This version of the form is not currently in use and is provided for reference only. Download this version of

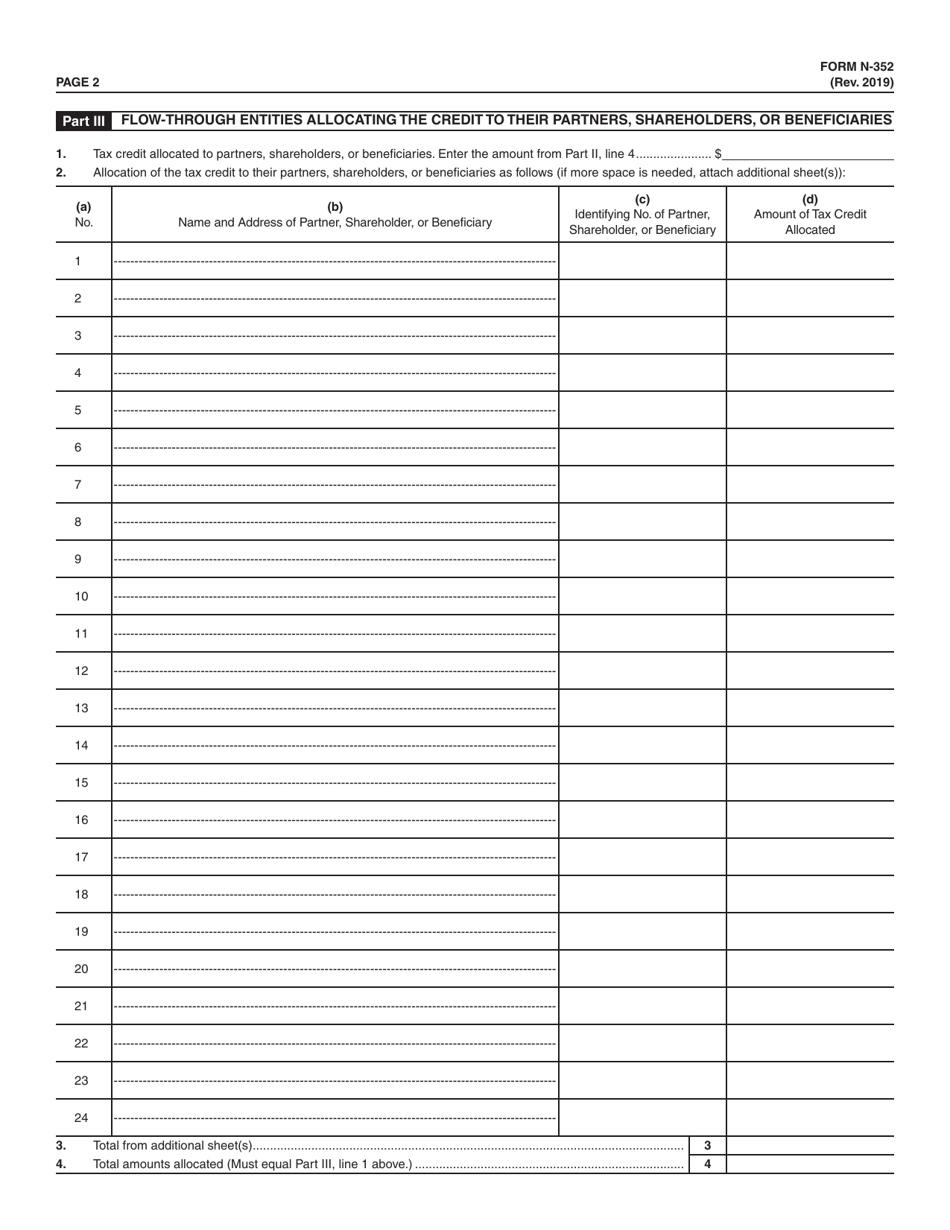

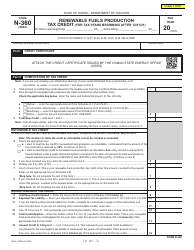

Form N-352

for the current year.

