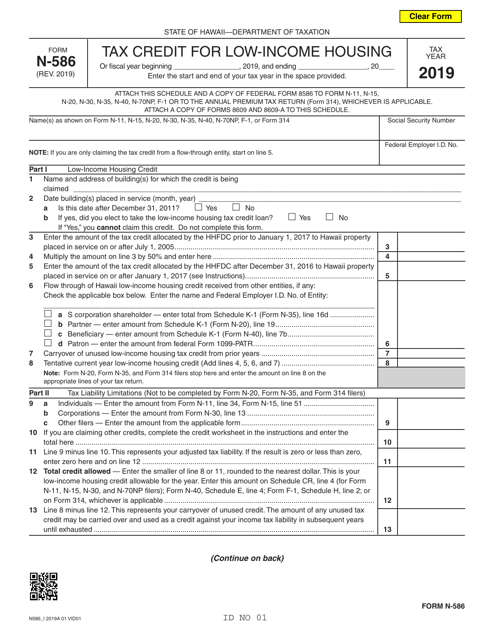

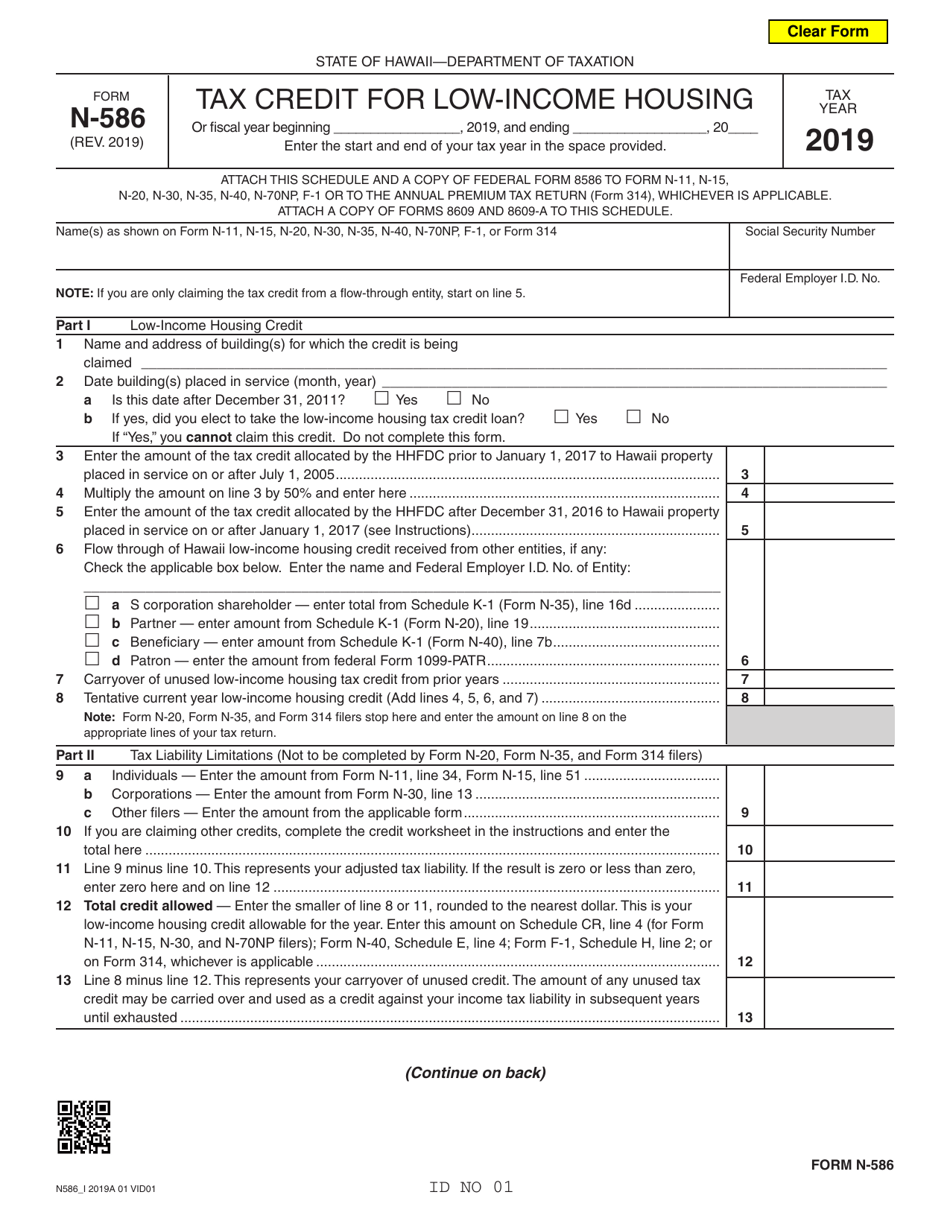

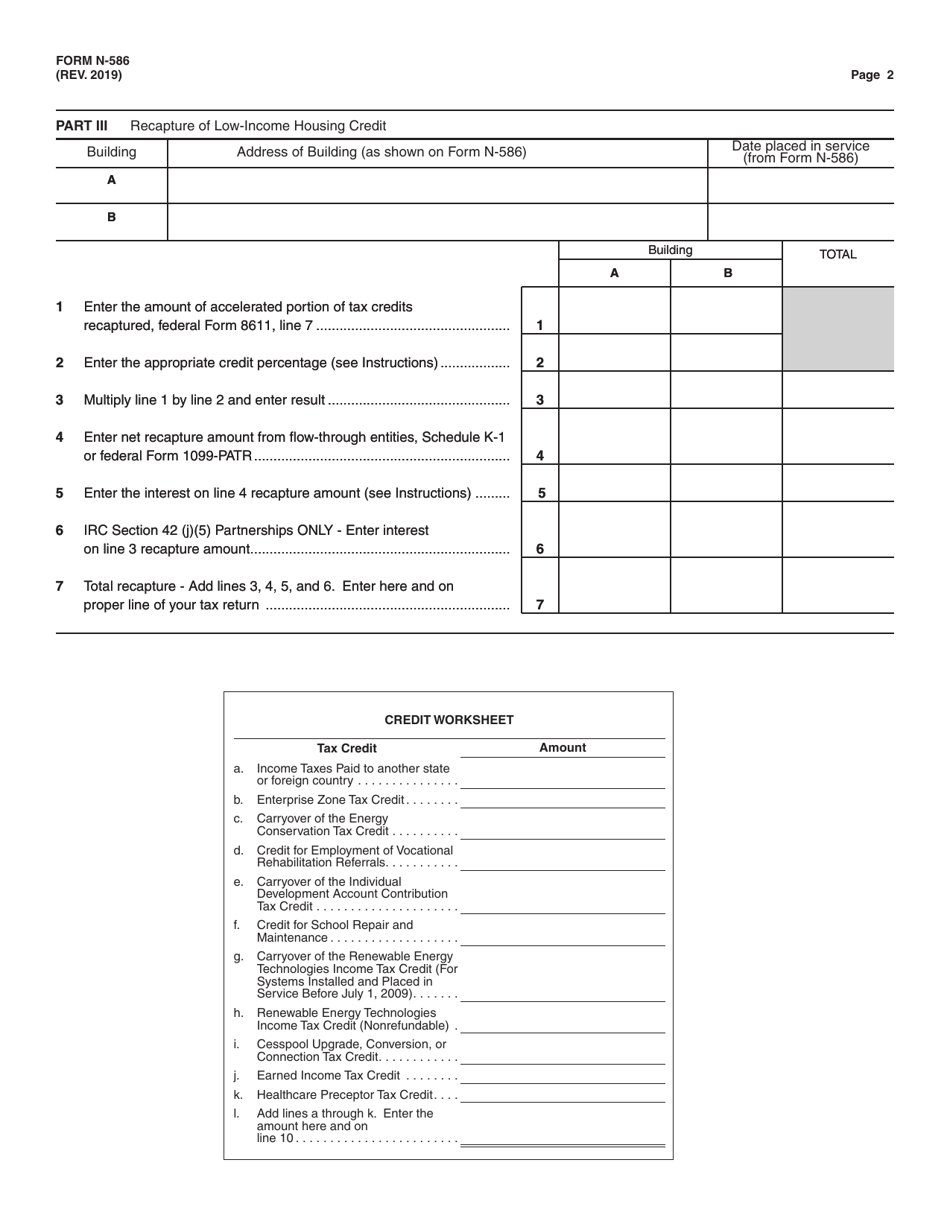

Form N-586

for the current year.

Form N-586 Tax Credit for Low-Income Housing - Hawaii

What Is Form N-586?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

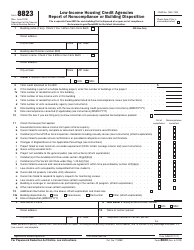

Q: What is Form N-586?

A: Form N-586 is a tax credit form for low-income housing in Hawaii.

Q: What is the purpose of Form N-586?

A: Form N-586 is used to claim tax credits for low-income housing projects in Hawaii.

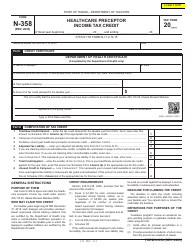

Q: Who can use Form N-586?

A: Developers and sponsors of low-income housing projects in Hawaii can use Form N-586.

Q: What is the eligibility criteria for the tax credit?

A: To be eligible for the tax credit, the low-income housing project must meet certain requirements set by the Hawaii Housing Finance and Development Corporation.

Q: How much is the tax credit?

A: The amount of tax credit available varies depending on the number of qualified low-income housing units in the project.

Q: When is the deadline to file Form N-586?

A: The deadline to file Form N-586 is typically April 20th of the year following the tax credit year.

Q: Are there any other forms or documents required to be filed along with Form N-586?

A: Yes, you may be required to submit additional supporting documentation to verify the eligibility and compliance of the low-income housing project.

Q: Can I claim the tax credit for a project in a different state?

A: No, Form N-586 is specific to low-income housing projects in Hawaii.

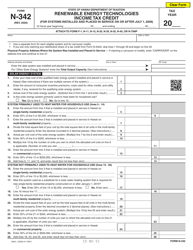

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-586 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.