This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form N-615

for the current year.

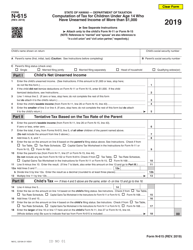

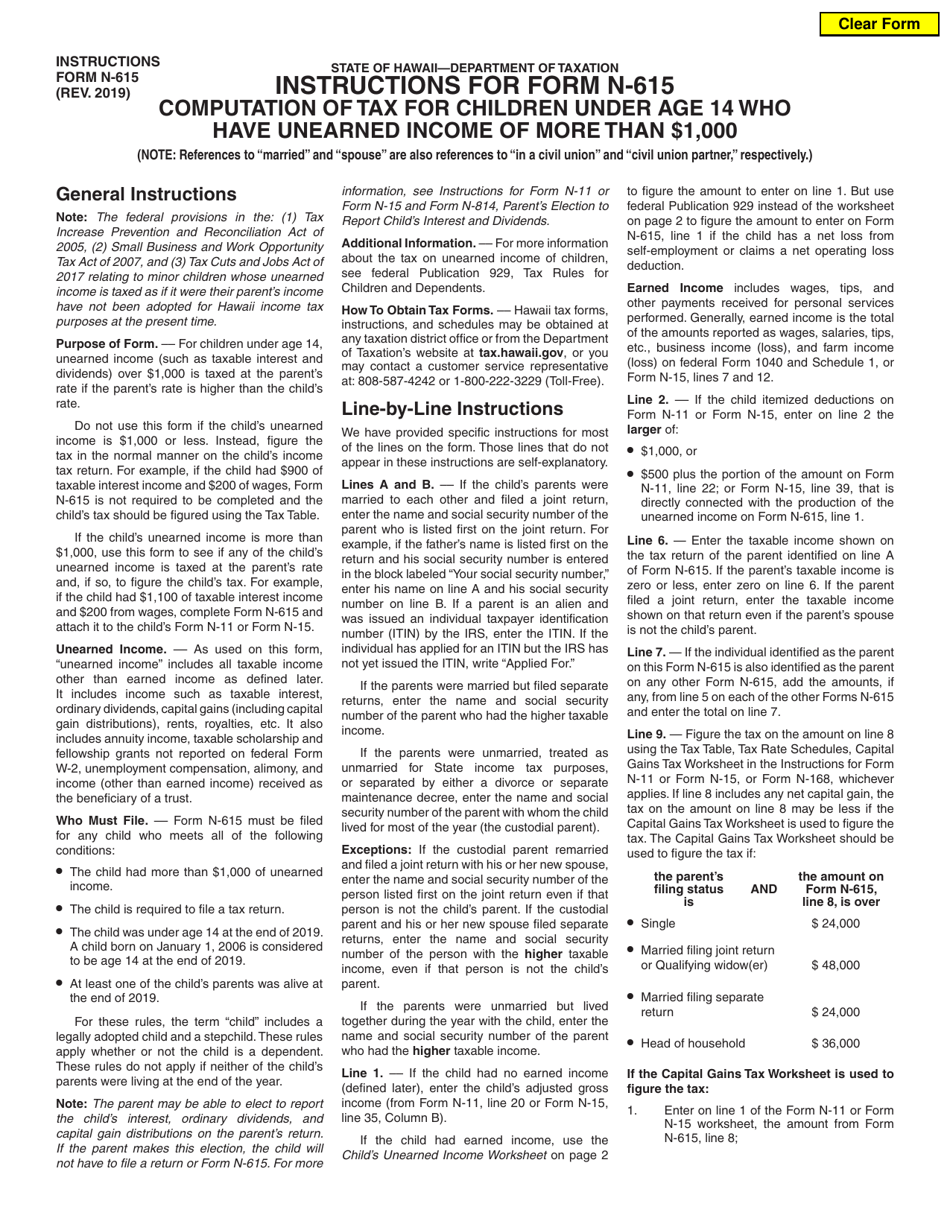

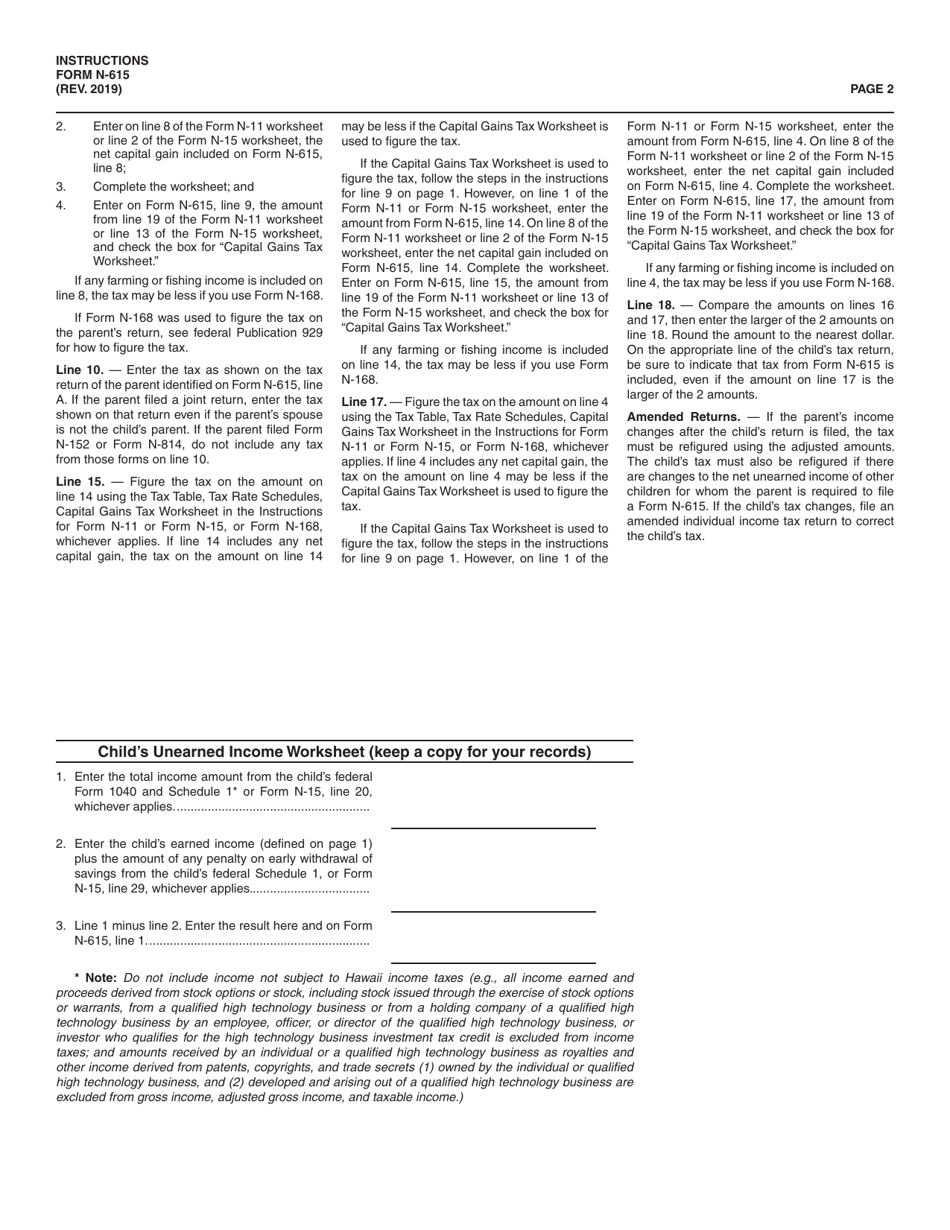

Instructions for Form N-615 Computation of Tax for Children Under Age 14 Who Have Unearned Income of More Than $1,000 - Hawaii

This document contains official instructions for Form N-615 , Computation of Tax for Children Under Age 14 Who Have Unearned Income of More Than $1,000 - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form N-615 is available for download through this link.

FAQ

Q: What is Form N-615?

A: Form N-615 is a tax form used for computing tax for children under age 14 in Hawaii who have unearned income of more than $1,000.

Q: Who should use Form N-615?

A: Form N-615 should be used by parents or guardians of children under age 14 in Hawaii who have unearned income of more than $1,000.

Q: What is unearned income?

A: Unearned income refers to income that is not earned through employment, such as interest, dividends, and capital gains.

Q: Is there a specific age requirement to use Form N-615?

A: Yes, Form N-615 is specifically for children under age 14.

Q: What is the purpose of Form N-615?

A: The purpose of Form N-615 is to calculate the tax owed by children under age 14 in Hawaii who have unearned income of more than $1,000.

Q: Are there any exemptions for children under age 14 with unearned income?

A: Yes, there may be exemptions available for children under age 14 with unearned income. Please consult the instructions for specific details.

Q: Are there any penalties for not filing Form N-615?

A: Yes, there may be penalties for failure to file Form N-615 if your child meets the criteria for using this form. It is important to consult the instructions and meet the filing requirements.

Q: What are the consequences of incorrect or incomplete information on Form N-615?

A: Providing incorrect or incomplete information on Form N-615 may result in delays in processing your child's tax return or potential audits by the tax authorities.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.