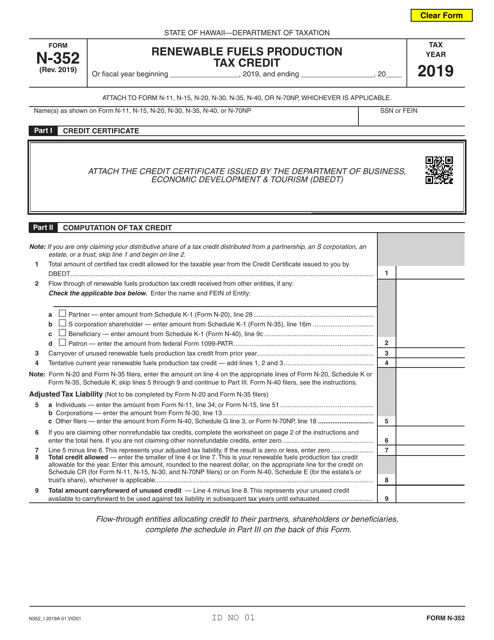

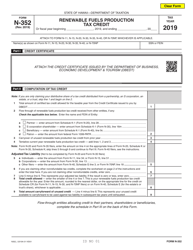

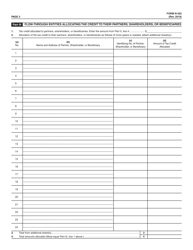

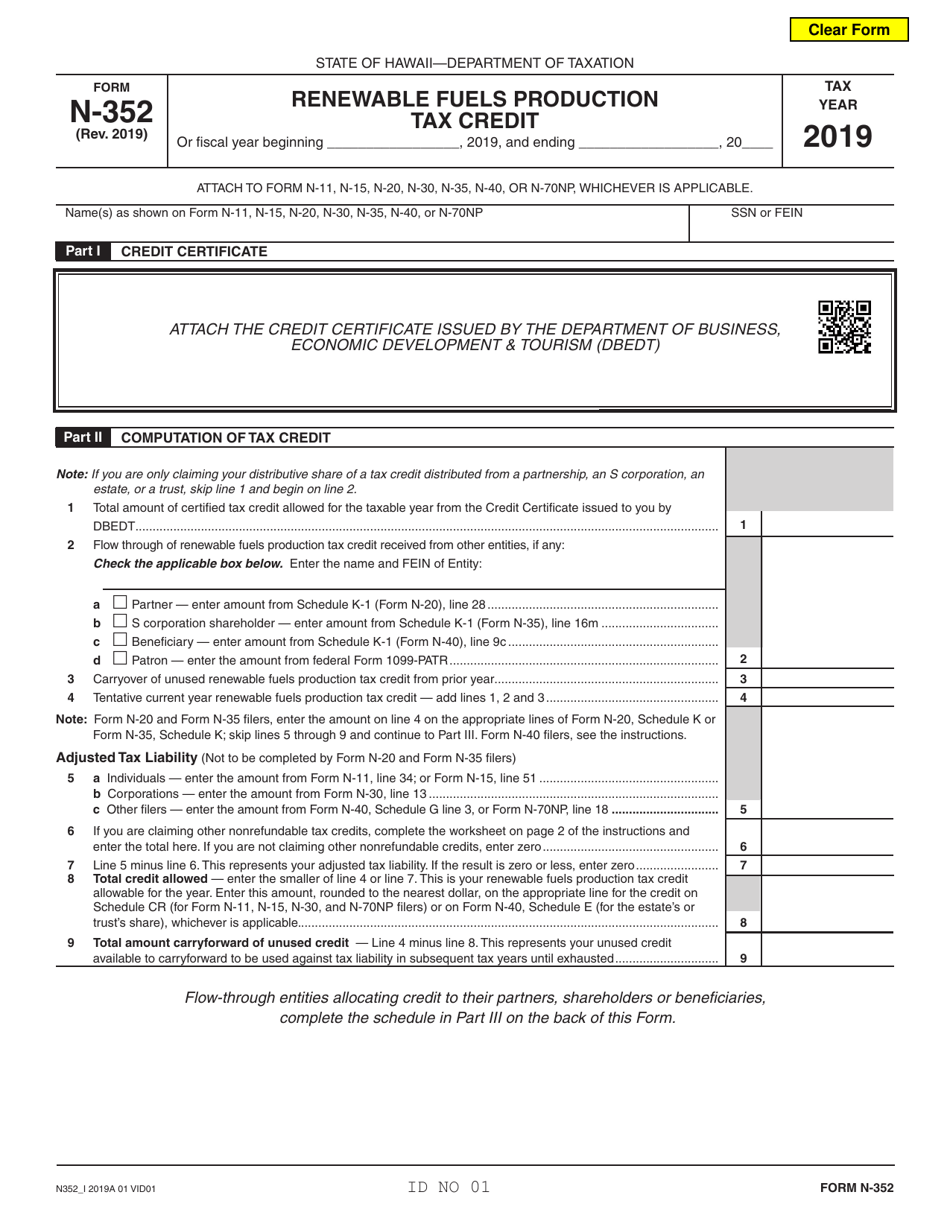

Form N-352 Renewable Fuels Production Tax Credit - Hawaii

What Is Form N-352?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-352?

A: Form N-352 is a document used to claim the Renewable Fuels Production Tax Credit in Hawaii.

Q: What is the Renewable Fuels Production Tax Credit?

A: The Renewable Fuels Production Tax Credit is a tax credit available to individuals or businesses in Hawaii who produce renewable fuels.

Q: Who can file Form N-352?

A: Individuals or businesses in Hawaii who produce renewable fuels can file Form N-352 to claim the tax credit.

Q: What is the purpose of Form N-352?

A: The purpose of Form N-352 is to calculate and claim the Renewable Fuels Production Tax Credit in Hawaii.

Q: What information is required on Form N-352?

A: Form N-352 requires information such as the taxpayer's name, contact information, description of the renewable fuels produced, and calculation of the tax credit amount.

Q: When is the deadline to file Form N-352?

A: The deadline to file Form N-352 and claim the Renewable Fuels Production Tax Credit in Hawaii is typically April 20th of the following year.

Q: Can I claim the Renewable Fuels Production Tax Credit if I don't live in Hawaii?

A: No, the Renewable Fuels Production Tax Credit is specific to individuals or businesses in Hawaii who produce renewable fuels.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-352 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.